primeimages/iStock via Getty Images

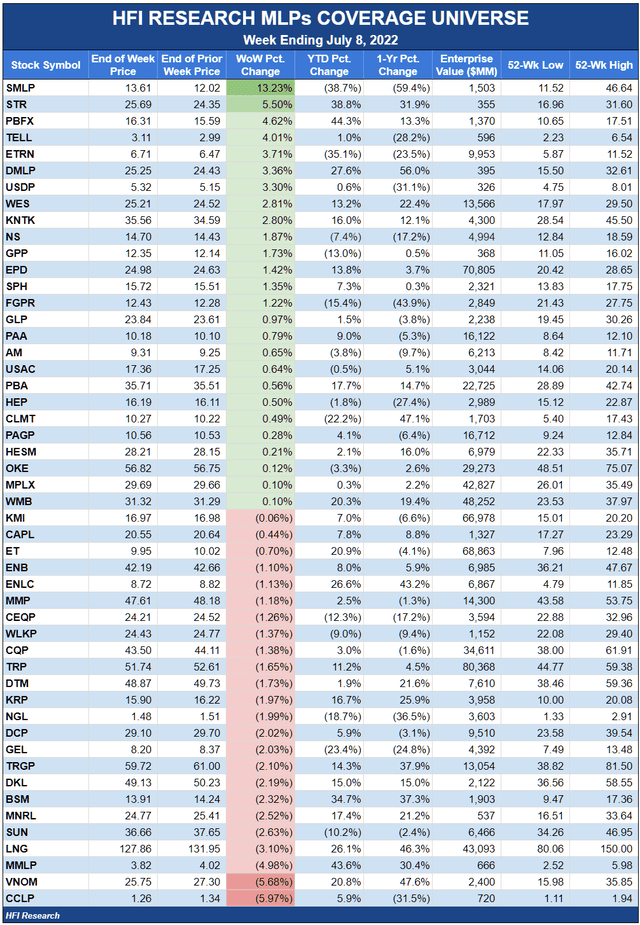

Midstream Sector Performance

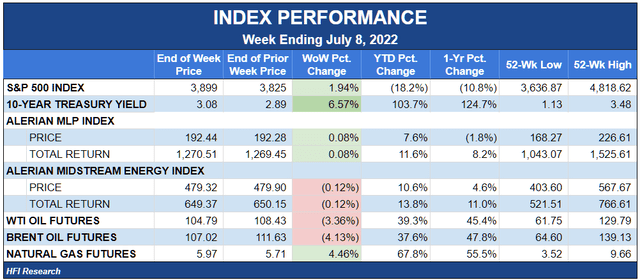

Midstream was broadly flat in a volatile week that saw WTI open at $109 per barrel, plunge 12.6% to $95, and then recover 10.2% to close the week at $104. The sector outperformed the broad energy sector and E&Ps, with the XLE down 2.3% and the XOP down 2.1%.

Midstream’s gains came amid a surge in interest rates, with the 10-year closing 6.6% higher. Throughout the recent volatility, the sector has shown no particular correlation to rates. We believe rates will have to surge far higher to impact high-yielding energy equities, which continue to trade at much steeper yields than utilities and REITs despite the midstream sector’s overwhelmingly bullish fundamentals.

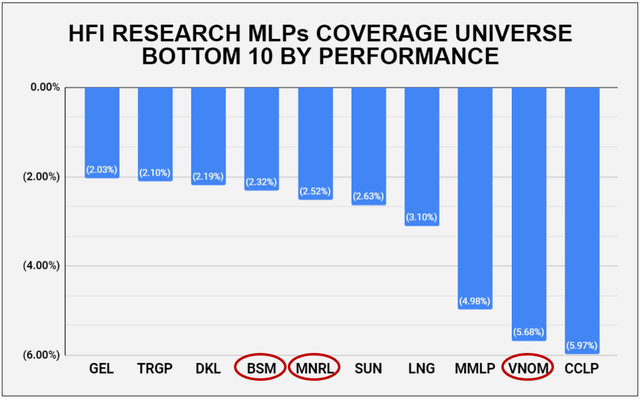

The selloff in crude caused mineral/royalty interest owners to underperform pure midstream operators. Black Stone Minerals (BSM), Brigham Minerals (MNRL), and Viper Energy Partners (VNOM) all featured among the sector’s bottom ten performers.

We published a bullish writeup on BSM, which we recommend as a Buy at its currently depressed price. Other mineral/royalty companies are also attractively priced after the selloff over the past few weeks. These companies will be gushing cash if oil remains above $100 per barrel, which we expect due to the ongoing structural supply deficit in the global oil market.

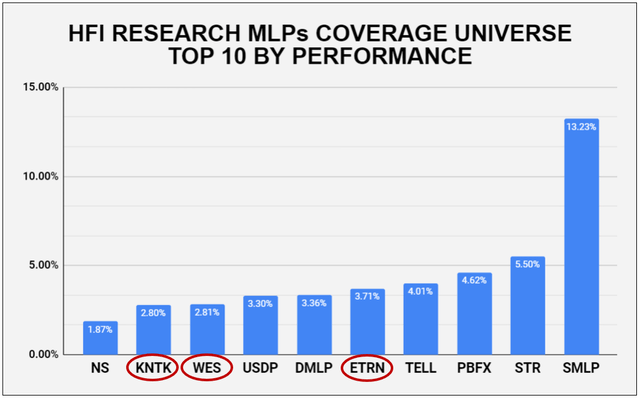

We’d note that Dorchester Minerals (DMLP) and Sitio Royalties (STR) performed much better than their peers. We would recommend buying well-run DMLP but would avoid STR until we can better gauge the performance of the Falcon Minerals-Desert Peak Minerals merger.

G&Ps performed surprisingly well amid no major company-specific developments. The G&P performance was likely attributable to how beaten down the equities had become in the prior weeks, and not to any fundamental improvement. Our holdings, Kinetik (KNTK) and Western Midstream (WES) were joined by the beleaguered Equitrans (ETRN) were among the top ten performers. We rate KNTK and WES as Buys, while we rate ETRN as a Hold until we can better quantify the financial implications of continued delays in the company’s Mountain Valley Pipeline project.

PBF Logistics (PBFX) traded higher after its sponsor, PBF Energy (PBF), said it was considering acquiring the company. PBFX’s price surge took it to the top of the sector’s year-to-performance, edging out MMLP. Despite the increase, PBFX units remain cheap, and we rate them a Buy.

NuStar (NS) units continued to be strong after the company put through an 8.7% price increase—the maximum currently allowed by the FERC index—on its major refined product pipelines.

Summit Midstream (SMLP) got a boost after it paid off $500 million of debt it owed through an industrial revenue bond. Tellurian (TELL) share benefitted from spiking LNG prices, which presumably improve its prospects for securing financing for its Driftwood LNG project. Still, we recommend avoiding speculative TELL shares.

Weekly HFI Research MLPs Portfolio Recap

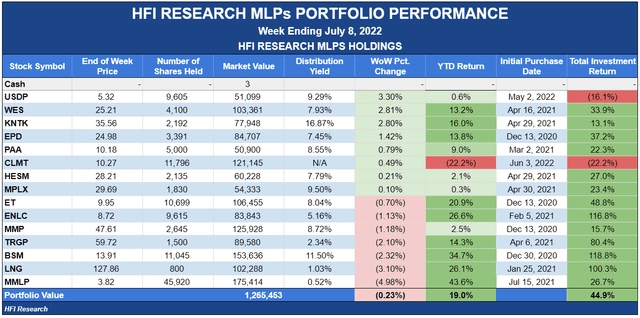

Our portfolio underperformed its benchmark, the Alerian MLP Index, by 0.3% during the week.

We increased our position in Calumet Specialty Products Partners (CLMT), as discussed here.

Our portfolio’s performance was held down by a decline in Martin Midstream Partners (MMLP), on no news. Cheniere Energy (LNG) was also weak, probably on concerns that the Biden administration may force its Corpus Christi LNG export operation to shut down because it had exceeded pollution limits. Cheniere has requested an exemption from pollution limits, which its management has claimed would be too stringent to allow the facility to operate.

We don’t expect the administration to force a shutdown of Cheniere’s or any other major LNG facility. While such a move would provide a boost to the U.S. economy through lower domestic natural gas prices and would placate environmental activists in the administration’s base, it would be potentially catastrophic for the global economy. Europe is in the grips of an unprecedented natural gas crisis. The continent has seen its natural gas import costs soar over the past few weeks after a production outage at U.S. Freeport LNG’s Quintana Island facility, a reduction in volumes on the Nord Stream 1 pipeline, and a halt in gas production after a worker’s strike in Norway. European natural gas prices are currently trading in the $50 per MMBtu range, versus around $6 per MMBtu in the U.S.

The significantly higher prices that would result from another LNG outage would risk crushing the European economy, the world’s largest economic block. No doubt the knock-on effects would be a shock to the global economy. We believe the Biden administration will come to its senses and allow LNG export facilities to operate. Cheniere has a multi-decade run ahead of it as the premier global LNG producer and we recommend its undervalued shares as a Buy.

News of the Week

With Europe’s natural gas woes in the spotlight, midstream news was focused on LNG. On Wednesday, NextDecade (NEXT) announced a sale and purchase agreement with China’s Guangdong Energy Group for 1 million tons of LNG per annum. Then on Friday, Shell (SHEL) reported that it had resumed LNG exports at its Prelude floating LNG facility after a series of work stoppages by unions demanding better pay. Exports are likely to continue to be reduced until the union’s work stoppages ease further.

Turning to domestic natural gas, an Energy Transfer (ET) natural gas pipeline exploded in a rural area west of Houston on Thursday. ET quickly turned off the gas line, and the fire was put out in less than an hour. The incident is one of many operational snafus by ET over the past few years. If they continue, they could be a risk to the company’s reputation, business prospects, and equity value.

A Michigan regulatory panel said it needed more information from Enbridge (ENB) on risks related to the company’s plan to build a tunnel beneath the Straits of Mackinac to house its Line 5 pipeline, which the company proposed to satisfy its environmental critics. ENB and Michigan have been engaged in legal battles over ENB’s ability to operate its 69-year-old pipeline, which satisfies 55% of Michigan’s propane needs. The state bases its opposition mainly on the grounds that it would cause extensive environmental damage if it were to rupture. Apparently lost in their reasoning is the impact on the livelihoods of the thousands of Michigan residents who depend on propane for heat in the winter.

Capital Markets Activity

None.

Be the first to comment