WD Stuart/iStock via Getty Images

Introduction

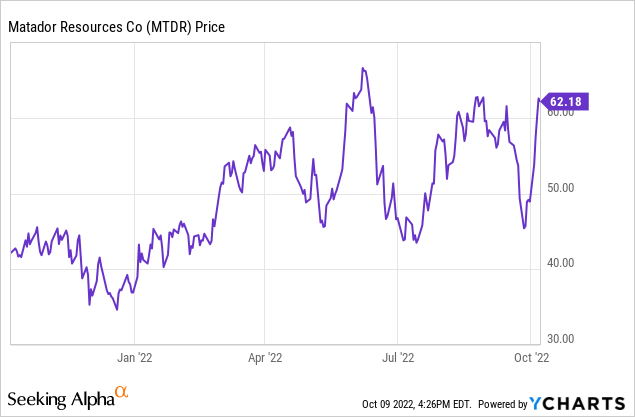

It has been just over three years since I last discussed Matador Resources (NYSE:MTDR) here on Seeking Alpha. Back in 2019 I wasn’t convinced the stock was very cheap (mainly due to the relatively high net debt position on the balance sheet) but in the past 37 months the Matador management has done everything right. The company didn’t run into any major issues in the 2020 oil crisis and the production rate continued to climb thanks to the policy to reinvest in the business. Whereas the company produced just 19 million barrels of oil-equivalent in 2018, it will likely end 2022 with a total production of close to 38 million barrels of oil-equivalent. A 100% production increase in just four years’ time.

The second quarter and first semester of this year were excellent

This also means the company is currently printing cash thanks to the high oil and gas prices. In the first half of this year, for instance, the average oil price exceeded $100/barrel and even after taking the impact of the hedge book into account, Matador’s net realized oil price was just under $100/barrel. The average natural gas price was just over $8.5/Mcf and after taking hedges into account, Matador was able to lock in an average realized natural gas price of approximately $8/Mcf.

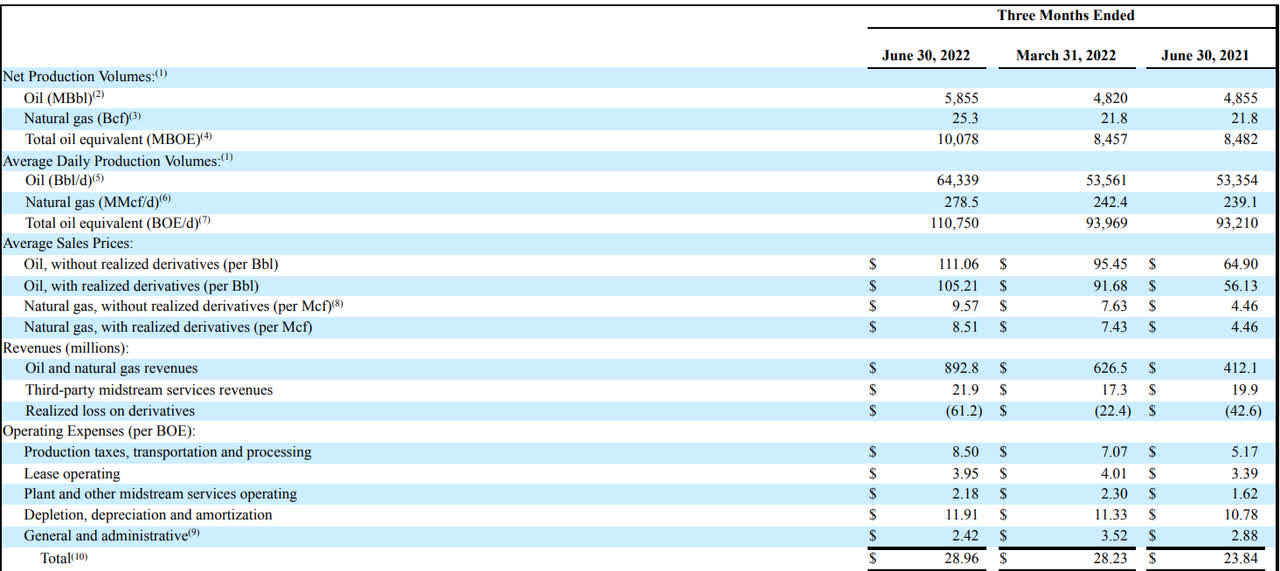

Matador Investor Relations

And as you can see on the image above, the average production cost per barrel of oil-equivalent remained relatively low at less than $29/barrel oil-equivalent and you can also clearly see about 40% of the total production cost consists of the non-cash depletion and depreciation expenses. This means the pure cash expenses per barrel of oil-equivalent were less than $17/barrel.

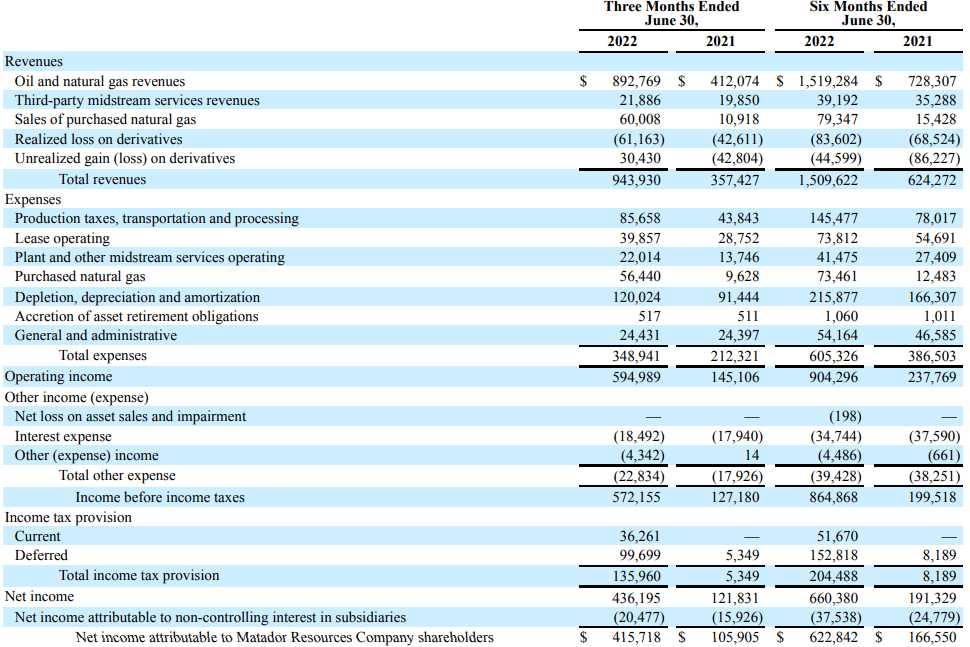

That obviously bodes well for the company’s financial results and as Matador produced a total of 18.5 million barrels of oil-equivalent in the first half of the year (which works out to approximately 102,000 boe/day), the total revenue cape in at approximately $1.51B. This includes about $128M in realized and unrealized losses on the hedge book as well as the low-margin sales of third party natural gas.

The total operating expenses came in at just over $605M (and again, in excess of a third of all operating expenses were represented by the depletion and depreciation expenses. If we would exclude the cost of the third party natural gas, this percentage would have increased to just over 40%).

Matador Investor Relations

This also means the operating income came in at in excess of $900M, which is almost four times higher than the operating income in the first half of last year. The interest expenses decreased as Matador has been reducing higher cost debt, and this resulted in a pre-tax income of almost $865M and a net income of just over $660M. After deducting the $37.5M in net income attributable to non-controlling interests, the net income attributable to the shareholders of Matador came in at $623M or $5.28/share.

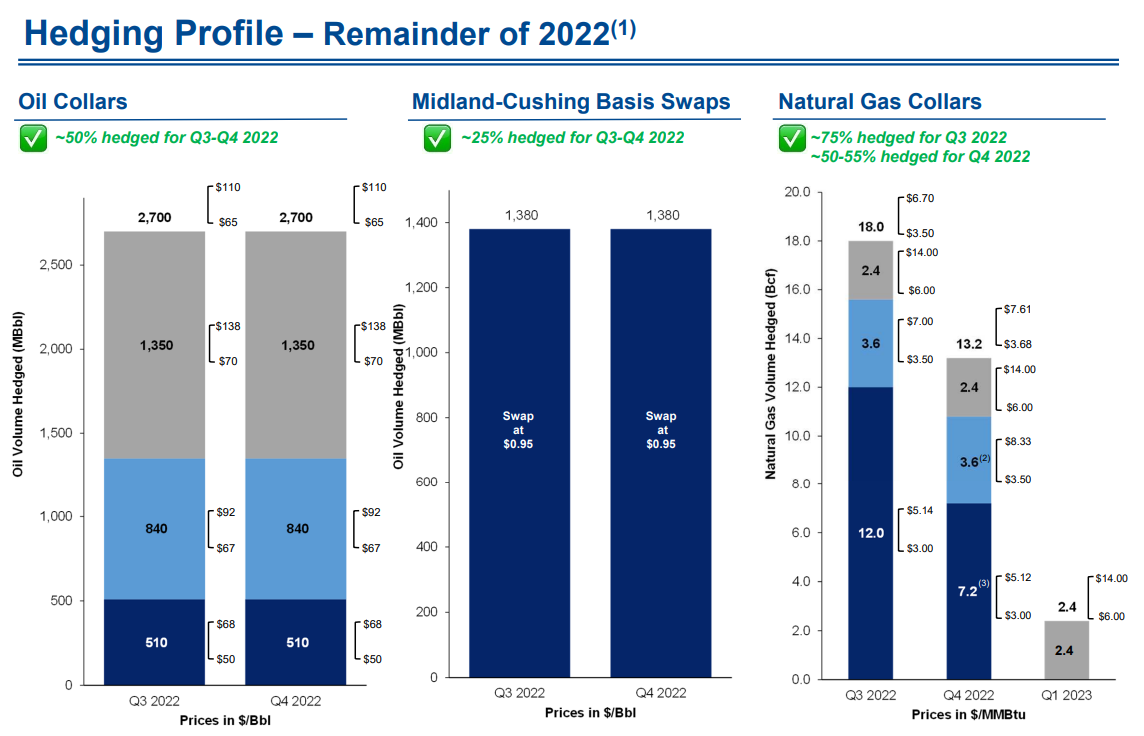

You also notice the Q2 performance was clearly stronger than the Q1 results. There were three factors at play here. First of all, the oil and natural gas production was higher, and the increased output was sold at higher prices. And thirdly, the timing of the hedging losses was important: the total realized and unrealized hedging losses were just over $30M in Q2, compared to $98M in the first quarter. While Q2 was extremely strong, it likely will be an anomaly thanks to the ‘perfect storm’. Expect Q3 to be weaker on an operating basis (although Matador may be able to record a gain on the hedge book).

Matador Investor Relations

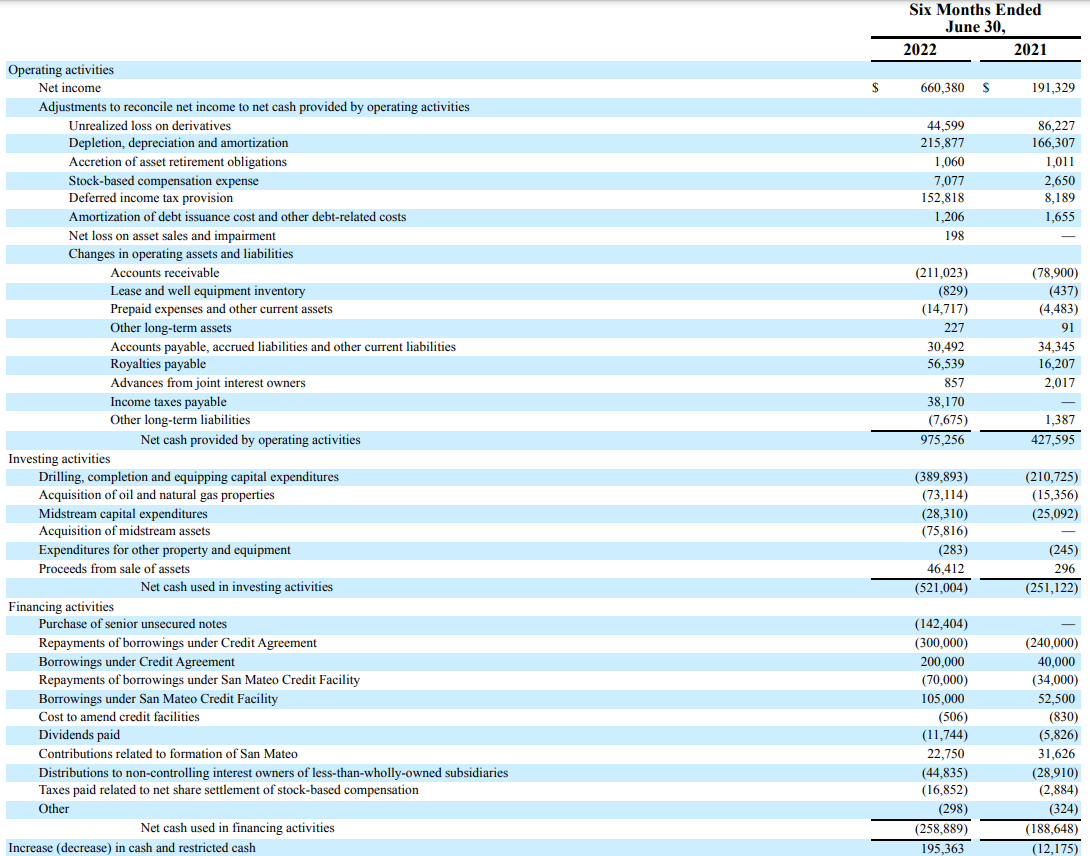

The strong performance obviously also results in strong cash flows. The cash flow statement of Matador shows an operating cash flow of $975M on a reported basis. This includes a total net working capital investment of approximately $99M. We should also deduct the $45M in dividends paid to non-controlling interests. This means the adjusted operating cash flow was $1.03B.

Matador Investor Relations

The total capex during the first semester was approximately $420M (including the capex invested on the midstream assets). That means Matador generated north of $600M in free cash flow in the first half of the year. Keep in mind this includes the deferral of just under $153M in taxes so on a more normalized basis, the free cash flow would have been approximately $450M.

The company paid about $12M in dividends and as you can see above, Matador repurchased in excess of $140M of senior unsecured notes and repaid a net amount of $100M on the credit facility. This means we can likely expect the net interest expenses to decrease in the second half of the year.

Keep in mind the free cash flow result in the second half of the year will likely be lower than in H1. Not only will the realized oil and gas price be lower, the full-year capex guidance calls for an investment of $815M to $895M and considering the impact of inflation we will likely end up at the higher end of that range which means the H2 capex will likely be approximately 15% higher.

The safer option? Buy Matador debt

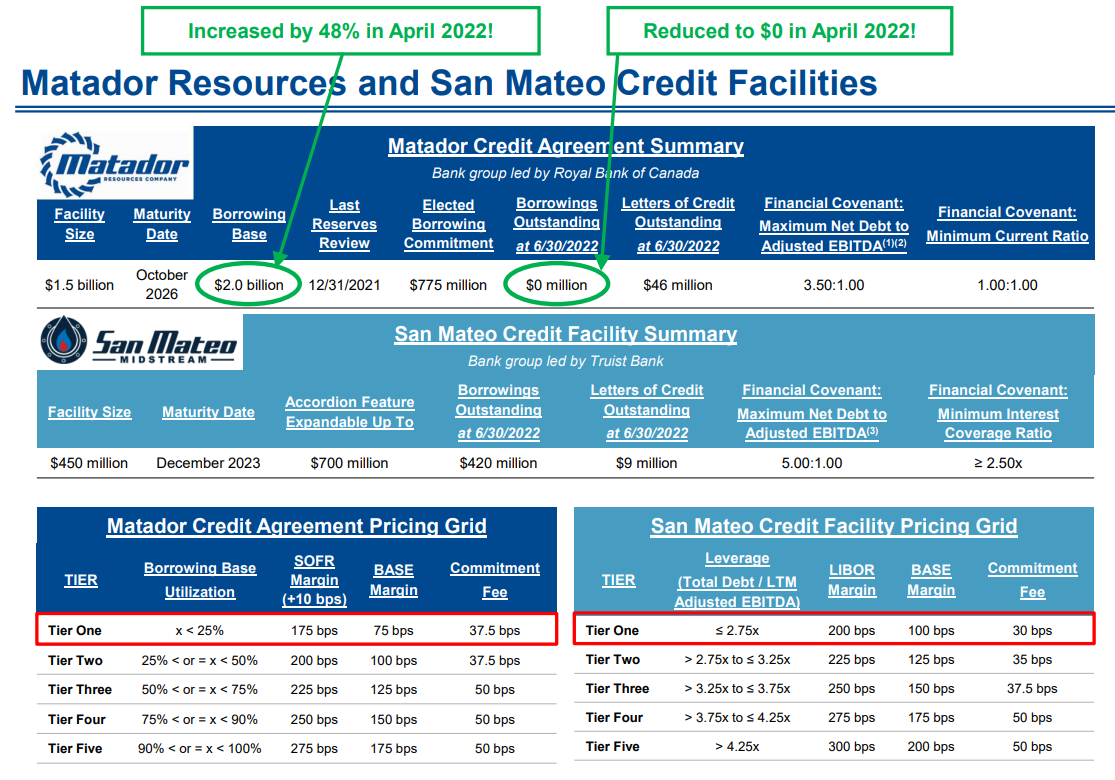

In the first half of the year, Matador saw its total cash (including restricted cash) increase from $87M to $282M. Meanwhile the gross debt decreased from $1.53B to $1.32B resulting in a net debt decrease from $1.45B to just over $1B. I like the focus on the debt decrease as it means Matador has the right priorities in mind.

As of the end of June, the company still had just over $900M in senior unsecured notes payable. That’s a lot of money in absolute terms, but it’s really just over a year of free cash flow so from a relative perspective the refinancing of these notes when the maturity date comes close should not be an issue, especially knowing the company can easily tap its credit facility to do so.

Matador Investor Relations

I would actually argue the senior unsecured notes are pretty interesting. These notes are currently trading at 97.45 cents on the dollar and have a 5.875% interest coupon. They mature in about 4 years, on September 15 2026 which means the yield to maturity is approximately 6.6% at the current price of the debt.

Investment thesis

Matador’s shares are still relatively cheap if you believe in a strong oil and gas price for the next few years. Meanwhile, I think the debt is also pretty attractive with a 6.6% yield for a 4 year senior unsecured note.

I currently have no position in either of both securities. While I have been writing put options on Matador’s common shares, those options expired out of the money. The debt is getting increasingly interesting and perhaps I will use the proceeds of the early repayment of my Surge Energy debenture to reinvest the proceeds in Matador’s debt.

Be the first to comment