Sushiman/iStock via Getty Images

A Quick Take On Solo Brands

Solo Brands (NYSE:DTC) went public in October 2021, raising approximately $219 million in gross proceeds from an IPO that was priced at $17.00 per share.

The firm owns and operates a number of primarily direct-to-consumer product brands worldwide.

Given external risks and uneven revenue growth history, I’m on Hold for DTC in the near term.

Solo Brands Overview

Southlake, Texas-based Solo was founded to grow outdoor consumer lifestyle brands via a direct-to-consumer (DTC) marketing approach.

Management is headed by President and CEO, John Merris, who has been with the firm since October 2018 and was previously Chief Revenue Officer at Clarus Glassboards.

The company’s primary offerings include:

Company Products (SEC)

The firm markets its products through a digital-first strategy, primarily via each brand’s website.

The company supplements its DTC marketing through third-party e-commerce sites including Amazon and wholesale distribution.

Solo’s Market & Competition

According to a 2021 market research report by 360 Research Reports, the global market for outdoor gear and apparel was an estimated $49.25 billion in 2020 and is forecast to exceed $75 billion by 2027.

This represents a forecast CAGR of 5.8% from 2021 to 2027.

The main drivers for this expected growth are an increase in consumer participation in outdoor activities for health and recreation purposes in the U.S., Europe, and China.

Also, growing disposable incomes along with increasing innovation from suppliers will add to the demand profile over time.

The firm’s brands compete with a wide variety of competitive products and platforms.

Solo’s Recent Financial Performance

-

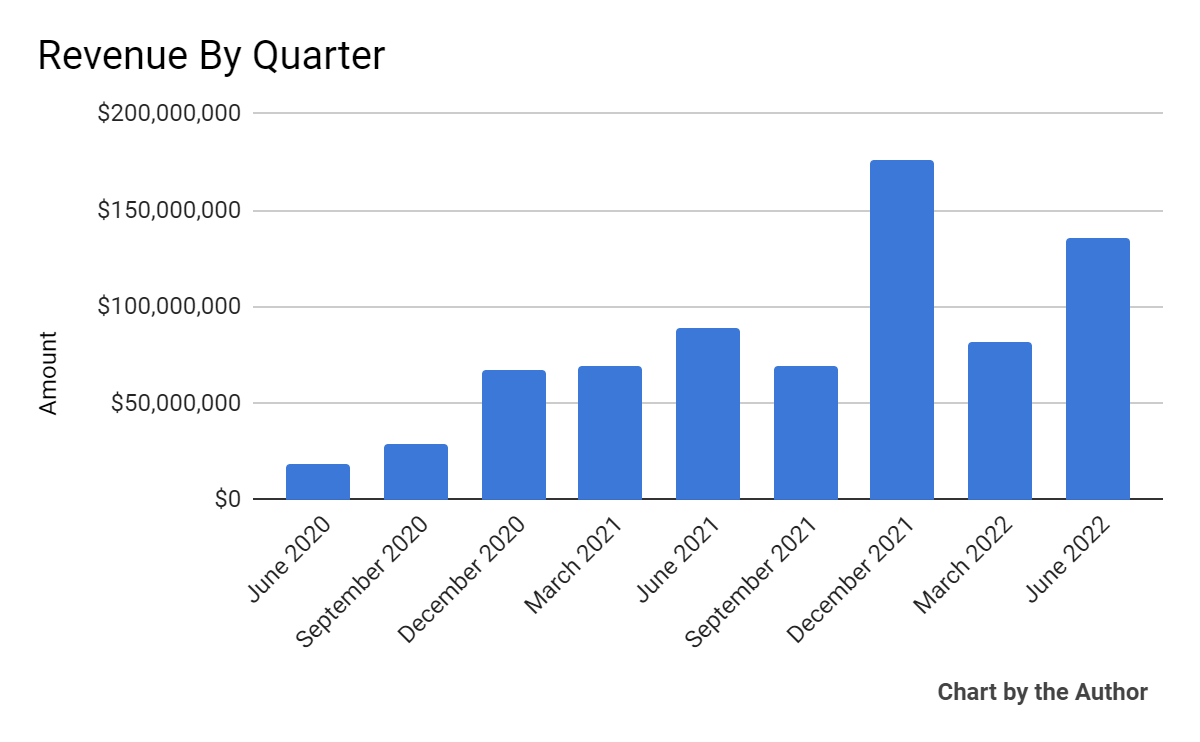

Total revenue by quarter has risen unevenly in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

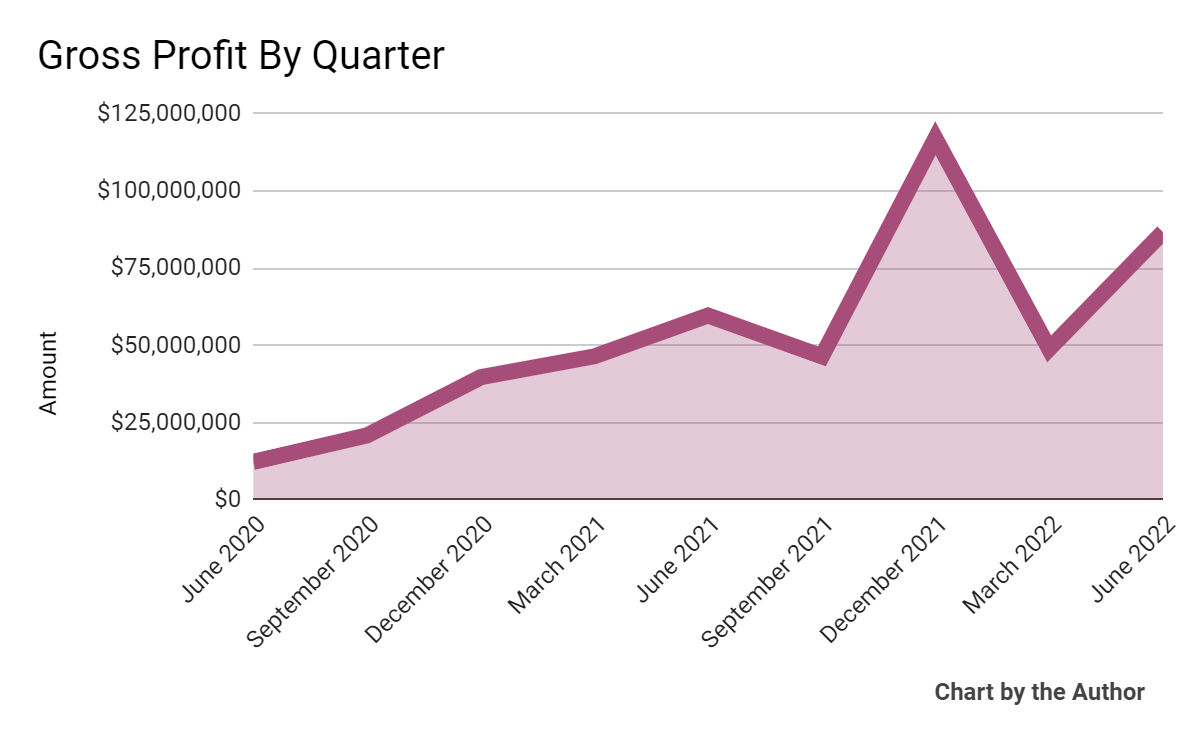

Gross profit by quarter has risen with high variability:

9 Quarter Gross Profit (Seeking Alpha)

-

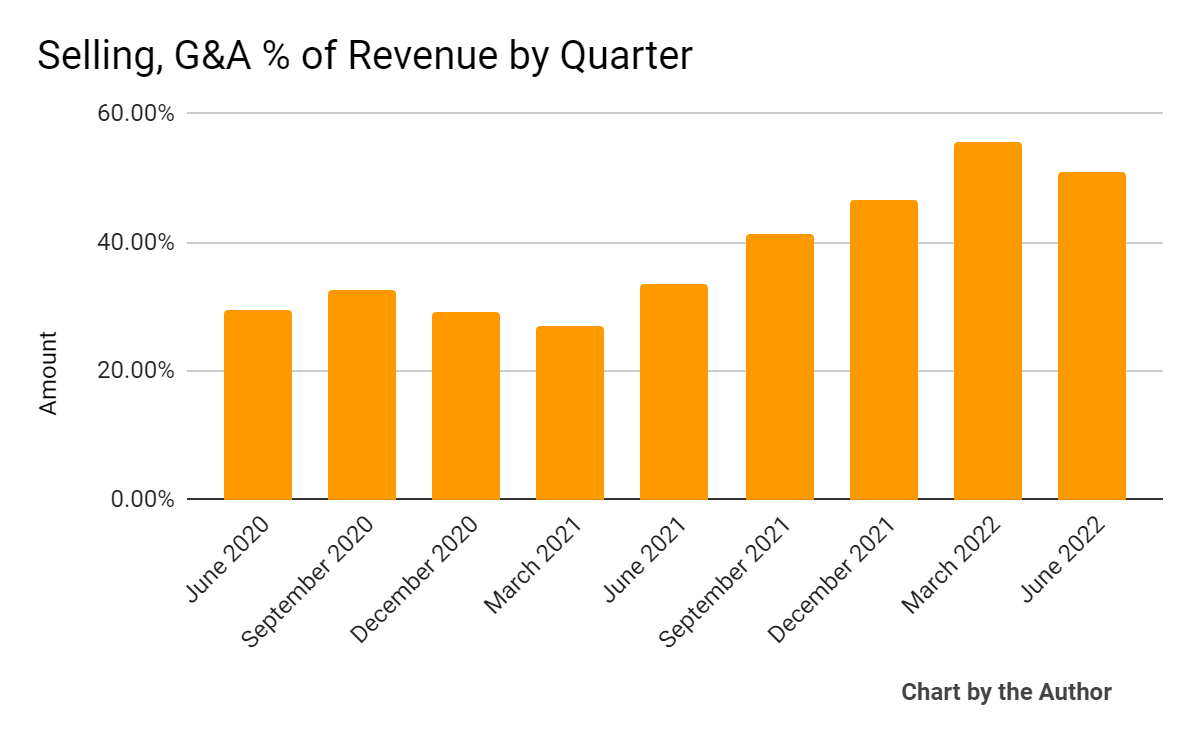

Selling, G&A expenses as a percentage of total revenue by quarter have grown, as the chart shows below:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

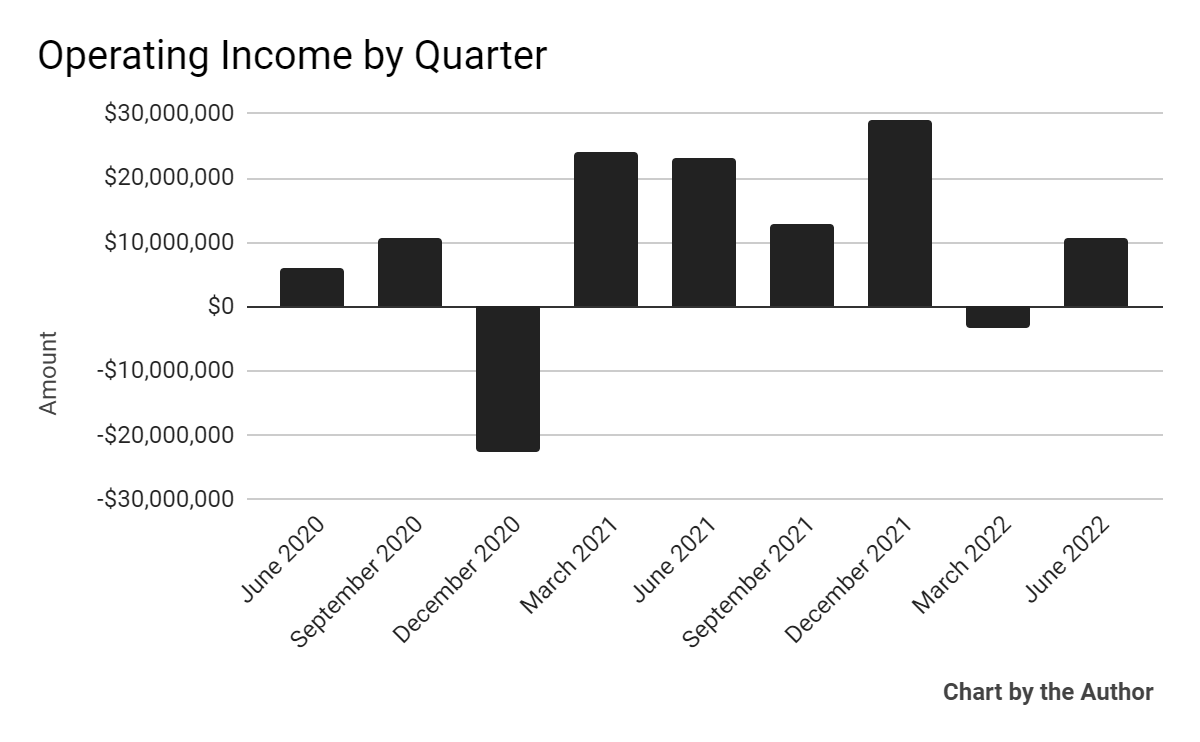

Operating income by quarter has fallen in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

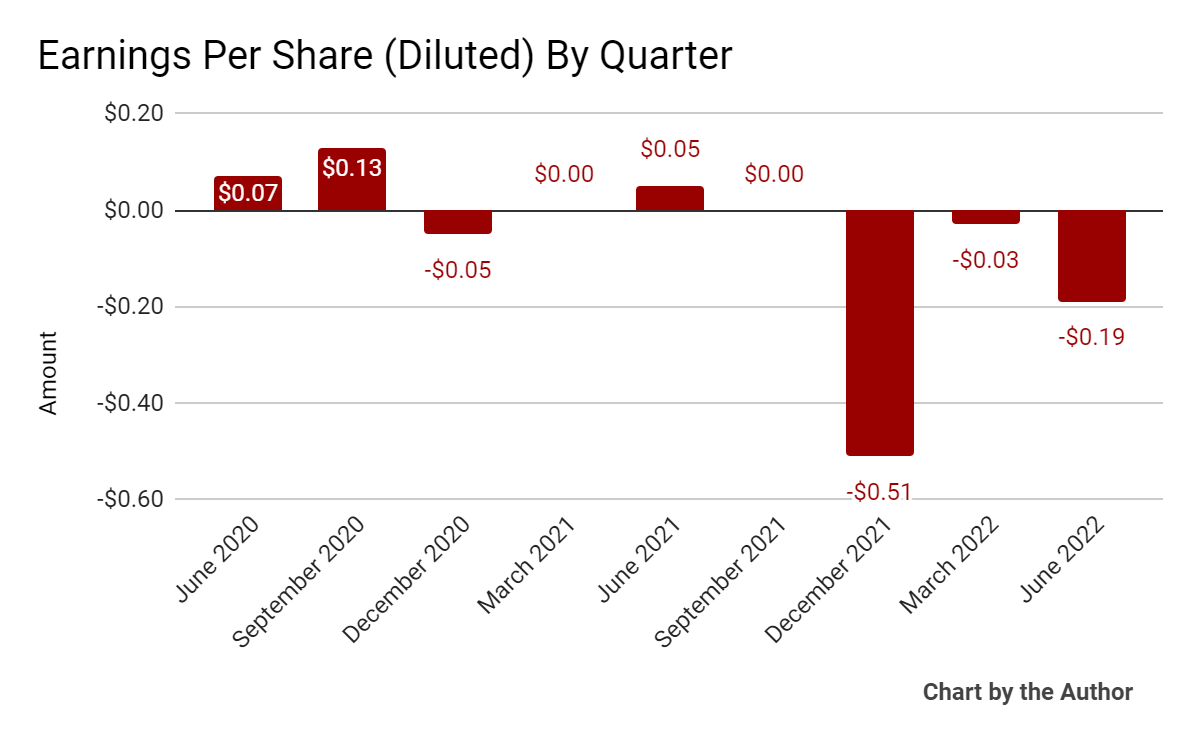

Earnings per share (Diluted) have dropped into negative territory in recent quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

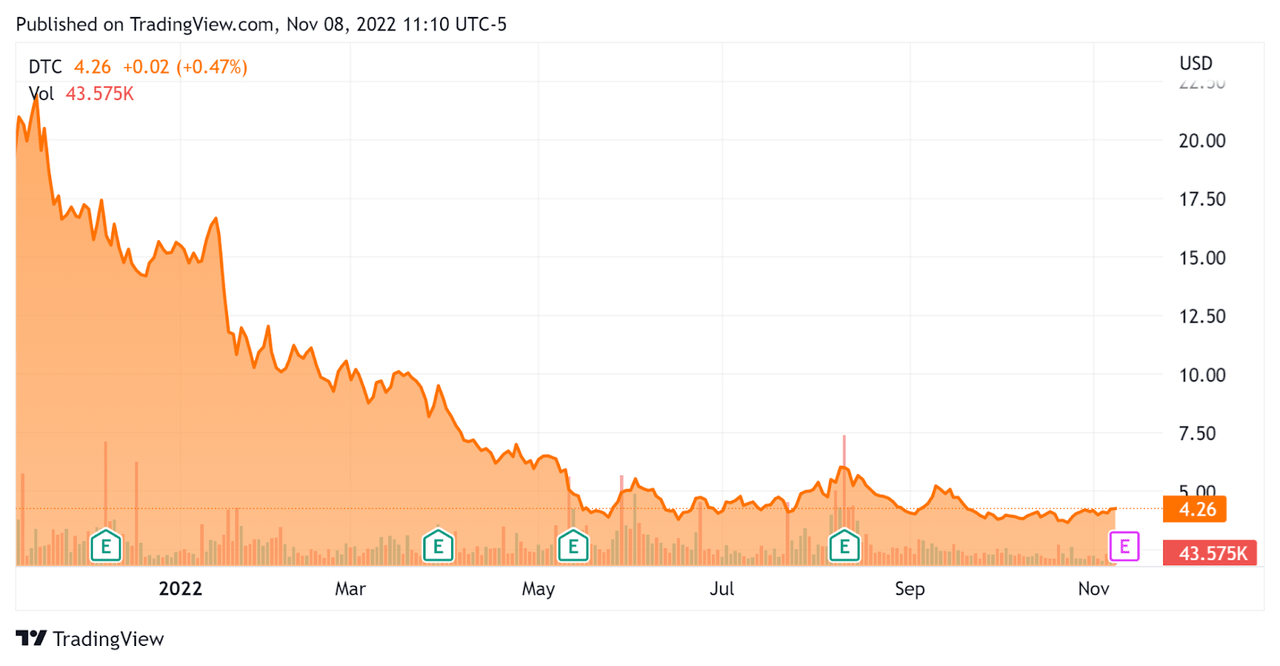

Since its IPO, DTC’s stock price has fallen 77.7% vs. the U.S. S&P 500 Index’s drop of around 18.3%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Solo Brands

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

1.33 |

|

Revenue Growth Rate |

82.9% |

|

Net Income Margin |

-1.5% |

|

GAAP EBITDA % |

15.7% |

|

Market Capitalization |

$386,080,000 |

|

Enterprise Value |

$615,000,000 |

|

Operating Cash Flow |

-$15,230,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.73 |

(Source – Seeking Alpha)

Commentary On Solo Brands

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its growth and retention metrics.

The company is expanding its wholesale distribution and international business channels.

DTC currently has 3.2 million customers, ‘of which 50,000 have purchased from at least two of our brands,’ indicating further cross-selling potential.

Management said it was launching its offerings in Australia and continuing to roll out its products in Europe.

As to its financial results, topline revenue rose 53% year-over-year, with direct-to-consumer sales increasing 63%.

The company’s repeat purchase rates and referral rates were ‘both above 40%.’

However, gross margin dropped to 63.7% from 67.3% in the same period in 2021. And selling, G&A % of net sales rose sharply ‘due to higher expenses from our acquisitions’, higher headcount, and increased stock-based compensation.

Negative earnings worsened significantly due in part to an impairment charge from its acquisition of Isle.

For the balance sheet, the firm ended the quarter with cash and equivalents of $26.7 million and debt of $152.4 million.

Over the trailing twelve months, free cash used was $28.6 million, of which $13.4 million was CapEx.

Looking ahead, management said the balance sheet ‘will continue to be a major focus of ours.’ It expects Q4’s results to produce significant revenue from seasonal factors.

However, the current macroeconomic environment is ‘anything but normal’ and a global macroeconomic slowdown is underway.

The primary risk to the company’s outlook is a drop in consumer discretionary spending, leading to reduced sales growth just as the firm is spending more to broaden its reach.

Given external risks and uneven revenue growth history, I’m on Hold for DTC in the near term.

Be the first to comment