Juanmonino/iStock Unreleased via Getty Images

Introduction

This article may start with a disclaimer: I am a big fan of Pepperidge Farm Goldfish and Milano cookies. Since I want to invest in companies I am familiar with, I started researching about Pepperidge Farm. This is what brought me to Campbell Soup (NYSE:CPB), the current owner of this beloved brand. However, as much as I love some of its products, I would like to share why at the moment I currently rate the company as hold, meaning that investors who already own the company may do well sticking with it, but investors who wish to initiate a position in the stock should and could wait for a more reasonable valuation.

Summary of previous coverage

This article can be seen as the fourth episode of a series in which I started researching and covering some of the most important players in the Packaged Food and Meats Industry. The main reasons I am looking at this industry are the following:

- They sell products that everybody always needs. In other words, they are consumer non-cyclical companies

- They usually enjoy high gross profit margin and a good return on common equity

- They are able to return excess cash to the shareholders with interesting yields

In my previous articles I looked at The Kraft Heinz Company (KHC); The Hershey Company (HSY) and Hormel Foods (HRL).

The company

The company started its journey back in 1869 when Mr. Campbell, a fruit and vegetable vendor and Mr. Anderson, a commercial canner and packer formed their company. In 1922 the company officially became Campbell Soup Company. In 1961 the company acquired the brand that led me to research the company: Pepperidge Farm, a baked goods company founded by Margaret Rudkin. I would like to spend a few words on this business woman and her history because I think it is worth knowing. She lived in Fairfield, Connecticut on a property called Pepperidge Farm. She began baking all-natural stone ground whole wheat bread for her youngest son who suffered from severe allergies and asthma and couldn’t eat most commercially processed foods. Bear in mind that at that time Mrs. Rudkin had never baked in her life. Her bread eventually turned out to be so good that her son’s doctor prescribed it to other patients. This made her approach her local grocery store to see if he would be selling her bread. The grocer at first was reluctant but once he gave a taste he changed his mind. The rest is a beautiful growth story that led to the recalled acquisition of Pepperidge Farm by Campbell Soup.

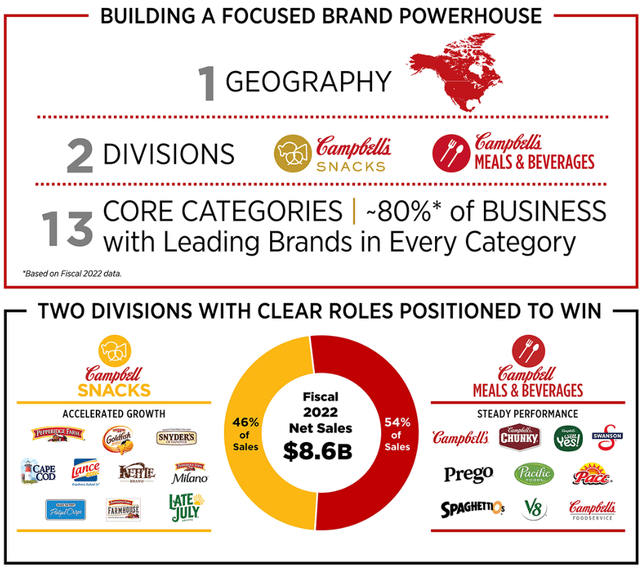

Campbell Soup is mainly focused on North America which can be an advantage at the moment, given the strength of the U.S. dollar and the hit that many American companies are taking on their international sales. As shown below, the company has two divisions: Snacks and Meals & Beverages, which account respectively for 46% and 54% of sales. This makes the company’s portfolio well-balanced with many leading brands in 13 core categories.

Campbell Soup Investor Relations Website

2022 Fiscal Year Results

At the beginning of September, the company released its fourth quarter results and full-year fiscal results.

For the full year the company reported a net sales increase of 1% and an organic net sales increase of 2% to $8.6 billion.

However, EBIT decreased to $1.2 billion and the adjusted EBIT decreased 4% to $1.3 billion and the adjusted EPS totaled $2.85 compared to $2.86 in the prior year. The decrease was mainly due to the well-renown inflationary pressures.

The company, in any case, delivered a good Q4 with net sales and organic net sales increasing 6% to $2.0 billion and an adjusted EBIT increased by 5% to $269 million. This led to an adjusted EPS increase of 8% to $0.56. This showed that, even if for the fiscal year we saw a decrease, in Q4 the company is implementing successful inflation mitigation and cost management.

If we zoom out and compare the results to 2019, we see that Q4 consumption was up 8% YoY and up 21% compared to 3 years ago. For the full year, consumption was up 4% versus the prior year and up 14% versus 3 years ago. So, overall, the company can say that it is growing at a 4% pace.

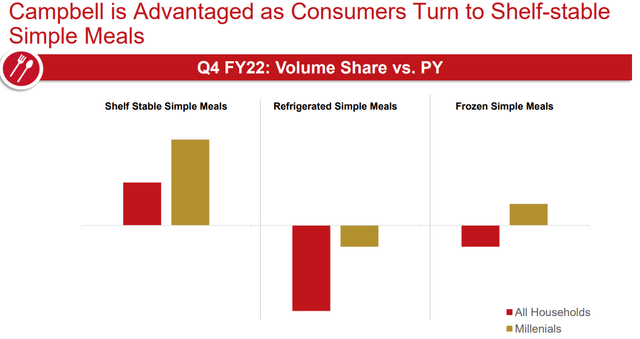

I see two aspects to consider as we approach challenging economic times. First of all, consumers often tend to turn to meals and beverages that offer value and taste, allowing to save on out-of-home food. Campbell, for sure, can meet this need. In fact, during tougher economic times, shelf-stable simple meals grow in importance, as it is shown in the slide below that helps us visualize the growth of volume share of total food. Not by chance, the company aims at building a $1 billion sauces business, given the tailwinds of the increasing quick scratch cooking as consumers continue to eat more at home to save money. In fact, its Prego brand remained the number one share leader in the Italian category for the 39th consecutive month and delivered consumption growth of 12.4% compared to the prior year.

Mark Clouse, Campbell CEO, talked about this during the last earnings call

The strong value and convenience of categories like pasta sauce and ready-to-serve soup have driven the segment’s outperformance versus both refrigerated and frozen simple meals. This consumer behavior, importantly, among younger households, gives us confidence in the continued relevance of our categories heading into fiscal 2023.

Campbell Soup Q4 Results Presentation

Secondly, the snacking sector has proven more than once of extreme resiliency during prior economic downturns.

To this, we have to add that Campbell management reported that the company will not rely only on pricing to manage inflation as it has already delivered $850 million of multiyear cost savings and it aims at reaching $1 billion by fiscal 2025. Part of these savings are also turning helpful as Campbell, having improved its supply chain execution, can now invest more in promotional activity, as it has already started doing during the past quarter (by the way, I just published a recent article on why Google should benefit from this resumed advertising spending trend). Part of this spending turned out to be very successful, especially for Gold Fish, which delivered excellent results driven by relevant innovation and award winning marketing. In fact, the company has developed for this brand a limited time-only strategy with the recent collaborations to develop new flavors with Frank’s RedHot, Jalapeno Popper, Old Bay and Dunkin’ Donuts that led to the Goldfish Dunkin’ Pumpkin Spice Grahams. Since their launch, Frank’s RedHot and Jalapeno Popper Goldfish have driven incremental sales of 60% for the Goldfish brand.

Campbell also decided to be open about 2023 fiscal guidance, expecting net sales to increase by 4%-6% and an adj EBIT increase between 1% and 5%.

Cash returned

Though Campbell is not a company that aims at becoming a Dividend Aristocrat, it has a steady dividend history with reasonable hikes that, however, do not take place yearly. The company is able to generate enough cash from its operations than can be deployed to develop the business through investments and M&As. But it turns out that it does have excess cash that can be returned to the shareholders. In fiscal 2022, cash flow from operations was $1.2 billion, a 14% increase over prior year. Campbell returned over $600 million in fiscal 2022 to its shareholders through dividends and share repurchases. Regarding buybacks, at the end of Q4, Campbell had approximately $375 million remaining under the current $500 million strategic share repurchase program and approximately $172 million under our $250 million anti-dilutive share repurchase program. The 3% dividend yield is for sure interesting, and the payout ratio is around 52% which is reasonable for the industry. However, investors should not expect a yearly dividend growth.

Valuation

Overall, I think Campbell Soup is a good business that offers steady results though at a slow pace. However, there are some facts that make me stay on the sidelines and one is the dividend. Since I don’t know when and how it will be raised, it is difficult for me to fit this stock into my dividend growth portfolio. Overall, the company is very profitable, with a gross margin profit of 30%, an EBIT margin of 14% and, most importantly, a ROTC of 9%. However, if I compare it to the other peers I pointed out in the beginning of the article, I see more quality and more upside elsewhere.

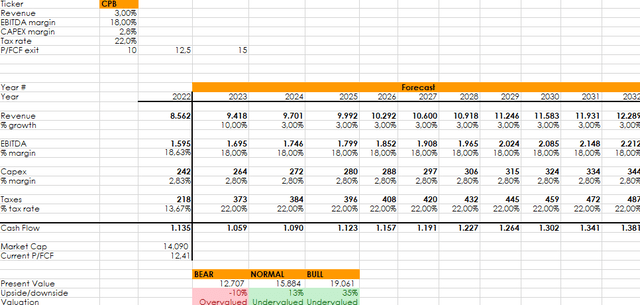

If I run a discounted cash flow model to get an idea of Campbell’s value I see it more or less fairly priced, given the current market conditions. In fact, by plugging in the numbers Campbell provided with its 2023 guidance I get that with a price/FCF exit multiple of 10 we would have just a 10% downside. If the company keeps on trading near its current multiple of 12,5 then we could have a 13% upside. Only with a bull-scenario multiple of 15 we would be before an interesting 35% potential upside.

Author with data from Seeking Alpha

Thus I think that current shareholder can reasonably hold on to the stock, but new investors can wait for better entry points and, meanwhile, take advantage of many other opportunities in the market.

Be the first to comment