MoMo Productions

Investment Summary

Here at HBI, we are mandated to provide our clients with uncorrelated equity premium for those seeking exposure to healthcare equities. We do that by searching for highly liquid diversifiers that have this tactical alpha available. That involves performing deep macroeconomic research across the entire spectrum of health care markets. One such avenue we’ve seen as a resilient avenue for equity investors lies within geriatrics. The global macro healthcare sphere includes the geriatric care services market, a projected $1.75 trillion behemoth.

The geriatric care services market is a rapidly growing industry with significant potential for investors. As the global population ages, the demand for geriatric care services is expected to increase, providing opportunities for growth and investment. Overall, we believe there is significant potential for investors who are looking to capitalize on the growing demand for these services. By conducting thorough research and analysis, we are looking to identify investment opportunities in this corner of the market. We turned to agilon health, inc. (NYSE:AGL) to investigate if it fulfilled the mandate. Here, we’ll present our findings. Net-net, we rate AGL a hold.

Exhibit 1. AGL 2-year price evolution. You can see the stock has walked sideways for the bulk of 2022, but lacking support

Volume in particular is drying up. This could help with support of a potential breakout. However, it could also mean a lack of buyers.

Geriatric market growth is a defensive option for equity portfolios

To understand our thesis behind AGL, it’s important to have a baseline of the underlying market. We believe this will help investors see why there could be more selective opportunities available.

Here’s some of the notable take-outs from our recent dive into the sector. From the growth percentages, it does makes sense why the market is seeking more from AGL, and, despite the Q3 earnings print [discussed later], may be allocating capital elsewhere:

- In recent years, the geriatric care services market has seen significant growth and is expected to continue to expand in the coming years. According to a recent report by Precedence Research, the global geriatric care services market is projected to reach $1.75 trillion by 2030, with a CAGR of 5.78%. This growth is driven by several factors, predominantly the aging of the global population, the increasing prevalence of geriatric chronic diseases, and changes in healthcare policy.

- We’d advise that one of underlying trend in the market is the growing preference for in-home care over institutional care. As older adults and their families become more aware of the benefits of in-home care, such as improved quality of life and greater independence, cost-benefit, consolidated payments, tax concessions, etc., the demand for these services is expected to increase. This trend may benefit companies that provide in-home care services and could result in increased investment opportunities in this segment of the market.

- Speaking of trends, we also observed the market is growing focus on providing personalized and specialized care to the spectrum of the market. As the population ages, the needs and preferences of older adults are becoming more diverse, and there is a greater demand for care that is tailored to individual needs. This trend may benefit AGL in its growth initiatives looking ahead. Its broad network of members would certainly benefit from a model set on specialized geriatric care services, such as memory care and hospice care.

- On this tone, the global geriatric care services market is also affected by advances in medical technology, changes in consumer preferences, and other economic and social factors. Adjacent markets, like med-tech offer additional growth opportunities within this spectrum. The best example of this is orthopedics. As a result, the size and growth of this entire market may vary depending on various factors, varying from healthcare to entertainment to real estate.

Switching this to AGL, you’ll see that it fits within the investment thesis, although there’s additional factors to consider in this investment debate. Most notably, is where investors are allocating the capital. If this is a high-growth market, then, AGL’s performance may have not been up to the market’s expectations, missing EPS consensus estimated by $0.02.

AGL Q3 numbers not welcomed by the market

Despite a fairly mixed quarter, there were a number of positives to mention. The first positive we’d note is that in 2023, AGL says it will have a national network of 2,200 primary care physicians and 500,000 senior patients across 12 states. It also reinvested over $130mm this YTD through surplus sharing and quality incentives for doctors. We’d hope to see this pull through to deepen the company’s physician network.

Turning to the numbers, top-line growth of 52% YoY resulted in $695mm in revenue for the quarter. The Medicare Advantage (“MA”) business performed better internal expectations. Medical margin increased 74% to $76mm, and medical margin per member per month (“PMPM”) increased 19% to $93 as evidence of this. Medical margin growth was driven by the maturation of AGL’s year-2 plus partner markets. Moreover, YoY, MA membership grew 45%. This reflects strong performance across the 16 partner markets, inclusive of higher-than-forecasted membership growth.

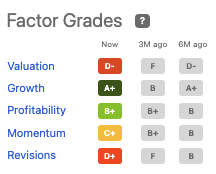

Despite the above, the market priced in all the earnings upsides for agilon health, inc. swiftly. Consequently, there’s been no turnaround in share price. Investors were seeking much more from the company last quarter. If you’re wondering why, when we look at the quantitative data, the downside price action is well supported. AGL has a rating of hold from Seeking Alpha’s proprietary factor grading, which provides an objective viewpoint. Despite excelling in areas of growth, agilon health, inc. is lagging in other key areas required for share price appreciation. This also supports our neutral view.

Exhibit 2. AGL rated “hold” by Seeking Alpha factors

Data: Seeking Alpha. AGL

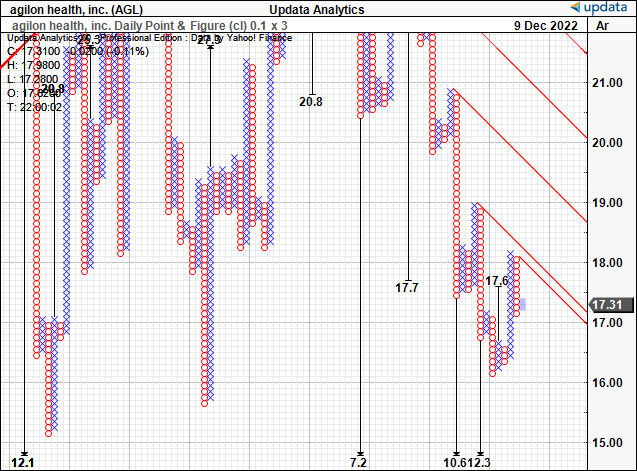

Speaking of objective viewpoints, point and figure analysis provides the same kind of data from a market positioning perspective.

You can see below that there are downside targets for AGL down to $12.30 then $10.60. We would encourage investors to factor that into the investment debate. Quantitative data can help with objective investment reasoning.

Therefore, we rate AGL a hold, and with lack of earnings to value the stock fundamentally, we believe there is sufficient quantitative data to warrant a hold.

Exhibit 3. Downside targets to $12.30 and then $10.60

Data: Updata

Be the first to comment