Ryan Fletcher/iStock Editorial via Getty Images

Jet maker Airbus SE (OTCPK:EADSF, OTCPK:EADSY) recently published its order and delivery numbers for September. In this report, I will be analyzing orders, deliveries, cancellations and other mutations. In August, Airbus booked no orders, so it will certainly be interesting to see whether order numbers continued to plateau after a big month for orders in July.

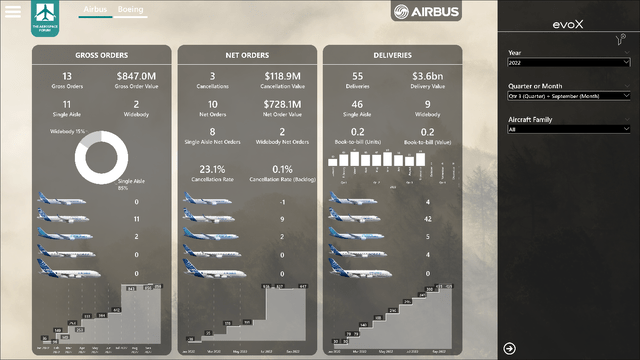

For this report, I will be using the evoX order and delivery monitor developed by The Aerospace Forum. For those who have been following the monthly order and delivery reports that I write for Airbus and The Boeing Company (BA), you might notice that this monitor looks completely different. So, I wanted to briefly introduce this new product that I will occasionally use as the backbone for investor updates. Over time, our data analytics capabilities have significantly expanded. With that come new insights on how to do things better. As a result, I have launched evoX, which combines front-end efforts and back-end improvements to improve our data analytics tools.

The evoX project introduces a completely new look for interactive monitors, but it does not stop there. We consolidated various monitors and pages into one, making more data accessible with a single tool and from the same data we present more information to you. So, we are better leveraging the hundreds of thousands of datapoints we got, which allows us to better highlight the data-driven approach of the analysis.

Just like before, using these tools we are able to analyze orders and deliveries and see where manufacturers are falling short, meeting or exceeding expectations.

Modest Order Inflow For Airbus In September

Airbus orders and deliveries September 2022 (The Aerospace Forum)

In September, Airbus booked 13 gross orders, marking an increase of 13 orders, consisting of 11 single-aisle aircraft and 2 wide-body aircraft with an estimated value of $847 million:

- A private customer ordered one Airbus A320neo.

- Sichuan Airlines ordered three Airbus A320neos and three Airbus A321neos.

- An undisclosed customer ordered four Airbus A321neos.

- An undisclosed customer ordered two Airbus A330-900neos.

During the month, the following changes were made to the order book:

- Azorra Aviation converted orders for two Airbus A220-100s to orders for two Airbus A220-300s.

- Ibom Air converted orders for six Airbus A220-100s to orders for six Airbus A220-300s.

- Macquarie Financial Holdings cancelled an order for one Airbus A220-300.

- Tibet Airlines was identified as the customer for one Airbus A319neo.

- Air Cote d’Ivoire cancelled an order for two Airbus A319neos.

- BOCOMM Leasing was identified as the customer for two Airbus A320neos.

- CALC converted orders for three Airbus A320neos to orders for three Airbus A321neos.

- China Southern Airlines was identified as the customer for one Airbus A321neo.

September was not really a mind-blowing month. We saw some orders come in and while there are some upbeat expectations for wide body aircraft, we are not seeing it back in the division between wide body and single aisle orders. While gross orders did not impress, there also were no noteworthy cancellations. It was mostly the usual flow of minor adjustments, including a cancellation from Air Cote d’Ivoire, which is no longer interested in the Airbus A319, and Macquarie Financial Holdings, which is not having the best of luck with placing the A220s it has on order. Further adjustments included upgrading for three orders from the A320neo to the A321neo and some identifications of customers.

Airbus logged 13 gross with an obvious value of $847 million while it scrapped 3 orders valued $118.9 million from the books, bringing the net orders to 10 orders with a value of $728.1 million. A year ago, Airbus booked 1 order and no cancellations, bringing its net orders to 1 unit with a net order value of $39.5 million. So, we see that order inflow increased year-over-year.

Year-to-date, the European jet maker booked 856 gross orders and 209 cancellations, bringing the net orders to 647 units with a net order value of $29.8 billion. In the first nine months of 2021, Airbus booked 270 gross orders and 133 net orders with a net value of $8.1 billion. So, Airbus is having a far better year this year, and to a major extent that is driven by a surge in order inflow in July, as a big order from Chinese airlines was logged and options for the A320neo family were firmed by easyJet.

Deliveries Are Reason For Concern

Airbus

In September, Airbus delivered 55 jets compared to 39 in the previous month. The European jet maker delivered 46 single-aisle jets and nine wide-body aircraft with a combined value of $3.6 billion:

- Airbus delivered four Airbus A220s.

- A total of 42 Airbus A320neo families were delivered, consisting of one Airbus A319neo, 19 Airbus A320neos and 13 Airbus A321neos.

- Airbus delivered five Airbus A330neos consisting of two -800s and three A330-900s.

- Four Airbus A350s were delivered, three -900 models and one -1000 model.

In September we saw the usual end-of-quarter jump in deliveries. However, with 55 commercial aircraft deliveries, this was the lowest end-of-quarter number this year and it makes one wonder how much production can actually be stretched this year. Usually, the first and third quarters are the weakest quarters for deliveries, but the third quarter tends to be higher than the first quarter. This is, however, not the case this year as Q1 and Q3 were even. Overall, wide-body deliveries are stronger than anticipated, but single-aisle deliveries continue to lag behind expectations due to supply chain issues.

Compared to last year, deliveries increased by 15 units while the delivery value increased by $1 billion. Year-to-date, Airbus delivered 435 aircraft valued at $28.8 billion compared to 424 aircraft valued at $27.62 billion last year. The good thing is that deliveries are now higher year-over-year, and that also holds for the value of the deliveries. However, with three months remaining for Airbus, I do not see a clear path to the 700 deliveries that Airbus targets, and I would expect deliveries to be closer to 650-660.

The book-to-bill ratio for the month was 0.2 in terms of orders as well as value. For the first nine months of the year, the gross book-to-bill is 2.0 in terms of units and 1.7 in terms of value while the cancellation rate is 24.4% and 4.3% when measured against the backlog. The book-to-bill ratio for the year is looking extremely strong. This is primarily driven by a combination of the big order from Chinese airlines, but also by the underwhelming delivery numbers due to supply chain issues. So, book-to-bill ratios higher than one do show balance or oversold positions in general, but in this case, they also reflect the big challenges when it comes to hiking production.

Conclusion: Airbus Stock A Buy, But Delivery Target Cut Expected

My conclusion on Airbus has been more or less the same for months. Orders are rolling in, some months faster than others and September was a slow month. However, on the order side of the story, I don’t see any problems. The backlog is strong and a weaker order year will not disrupt production. The problem I am seeing is on the delivery side. Airbus has a lowered target of 700 deliveries this year, but with three months remaining that would require almost 90 deliveries per month until year-end and that is something I do not see happening. Wide-body delivery numbers are looking strong, but single-aisle deliveries remain underwhelming and as a result of that I do believe that Airbus will further decrease its delivery target.

I continue to like shares of Airbus for the longer term and continue to be invested in the company, but the full potential to deliveries is now a story that extends further into the future than initially anticipated

Be the first to comment