Mario Tama/Getty Images News

Thesis

We highlighted in our previous article on Petroleo Brasileiro S.A. (NYSE:PBR) that its dividends could be at risk of further cuts. Therefore, we urged investors not to jump on board yet, as the market needed to de-risk its execution challenges on its normalization phase through FY24.

Notwithstanding, we didn’t expect Brazil’s President-elect Luiz Inacio Lula da Silva to move so quickly to potentially dismantle Petrobras’ C-suite as he attempts to shake out its management.

Lula’s initial spending plans caused considerable consternation among Brazilian equities investors, who feared a return of its record inflation days. Brazil’s central bank has also vowed to maintain its combative stance against inflation after a relatively successful fight in 2022.

Lula was also reported to be keen on restructuring Petrobras, targeting its distribution policy and reinvestment/asset divestment strategies. Therefore, the political risks have undoubtedly caught PBR investors off-guard over the past month, as they fell into the unsustainable allure of its high dividend yields.

Hence, we believe the market has gotten PBR’s selloff spot on as it “refused” to re-rate PBR despite its aggressive distribution policy. The market needed to account for its execution and political risks, as seen in the recently slashed analysts’ estimates.

Hence, we believe Wall Street analysts have likely de-risked Petrobras’ estimates, despite the specter of a potential change in its C-suite. We also gleaned a significant valuation discount against its oil & gas peers’ median, which we postulate is appropriate to account for its political risks.

Therefore, we believe a speculative buying opportunity has emerged for investors willing to stomach near-term volatility.

Revising from Sell to Speculative Buy with a medium-term price target (PT) of $12.5 (implying a potential price performance upside of 23%, excluding dividends).

PBR: Analysts Slashed Its Dividends Projections

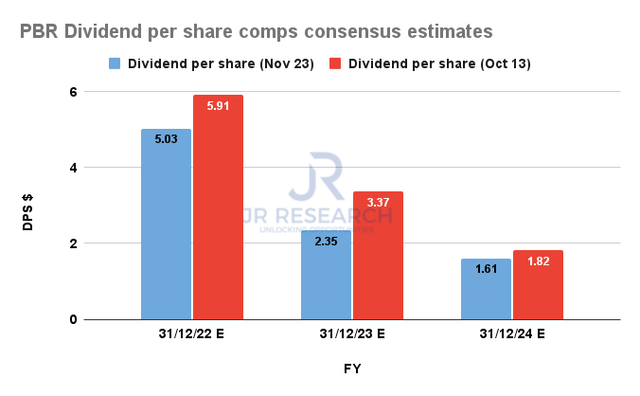

PBR Dividends per share comps consensus estimates (S&P Cap IQ)

With the recent moves by Lula and his associates to potentially retake control of Petrobras’ executive decisions, analysts have finally awakened to the possibility of a significant change in its distribution policy.

As seen above, analysts’ estimates for FY23’s dividend per share (DPS) have been slashed by more than 30% from its previous October projections. Thus, the projected payout ratio has also fallen to 77.8%. However, we believe this ratio could be at risk if the global energy demand softens further, coupled with Lula’s priorities to reinvest its earnings ahead of its distribution priorities.

Therefore, we urge investors to consider PBR’s NTM dividend yield of 16.5% as highly uncertain. The critical question is whether it has been reflected in its valuation.

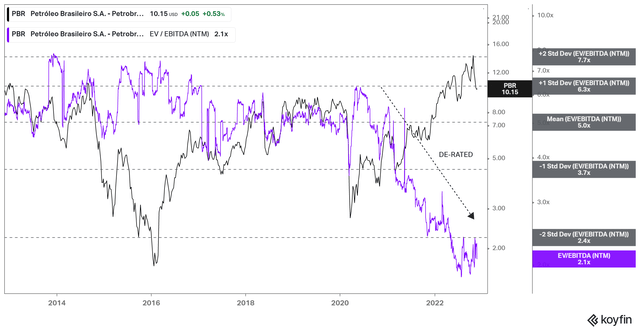

PBR NTM EBITDA multiples valuation trend (koyfin)

PBR last traded at a NTM EBITDA of 2.1x, well below its 10Y mean of 5x. Moreover, its NTM normalized P/E of 3.04x remains well below its peers’ median of 9.6x (according to S&P Cap IQ data).

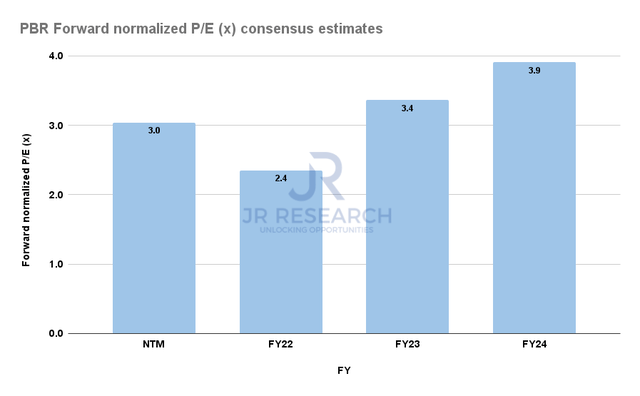

PBR Forward normalized P/E consensus estimates (S&P Cap IQ)

Despite factoring in earnings compression risks through FY24, we believe the bifurcation between PBR and its peers’ valuation remains constructive. Hence, we believe that near-term risks in PBR have likely been reflected.

Notwithstanding, investors are reminded that the “Lula effect” remains uncertain, so it’s critical to tag any exposure in PBR as speculative. As such, we urge investors to maintain appropriate risk management and capital allocation plans if they decide to add.

Is PBR Stock A Buy, Sell, Or Hold?

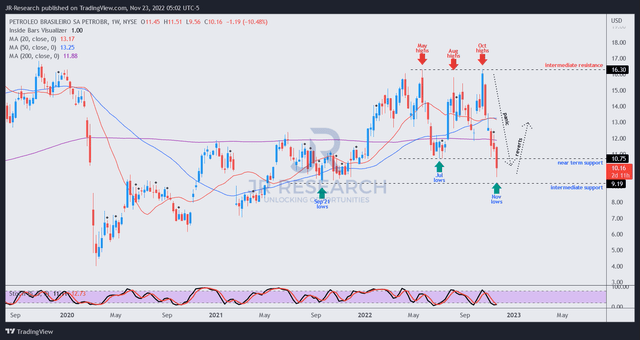

PBR price chart (weekly) (TradingView)

PBR fell more than 40% from its October highs to its recent November lows. However, the speed of the collapse has likely shaken out weak holders adequately.

With a re-test of its July 2022 lows and possibly PBR’s September 2021 lows, we view PBR’s capitulation move constructively.

Revising from Sell to Speculative Buy with a PT of $12.5.

Be the first to comment