Adrian Wojcik

Coca-Cola Europacific Partners (NASDAQ:CCEP)(“CCEP”) was still in recovery mode when I first covered it with a ‘buy’ rating back in April. The bull case was fairly straightforward: the stock was only trading for around 16x prior-year earnings at the time, and with those earnings artificially depressed due to the impact of COVID restrictions, there was plenty of low-hanging fruit to be plucked from a full recovery.

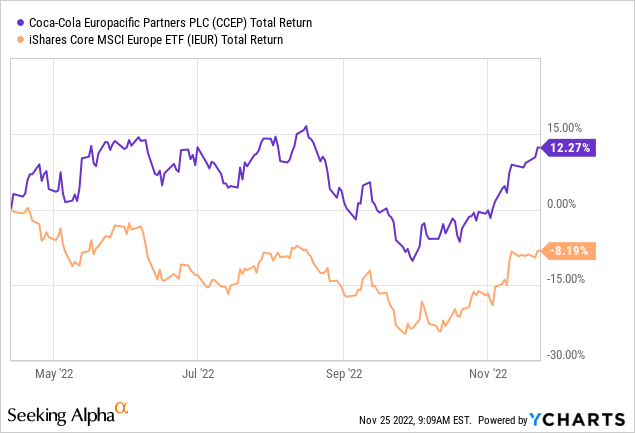

These shares have done very well in the interim, comfortably outperforming the broad pan-European benchmark index amid deteriorating economic prospects for the continent.

With that in mind, CCEP represents an interesting stock in what looks set to be tougher times for corporate earnings more generally. Cash flows are already defensive in nature here owing to the strength of The Coca-Cola Company’s (KO)(“TCCC”) brands, but CCEP is doing more than just holding its own right now, with the firm upgrading its FY22 and mid-term guidance as beverage volumes cruise past pre-COVID levels.

CCEP will always be subordinate to TCCC – the latter sells beverage bases to CCEP and can leverage that to extract maximum economic value – but these shares remain relatively inexpensive, while an above-average dividend yield and decent growth prospects might still appeal to income investors. Buy.

Back Into Growth Mode

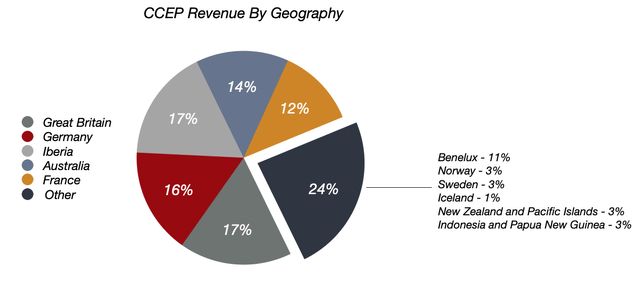

This year was always going to be one of recovery-driven growth for the company, given the impact of COVID restrictions in 2021. As a reminder, CCEP’s territories encompass most of Western and Northern Europe, plus certain Asia Pacific territories like Australia and New Zealand, where restrictions imposed on the on-trade and tourism were particularly strict.

Data Source: Coca-Cola Europacific Partners 2021 Annual Report

Year-on-year comps may flatter performance a little, but beverage volumes vis-à-vis pre-COVID 2019 suggest the firm is squarely back into growth mode. With that, pro forma comparable volume (i.e. incorporating the impact of the Coca-Cola Amatil acquisition in 2021) of 888M unit cases was up 5.5% in Q3 2022 versus the equivalent period in 2019. Pricing has unsurprisingly been strongly positive in that time too, with FX-neutral revenue per unit case up double-digits, leading to pro forma third quarter revenue (€4.48B) being around 17% higher than 2019.

Growth has been broad-based in terms of both channel and geography. With regard to the latter, both Europe and API (Australia, Pacific and Indonesia) recorded revenue growth of ~17% in Q3 versus 2019. In terms of channel, management noted that both at-home and away-from-home were trading above 2019 levels with respect to both volume and sales:

Our focus on core brands, leading in-market execution, and further price and mix, delivered volume and revenue, across both channels, ahead of 2019.

Damian Gammell, CEO

Near And Medium-Term Guidance Upped

With volume comps stronger than expected, management has upped near-term guidance. FY22 pro forma comparable sales growth is now seen coming in at around 15-16%, up from 11-13% previously. COGS inflation, highlighted in the last piece as something to monitor, is also seen higher, though, with pro forma comparable growth now seen at around 8.5% per unit case. That is up from 7.5% at the end of Q2 (and 5% at the start of the year) due to higher commodity inflation, though management still raised operating profit guidance, with that now seen increasing 11-12% versus high single-digits previously. Free cash flow is seen coming in at “at least” €1.8B, up from earlier guidance of €1.5B, while pro forma comparable EPS growth is seen at 14-15%, including a low-single-digit tailwind from currency.

FY23 is a bit harder to gauge, with management understandably only providing very light guidance right now. Price is going to do the heavy lifting on the revenue side given inflation and the strong volume performance in FY22, and another round of price hikes in H2 will feed through positively next year (revenue per unit case was 2% higher in Q3 versus H1). That said, volatility in terms of the energy price environment makes it harder to gauge the expenses and EBIT outlook.

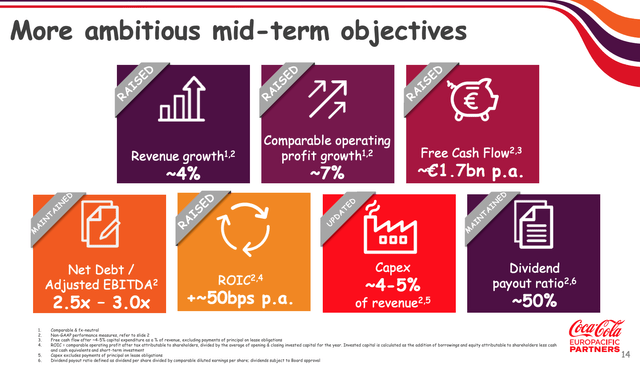

On the plus side, medium-term guidance has also been raised. Constant currency revenue growth is now seen coming in at a 4% annualized clip, up from low-single-digits previously. Comparable operating profit growth is likewise seen clocking in at 7%, up from mid-single-digits previously, while the floor for annual free cash flow generation has been raised to €1.7B from €1.25B.

Source: Coca-Cola Europacific Partners Capital Markets Event Presentation

Much of CCEP’s business in inherently mature. Beverages in the sparkling category account for approximately 85% of total volume, while Coca-Cola trademark beverages account for circa 60%. Given the company’s geographic footprint skews heavily toward developed markets with high per-capita soda consumption and poor demographics, organic volume growth potential for much of its business is constrained. CCEP does enjoy some top line growth drivers, though, with higher growth beverage categories (energy, ready-to-drink categories like tea, coffee and alcohol) helping out on the volume side in mature markets alongside potential gains from price/mix.

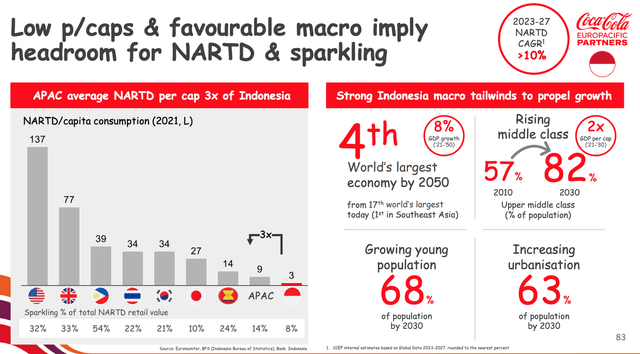

Geographically, Indonesia, currently just a low single-digit percentage of revenue, represents the company’s brightest prospect for organic growth, with plenty of scope for volume gains from both per-capita consumption growth and demographic trends.

Source: Coca-Cola Europacific Partners Capital Markets Event Presentation

Finally, faster than expected deleveraging following the Amatil acquisition raises the prospect of additional M&A activity. Net debt was €10.45B at the end of Q2, with management guiding that the top end of its 2.5-3x target leverage range would now be met in FY23 (previously FY24). Buying out the circa 30% of PT Coca-Cola Bottling Indonesia owned by TCCC seems a likely near-term step and would naturally boost CCEP’s growth profile.

Shares On The Cheaper Side Of Fair Value

CCEP shares trade for around €52.50 each as I type, putting them at around 16x FY22 earnings estimates and 14.5x tentative FY23 estimates. The dividend yield is 3.2%, with management committing to a fairly transparent dividend policy of paying out 50% of earnings. Discounting implied ~6% annualized long-term dividend growth gets me to a fair value in the €55-€60 per share area, around 10% higher than the prevailing price and putting the shares on the cheaper side of fair value. Buy.

Be the first to comment