Nattakorn Maneerat

Thesis

We updated investors in our previous update on leading middle-market business development company (BDC) Owl Rock Capital Corporation (NYSE:ORCC) that the market sent fearful investors into a selling frenzy, forcing ORCC into lows last seen in April 2020.

However, that also presented a tremendous opportunity for astute investors to capitalize on the bond market-driven fear then, given the discount to net asset value (NAV) at its October lows.

Accordingly, ORCC’s October lows were robustly supported, as further selling downside was rejected decisively. As such, ORCC has significantly outperformed the broad market since our previous article, posting a price gain of more than 22%.

Owl Rock Capital’s Q3 earnings release also calmed investors’ nerves, as it outperformed the previously slashed analysts’ estimates on both lines. In addition, ORCC’s credit performance was better than expected and helped lift its NAV per share above its Q2 metric. Coupled with spreads that stayed relatively flat QoQ, it’s possible that ORCC’s Q2 could have marked a bottom in its NAV deterioration (unless a severe recession occurs).

Given the momentum spike leading into its Q2 earnings, we postulate that the market had correctly anticipated a better-than-expected report card. However, we glean that ORCC’s valuation is more well-balanced now, even though management raised its base dividend distribution (with the additional supplemental distribution).

Revising from Buy to Hold, we urge investors to wait for a pullback before adding further.

ORCC: Strong Net Investment Income Visibility Through H1’23

Given the Fed’s rapid rate hikes, it has benefited Owl Rock Capital in Q3, as its net interest margin (NIM) increased to 10.2% from 8.9% in Q2. However, its spread was relatively constant, as it increased to 6.7% (from Q2’s 6.6%), given the increase in its cost of debt.

Notwithstanding, the company still outperformed the consensus estimates (bullish) on its net interest income (NII) per share metrics. Furthermore, the company continues to see clear visibility into Q4, as management guided to at least $0.39 in NII per share.

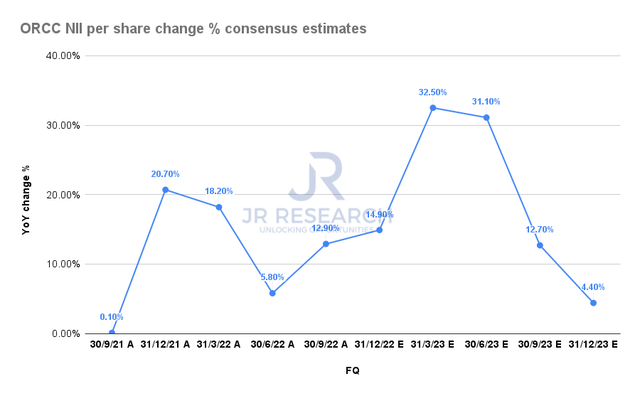

ORCC NII per share change % consensus estimates (S&P Cap IQ)

Accordingly, Wall Street raised its previously slashed estimates on its NII per share projections for Q4 to $0.4, slightly above the company’s guidance. The revised projections suggest that the NII tailwinds could continue lifting Owl Rock Capital’s operating performance through H1’23 before normalizing in H2.

We believe the estimates are credible, as Fed Chair Jerome Powell also hinted at a possibility of a pause after two more hikes. Still, interest rates are expected to remain higher for an extended period, boosting the company’s ability to sustain its NII.

However, we postulate that Owl Rock Capital’s NII per share growth rates are still expected to normalize as the Fed pauses its hiking regime. As such, we believe it could impinge on ORCC’s upward momentum.

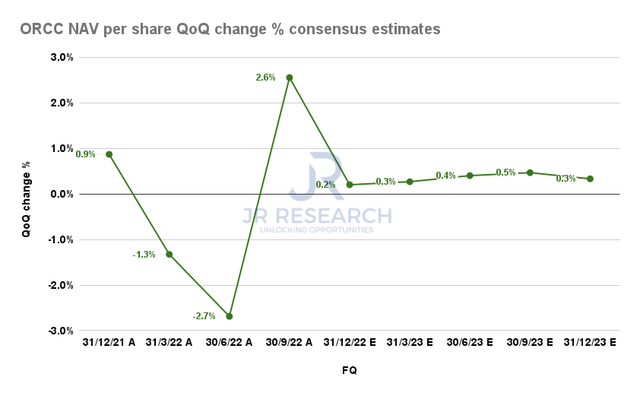

ORCC NAV per share change % consensus estimates (S&P Cap IQ)

Moreover, Owl Rock Capital’s NAV unexpected dislocation in Q2 has likely normalized in Q3 (up 2.6% QoQ), given robust credit performances from its portfolio companies.

Moving forward, we postulate the possibility of a further re-rating in its NAV could face significant challenges as ORCC remains fully invested. Moreover, its investment cadence has also slowed, and we believe it could remain subdued as we near a global recession. Notwithstanding, the potential for upside surprises remains in the cards, as management highlighted that it had assumed modest repayments in its guidance.

With that in mind, we believe the consensus estimates are credible, as the risks of more valuation pressure in its portfolio companies could increase, depending on the extent of the recessionary impact.

Accordingly, while the company has yet to discern any significant deterioration in the underlying performance of its portfolio companies, we urge investors to reflect the appropriate level of risks in their modeling.

Is ORCC Stock A Buy, Sell, Or Hold?

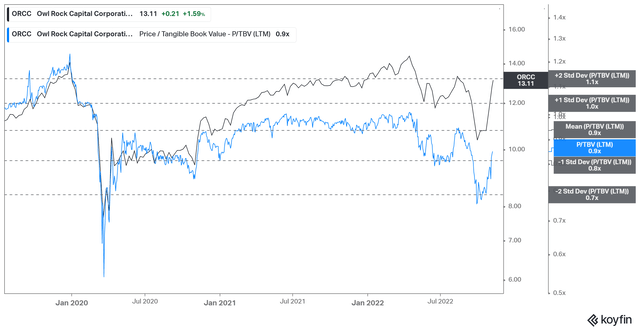

ORCC TTM TBV multiples valuation trend (koyfin)

With the sharp reversal from its October lows, ORCC is no longer significantly undervalued. As a result, its TTM tangible book value (TBV) multiple of 0.9x has reverted to its all-time mean.

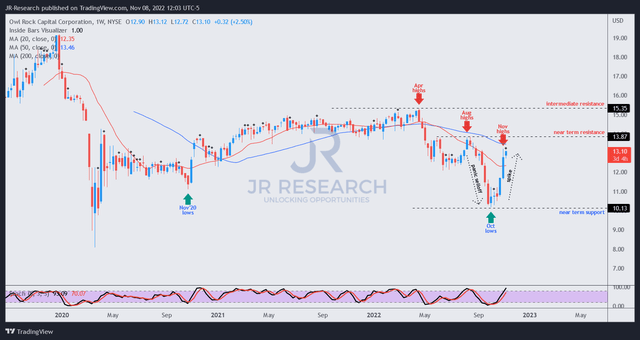

ORCC price chart (weekly) (TradingView)

As seen above, ORCC’s price action has reverted toward its 50-week moving average (blue line), closing in against its August highs.

Hence, the market has astutely reversed the panic selloff as it forced weak holders to capitulate at the worst possible moments.

Despite that, we gleaned that the sharp reversal spike is not constructive, with a pullback looking increasingly likely. Moreover, ORCC’s near-term resistance is expected to demonstrate intense selling pressure, impeding investors who jump on board at the current levels.

Coupled with a more well-balanced valuation, we move to the sidelines from here.

Revising from Buy to Hold.

Be the first to comment