sefa ozel/iStock via Getty Images

Editor’s note: Seeking Alpha is proud to welcome Paid To Wait as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Shares of Miller Industries (NYSE:MLR) have returned back to their long-term trajectory after being overextended during most of the year 2021. Taking a historical view on the financials of the company shows that it has been able to grow profitably for over a decade. Based on the average ROE, management has been able to allocate capital efficiently. As a result, the stock price has appreciated at nearly 10% CAGR over the last ten years.

Currently, the company is facing headwinds from cost inflation and availability of materials. However, management considers these issues temporary. If these headwinds are transitory, then Miller shares can provide a long-term investment opportunity for capital appreciation and dividend income with a little downside risk.

The successful track record of the company provides a solid foundation for a buy recommendation. Intrinsic value calculation shows that the shares are below their fair value, and if the company can grow even slightly below its historical levels, the shares have good upside potential. Miller Industries is a good pick for a long-term investor who appreciates a safe dividend income.

Company overview

If something unfortunate happens to us on the road while driving, Miller’s products are able to help us. Miller Industries is a small-cap industrial manufacturer of towing and recovery equipment for different kinds of vehicles. Miller operates under several brands in the United States and internationally. The company has manufacturing sites in the United States, the United Kingdom, and France.

According to Miller, it is the largest company in its niche. In the past, the company has made several acquisitions to consolidate the industry. There are no other listed competitors and the rest of the industry is rather fragmented. Plenty of smaller players – such as Danco Products in the United States, NRC Industries in Canada with a revenue of $20 million, and Bro Bärgningsbyggen AB in Sweden with a revenue of $4 million – serve the same customers: towing contractors.

A decade of financial performance

There’s rarely anything better than over a decade of financials to determine the quality of a company and the strength of its competitive advantages.

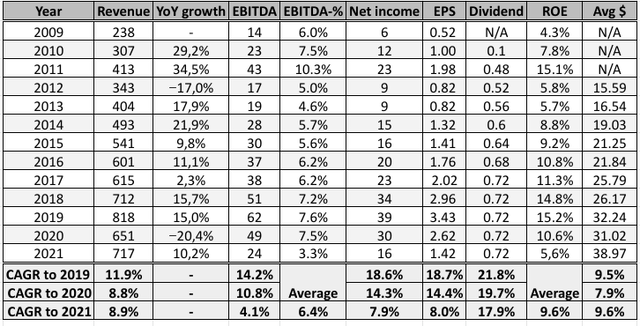

Miller Industrial’s long-term financials. Figures in millions, USD. (Roic.ai and the author)

I collected the financial figures from 2009, the starting point of the phenomenal uptrend of Miller Industries’ stock, until the recent 2021 results. In 2021 the company achieved a revenue of $717 million, EBITDA $24 million, and net income of $16 million. At the bottom of the table, I have calculated the compound annual growth rates until 2019, 2020, and 2021. The individual line for CAGR to 2019 is one of the most meaningful ones, since it was the year before the global pandemic hit the world.

The revenues of the company have increased at a CAGR of 9%-12%. EBITDA margin has averaged 6.4% over the 13 years, and absolute EBITDA has grown 4%-14% CAGR. Net income, EPS, and dividends have grown at a faster pace if we close our eyes from the year 2021, growing at a CAGR of 8-19%. Meanwhile, return on equity has averaged 9.6% over the past thirteen years.

The purpose of the table is to illustrate that Miller Industries and its management have been able to grow the company profitably for over a decade and allocate capital efficiently. As we can see in the last column of the table above, the stock price has followed Miller’s financial performance and growth. The average share price has had a CAGR of approximately 10% over the last decade.

Holding the line?

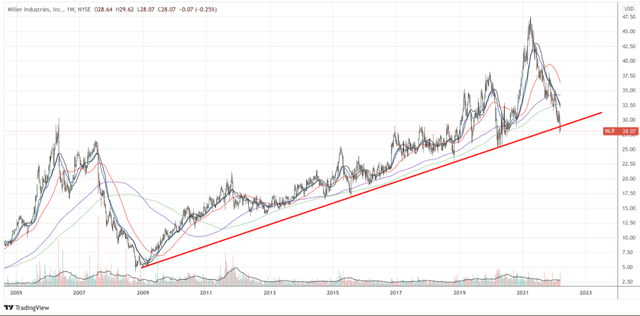

Miller Industries stock price (TradingView)

Starting from 2019, Miller Industrials’ stock has been in a clear long-term uptrend. 2009 was the year when the company started to climb out of the aftermath of the financial crisis. However, 2008 was a worse year for the company and it remained profitable. The stock picked up and continued its march upward.

Last year, the stock price got overly extended, reaching over $46. And as often seen in the past, the stock price resumed to the trendline. Is Miller Industries capable of continuing solid financial performance and keeping the stock above its long-term trendline?

Recent results

In order to evaluate if Miller is able to hold its trajectory, we can look at the question from two different angles: recent results and future outlook. 2018 is the most comparable year to 2021 in terms of revenue and average stock price compared to the current market price. However, in 2018 Miller made twice the EBITDA and net income compared to 2021. What changed?

From 2014-20 the selling, general, and administrative costs have hovered between $30 million and $40 million per year, 2019 being an exception. In 2021, SG&A costs climbed to $46.2 million (in 2018 they were $39.5 million). According to the latest 10-K, the cost increase was due to increased travel expenses and the resumption of activities that took place before COVID-19. Management also highlighted the impact of increased salaries and inflationary pressures.

Cost of operations went from $628 million in 2018 to $647 million in 2021, an increase of $19 million. This is how management commented on the cost of operations in the 2021 10-K (linked to above):

Primarily due to rising inflation, supply chain disruptions/constraints, and significant increases in labor costs. These factors were more pronounced during the third and fourth quarters of 2021, in comparison to the prior two quarters, which resulted in significantly increased costs, and contributed to a substantial decrease in net income during the second half of 2021.

In total, the two largest – and the two only meaningful – cost items have increased by $25.7 million. That’s only an increase of 3.9%, but due to the low margin nature of the business, the impact on the bottom line is significant as we can see in the financial figures for 2021.

What did management say about sales in 2021? Again, as per the 10-K linked to above:

Net sales during 2021 were adversely impacted by supply chain disruptions throughout the year, which increased work in process and inventories as deliveries of our products were delayed by delays in deliveries of certain critical final component parts from our suppliers, which in turn substantially increased our backlog of orders.

For this reason, the inventories of the company increased by almost 37% during 2021 compared to 2020 and kept the order backlog at historical highs.

Future prospects

The second angle is the outlook for the future. As there are no analysts following the company, I’ve taken management’s comments as a starting point to discuss what the future could look like for Miller. In order to evaluate if the above-mentioned headwinds are transitory, I will focus on pieces of information about the pricing power, cost control, and the order backlog of the company. As per the Q4 2021 earnings call:

Demand remains at all-time highs. Given the favorable macro dynamics and strong backlog levels, we remain confident about our long-term business prospects. We also saw continued improvement in our international operations as European pandemic restrictions eased. The extended nature of supply chain and inflationary challenges has proved difficult for not only Miller, but for nearly every manufacturing company around the globe.

Supply chain constraints and inflationary pressures had eased slightly as we moved into 2022, however the impact of the current military conflict between Russia and Ukraine has added an additional negative impact on our raw material availability and pricing.

Sales in Europe saw a decline in 2021 and are now coming back up. The company operates in Europe through its subsidiaries called Jige International and Boniface. Miller doesn’t disclose the sales split in different geographies, but based on my review of the distributors, the company clearly has more room to grow in Europe. Jige International manufactures a wide range of vehicles intended for military use that could bring in additional sales as Europe starts rearming itself.

I believe that Miller’s management, employees, and customers have had time to get used to the prevailing situation by now. Customers have a need to renew their equipment at certain intervals, so the company can fulfill that existing demand. The large order backlog tells us that competitors have also been suffering. As the largest player, Miller will be served first by its suppliers.

As time goes on, the financials of the company will benefit from reduced backlog as Miller mainly manufacturers for orders. The comments by management indicate a positive outlook, but naturally, they remain cautious about the recent developments in the war in Ukraine. Again, as per the earnings call linked to above:

We have enacted a series of price increases to our customers to cover the increased costs. However, as we have mentioned previously, it takes time to realize the benefits from these price increases due to the increased backlog levels.

… we continue to see extremely high levels of demand in our domestic business and have experienced strong backlog growth. While we are encouraged by our year-over-year revenue growth, we have been unable to capture the new demand as a result of supply chain constraints and material shortages.

In 2021, the company finished the implementation of its new ERP system in order to drive efficiency and customer satisfaction. Additionally, from 2017 to 2021 the company invested $82 million into the automatization and expansion of its plants, which should bear fruit in the coming years. In 2021, Miller significantly decreased its investments in property, plants, and equipment as a cost-control measure. This is a good example of the prudence of management.

Difficult market conditions could provide an opportunity for Miller to acquire a new brand under its umbrella. Miller has a history of acquisitions and clearly plans to remain open for opportunities if they arise.

We can conclude that there will be further pressure on the company’s profits during the following quarters, but Miller maintains a good level of demand and has been able to implement price increases to offset the cost increases. Simultaneously, the company has measures in place to limit the impact of cost increases to its bottom line. The company has not neglected to invest in its operations and has a solid foundation for the future.

Downside considerations

One could argue that Miller Industries has entered into a secular decline based on recent results and price action. There’s certainly a possibility of that. If the prices for steel and other commodities continue to rise, Miller will have a tough time keeping up with rising costs. Eventually, the decline in demand would kick in and a vicious cycle would begin.

The likelihood of the secular decline scenario increases if the war in Ukraine is prolonged, central banks increase rates too fast, and the overall macroeconomic picture worsens. As Millers’ products are discretionary, customers can in some capacity prolong the interval of renewing equipment. Its customers could have more difficulties to finance purchases and face profit declines themselves as fuel prices and wages are soaring, both of which would lead to dampened demand for products of Miller Industries.

If this scenario is realized, the strong balance sheet of the company will protect Miller in times of turmoil. The company carries no long-term debt and has a cash balance of $50 million, around 13% of the company’s market cap.

Total return potential

Capital appreciation

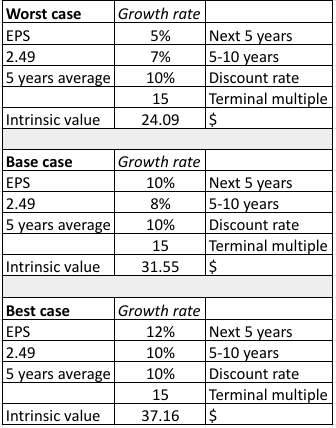

Based on historical financial figures and future outlook, I will form a simple and conservative intrinsic value scenario based on earnings per share of $2.49, an average for the last five years. I choose to do this because of the cyclical nature of the business and the two extraordinary years behind us.

In the worst case, I assume that the EPS growth is halved from historical levels but continues higher after five years. This is a scenario that could present itself if the headwinds for the business remain but management is able to mitigate part of the effects.

In the base case, I assume that EPS keeps on growing at a pace of 10%, two percentage points higher than historical EPS CAGR to 2021 (please see the table at the beginning of the article). Finally, in the best case, I assume that the growth continues first at slightly below the historical levels at 12%, two percentage points slower than historical CAGR to 2020. In order to remain conservative, in both cases, I assume that the growth rate slows down two percentage points after the next five years.

Both the discount rate and terminal multiple are the same for all scenarios. One could argue that for a long-term steady performer such as Miller the discount rate could be a notch lower and the terminal multiple could be a little higher. In order to mitigate the risk presented by the current inflationary forces and risks of an economic downturn, I want to remain conservative with the inputs.

If the company can maintain growth at slightly below its historical level, the intrinsic value of the company is $37 per share, providing nearly 40% upside potential. It’s worth noting that even if the EPS growth rate is halved, the downside in the stock price is rather limited. If we give 20% probability for the worst case, 30% probability for the base case, and 50% probability for the best case, considering the long track record, we arrive to a target price of $32.9 per share.

Three scenarios for intrinsic value of Miller Industries stock (Calculation by the author)

Dividend

Miller has paid a dividend for 45 consecutive quarters in a row. The dividend payment has remained at the same level since 2017. Miller pays $0.72 per share in annual dividends, which equals a yield of 2.6%. The average dividend yield for the past 10 years is 2.8% with a payout ratio of 42%. A modest but safe dividend will provide a good starting point for a nice total return.

Conclusion

The nature of sales and profits for industrial companies is bumpy. So it is with Miller Industries. Having a long-term look provides a backbone to have confidence in one’s potential investments.

An investment in Miller Industrials won’t make someone rich. Based on the analysis we can conclude that the stock is fairly valued by conservative assumptions. If the company is able to grow revenue and profits as it has been doing for over a decade, there’s a significant upside in the stock. Considering a healthy dividend, Miller Industries can be a good small-cap cornerstone of a portfolio seeking a good total return.

Since the supply chain issues and inflationary pressures will likely persist during the next couple of quarters, an investor can build a position in this stock gradually and monitor how the situation develops.

Be the first to comment