Benito Vega

Akero Therapeutics, Inc.’s (NASDAQ:AKRO) Efruxifermin is an FGF21 (fibroblast growth factor 21) analog which is differentiating itself in a crowded space by producing outstanding data. There are 7-10 FGF21 analogs that have been run through clinical trials. The NASH therapy space has drugs which have, roughly, the following mechanisms of action:

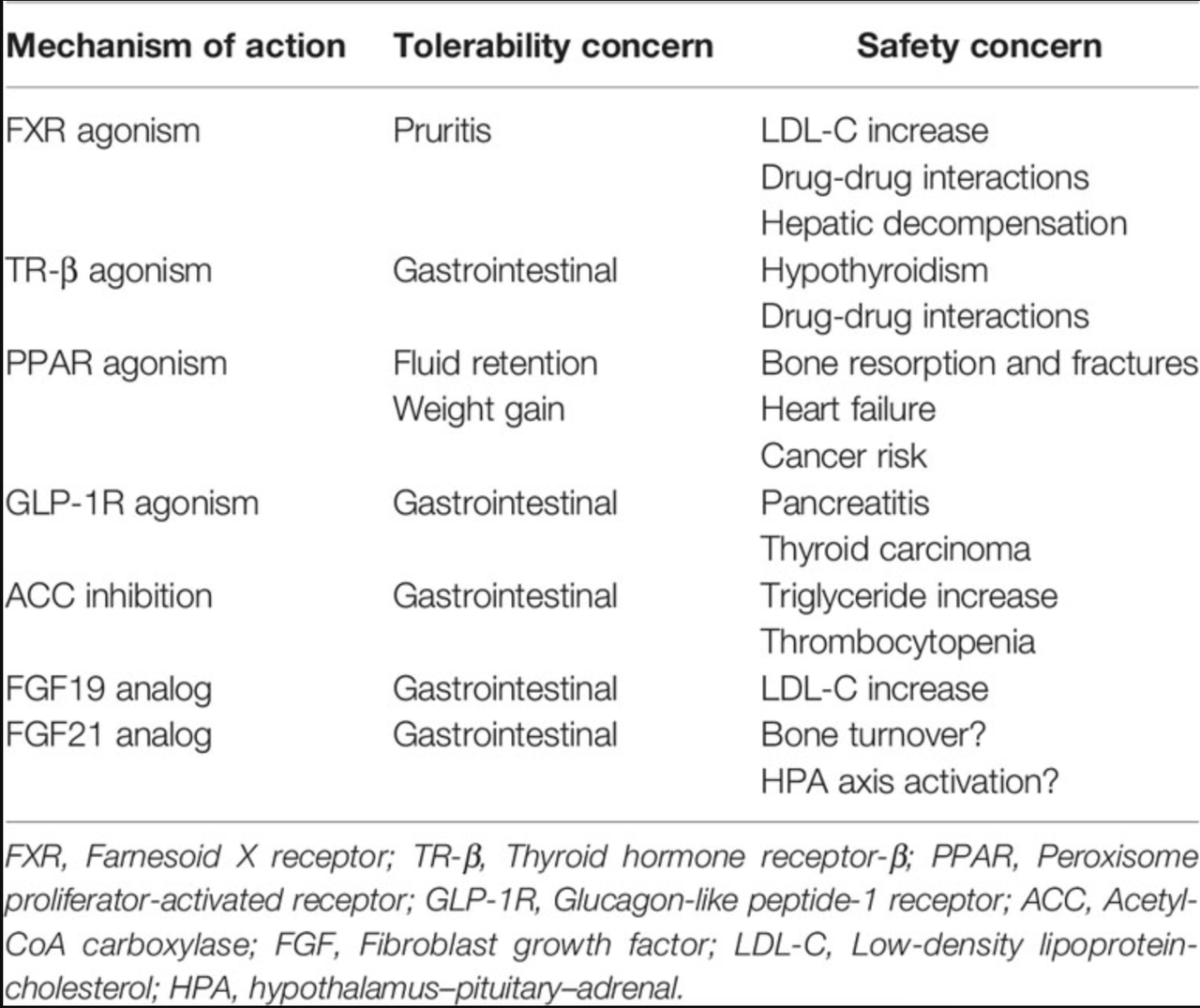

FXR agonism, TR-B agonism, PPAR agonism, GLP-1R agonism, ACC inhibition, FGF19 analogs, FGF21 analogs.

Below is a list of the tolerability and safety concerns of each of these mechanisms of action:

MoA of NASH drugs (frontiersin.org)

Source – FGF21: An Emerging Therapeutic Target for Non-Alcoholic Steatohepatitis and Related Metabolic Diseases

NASH fibrosis is staged from F0 to F4. Here are the descriptions:

Fibrosis stage

|

Definition |

Score |

|

None |

0 |

|

Perisinusoidal or periportal |

1 |

|

Mild, zone 3, perisinusoidal |

1A |

|

Moderate, zone 3, perisinusoidal |

1B |

|

Portal/periportal |

1C |

|

Perisinusoidal and portal/periportal |

2 |

|

Bridging fibrosis |

3 |

|

Cirrhosis |

4 |

Source- author

More patients die in the more advanced fibrotic stages, so the initial focus of research was anti-fibrotic. However, this approach produced limited clinical efficacy, so the current approaches are more targeted towards the underlying pathophysiology, like steatosis, or the abnormal retention of excessive fat on the liver. Steatosis drives hepatocytic injury and is upstream of inflammation and fibrosis. FGF21 is a hormone that in humans reduces liver fat and thereby liver injury, so FGF21 analogs like Akero’s Efruxifermin hold therapeutic promise.

Madrigal’s resmetirom, on the other hand, is an oral thyroid hormone receptor (“THR”) β-selective agonist. Thyroid hormones play key roles in human metabolism. THR- β, especially, is known to do the following in the liver:

In the liver, THs are actively involved in the regulation of metabolism throughout different pathways (Figure 2). Indeed, THs increase energy expenditure by having a direct effect on ATP consumption in metabolic cycles and membrane permeability as well as by indirect effects on mitochondrial biogenesis and activation (27, 28). In addition, different critical steps in the lipid metabolism are under THs control: cholesterol serum clearance by the low density lipoprotein (LDL) receptor, 3-hydroxy-3-metylgutaryl-coenzyme A reductase, cholesterol biosynthesis and cholesterol 7α-hydroxylase (CYP7A1) (29). Disruption in the normal THs signaling has been also reported to be causative of liver diseases such as non-alcoholic fatty liver disease (NAFLD)…

The difference between Madrigal Pharmaceuticals, Inc. (MDGL) and Akero is in their two molecules’ respective mechanisms of action; however, both target reduction of steatosis. There are numerous differences besides the MoA, including half lives, safety and tolerability, therapeutic benefit, and so on. However, both molecules are “good,” and their trials are gearing towards producing the first couple of approved drugs in NASH that may actually work.

Below is a somewhat longish overview of EFX and its mechanism, half life, and earlier trial data:

Efruxifermin (formerly AKR-001, AMG 876), the only other FGF21 analog studied in a clinical trial of biopsy-confirmed NASH patients, is a 92 kDa Fc-FGF21fusion protein with a 3-3.5 day half-life (based on intact C-terminal domain of the FGF21 moiety), which is substantially extended relative to the FGF21 analogs described above. This longer half-life results both from endosomal recycling mediated by the neonatal Fc receptor, and from stabilization of the N- and C-termini of the FGF21 moiety. Because the Fc domain is translated directly upstream of a peptide linker and N-terminus of the FGF21 variant, the N-terminus is protected from degradation by dipeptidyl peptidase (DPP) enzymes (296). Protection of the C-terminus is achieved via substitution of a glycine for the native proline at residue 171 (P171G) relative to mature (i.e., signal peptide removed) human FGF21, preventing degradation by FAP. In the context of a potential therapy for NASH, stabilization against FAP degradation is noteworthy because expression of FAP is greatly elevated in liver from NASH patients compared to appropriate control liver (297). Two additional substitutions further enhance the in vivo activity of efruxifermin: A180E, which increases affinity for KLB, and L98R, which decreases aggregation (238). Efruxifermin retains in vitro balanced potency as an agonist of FGFR1c, FGFR2c, and FGFR3c, a characteristic that may be required to elicit maximal effects on liver and extra-hepatic tissues. In a 4-week study in type 2 diabetes patients, weekly administration of up to 70 mg efruxifermin reduced triglycerides by 60-70%, non-HDL-cholesterol by about 35%, fasting insulin about 50%, and fasting glucose about 20% compared to baseline, while increasing HDL-cholesterol by 60% and adiponectin by about 95% (246). Efruxifermin did not significantly alter body weight over this 4-week trial but did significantly reduce the atherogenic lipoproteins ApoB and ApoC-III to a greater extent than did LY2405319 over the same period. Intriguingly, weekly but not every-other-weekly administration of efruxifermin demonstrated for the first time that an FGF21 analog could deliver improved glycemic control in humans, suggesting that the limitations of previous molecules may have been rooted in inadequate exposure. In a subsequent, 16-week study in biopsy-confirmed F1-F3 NASH patients, approximately half of whom were type 2 diabetes patients, efruxifermin improved glycemic control with significant reductions in HbA1c at doses up to 70 mg weekly. Improvements in lipid and lipoprotein profile were also observed, consistent with those seen after 4 weeks’ treatment. Efruxifermin reduced liver fat content by over 70% after 12 weeks dosing. For the first time, an FGF21 analog induced a strong reduction in liver fat that appeared to be associated with resolution of histological features of NASH, including fibrosis (298). An observed rapid and sustained 30% reduction in serum Pro-C3 levels is consistent with preclinical literature demonstrating FGF21’s antifibrotic activity, and with the reduction in Pro-C3 observed upon pegbelfermin treatment. Finally, the longer 16-week dosing revealed efruxifermin-associated weight loss.

What we note here is that EFX has a number of molecular characteristics which score brownie points for the molecule overall, and which have led to solid data from its phase 2a trial, which I covered earlier. Note that the presence of KLB, one of the two receptors to which it must bind to initiate downstream activities, is selectively expressed in liver and pancreas tissues, so that helps the molecule from having unwanted reactions. These unwanted reactions could include reduction in bone mineral density and decrease of growth through STAT5 signaling inhibition, however the jury is still out on whether these are serious concerns for EFX.

Just a couple of months ago, EFX scored more points after posting strong data from a phase 2b trial. Key highlights:

50mg (41%) and 28mg (39%) groups demonstrated ≥1 stage improvement in fibrosis without worsening of NASH, double the placebo rate (20%)

50mg (76%) and 28mg (47%) groups demonstrated NASH resolution without worsening of fibrosis, three to five times the placebo rate (15%)

50mg (41%) and 28mg (29%) groups demonstrated fibrosis improvement AND resolution of NASH, six to eight times the placebo rate (5%)

EFX-treated patients also experienced statistically significant improvements in liver fat, liver enzymes, noninvasive fibrosis markers, glycemic control, lipoproteins, and body weight

Although this was a small and brief study, the drug did well across multiple parameters, which is always a good sign. The small size of the study caused some problems; 9 patients dropped out in the high dose (3 related to treatment emergent adverse events, all GI tox), which would have missed statistical significance in fibrosis as a result, if they had been included in the final analysis. The company used a modified intent to treat analysis instead of ITT. This may not happen in a larger phase 3 – there were no other concerns.

Madrigal’s resmetirom is an oral drug so it will be more suitable for F2-F3 patients, or earlier stage patients. EFX is a subcutaneous injection so it needs to do well in more serious F4 cirrhotic patients for it to do well in the market. If both drugs do well in F2-F3, naturally the oral drug will score higher. Besides that, EFX phase 3 is a long way ahead (2026 topline) so it needs patience. There are other FGF21 drugs on the horizon, with the one from 89bio, Inc. (ETNB) looking closest. Madrigal’s phase 3 data is right around the corner, and if it is good, it will take the entire NASH space up, giving it momentum. If it is bad, it will not seriously hurt Akero’s prospects, which is next in line.

So one key takeaway from this phase 2b data is reversal of cirrhosis, which was indicated through excellent ELF (enhanced liver fibrosis) test data, although not explicitly, because they were not exactly looking for it; as well as by an extension part of the phase 2a BALANCED study. Next year, the company will produce F4 data:

In July of 2021, Akero initiated the SYMMETRY study, a Phase 2b trial in biopsy-confirmed NASH patients with compensated cirrhosis (F4), Child-Pugh class A. Based on enrollment to date, Akero expects to report results from the ongoing Phase 2b SYMMETRY study in the second half of 2023.

That would be a very important next step.

Risks

A recent article on Seeking Alpha highlights some of the risks I discussed already here. However, the article, while detailed, discusses generic and/or well-known risks. There are no real surprises. One of these risks is that Akero simply did not bother to use ITT (intent to treat) population methodology in this trial. It did not include the data from the 9 discontinued patients in the analysis, which, like I have said, would have missed the primary endpoint. About this, I wrote earlier:

ITT analysis is usually conservative in terms of treatment effect, and a modified ITT analysis, or mITT, for example, a per protocol ITT population assessment, would better represent the treatment effect in my opinion. This would be the population of all ITT patients who completed the trial per its protocol, and this would be a better assessment because including discontinuations – whether treatment-related or not – is a reflection, often, of the tolerability of the drug (in the former case) than of efficacy. Let’s not also forget that there were 6 patients who discontinued due to “administrative reasons,” and at least one patient in the drug arms who declined a second biopsy. This point is important because, as Akero points out in a conference call, most other NASH trials of its peers did not follow ITT, but only used data from those who did the second biopsy. That is understandable because if the primary endpoint assessment needs a second biopsy, and an ITT patient does not do it, what use is their data?

While this is fine, the larger phase 3 trial will almost definitely require ITT (by the FDA), so that’s a question that has been left unanswered by the phase 2b trial. However, there’s solid logic in not using ITT here in the small phase 2 trials.

The second issue is gastrointestinal toxicity. However, you have to understand that GI tox is associated with almost every NASH trial drug, and if it can be resolved using some other treatments or with dosing, then there’s no big surprise here. HARMONY did not produce any major surprise in terms of AE. We did not see any “unexpected” toxicities.

AKRO has a higher valuation than MDGL, despite the former’s later stage asset. Is it because the market thinks AKRO’s drug is better? Because if it does, it may be disappointed – because at this stage, we just don’t have data for such a comparison. Is it because AKRO targets – or may possibly target – a larger market with its cirrhosis focus? I doubt that, as well, because its delivery mode will hinder its commercial prospects to an extent. Instead of finding AKRO overvalued, I would just say that MDGL may be undervalued. Valuation right now is running on market sentiment, and MDGL has been trading at half the price it was some time after I first purchased it. I am sure that if they produce strong phase 3, their value will more than double – just like AKRO’s did, in September.

Financials

AKRO has a market cap of $2.1bn and a cash balance, after raising $200mn, of $380mn as of the last quarter. They spent $25mn in R&D and $11mn in G&A last quarter, so at that rate they have cash runway extending to 2025. However they will start a much larger phase 3 trial within that time, and this trial may cost them a lot more money. So, they may need a dilution before they come to approval. If the stock price goes up, however, then dilution will not be a problem.

Bottomline

AKRO was up a lot in September, and I took profits. The stock has gone even further up, but I don’t want to buy right now, nor do I want to sell out, given the prospects. I will continue holding Akero Therapeutics, Inc., possibly buying at dips.

Be the first to comment