sefa ozel/E+ via Getty Images

If you only had $5 to spend and had no socks, would you buy a pair? Or would you instead venture out barefoot and buy an iced coffee at Starbucks (SBUX)? Hopefully, like most reasonably minded humans, you would pick the former and grab a new pair.

This pretty much sums up my thesis for Hanesbrands (NYSE:HBI). Thanks for reading and good luck to all…

Ok, ok, I will write a full article. And in this article, I will explain why I believe that Hanesbrands presents a compelling value proposition, in part from its highly recession resistant products and also from the absolute destruction that the stock has weathered over the past year.

Overview

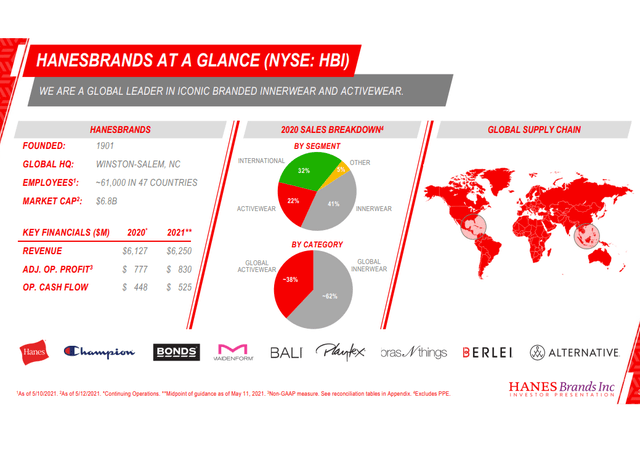

Hanesbrands operates in the global inner wear (underwear, socks, bras, etc.) and activewear segments of the apparel industry, producing low to mid-priced garments under brand names such as Hanes, Champion, Bonds, Bali, Playtex and others.

The company claims the number #1 or #2 North American market position in the following categories, men’s underwear, women’s intimates, kid’s underwear, socks, hosiery and T-shirts. The company also boasts of a growing position throughout Europe, Latin America, Asia, and Australia.

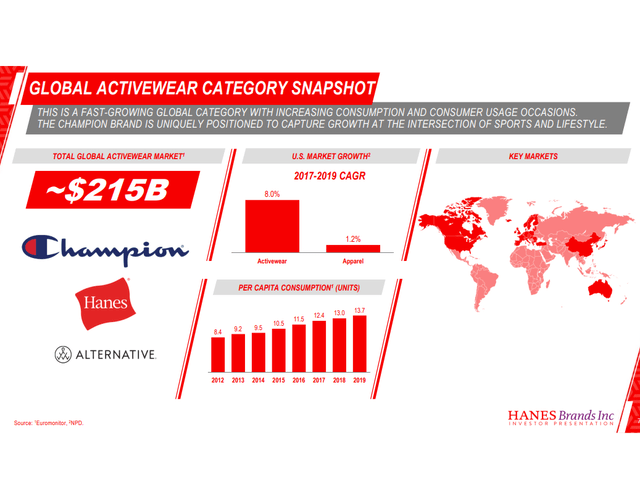

In addition to a vast inner wear offering, the company has been extensively building the Champion brand, which is its flagship activewear product line. Now, I think each of us can appreciate that “activewear” is a bit of a misnomer, as sweatpants and hoodies pretty much sums up most of our evenings. I would venture to guess that most of us are not exactly training for a triathlon.

The “activewear” market is the company’s growth engine, as it is for most apparel makers these days, given their comfy, restriction free appeal. Let’s face it, the sane-headed don’t wear khakis to eat a tub of ice-cream whilst binge-watching Netflix (NFLX).

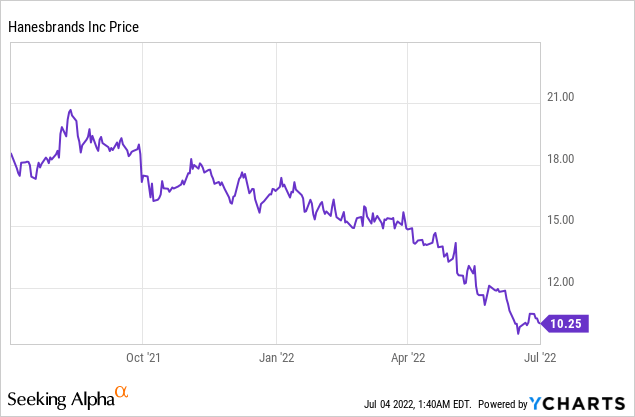

This predominantly comfy, cozy product offering, of late, has certainly not led to a prosperous stock price, nor to a happy investor base. The company’s shares have cratered over the last year over worries ranging from supply chain issues, inflation, debt worries and now a possible recession in the near future.

To hone in on some of the concerns that seem to have been driving the share price, frankly, all of them are valid. Supply chains have been and still are a mess, inflation continues to ravage around the world, the company certainly does have elevated debt levels and a recession, if we are not already in one, seems imminent.

However, unless you are projecting these negative factors to be fatal to the company, they are only valid up to a point. I would like to point out that the cure for supply chain issues and likely for inflation as well, is, in fact, a recession. And to the point of recession worries specific to Hanesbrands, I would like to dig in to the product offering to get a sense of the potential damage.

Recession

In April 2022, Hanesbrands shares started to slide precipitously from $15 down to the current $10.25 level, or roughly 33%. This move coincides with the greater stock markets worries regarding a potential recession on the horizon.

Yes, the company sounded cautious in the Q1 conference call given the highly volatile macro environment, however I could literally list hundreds of much more highly exposed companies whose shares have not come close to the decline Hanesbrands has suffered.

Let’s remember that 62% of total sales at Hanesbrands are basically underwear and socks. These are not exactly discretionary purchases. If you need a new pair of underwear, you NEED a new pair of underwear. Certainly, these products will be affected during a recession, however it is not like these are designer brands. Hanesbrands mainly serves the middle to low price point already, making them much less exposed to consumers shifting down the value chain.

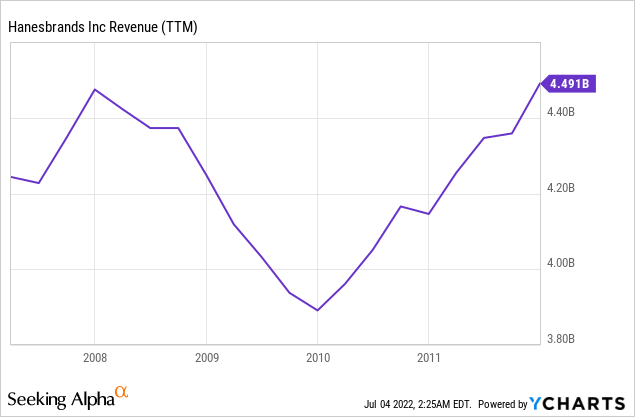

In looking deeper at actual numbers from the most recent severe recession year of 2009 (outside of COVID-19), I found that in the men’s underwear segment, which is a large percentage of Hanesbrands’ product mix, sales dropped by a rather miniscule 2.3%, only to rebound the next year and continue on an upward trajectory.

Quart.com

And in looking at the entire company’s product line, including its more discretionary items such as activewear, T-shirts etc. The revenue drop, while more severe, was still a reasonable 14%, followed by a rapid return to above baseline 2008 figures by 2011.

Please keep in mind, this was the financial crisis of 2008-09 I am talking about here. Most people legitimately thought that the financial world was ending, and talks of a new great depression were abound.

I would argue that a 2008-09 level recession is likely not in the cards this time around. However, if it is, I would argue that Hanesbrands is positioned far better than others in the consumer discretionary sector and certainly much better than others in the apparel or retail industry.

Valuation And Debt

On a very basic level, the company is currently dirt cheap. Hanesbrands current P/E ratio is 5.76. This is roughly 40% below the five-year average of 10. In addition, the company pays a 5.85% dividend that is very well covered with only a 33.71% payout ratio.

One obvious and legitimate reason for this discount, is the debt on the balance sheet, not so much the amount of debt, but the maturity schedule. Basically all the company’s long-term debt of $3,325 billion matures between 2024 and 2026, leaving the company with rather limited options other than to refinance at what are likely to be higher interest rates.

| As of April 2, 2022 |

Interest Rate |

Principal Amount ($) |

Maturity Date |

|

Senior Secured Credit Facility: |

|||

|

Revolving Loan Facility |

1.69% |

20,000 |

November 2026 |

|

Term Loan A |

1.75% |

993,750 |

November 2026 |

|

4.875% Senior Notes |

4.88% |

900,000 |

May 2026 |

|

4.625% Senior Notes |

4.63% |

900,000 |

May 2024 |

|

3.5% Senior Notes |

3.50% |

552,425 |

June 2024 |

Source: Gurufocus.com

The most pressing maturities appear to be the roughly $1.45 billion due in 2024 and with rates likely to remain elevated into these maturities, investors are certainly looking for elevated interest payments to boot.

In the trailing 12 months, the company paid roughly $150 million in interest costs to service the debt, which included some debt which was paid off in December 2021. With credit ratings of BB by S&P and Ba3 by Moody’s, the company’s debt is considered just below investment grade, indicating current debt rates for newly issued bonds could be around 6-7%.

So, in a current worst case scenario of refinancing the $1.45 billion, 2024 debt currently carried at a blended 4.16% rate, costing roughly $61 million per year. With newly refinanced 7% debt, the interest cost would go from $61 million to $101 million, adding around $40 million in interest expenses.

While this is certainly not ideal, nor is it a positive development, it is hardly a death blow to a company producing over $500 million in yearly free cash flow. The company will clearly take it on the chin for the 2024 maturities, however they still have some time left for the 2026 tranche and if we get the recession we currently expect, interest rates are unlikely to remain elevated indefinitely.

I would argue that this bad news, along with a potential recession, is more than priced in at current share prices.

Bottom Line

I believe that Hanesbrands operates in a recession resistant niche of the apparel industry. While the debt is certainly frustrating and management will certainly not receive a gold star for its handling of the situation, it is not a sword of Damocles hanging above their heads so long as nothing truly disastrous occurs in the financial markets, which in that case, all will suffer.

The company, in my opinion, operates in a sector that I find attractive and appears to be having success in growing the Champion brand, which looks to be a key growth driver going forward. Not to mention the attractive and well covered 5.85% dividend yield.

I believe that shares have been unreasonably punished of late and provide a margin of safety given the currently assigned valuation. I see a clear path to 50%+ returns over the next few years as the debt refinance issue is addressed and supply chain/inflation issues recede.

I am planning to open a moderate sized position in the very near future and look forward to your comments below.

Thank you for reading and good luck to all!

Be the first to comment