Eliyahu Parypa/iStock Editorial via Getty Images

Deleveraging

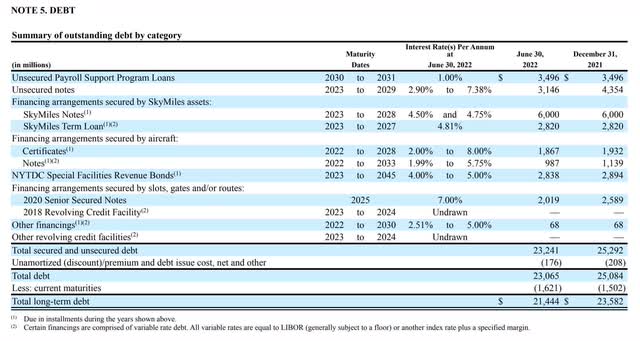

During the pandemic, to survive, Delta Air Lines (NYSE:DAL) leveraged its balance sheet and took on over $10 billion in debt. Two years later, the company’s earnings are beginning to return to pre-pandemic levels. As a result of this resurgence, Delta Air Lines is now focusing on reducing its debt. As of the end of the second quarter this year, Delta had $21.4 billion in long term debt, which is down from $23.6 billion at the end of 2021.

According to an article by the Wall Street Journal this month:

The company is targeting adjusted net debt of $15 billion by 2024, which would mean a reduction of $5 billion in adjusted net debt between now and then.

Below is a summary of Delta’s outstanding debt by category as of June 30, 2022:

Paying down debt is obviously important to reduce leverage and free up cash flow, but in an environment where interest rates are continuing to rise, it is even more critical for the company.

Return of Corporate Travel

Helping the company’s efforts to deleverage is the return of business travel. The airline industry as a whole is seeing corporate travelers returning close to pre-pandemic levels. According to the Global Business Travel Association (GBTA), an industry association, global business travel spending is expected to gain 33.8% in 2022.

In a recent survey, 85% of business travelers said they definitely need to travel to accomplish their business goals. Looking one year out, over three-fourths said they expect to travel for work more or much more in 2023 than they did in 2022.

In American Airlines’ (AAL) most recent earnings call, the company reported that its business travel has reached 80% of 2019 levels in the first quarter of 2022. The company predicts it will be 90% recovered in the second half of the year.

Likewise, Delta Air Lines said its business travel volumes reached the highest post-pandemic levels. Prior to the pandemic, business travel was 31% of Delta’s total operating revenue. Through the first six months of 2022, business travel was already at 28.7% of total operating revenue.

The impact of corporate travel to airlines’ bottom line cannot be overstated. Even though business travelers only make up 12% of airline passengers, they pay higher rates than other customers and are typically twice as lucrative, accounting for as much as 75% of profits.

Even with the strengthening in corporate travel, full recovery for the entire industry isn’t expected until 2026. The biggest obstacles to a full recovery in global business travel are persistent inflation, high energy prices, supply chain challenges and labor shortages, and an economic recession.

Global Business Travel Association

International Travel

Another tailwind for the airline industry is the resurgence of international travel. In November 2021, travel restrictions on most fully vaccinated foreign visitors to the United States were lifted. This action made travel to the U.S. by many foreign nationals possible for the first time in 18 months.

Despite this policy change, the industry expects the significantly lower international demand environment to continue through 2022, with the recovery pace continuing to trail domestic travel.

According to Delta Air Lines in its latest quarterly report, international revenue has lagged the recovery in domestic travel, but improved in the June 2022 quarter to approximately 80% recovered compared to the June 2019 quarter as travel restrictions eased and many countries ended testing requirements. The company said:

Our corporate customers expressed increased plans to travel internationally in the second half of the year given the elimination of the pre-departure test requirement for flights returning to the United States.

Financial Targets

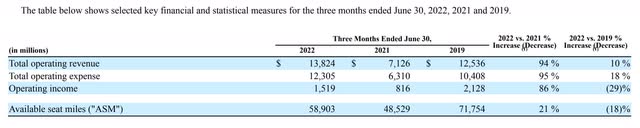

Halfway through the second year after the pandemic, Delta Air Lines’ total operating revenue increased 94% from a year earlier and is up 10% from 2019 before the pandemic.

For the remainder of the year, the company expects to deliver meaningful profitability. Fast forward to 2024, Delta is estimating revenues to grow to $50 billion with earnings of $7 per share or greater.

Should Delta Air Lines meet its 2024 targets, it would move the company beyond the pre-pandemic levels of 2019, and begin a new stage of growth for the company.

Analysis

Buy Rating: I have a Buy rating for Delta Air Lines’ stock with a two-year target price of $70 per share.

With the return of business travelers and the rise in international travel, Delta Air Lines should be able to grow its revenues by 10% over the next two years. Going along with this resurgence in revenues, net margins should also improve to 8% driven by higher margin, premium tickets from business class travelers.

With regards to its bottom line, earnings are estimated to grow over seven-fold from $599 million to $4.48 billion during the same period. This translates to earnings per share growing from $0.93 to $7.00 per share.

Finally, the stock’s price-to-earnings multiple should contract from 30 to 10 times earnings due to the sharp increase in earnings making the stock more attractive to investors.

Below is a table contrasting Delta’s current metrics and stock price to the 2-year estimate:

| Delta Air Lines |

Current* (as of 9/29/22) |

2-Year Estimate |

|

Revenue (in millions) |

$41,797 |

$50,836 |

|

Net Margin (%) |

1.43% |

8.8% |

|

Net Income (in millions) |

$599 |

$4,485 |

|

# Outstanding Shares |

644,000,000 |

641,000,000 |

|

Net Income per Share |

$0.93 |

$7.00 |

|

Price/Earnings (‘PE’) Ratio |

30 |

10 |

|

Stock Price |

$28.24 |

$70 |

Source of company metrics: Morningstar, Delta Air Lines

*Current metrics based on TTM 2022 2nd quarter results.

The combination of the resurgence of international travel and the return of corporate travel bodes well for Delta Air Lines to not only return its revenues and earnings to pre-pandemic levels but to begin to exceed them and return the company to sustained profitability.

As the #1 ranked airline according to The Points Guy based on customer satisfaction, Delta could return to being the most profitable airline among domestic carriers.

Be the first to comment