Sundry Photography

Sony Group Corporation (NYSE:NYSE:SONY) had given a good long-term capital appreciation profit for shareholders until this year’s market turmoil caught it in its grip. Now is an ideal time to buy back in to Sony, as the stock price is set to at least reclaim early 2022 levels. That would involve an approximate doubling of the stock price. The excellent Q2 results just announced have already given the stock an instant 10% boost.

Sony is a well-integrated and well-managed conglomerate addressing mainly secular growth areas. It has exciting new growth products of its own to add to the existing ones. These include console and online gaming, streaming, movies, image sensors, semiconductors and music. It is also well-diversified geographically.

Sony’s status as a conglomerate, and one that invests long term for capital growth, is an attraction for those looking for long-term capital growth in their shareholder accounts. It offers sound valuation metrics, growth on current products, and exciting potential growth products for the future.

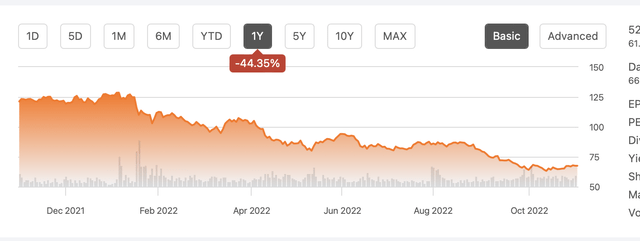

Stock Price

Up until mid-2022, long-term stockholders had been sitting pretty with their annual stock gains. One hopes some had taken profits (something I always recommend) before the stock market correction occurred.

As per the SA Quant Ratings page, the 1-year stock chart illustrates the hit:

The 44% fall in the share price cannot rationally be put down to any part of Sony’s micro performance.

The 5-year stock chart illustrates how stockholders had been sitting pretty up to this year:

Sony’s stock price has still managed to give a 5-year return of 79%. This compares to the S & P figure of 51%. It has an annualized 5-year return of 12.38% compared to that of the S&P 500 Index (SP500) of 8.6%

There were good reasons why in the 4 years before 2022 the company had an almost unbroken ascent. This can now be expected to resume its forward march (from whenever you feel the bear market has calmed down). Sony may well benefit from investors who have been burned and are looking for something safer than the usual high-risk tech flyers.

Overview of Company

As a conglomerate, Sony has better earnings stability than most of its peers. This stability is a boon, as we still live in uncertain times. Covid and Russian aggression are still macro risk factors. Rising interest rates pose their own risks to everyone.

The Company has organic growth across its existing divisions. Its individual product divisions are backed up by its Finance & Insurance arm. Some years ago, Dan Loeb (always one to see short-term profiteering and redundancies over long-term growth and employee benefit) was rightly turned down by the Sony board when he wanted to break up the company into parts.

As per my article in May, Sony has exciting new product development areas. These include electric vehicles (“EVs”), drones, robots, virtual reality, and what is usually termed the “metaverse.” By definition, these may or may not develop into new standalone profitable divisions. They are especially well-placed for the metaverse, if indeed one believes that is the next big thing.

The EV arena looks especially exciting, but should not impact on revenues until 2025 or 2026. The joint venture with Honda (HMC) entitled “Sony Honda Mobility” is seen in particular as a moneymaking content platform for Sony. It appears to be looking to build an open community and create a new mobility entertainment concept. For me, I think this is probably the direction in which Apple (NASDAQ:AAPL) will also move in the EV space. The EV concept is especially apposite for Sony with its leading position in the fields of image sensors and music.

Their robot division is very impressive, as was shown at a recent expo. Sony is the leading developer of robots for healthcare (for surgery and for nursing care). This is seen as a huge potential market in an aging population, in Japan and everywhere. This expo no doubt told us more about the exciting future of robots than the recent “Optimus” display by Tesla (NASDAQ:TSLA).

The Play Station product has been the bedrock of revenues in recent years. It has always dominated the market despite the efforts of Microsoft (NASDAQ:MSFT) and, to a lesser extent, of Nintendo (OTC:OTCPK:NTDOY). For me, its biggest boon is the way that it provides a huge captive audience of almost captive users. This is very similar to Apple’s huge advantage over competitors with its iPhone user base.

The fight is now being taken into field of VR (virtual reality). Sony expects to have 2 million of its new VR2 headset manufactured by March 2023 with official release in February. Pre-orders are starting in November. It is pictured here:

It has been forecast that the VR market will be worth $571 billion by 2030. This could add a further large revenue increase to the substantial Games & Network Services division. In another potential game-changer for the division, there have been reports of Sony adding advertising to free games. This could take the form of the company getting a cut of the revenue. Or it could take the form of the company getting revenue by selling player data.

Sony’s Q2 Results

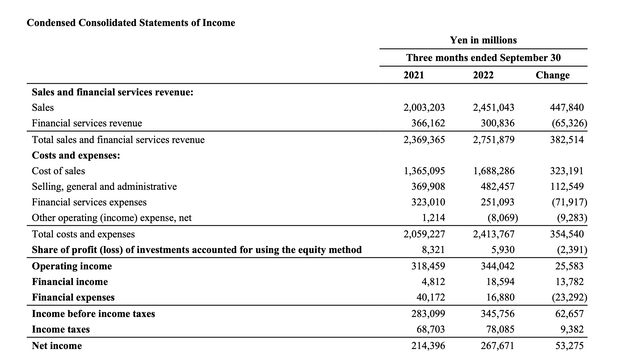

Once again, the company exceeded expectations of analysts. They have a long history of underestimating the company. Year-on-year revenue was up, net income was up, operating cash flow was steady, and the always cautious management increased the FY 22 outlook, raising guidance by 4.5%. If this raised FY 22 outlook is achieved, then the company is currently trading well below EV/EBIT norms.

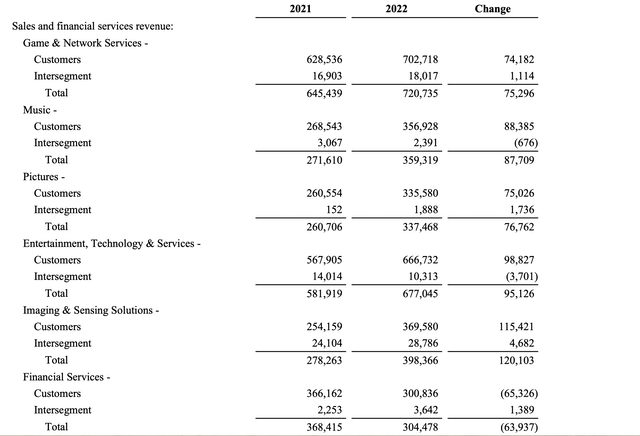

The company is firing on all cylinders. Across the board revenue spread announced by the company was highly promising:

This produced a healthy Consolidated Statement of Income:

The weaker yen helped the strong results in general. Sony has a balanced revenue spread around the world, although the company reports in Japanese Yen. Japan accounts for about one-third of revenues.

* Their most important Game & Network Services division showed some headwinds. The videogames profits forecast was cut by 12% for the full year. The company is experiencing higher costs from development and acquisitions. They produced 6.5 million PS5’s in the quarter, about as expected. At the analyst call, management stated they planned to produce 23 million PS5s in 2023. They confirmed they were having success in ramping up production to meet huge demand.

* Revenue growth was excellent in the perennially underrated image sensors division. This division goes from strength to strength. Sony are world market leaders.

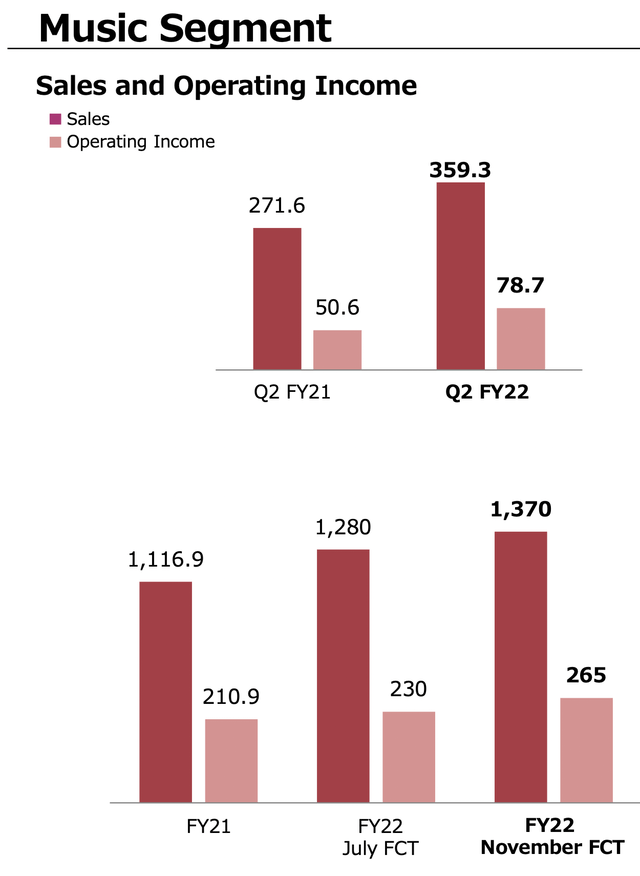

* Growth in the music division is very strong. Music is a tremendous secular growth market. Sony, as the world’s largest music publishers, are at the forefront of the trend. Their growth rate is illustrated by the details accompanying the Q2 results:

* Pictures management was very successfully reorganized in the last few years. The benefits are clearly showing now in a range of film successes. This division also includes their fast-growing anime product range. Again, that is a strong secular growth area.

Most importantly, the company showed they can flourish across divisions even despite the turbulent times experienced by consumers.

The full statements and press release can be viewed here.

Valuation

As I detailed in an earlier article, Sony has a long history of trading at a substantial discount to the sum of its parts on a discounted cash flow basis.

Its valuation metrics right now appear attractive. As per information provided by Charles Schwab, in comparison with the bracketed S & P Global BMI Consumer Discretionary sector:

P/E = 14.11 (22.59).

Price / Forecasted Earnings = 12.20 (19.26).

Price/Sales = 1.27 (1.28).

Price/Tangible Book = 3.25 (2.97).

Price/Cash Flow = 7.37 (13.56).

Profitability is excellent with gross profit margins at 27.93% and EBIT Margin at 11.41%

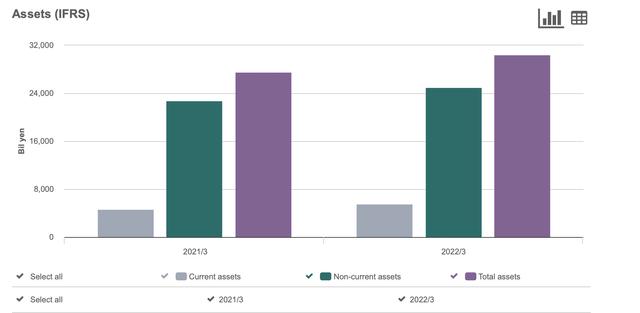

Capital structure is secure with market cap of $82.2 billion, total debt at $24.56 billion and cash of $5.56 billion. The debt has increased somewhat due to recent purchases, as the balance sheet details illustrate. It is still very satisfactory though, as one would expect from Sony’s quite conservative management. Debt to equity ratio is 47.79 % (when generally a debt to equity ratio of under 50% would be considered sound). Total long-term debt was reduced by 29% in the latest quarter. Total assets increased 3.3% while total liabilities rose 4.2%

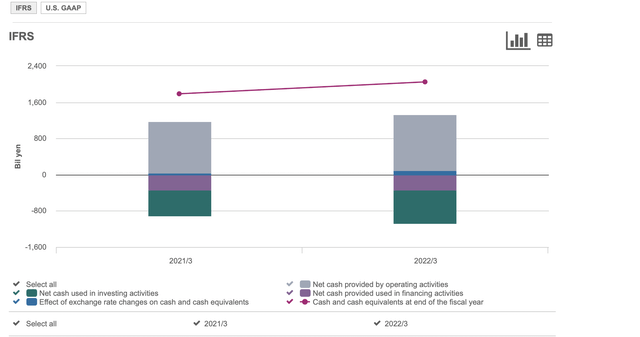

As per information from Sony, their accretion of net cash and amount of net cash used for capex investment is very strong:

Meanwhile their asset base is growing:

Risks to my Thesis

* The company may not produce the blockbusters in its Pictures division that are forecast for Sony by many. That is in the nature of the business.

* Chip shortages worldwide could hit Sony’s PS business.

* The semiconductors business could be adversely affected by as-yet unknowable conflict in chips between the USA and China.

* Legal developments concerning Microsoft’s attempt to take over Activision Blizzard (NASDAQ:ATVI) may have negative consequences for Sony’s console and streaming gaming business. Microsoft are paying $69 billion for ATVI. That makes one realize how important it is to their console business, which has always been second-best to Sony. The big deal for Sony, the purchase of “Bungie,” with its “Destiny 2” franchise, cost only $3.6 billion. Organic growth is more apt for Sony than high buyouts of other companies.

* A downturn in mobile phone demand would hit the image sensor division.

Conclusion

Sony offers investors a well-managed company with a wide range of current growth earnings from vertically integrated divisions. Their results show they can thrive even in a tough time for consumers. Add to this new growth areas, and it is an attractive package for investors going forward.

Sony offers a sound valuation and great growth potential on a secure base. That seems ideal in these uncertain times. There is every reason to expect that previously attained stock price levels can be revisited and subsequently exceeded. Sony’s stock price at the time of writing is $72.10. The 52 week high is $133.75. That gives Sony a very attainable doubling of the stock price as a medium-term target.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment