Thomas Barwick

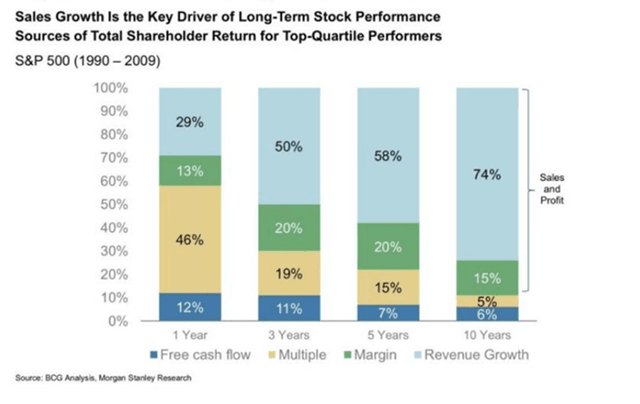

This article is the latest in my series where I look to find companies that will outperform the market over the long term. I focus on the key drivers of long-term stock market outperformance, revenue growth and margins.

Drivers of Long-Term Stock Performance in Top-Quartile Performers ((BCG Analysis, Morgan Stanley Research))

Thesis

This article will focus on these two key metrics (revenue growth & margins) to illustrate why I believe that Airbnb (NASDAQ:ABNB) will outperform the market over the long term.

About Airbnb

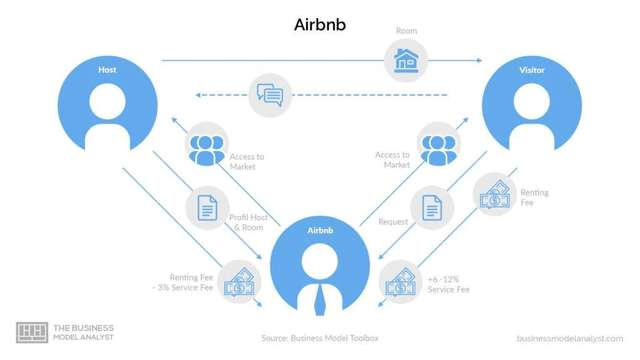

Airbnb is a peer-to-peer (P2P) online travel agency (OTA), with a leading alternative accommodation network. Airbnb is a capital-light, fully digital platform (app & website only) that has scaled at a rapid rate since it was launched in 2008. In 2016, Airbnb expanded its service offering to include “Experiences”, whereby a host can offer tours or tickets to events through the app. Airbnb’s revenue comes from two primary sources:

Commissions from property and experiences hosts: Typically, ~3% of the rent for property hosts and ~20% of the amount charged for experience hosts. Fees from guests: typically, ~6-12% of the booking amount.

Airbnb Business Model (Businessmodelanalyst.com)

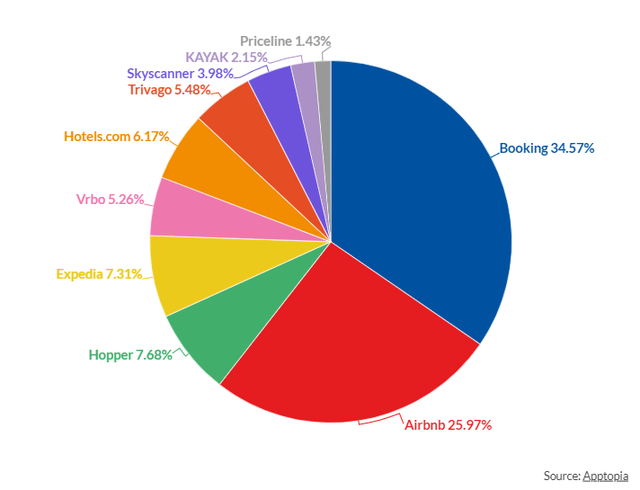

Airbnb’s platform has reached a critical mass scale, with the network of hosts and guests benefiting from a virtuous cycle. Airbnb has grown from 2,500 listings and 10,000 users in 2009 to ~5.7m active listings and over 300m annual bookings in 2022. Airbnb is estimated to make up ~25% of the global travel accommodation market share and is the second largest player behind Booking Holdings (BKNG) (Booking.com):

Travel Accommodation Industry Market Share (Apptopia)

Additionally, Airbnb is the leader in the “alternative accommodation network”, with morning star estimating Airbnb holds a ~40% market share vs ~25% for Booking and ~15% for Expedia (EXPE).

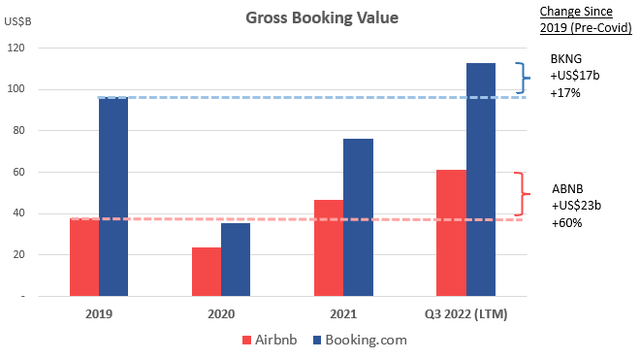

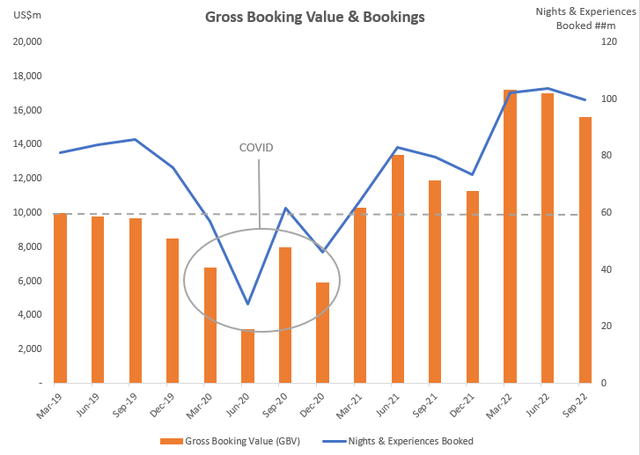

Airbnb has successfully navigated an extremely difficult operating environment caused by the COVID pandemic and increased its market share during this time. At the peak of the pandemic, new bookings were down ~80%, with a growing portion of hosts switching to typical long-term rentals due to the collapse of the short-term market. Airbnb successfully pivoted and launched “monthly stays” to compete with normal rental services but without the standard annual contracts. Additionally, Airbnb completed its IPO in Dec-20 which helped improve its capital position during the tumultuous covid period. Management’s agile approach during the pandemic has helped Airbnb has gained significant market share. Since 2019, Airbnb has increased its Gross Booking Value (GBV) at a far superior rate (60% vs 17%) than its main competitor Booking.com:

Author Created (Company Filings)

Airbnb Revenue Growth

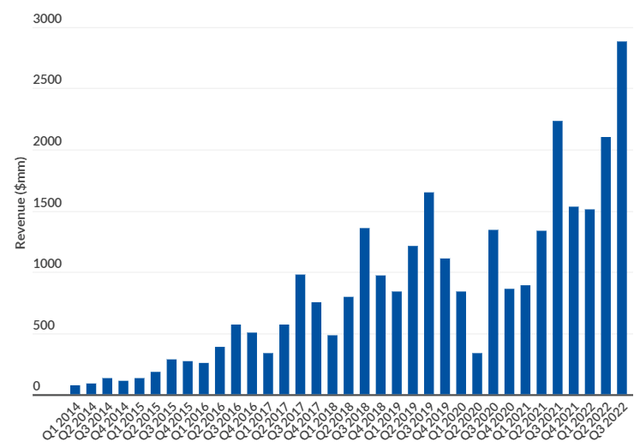

Airbnb has grown its revenue at a rapid rate as its platform passed its inflection point, illustrating the power of the network effect. Airbnb increased its revenue from US$423m in 2014 to US$8b (LTM) as of Q3-22 after its record quarterly revenue, implying a ~45% CAGR over the last 8 years.

Airbnb Revenue (Business of Apps)

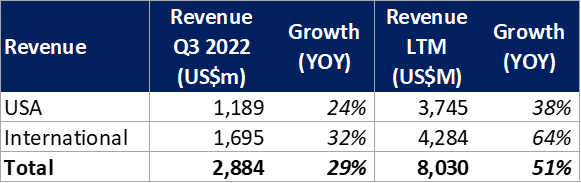

Airbnb is fresh off a record quarter in terms of profitability and revenue, with Q3-22 revenue of US$2.9b growing 29% YOY and 36% on a constant currency basis:

Author Created (Company Filings)

Airbnb has achieved this durable strong revenue growth through a combination of factors:

- Increasing the GBV per night booked, and thus the overall GBV

- Increasing the number of nights booked on its platform

- Increasing its take- rate over time

- More recently through the introduction and expansion of experiences.

I will now assess whether these trends are likely to continue to support this robust revenue growth into the future.

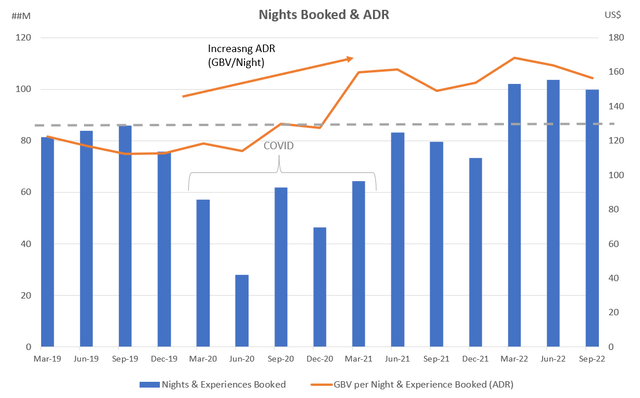

1. GBV And The GBV Per Night Booked

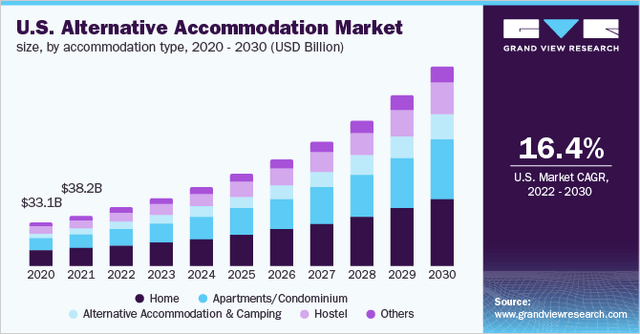

The global travel and accommodation industry is expected to exhibit strong growth through to the end of the decade, with pent-up demand resulting from the Pandemic. The industry is expected to grow by ~10.3% p.a. to 2030. Additionally, the alternate accommodation industry (Airbnb’s market) is expected to grow at a higher rate of ~16.5% p.a. to 2030.

Grand View Research

Airbnb is well positioned to leverage this growth in travel accommodation spend. Airbnb has a history of increasing its GBV at a greater rate than nights & experiences booked, meaning it can successfully capture the increase in travel spending. This is evident when comparing the Sep-22 quarter to the Sep-19 pre-COVID equivalent, with GBV increasing by 60% vs only a 16% increase in nights & experiences booked.

Author Created

Airbnb has therefore been able to increase its GBV per night & experience booked (ADR) at a mid-teens growth rate in recent years:

Author Created

2. Number Of Nights Booked On Its Platform

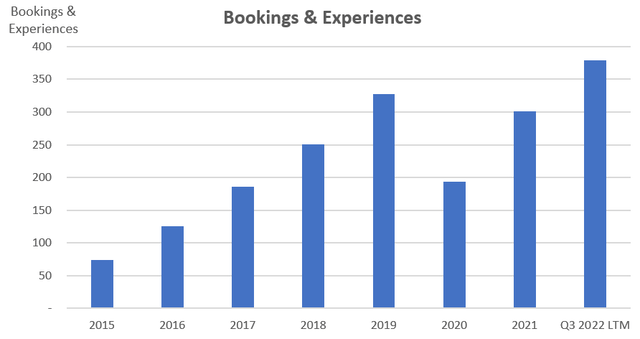

Airbnb has consistently grown its bookings on its platform from ~74m in 2015 to 379m in Sep-22 (LTM).

Author Created (Company Filings)

COVID has revolutionized consumer preferences with more travellers now seeking the flexibility to work from or live abroad. This consumer shift explains why Airbnb has managed to capture significant market share since COVID and I expect this to be a tailwind moving forward. Millions of people now have additional flexibility they didn’t have before the pandemic and Airbnb will continue to benefit from this. Guests are continuing to stay longer on Airbnb, with long-term stays accounting for ~20% of total nights booked in Q3-22, up from ~14% in 2019 (pre-covid). This trend is supporting strong GBV and revenue growth, with travellers booking longer stays on the Airbnb platform.

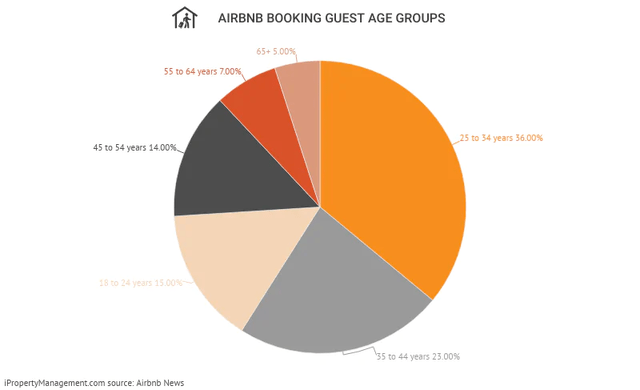

Another important factor is the younger generation’s preference for staying in Airbnb. ~75% of Airbnb’s users are under the age of 44 and ~50% are under 34.

Airbnb News

Airbnb is well positioned to continue increasing the number of bookings on its platform through its global reach, evidenced by its platform being a top-10 iOS travel mobile app in 87 countries (According to Trip Annie). Airbnb’s brand has become so strong it has become both a noun and a verb, with “Airbnb” now synonymous with the alternate accommodation industry. Airbnb’s strong brand is evident by the fact that over 90% of platform traffic comes directly and through organic search.

Management has shown an ability to continue to innovate and improve the Airbnb platform, which continues to support growth in nights booked on the platform. Recent examples include:

- The introduction of Airbnb Categories in May-22. This has helped point demand to appropriate supply (hosts).

- The introduction of Aircover. Aircover was introduced for Hosts in 2021 and was introduced for guests in May-22 due to its positive reception from hosts. So far this has translated into improvements in NPS and increased the conversion of guests re-booking after a host cancels.

3. Consistent Increase In Take-Rate

Airbnb has increasingly been able to capture more of the growing GBV, with its take rate consistently improving each year from 11.4% in 2014 to ~13.1% as of Q3-22 (LTM). Whilst this increase may seem insignificant, just a 0.1% increase in the take-rate contributes an additional ~US$60m at the current GBV levels. Airbnb’s consistent take rate increases show it can effectively monetize its platform whilst adding value to hosts and guests. Since 2008, hosts have earned US$180b on the Airbnb platform, highlighting the value to hosts on the platform. Expect this trend to continue, particularly as the higher take rate Experiences division (~20% fee) increases in GBV.

4. Experiences Division To Leverage Existing IP

Management believes it can successfully expand the experiences divisions without much incremental investment. This is because they can incorporate it into the existing platform and through synergies with the travel accommodation product. The experiences division was particularly hard hit by the pandemic, with the entire division suspended during COVID. Whilst management does not currently provide data on the experiences division, they have flagged it as a focus moving forward. The re-opening of key Asian markets (outbound tourism from China & Japan), combined with management’s planned expansion is likely to support a strong recovery in experiences revenue.

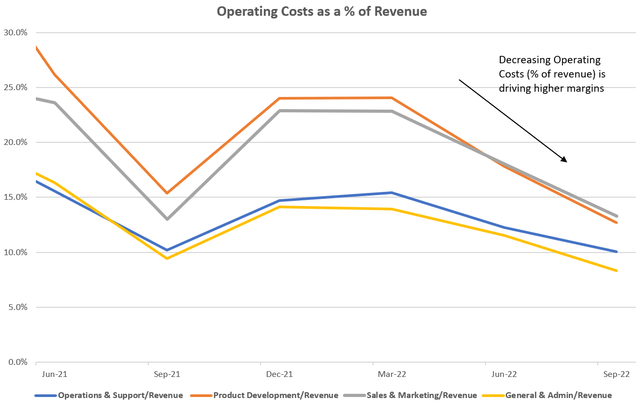

Management Delivering On Improving Profitability And Driving Higher Margins

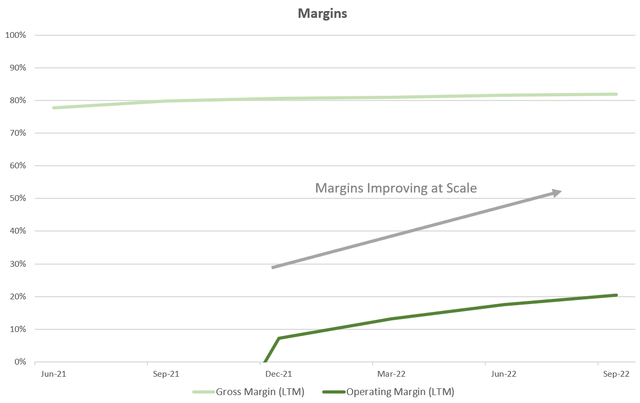

Airbnb is one of the few tech companies currently improving margins and delivering on its promises to achieve strong profitability. During the COVID pandemic’, Airbnb laid off ~25% of its workforce, with CEO Brain Chesky flagging his intent to “become lean regardless of the economy” and to achieve profitability through reducing operating costs. Chesky has delivered on his words, with Airbnb achieving its most profitable quarter in Q3-22 with a net income of US$1.2b, up from US$400m (+200%) the prior year. The quarter represented a 42% net income margin and generated US$960m in FCF, with US$3.3b over the LTM. The strong quarterly results demonstrate that Airbnb continues to drive growth and profitability at scale:

Author Created (Company Filings)

Management has “radically adjusted” their marketing expenditures to be substantially lower in recent quarters. They have also reduced variable costs and improved leverage on fixed costs. Management has guided that they expect to continue improving margins overtime on the back of this cost control and increasing scale:

Author Created (Company Filings)

Airbnb has a relatively small employee base and high revenue per employee of ~US$1.3m compared to its competitors. Chesky intends to maintain the lean employee base that arose from the COVID layoffs and believes that Airbnb is nimbler and more effective as a result. So far Chesky has struck the balance between profitability and productivity and I believe this will continue.

Other Considerations

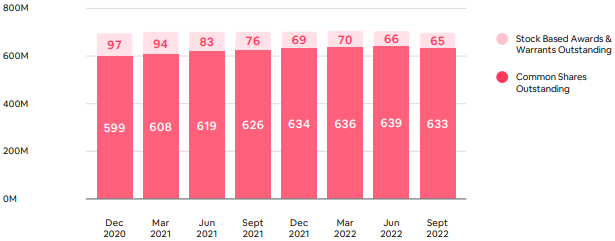

Founder Led

Airbnb has one of the highest insider ownerships of the large tech companies, with the three founders owning ~29% of the company. Importantly, management is managing shareholder dilution and has repurchased US$1b of the authorised US$2b share buyback program. Airbnb’s strong FCF will support continued share buybacks to manage stock-based compensation.

Company Q3 Earnings Presentation

Competition

Airbnb operates in the intensely competitive travel accommodation industry. Airbnb faces risks from both direct competitors such as Booking Holdings and Expedia Group, as well as from large tech players such as Google through a metasearch model. A key differentiator to its competitors is that Airbnb’s core segment is the listings of small-time homeowners looking to monetize their properties. This includes the unique offering of private rooms in a shared house/apartment, which is a product not offered by major competitors. This provides Airbnb with a natural recession hedge, with many people turning to Airbnb to earn extra income and travellers increasingly seeking more affordable travel accommodations. I believe that Airbnb is thus best positioned amongst its competitors to outperform during a recessionary environment.

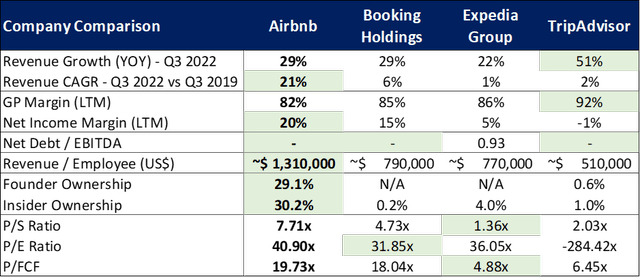

Airbnb’s strong brand and impressive growth prospects come at a cost, with AIRBNB trading at a premium to its competitors:

Author Created (Company Filings)

I believe Airbnb has the strongest brand recognition and is the most recognized name in the vacation rental industry. The word “Airbnb” has become a genericized trademark/proprietary eponym for alternate accommodation stays. This brand strength, higher revenue growth and higher profit margins, combined with Airbnb’s continued taking of market share justify the higher valuation in my opinion.

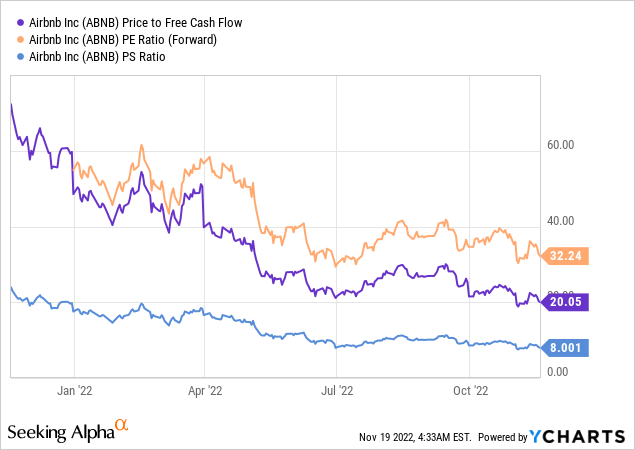

Valuation

Airbnb currently trades near all-time lows on key valuation metrics. Airbnb’s valuation is thus the most attractive it has been since the IPO in 2020. Whilst Airbnb stock can not be considered cheap, I believe a price-to-FCF ratio of ~20 is reasonable given the company’s strong fundamentals. Airbnb’s P/E ratio continues to improve as the company rapidly improves profitability. As such the forward P/E ratio for Airbnb is ~32 based on current analyst forecasts.

Risks

Google’s continued emphasis on placing paid ads and metasearch platform ahead of free organic search links could elevate marketing costs for Airbnb. Additionally, the alternative accommodations industry continues to face regulation headwinds around the impact on society (resident quality of life), safety and cost of living. So far management has successfully navigated these risks and this will be important to watch moving forward.

Conclusion

I believe Airbnb is well positioned to outperform the market over the long term on the back of robust revenue growth and high/improving margins. Airbnb has revolutionized the alternate accommodation industry and continues to provide incredible value to both guests and hosts around the world. Its resulting brand strength and increasingly popular platform should see it continue to take market share from its competitors. Whilst the stock continues to be very volatile in the short term, I believe the current valuation is reasonable with a long-time horizon. I believe market volatility and the tech sell-off provides a good opportunity for long-term investors to start a position in Airbnb.

Be the first to comment