hocus-focus

Thesis

While many stocks, especially in the tech sector, appear to be trading at significant discounts, given the sizable stock market drawdown, few can actually be reasonable labeled as value opportunities. Dropbox (NASDAQ:DBX) has been around for a while, carrying a conservative valuation for the better part of the last few years. Today, as explained in this analysis, the company provides investors with an interesting long case, despite the overhauling negative economic environment and some firm-specific struggles.

A Tough Macro Environment for Stocks

Between global conflicts, energy prices soaring, persisting supply chain disruptions and continuous inflationary pressures, the outlook for the economy and stock market is rather dim over the midterm. The accommodating monetary policy the Fed had been engaging in for years has come to an abrupt end, as borrowing costs have substantially increased across the board. Consumer confidence is also at multi-decade lows.

Increasing interest rates mean decreasing valuations, as perceived discount rates increase. High multiple stocks, carry more downside risk and are more sensitive to interest rate increases. The 10Y U.S bond yield currently stands at 3.8%, its highest level in over a decade, with analysts fearing further increases. In the case that inflation becomes even more persistent than it has already proven to be and the U.S economy enter a broader recession, further stock market decreases are likely.

Stock Performance

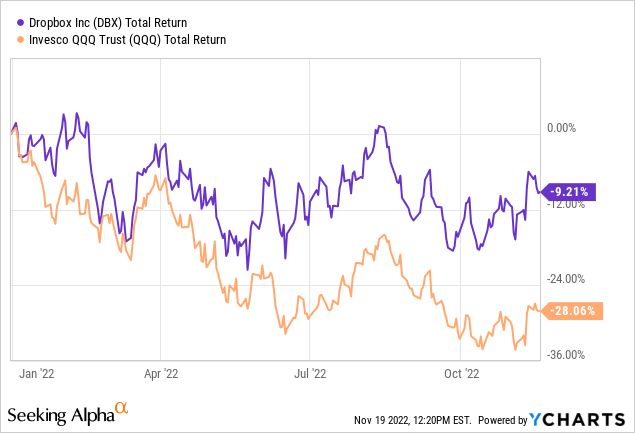

In the environment described previously, technology stocks have been hit especially hard with the Nasdaq losing more than a quarter of its value. As extreme valuation multiples and low cash flow productivity has been a common denominator of the poorly performing tech sector, Dropbox’s more attractive valuation and business attributes have allowed the stock to largely resist the fall.

The stock has retreated 9.21% YTD, outperforming both the S&P 500 and the Nasdaq (and almost all sector averages as well). Another relatively rare attribute that Dropbox possess is a beta (5Y monthly) of 0.8. A number that would indicate a somewhat defensive stock, is probably the result of the low valuation and consistent cash flow production that I will explore further in the next segments. Currently, Dropbox trades at a $22.30 ($7.82B market cap) and pays no dividends.

The Business at a Glance

As Dropbox has been focusing its strategy to transform the business from a purely cloud storage service to an online, dynamic collaboration platform, the company has reached more than 700M registered users and 17.55M paying users. While still accommodating the individual user, the company focuses its efforts on its business collaboration solutions. Dropbox’s offerings are also integrated with the largest software and technology names, including Google (GOOG) (GOOGL), Microsoft (MSFT), Slack, Salesforce (CRM) and others.

The growth factors the company identifies include upselling to existing customers, increasing the percentage of paying users and bringing forward new product and services solutions. In short, Dropbox aims to become the collaboration platform of choice for a large number of small and medium sized companies, offering simplicity and ease-of-use across a wide range of incorporating products.

A Look into the Q3 results

Dropbox released its Q3 2022 results on November 3, 2022. Both earnings and revenue beat expectations with the company also reporting moderate growth in paying users. More specifically, revenue came in at $591M for the quarter, a 7% YoY increase, while GAAP net income reached $83.2M (10% YoY increase). Paying users have accumulated to 17.55M, compared to 16.50M for the same period last year, marking a 6.4% increase. According to management foreign exchange rates provided an approximate $13 million headwind to growth for the quarter (revenue grew 9.7% on a constant currency basis).

Management’s during the earnings call reiterated the strength they observe in their teams’ plans, following packaging and pricing changes over the summer.

Longer-term Growth and Financial Health

Over the past 5 years Dropbox has seen an annualized 17% revenue growth. 2021 marked the company’s first profitable fiscal year, with more earnings growth expected ahead.

Cash from operations has also grown significantly since 2017, from $330M to $765M, indicating that the company is indeed cash-productive. Free Cash Flow has also stood at high levels given the company’s low capital expenditures, most of which account for acquisitions, as Dropbox expands its growth potential through strategic purchases. Management projects more Cash Flow growth ahead, expecting $1B in FCF by 2024.

As expected, given the nature of the cloud services industry, Dropbox maintains very generous margins. Gross margins stand at 80%, EBITDA margins at 23% and net margins at 15.5%. Management’s long-term targets regarding margin performance include a gross margin of 80-82% and an operating margin of 30-32%.

Despite accumulating some long-term debt over the recent years (long-term liabilities have reached $3.3B), the company’s balance sheet displays an otherwise healthy picture. The company’s cash stockpile along with short-term investments amounts to $1.45B, expanding management’s ability to freely choose different allocation strategies to fuel growth. A current ratio of 1.4x also indicates that no short-term liquidity problems are expected to arise.

For the entire 2022 fiscal year Dropbox is expected to generate $2.32B in revenue, while growth is expected to continue in the high-single digits over the next couple of years.

Valuation

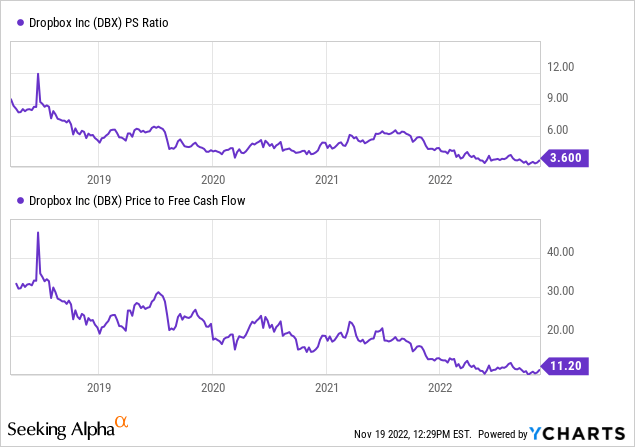

While Dropbox has not seen a huge drop in its stock price so far into the year, unlike many of its tech counterparts, still, the already reasonable valuation the stock carried seems to have improved further. Dropbox trades at a forward P/E of 14x, which is widely considered inexpensive both compared to market and sector averages, and peers.

Moreover, when considering both the P/S and P/FCF multiples of Dropbox, we can see in the charts provided below that the company trades near the lowest levels it has for the last 5 years. A 3.6x price-to-sales and a 11.2x price-to-free-cash-flow multiple are both considered rather conservative for a growing technology company.

Conclusions

The biggest challenge for Dropbox, in my view, is the implementation of a focused user-monetization strategy. Currently, only around 3% of total users are on paid plans. This indicates both a struggle and an opportunity. While the company seems to have failed to some extent to increase the perceived value of its services by customers, the recent strategic shift and new product incorporations seem to point the organization in the right direction. Growth in the business services segment (teams plans) is another driver for the future. As the nature of the business allows for great margin capability and a recurring revenue stream, monetization of client accounts will likely determine the future of the business.

Based on that, I believe that despite strong competitive pressures, Dropbox offers an attractive risk-reward tradeoff for investors over the next 5-10 years. Risks, however, despite a resilient stock performance should not be overlooked. When the stock’s inexpensive valuation and strong balance sheet are also entered into the equation, I believe that Dropbox makes a relatively compelling bullish case for investors and therefore rate the stock as a buy.

Be the first to comment