KanawatTH

Overview

I recommend buying Arqit Quantum (NASDAQ:ARQQ). With the heightened need for cyber security, organizations are turning to better, more secure alternatives for protecting their data. However, ARQQ is not your typical cyber security company. I believe it possesses a proprietary technology that is head and shoulders above the rest.

Business description

As a cybersecurity company, ARQQ has created a unique quantum encryption technology that fortifies the communication links of any networked device against all forms of cyber attack. The technology, Quantum Cloud creates low-cost, easily used software encryption keys that have been proven to be unbreakable. The amazing aspect of Quantum Cloud is that it can be applied to every edge device and cloud machine in the world.

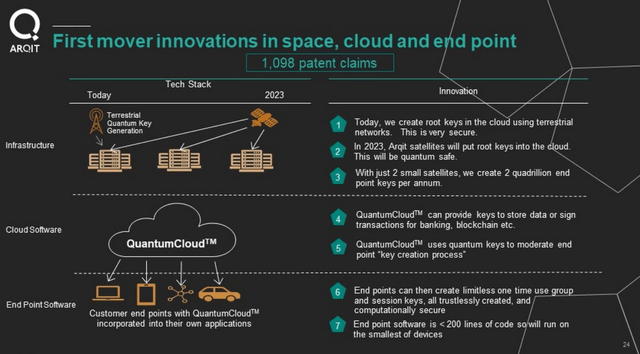

I encourage readers to read up on ARQQ technology in its F-1, as I will not be going into technical details. (Below is a graphical overview of the tech stack.)

A $230 billion dollar TAM

I believe there will be groundbreaking market opportunities for ARQQ products due to a predicted change in the cyber encryption industry in the next ten years. Public Key Infrastructure [PKI], the most popular cyber encryption technology, isn’t very good when it comes to dealing with newer technologies, especially quantum computers, which I expect to be developed enough to break PKI over the next few years. This means consumers, businesses, and governments, irrespective of geographical and industrial boundaries, will need to adopt newer technology in all electronic interfaces and dispose of the old. It is known that symmetric encryption keys are secure against quantum computers. The issue lies in finding a secure way to create and distribute symmetric keys electronically.

I expect ARQQ to have opportunities for growth in every direction: government, defense, telecoms, financial services, the internet of things, and connected car markets. Every connected or electronic service is susceptible to cyberattacks, especially in the future. The PKI might be unable to sustain such attacks, exposing every connected endpoint, network device, and cloud machine. Management has cited that the only effective mechanism for distributing cyber encryption technology is Quantum Cloud, which is both superior and secure.

ARQQ’s TAM is yet to be estimated because there are so many case studies out there. That said, Gartner estimates the global TAM for information security services to be worth around $230 billion by CY2025. This figure gives an idea of how big the market is for ARQQ.

ARQQ proprietary technology disrupts the legacy world of PKI

ARQQ is a necessary disruption to the calm in the digital world. It departs from the normal way of doing things, especially when more customers and businesses are pioneering more digital solutions.

Due to the failures of the PKI to stand up to escalating cyber attacks, ARQQ creates symmetric encryption keys, a cyber encryption technology that is secure against all forms of attack. Once created, the symmetric encryption key is computationally secure. This makes it impossible to guess the keys in a time frame shorter than a million years, even for a quantum computer.

The crux of ARQQ or Arqit’s solution is its ability to distribute symmetric keys at scale by creating them at endpoints. This has solved the nagging issue of creating and distributing symmetric keys through electronic means. ARQQ creates those symmetric keys at endpoints where they are needed and in groups of any size. Created at endpoints instead of being delivered, these keys cannot be in danger of interception.

I believe this is a groundbreaking discovery on the path to creating and distributing unbreakable symmetric keys. It was made using a “mixed trust model,” which makes it impossible for a third party to recreate or guess the key. This is because the key was never sent across any network when it was made, making it impossible to find out where it came from.

Easy to implement and scale

The average user, who doesn’t know much about cybersecurity, should be able to set up the software without much trouble.

Built into almost every major software system, Quantum Cloud is easily deployed with no major changes to existing customer infrastructure. While symmetric encryption keys impose low computational workloads on endpoint devices, ARQQ’s lightweight software works on even the smallest Internet of Things sensors.

Another important thing to note is that Arqit’s software automatically creates infinite volumes of keys at minimal cost, resulting in low capital expenditure. It doesn’t require human analysis and support to work. This limits personnel spending to the maintenance of core infrastructure, marketing, and customer support. This situation, therefore, is a win-win for both ARQQ and its customers.

Forecast

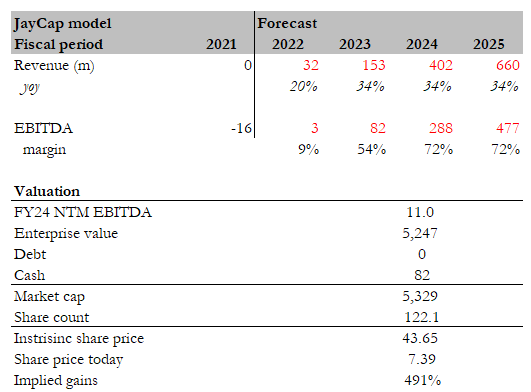

Based on my investment thesis, I expect ARQQ to grow at a faster rate as it commercializes its product and gains growth momentum from a small revenue base. As mentioned earlier, the TAM is huge, and it is difficult to project the exact sales figure; hence, I used management’s long-term guidance as a benchmark. I expect ARQQ to generate $660 million in revenue and $477 million in EBITDA in FY25. Assuming ARQQ does that and trades at the same forward EBITDA multiple as the S&P, it should be worth $43.65 (which is where it traded at the end of 2021).

Author’s estimates

Key risk

Very early-stage company with no profits

Just like every other start-up, investing in ARQQ is a leap of faith. Uncertainties are lurking around every corner. Investors must understand that this investment may be “dead money” until the numbers start to climb.

Evolving nature of cybersecurity industry

ARQQ disrupted the legacy PKI because of its superior proprietary technology. There is no saying that ARQQ can’t be deposed anytime soon. The cyber security market evolves quickly. A newer, better technology poses significant risks to the company.

Conclusion

ARQQ is undervalued at its current share price as of the date of this writing. Individuals, companies, and governments will always need and be ready to pay for cybersecurity services. This represents a market that will never run dry, with enough growth runway for investors.

Be the first to comment