gorodenkoff

… anyone can acquire wealth, the real art is giving it away.”― Daisy Goodwin, The American Heiress

Today, we profile a small biotech concern that thanks to a huge recent pullback is trading at a discount to cash. The company also has collaborations with two major drug giants. An analysis follows below.

Company Overview:

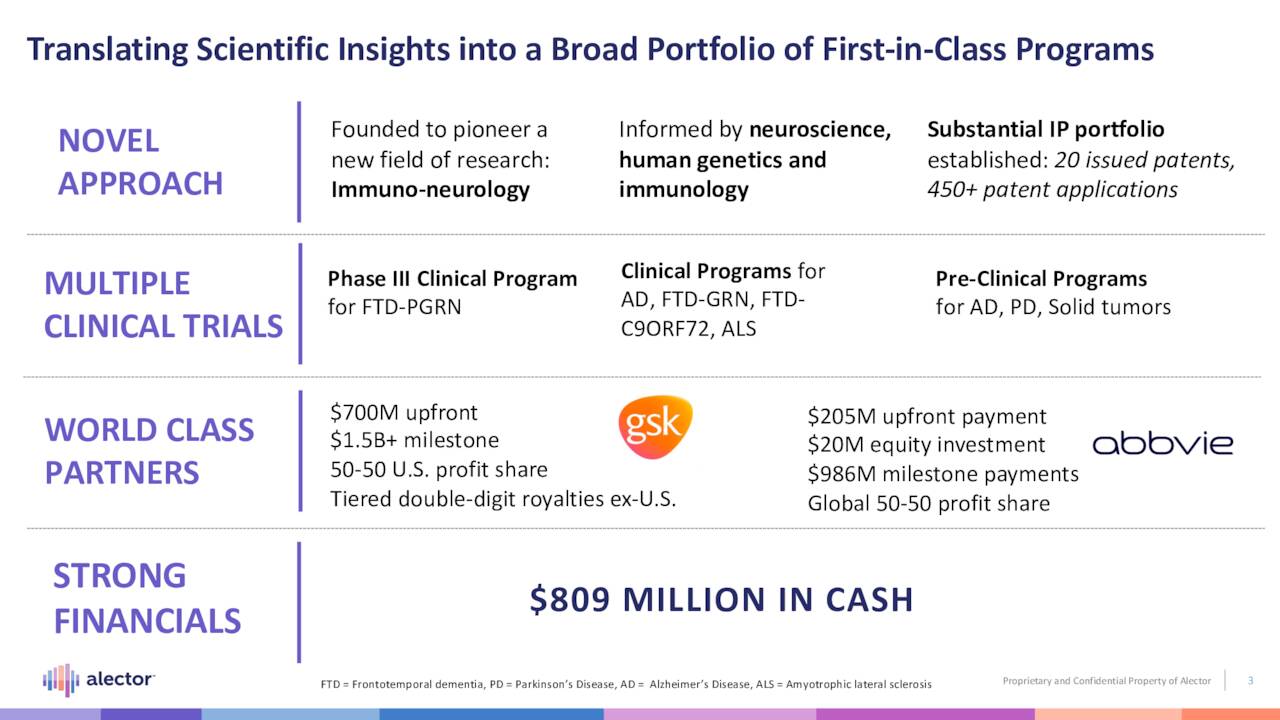

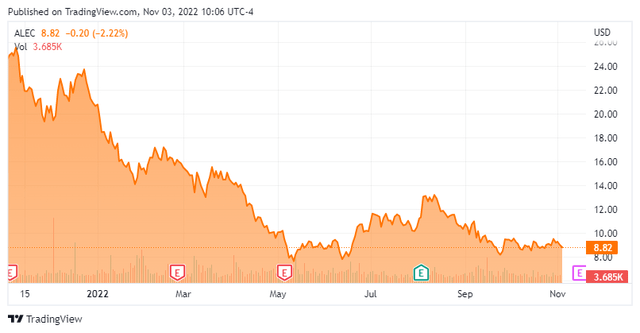

Alector, Inc. (NASDAQ:ALEC) is a South San Francisco-based clinical-stage biopharmaceutical concern focused on the development of therapies for the treatment of neurodegenerative disorders. The company has four clinical programs – three backed by partnerships with Big Pharma – pursuing five indications. Alector was formed in 2013 and went public in 2019, raising net proceeds of $168.2 million at $19 per share. Its stock currently trades around $8.75 a share, translating to a market cap of approximately $750 million.

September Company Presentation

Approach

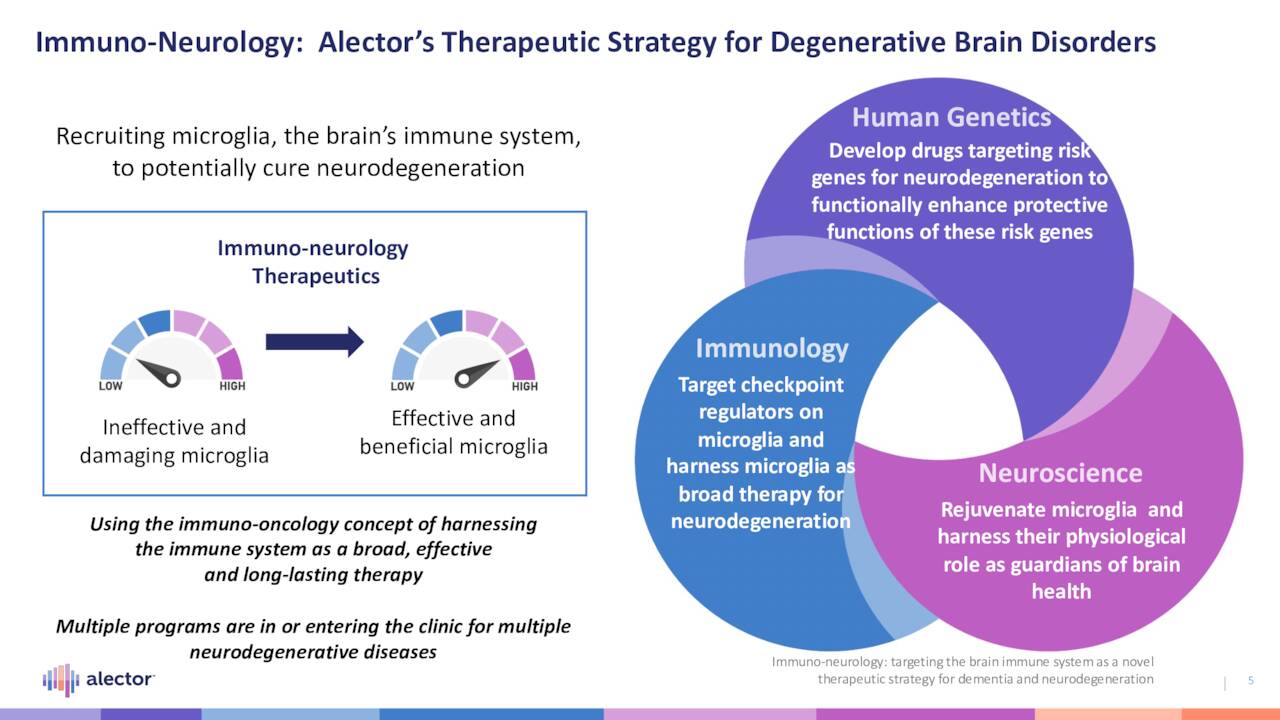

The company is pioneering research in what it dubs immuno-neurology, taking cues from neuroscience, human genetics, and immunology. More specifically, its therapies are designed to activate the microglia – the brain’s immune system – to halt neurodegeneration. Microglia play many roles in healthy brain function, including the maintenance of oligodendrocytes (myelin), astrocytes, neurons, synaptic connections, and immune tolerance; promotion of cholesterol metabolism and tissue repair of the vasculature and the blood-brain barrier; resolution of inflammation; and debris removal. A lack or improper functioning of microglia leads to neurodegeneration. By targeting checkpoints on microglia in diseased patients, Alector believes it can reinvigorate proper brain function, leading to the resolution of neurodegenerative disease. The technology underpinning this thesis was in-licensed from privately held Adimab back in 2014.

September Company Presentation

Pipeline

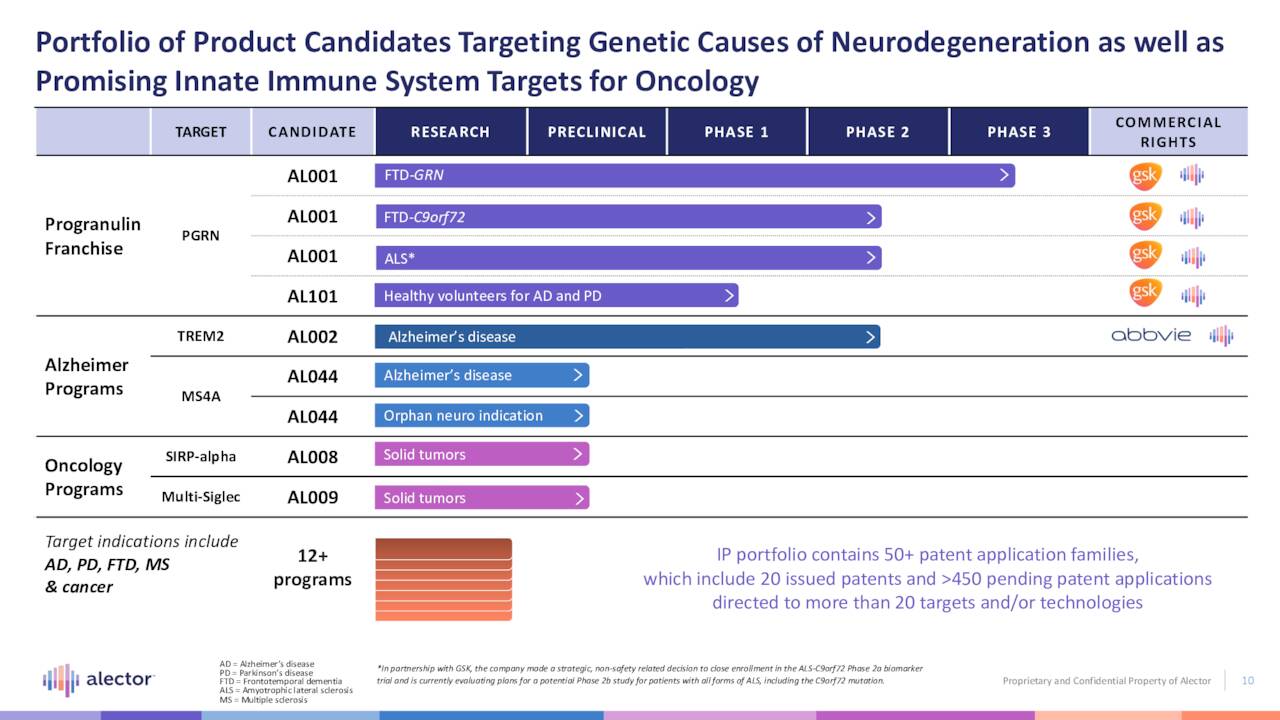

The company’s novel approach to neurodegeneration has elicited the interest of GlaxoSmithKline (GSK) and AbbVie (ABBV), both with whom it has inked significant collaborations – more on these deals below. The former has a claim on two Alector clinical programs, while the latter is down to one.

September Company Presentation

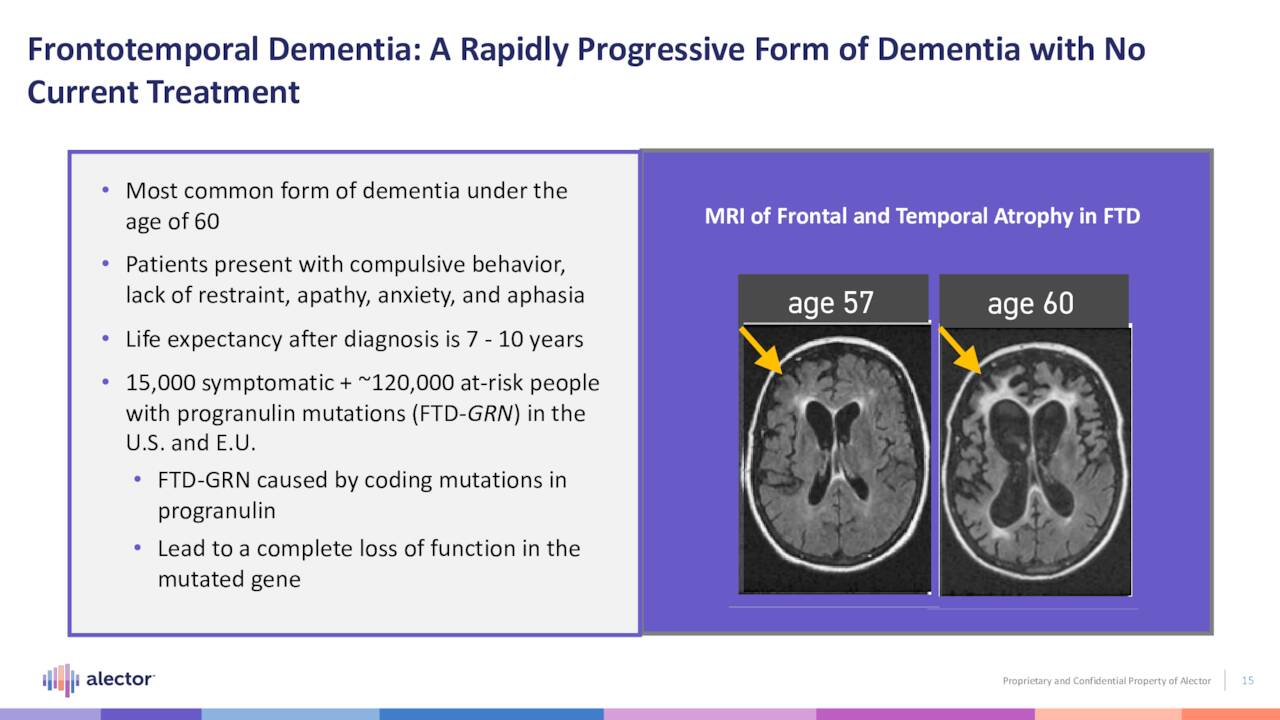

AL001. The company’s lead asset is AL001 (latozinemab), a monoclonal antibody that modulates progranulin, a regulator of immune activity in the brain. Specifically, this compound increases the half-life of progranulin by blocking Sortilin, a degrading receptor, with the goal of restoring progranulin to normal levels. It is undergoing evaluation in a Phase 3 trial (INFRONT-3) for the treatment of frontotemporal dementia caused by mutations of the granulin gene (FTD-GRN), a fatal, degenerative brain disease characterized by progressive deterioration of the frontal portions of the brain – regions responsible for language and behavior. Life expectancy post-diagnosis is approximately seven to ten years. It strikes people in their prime, afflicting ~55,000 in the U.S. and roughly double that in the EU, mostly under the age of 60. There are no FDA-approved therapies for FTD-GRN.

September Company Presentation

The randomized, placebo-controlled Phase 3 trial is enrolling ~180 patients who will receive either AL001 or placebo for 96 weeks with the primary endpoint being change in an FDA-approvable clinical dementia rating scale known as CDR plus NACC FTLD-SB, which assesses impairments in behavior, language, memory, judgement, and functional activities. The company’s recent public literature has not provided a timeline for enrollment completion or data readouts, only stating that it is opening additional sites and expanding recruitment efforts – possibly a signal that enrollment to date has been challenging.

September Company Presentation

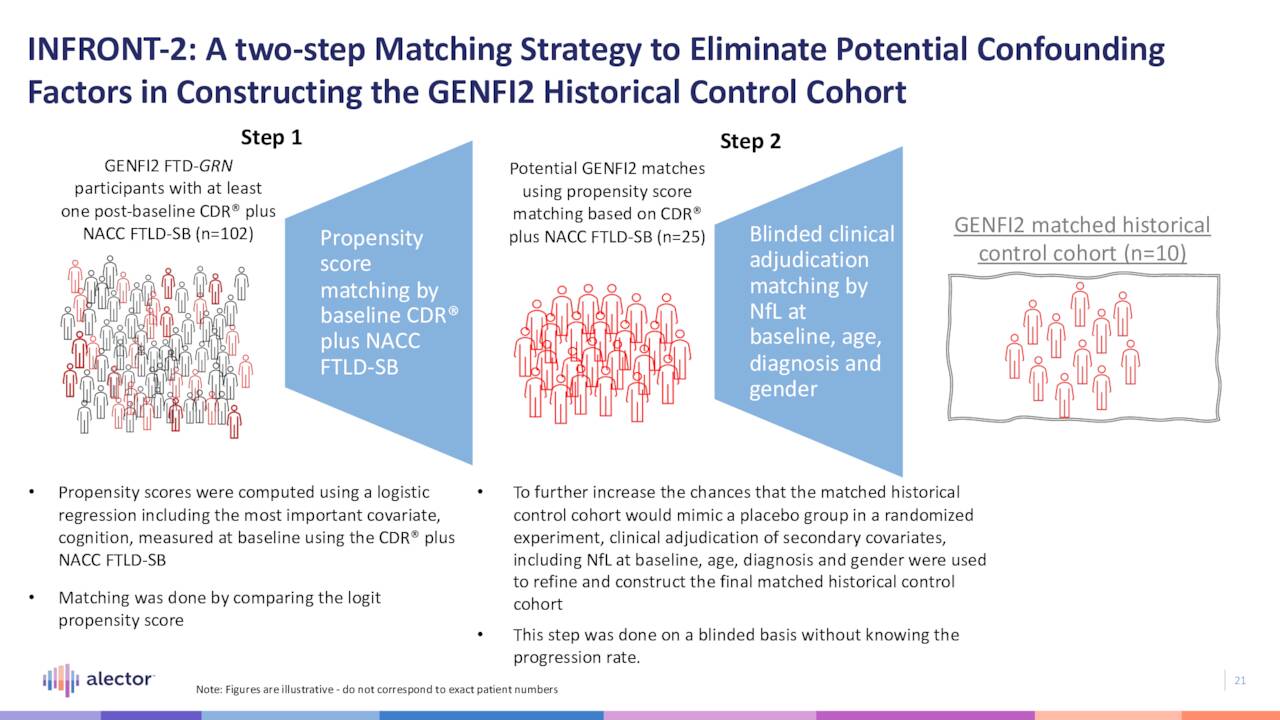

In an ongoing open-label Phase 2 trial (INFRONT-2), AL001 was able to restore progranulin levels to normal ranges in both plasma and cerebrospinal fluid (for the duration of treatment) in patients (n=12) whose progranulin levels were more than 50% below normal. Furthermore, it demonstrated a 48% reduction in disease progression versus historical control comparators on the CDR plus NACC FTLD-SB scale. AL001 was well tolerated at therapeutic levels and has received Orphan and Fast Track designations from the FDA for this indication.

Also, as part of INFRONT-2, AL001 is being assessed in patients (n=10) suffering from FTD as the result of a mutation of the C9orf72 gene. Data presented in March 2022 stated the candidate delayed annualized disease progression by ~54% versus a matched control cohort using the same CDR plus NACC FTLD-SB scale.

Despite the relatively small number of patients assessed to date – all with no placebo control – the company’s approach was somewhat validated by GlaxoSmithKline in July 2021, when the latter stroked a $700 million upfront check ($200 million of which was actually paid in 1Q22) for the commercial rights to AL001 and another therapy (AL101 – discussed below). In addition to the upfront money, Alector is eligible to receive over $1.5 billion in milestones payments, a 50-50 profit share in the U.S. and tiered double-digit royalties ex-U.S. It will also handle clinical development, except for Phase 3 studies for Alzheimer’s disease, Parkinson’s disease, and other non-orphan indications. With certain exceptions, Alector and GlaxoSmithKline with split development costs 40-60, respectively. News of this collaboration sent shares of ALEC surging 93% to an intraday all-time high of $43.32 in the subsequent trading session (July 2, 2021).

AL101. The other therapy that is part of the GlaxoSmithKline collaboration is AL101, a monoclonal antibody targeting progranulin but with the possibility of easier administration and less frequent dosing for the treatment of more prevalent neurodegenerative disorders, such as Alzheimer’s and Parkinson’s. Single-dose AL101 is currently undergoing evaluation for safety and tolerability in healthy subjects. To date, the treatment has been well-tolerated and has demonstrated elevated progranulin levels. Data from additional dose cohorts are anticipated by YE22.

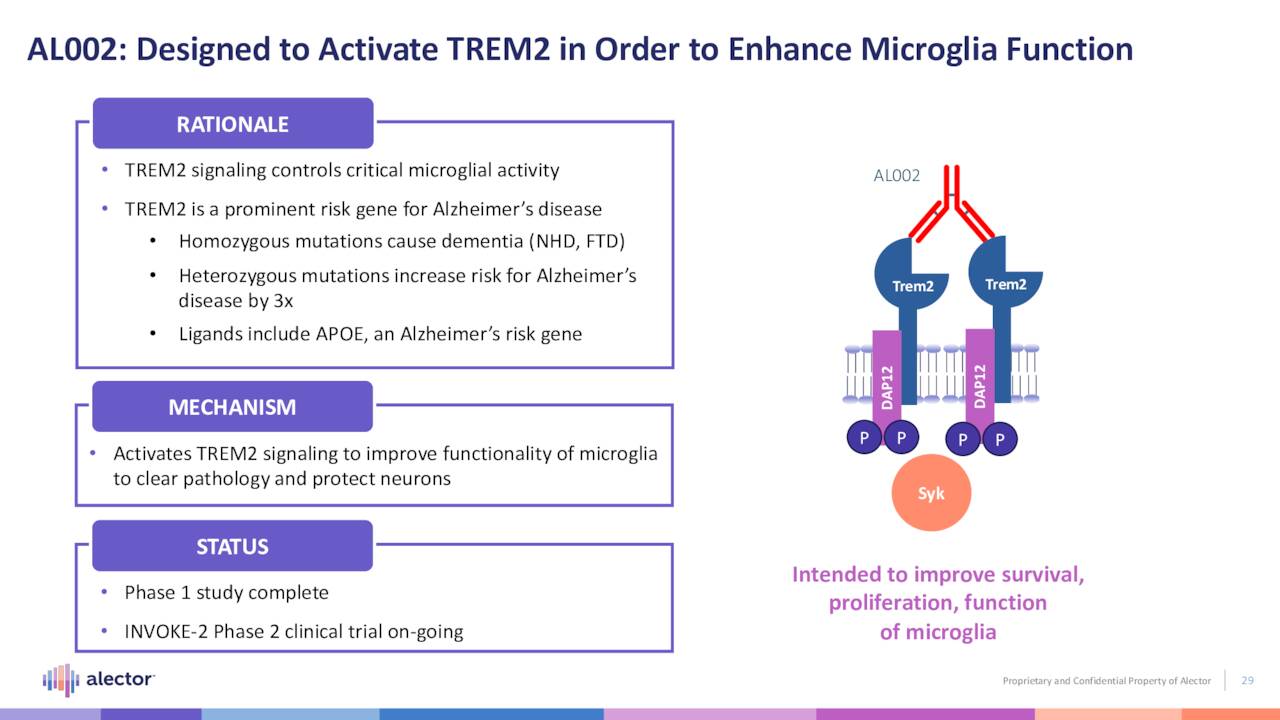

AL002. Alector’s other non-early-stage clinical program is AL002, a monoclonal antibody designed to improve functionality of the triggering receptor expressed on myeloid cells 2 (TREM2), whose signaling enhances microglia activity. It is undergoing assessment in a 265-patient proof-of-concept Phase 2 trial (INVOKE-2) in the treatment of Alzheimer’s disease. It goes without saying that this indication afflicting six million Americans has been a graveyard for clinical compounds. Even the one FDA-approved therapy, Biogen’s (BIIB) Aduhelm, has been a flop – not surprising considering its initial $56,000 price tag and scant evidence of efficacy. However, the landscape may have altered significantly on September 28, 2022 when Biogen and partner Eisai (OTCPK:ESALY) announced positive results from a Phase 3 trial evaluating its new therapy, lecanemab.

September Company Presentation

By contrast, early returns from INVOKE-2 indicate the appearance of amyloid related imaging abnormalities in some of the trial patients. While this is a somewhat normal occurrence in Alzheimer’s patients undergoing experimental treatment – usually clearing in four to 16 weeks – some serious adverse events (SAEs) have been reported. Specifically, the SAEs were occurring in patients with the APOE e4/e4 genotype, which represents ~10%-15% of the Alzheimer’s disease population. As such, Alector elected to amend trial protocol to eliminate this subset of patients from participation. This development may delay completion of trial enrollment, meaning the data readout scheduled for 2024 may get pushed out.

AL002 is the one of two programs that formed the basis of the company’s collaboration with AbbVie (ABBV) in 2017 – a deal that brought upfront money of $205 million, as well as a $20 million equity investment. However, the other Alzheimer’s disease program in that agreement (AL003) was terminated by AbbVie in June 2022 before it could get to a proof-of-concept trial. If ultimately successful with AL002, Alector is eligible to earn an additional $242.8 million in milestone payments for up to three indications with a 50-50 global profit share. AbbVie is responsible for clinical development beyond Phase 2.

AL044. The company’s one untethered program, Alzheimer’s treatment AL044, just entered the clinic in September 2022 to assess its safety and tolerability in ~72 healthy subjects.

Analyst Commentary & Balance Sheet:

Owing to the upfront money received from its two Big Pharma partners, Alector is in outstanding financial position for a clinical-stage concern. It held cash and marketable securities of $808.9 million on June 30, 2022, providing it a runway on current cash burn into late-2025.

The Street leans slightly positive on Alector’s prospects, featuring three buy and two outperform ratings against two holds and one sell. Their median twelve-month price target is $14. Morgan Stanley downgraded shares of ALEC in early September and lowered its price objective from $27 to $13, citing a long path to market for AL001 and an unclear path for AL002.

Verdict:

With a market cap of around $750 million, Alector currently trades at a slight discount to cash. Put another way, the market is not sold on any of the company’s clinical prospects. So far, its Alzheimer’s disease endeavors have yielded nothing, with earliest approval for that indication under a best-case scenario not happening until at least FY26. Meanwhile, Biogen and Eisai will most likely get the chance to take the first big bite out of the Alzheimer’s pie that some estimate to be as high as $60 billion. Even though this is bad news for Alector, the beta myeloid thesis regarding Alzheimer’s is now back in play, meaning that its AL002 therapy might be on the right track.

And Alector’s approach is unique. It does not appear that any other company in the biopharma universe is targeting microglia-related genes to solve neurodegenerative disorders.

That said, although the company’s lead asset AL001 has demonstrated promise in FTD-GRN, it is on a very small population of patients with no placebo control to date. Furthermore, with timelines for enrollment completion of its 180-patient, 96-week pivotal study nebulous, approval under a best case scenario – even with its expedited Fast Track designation – would not be until FY26. And with AbbVie throwing in the towel on one of its Alzheimer’s programs, it is easy to see why its stock is off approximately 80% since the post-GlaxoSmithKline euphoria of June 2021. However, trading a discount to cash puts somewhat of a slowly lowering floor in the stock.

ALEC would make a solid covered call candidate but liquidity is just so-so against this equity. For those looking to take a small ‘watch item’ holding in this name I would recommend using covered call orders utilizing the April $10 calls for a net debit of between $7.20 to $7.40 a share. That is what I did in my personal account. Other than that strategy, I am passing on any investment recommendation on this name for the moment.

If you have wealth without liquidity, you’re still in bondage. If you have capital without currency, you’re still in bondage. Liquidity equals freedom.”― Hendrith Vanlon Smith Jr

Be the first to comment