JHVEPhoto

Overview

CDW Corporation (NASDAQ:CDW) and TD Synnex (NYSE:SNX) are the two largest high-tech distributors in North America.

With operations spanning North America and Canada, both CDW and SNX generate large amounts of revenue and cash flow and pay out significant distributions by selling PCs, laptops, servers, monitors software, etc. while expanding their higher margin service business.

In this article, I will compare CDW and SNX potential based on their 2022 third-quarter results to see which one is the best investment for 2025.

On a revenue basis, SNX is a much larger company than CDW with revenues of $61 billion compared to CDW’s $21 billion.

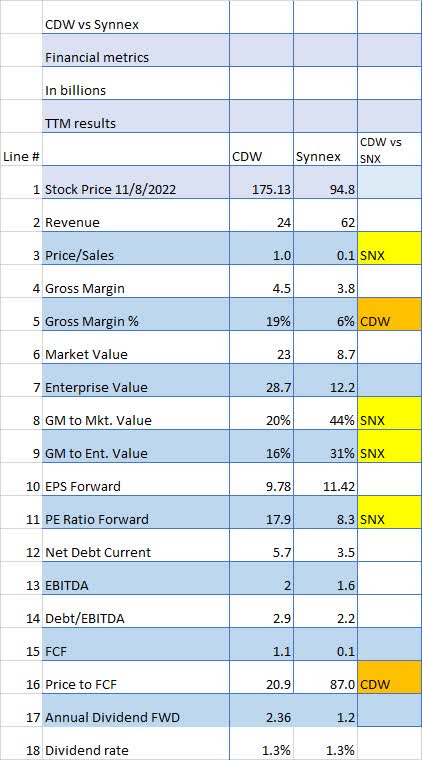

Financial metrics

When we look at the financial metrics comparing the two companies on a TTM (Trailing Twelve Month) basis, several metrics jump out including the fact that SNX Price/Sales (Line 3) is 1/10th CDW’s. That is basically because CDW sells more services which tend to have much higher margins than pure wholesale distributors like SNX although SNX is adding services to its revenue mix.

That is also shown by CDW’s higher Gross Margin % (Line 5) of 19% versus SNX’s 6%. But based upon GM to Market Value Percentage (Line 8) SNX’s margin is much higher than CDW’s 44% to 20%. And it is true also for GM to Enterprise % (Line 9). That would indicate that perhaps SNX is underpriced relative to CDW.

Seeking Alpha and author

SNX has a PE Ratio (Line 11) that is 1/2 of CDW’s but that comparison is reversed when it comes to Price to Free Cash Flow (Line 16) with the CDW ratio being less than 25% of SNX’s ratio.

Debt/EBITDA (Line 14), and the Dividend rate (line 18) are about the same.

Comparing CDW and SNX’s Price Return over the last 1 year shows both companies in negative territory (just like most of the high-tech industry) but CDW has outperformed SNX with a return of -5% compared to -15% for CDW.

Looking over a longer period of five years, CDW has outperformed SNX significantly, 163% to 45%.

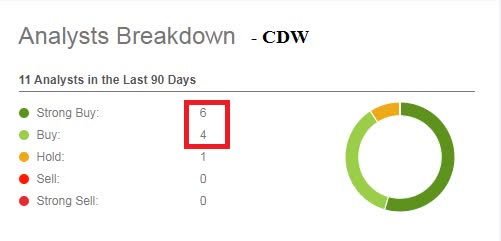

Wall Street Analysts’ ratings show both companies are well-liked by the investment community

Wall Street analysts appear to really like these two stocks. The total of 18 Buy recommendations and no Sells indicate that most analysts think these two stocks have a bright future ahead of them.

Seeking Alpha Seeking Alpha

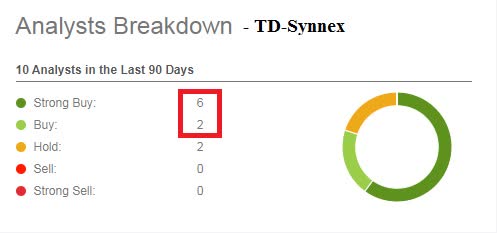

On the other hand, quants are not nearly as excited as the analysts, with a very modest “Hold” call for both stocks.

Seeking Alpha

Perhaps the quants know something that the other analysts don’t?

Synnex did well in the last recession compared to most of the tech industry

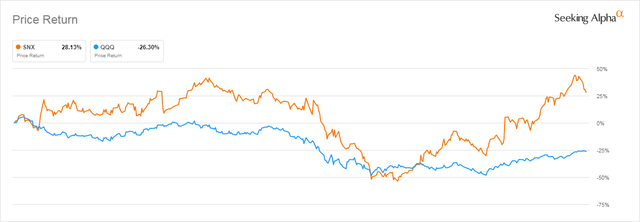

If you are concerned, as I am, of a looming recession in the next year or 18 months, knowing how a company did in the last recession can provide some investment insight. Since CDW was not a public company during the last recession I substituted the tech industry stalwart Invesco QQQ Trust (QQQ).

December 2007 through June 2009 is the last recognized recession period and SNX did extremely well versus the tech industry in general advancing by 28% while the QQQ fell -23%. This would indicate that SNX (and probably other tech distributors like CDW too) would be somewhat immune to recessionary influences.

Dividends and share buybacks

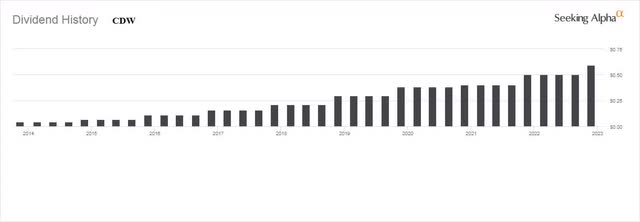

CDW has raised its dividend/distribution every year since it went public and can be expected to continue that trend in the future.

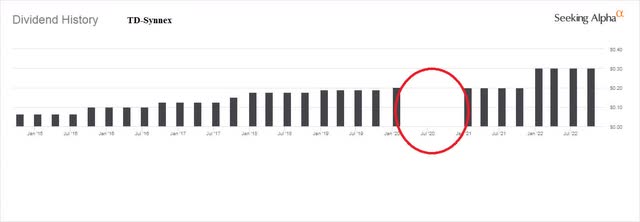

SNX’s dividend/distribution has been much less exemplary and in fact, was completely eliminated in 2020.

So if you are looking for a steady, consistent dividend, the choice is easily CDW.

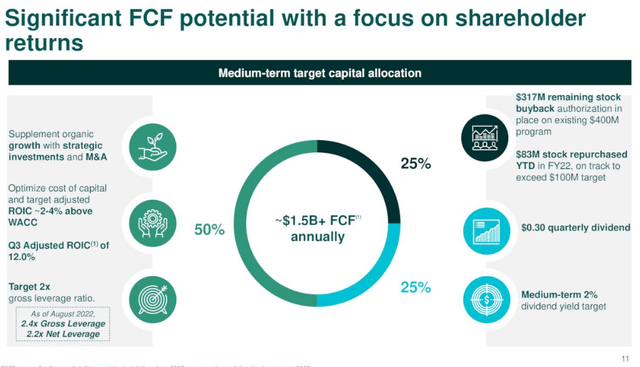

As for share buybacks, both companies have buybacks in place as shown by the most recent quarterly presentations.

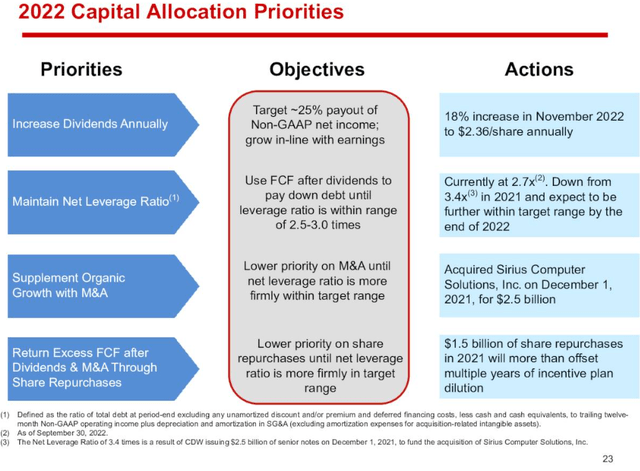

Notice in the following graphic, CDW states it will raise the dividend every year and in fact raised it 18% this month. They have also returned $1.5 billion to the shareholders via share repurchases.

And in SNX’s case, they have $317 million remaining in their repurchase authorization on a market value of $8.7 billion versus CDW’s market value of $23 billion.

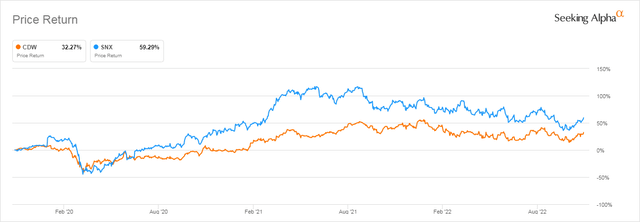

Share price since the Covid outbreak has increased for both companies

Both companies have benefitted from the end of Covid restrictions since the Covid lows of 2020 but SNX has done a significantly better 59% increase to 32% for CDW.

Conclusion:

High-tech distributors like CDW and SNX have both done moderately well over the last few years. In a consolidating industry, they are both expanding via acquisitions. Synnex, of course, merged with Tech Data in 2021 to become TD-Synnex and as can be seen in the above CDW presentation CDW also acquired Sirius Computer Solutions in 2021. In the high-tech distributor business, it’s “grow or die”.

As the number of distributors shrinks and the remaining ones get larger, competition should shrink somewhat and efficiencies of size can hopefully be realized. And both CDW and SNX are expanding their rather narrow margins by growing the high-margin service side of the business.

Looking at these two companies I see CDW as better financially, especially on the margin side and it is raising its dividend every year, always a plus for investors.

SNX after the Tech Data merger is poised to grow rapidly and has shown it will expand its service business too. But with the dividend cut to zero in 2020, they seem to be somewhat a lesser prospect than CDW.

Based upon the above analysis, CDW is a Buy, and SNX is a Hold.

Be the first to comment