designer491

Introduction

I don’t remember the last time I wrote an article focused on one or multiple stocks I wouldn’t buy. The same goes for short-selling opportunities, which I abandoned almost entirely a few years ago. However, after covering countless companies that I would love to own, I keep getting requests from readers looking for stocks to avoid. I’ve avoided this for a long time as I prefer to focus on companies I like. However, it makes sense to cover stocks I wouldn’t buy. After all, knowing what not to buy is a part of the process. In this article, I will give you two stocks that I would not buy. I am fully aware that a lot of readers probably own at least one of the companies. So, before we start, please be aware that I don’t *hate* any of these companies. They are just not suitable for a low-volatility dividend growth portfolio, and I believe there are better alternatives out there for various reasons. After all, while losing money is bad, buying stocks with a bad long-term risk/reward is also a big problem. I believe the stocks discussed in this article do not offer an attractive risk/return.

So, let’s get to it!

What I’m Looking For In A Stock

Now, before I start saying bad things about a stock you may or may not own, let me explain what I’m looking for in a stock. My average dividend yield is currently 2.4%. That’s not a lot, which has everything to do with my age (27), as I’m not in a position where I need a high income from dividends. I took that into account when I thought about the stocks I wanted to cover in this article. After all, a lot of people depend on the income from their portfolios.

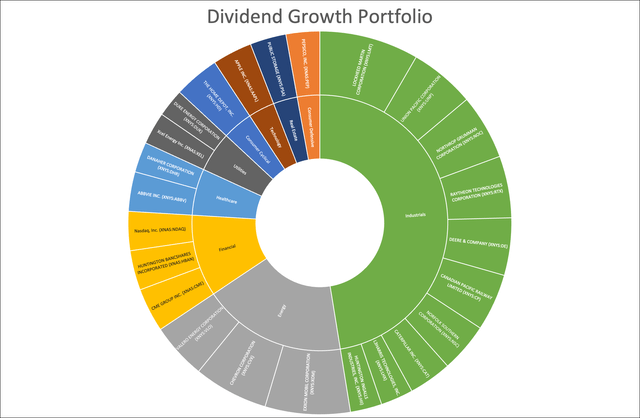

As the overview below shows, my portfolio is far from mainstream. I have high industrial exposure and above-average energy exposure. I also own energy stocks in my trading portfolio.

I’m not overweight in industrials because I love industrials so much. It just happened because when I buy a company, I look for quality factors like the ability to consistently grow the dividend. It just happens that a lot of these companies are industrials. Moreover, I’m increasingly looking for low-volatility stocks when it comes to investing larger sums of money.

I believe that dividend growth and low volatility are a great mix for success for several reasons. First of all, consistent dividend growth shows that a company is successful. It’s a stamp of approval. After all, being able to let shareholders benefit from one’s success isn’t something the market takes for granted. Doing it consistently and growing the dividend at rates above inflation also protects investors against inflation.

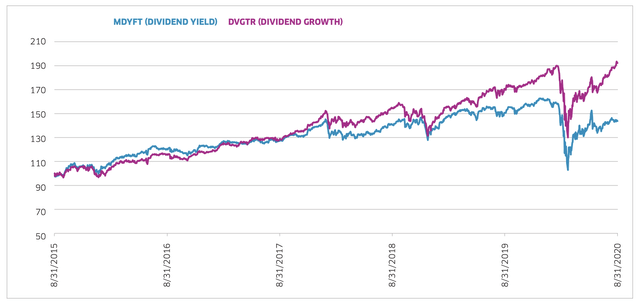

Using Nasdaq (NDAQ) data, dividend growers have consistently outperformed stocks with an emphasis on a high yield. However, in general, it needs to be said that dividend stocks (both high and low growth) tend to outperform the market.

The reason why a lot of dividend stocks outperform the market is that dividends stand for quality. In a recession, when (some) investors are forced to sell, they first sell stocks with lower quality aspects.

This creates a situation where dividend stocks tend to outperform the market during drawdowns. This allows even slower-growing dividend stocks to outperform the market on a long-term basis without outperforming the market in every bull market. It’s all about protecting the downside.

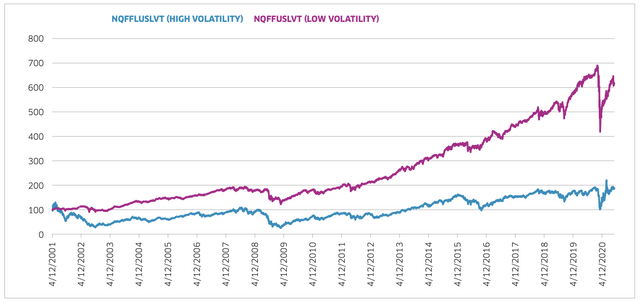

The chart below goes back to 2001 and perfectly shows why low-volatility stocks are doing so well. In the Dotcom bubble, the housing recession, the 2015/2016 manufacturing recession, and the pandemic, low-volatility stocks did much better than stocks with high volatility.

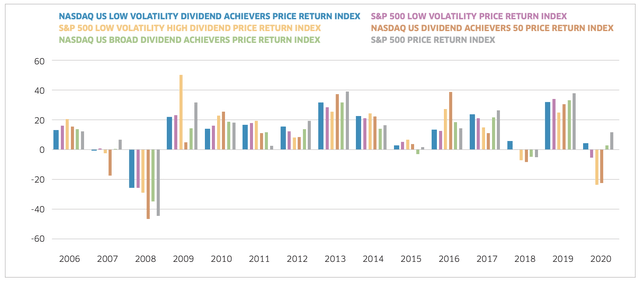

The next chart shows where returns have come from.

Hence, to use Nasdaq’s own words:

[…] low volatility and dividend strategies are two key factors in the market today. Low volatility has shown to have superior performance compared to high volatility strategies. Further, within low volatility, large-cap securities and securities within certain sectors have shown to exhibit the lowest volatilities historically. From the various income strategies that exist today, dividend growth strategies have shown to outperform dividend yield-focused strategies. The other crucial benefit of dividend growth-oriented strategies is that they protect against inflation eroding the value of dividends.

Also, as you may see in my portfolio, I sometimes break the low-volatility rule. In that case, I look for exceptions. My energy stocks are volatile, yet their yields are better.

With all of this in mind, let’s look at the stocks that I wouldn’t buy if I were you.

1. FedEx Corporation (FDX)

I didn’t go with obvious stocks that most people wouldn’t buy. I decided to go with companies that may be on a lot of investors’ radars as I also considered buying these stocks.

Hence, the first one is a company that is actually on top of its field, yet its stock isn’t the perfect tool for dividend growth – or even income.

With a market cap of $45.4 billion, FedEx is one of the nation’s largest transportation companies. The company engages in e-commerce and business services in the United States and beyond. These operations include express transportation, small-package ground delivery, freight transportation service, time-critical transportation, cross-border enablement, technology, and e-commerce transportation solutions.

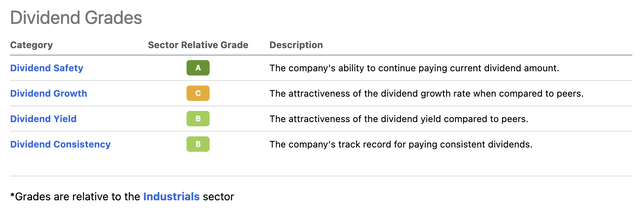

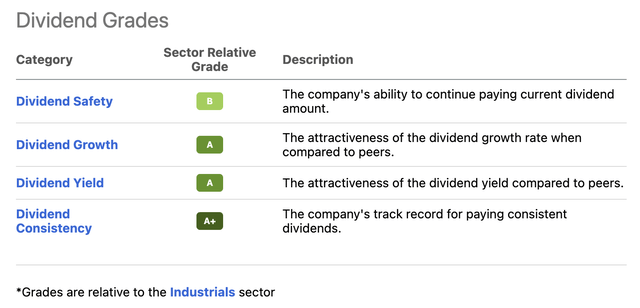

The company’s dividend scorecard isn’t bad at all. The company scores high on dividend safety and relatively high on its yield and consistency. These grades are relative to the industrial sector.

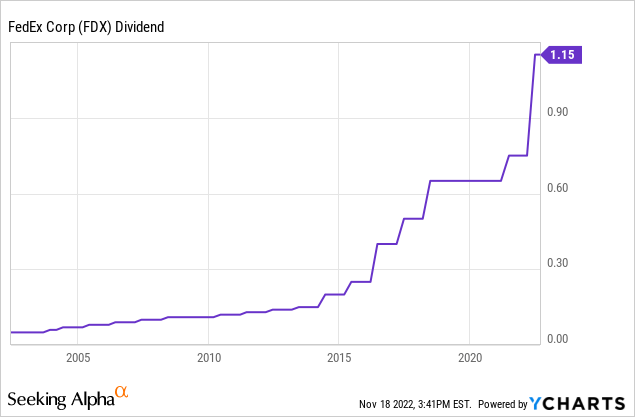

FedEx yields 2.6%, which is based on a $1.15 quarterly dividend per share. The average annual dividend growth rate of the past 10 years is 22%, which is a tremendous number. On June 14, management announced a 53.3% dividend hike.

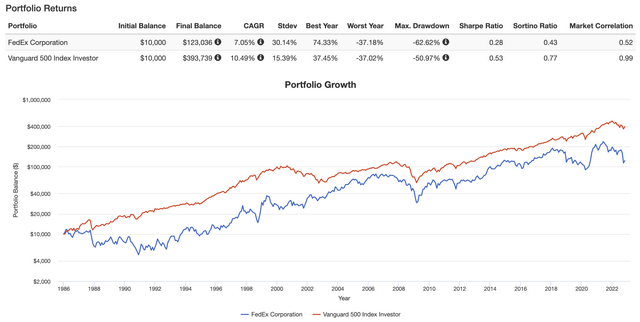

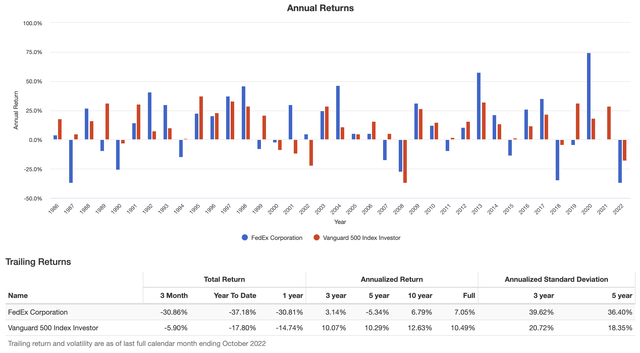

Yet, FDX is still on my list. The problem is that the company is extremely cyclical. It’s prone to increasingly tough competition, volatile freight rates, and consumer sentiment. Going back to 1986, the company has returned 7.1% per year (including dividends). That’s well below the S&P 500’s performance of 10.5%. During this period, the standard deviation was 30.1%. Hence, the company has an abysmal Sharpe Ratio of less than 0.30. That’s terrible.

Moreover, the company’s performance is consistently below par. On a three, five, and ten-year time horizon, the company is underperforming the market with high volatility.

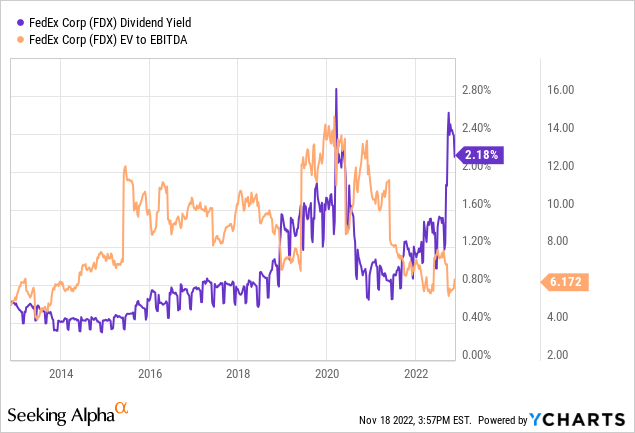

Right now, FDX is trading at 6.2x LTM EBITDA with a yield of 2.6% (YCharts has not been updated). That’s its highest yield in more than 10 years if we ignore the 2020 sell-off.

There’s nothing wrong with FedEx, I just believe there are better stocks on the market that come with a lot less volatility and bigger moats.

Also, the yield isn’t attractive enough to make an exception for underperformance. Not beating the S&P 500 consistently is fine. However, that’s only acceptable if a stock has a high yield and low volatility to provide income options for income-seeking investors.

2. 3M Company (MMM)

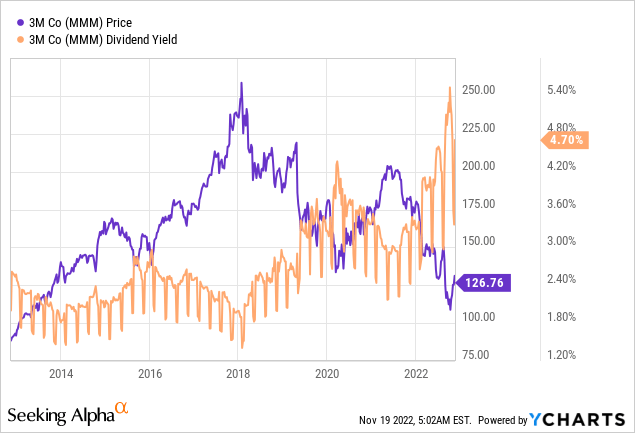

I have to say that putting 3M on the list wasn’t an obvious choice. After all, this $70.1 billion market-cap industrial conglomerate has been punished severely, pushing its yield to 4.7%. That’s based on a $1.49 quarterly dividend per share.

In this case, the company’s stock price is back at 2013 levels after entering a very volatile downward trend in 2018. Back in 2018, global economic growth peaked, ending an impressive upswing in 3M’s stock price.

In 2020, the downswing accelerated as a result of the pandemic.

It also doesn’t help that the company is involved in some major lawsuits like the earplug situation, which became an issue in 2016 when Moldex-Metric filed a complaint against 3M under the False Claims Act.

According to Seeking Alpha contributor Jonathan Wheeler:

The current decision is for litigation to continue forward while bankruptcy proceedings are ongoing for Aearo. Uncertainty is high here, and if 3M suffers a significant legal setback with its plans to effectively separate Aearo and settle vice going to court with each case, it could further impact the stock.

Other than that, the 3M dividend scorecard is looking quite good. Bear in mind that the scorecard is comparable to the FDX scorecard as both are operating in the industrial sector.

The company scores high on safety, growth, yield, and consistency. Consistency scores an A+ as the company has hiked its dividend for more than 60 consecutive years, making it one of the few dividend kings.

Yet, the stock ended up in this article.

Due to ongoing circumstances, 3M’s dividend growth has dropped. These are the most recent hikes:

- February 2022: +0.7%

- February 2021: +1.0%

- February 2020: +2.0%

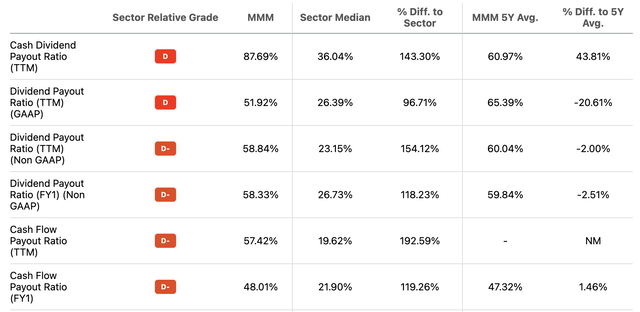

The company’s payout ratios all score very poorly versus the sector median.

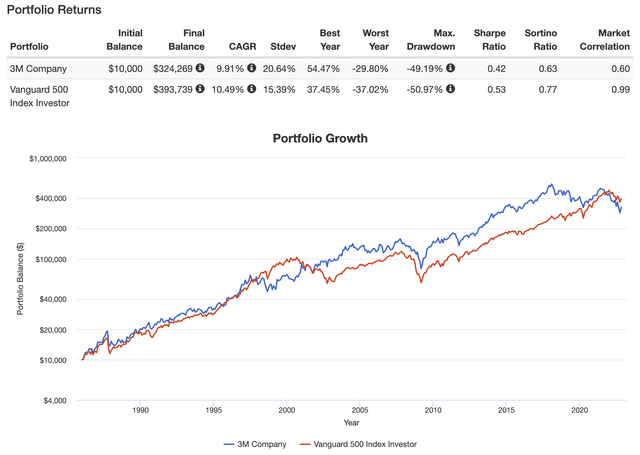

Moreover, the company’s performance has started to lag. Going back to 1986, the stock has returned 9.9%. That’s a decent performance. Moreover, the 20.6% standard deviation is manageable and not something to complain about.

However, the performance has come down a lot. Over the past 10 years, the annual return has declined to 6.7% (versus 12.6%). On a five-year basis, that number is negative 8.5% (versus positive 10.3%). The standard deviation has increased to 25%.

This is obviously due to ongoing issues that will be resolved over time.

My issue is that there are better alternatives. If I wanted to buy a yield of more than 4%, I would likely buy a telecommunication, a utility company, or a REIT. If I wanted an industrial company with dividend growth, I would likely go with something with more growth. For example, Honeywell International (HON).

Takeaway

For the first time in a very long time, I wrote an article including stocks that I would not buy. I went with popular stocks, as I believe that adds more value than picking stocks that most people won’t like anyways.

In this case, I picked two companies that aren’t terrible. Just not good enough to make the cut. After all, there are a lot of good dividend growth stocks out there. Investors do not have to settle for anything.

My decision to include FDX and MMM is based on my view to focus on low-volatility dividend growth, which tends to deliver the best long-term results. FDX and MMM prove that. FDX is simply too volatile due to the nature of its business. I rather go with something that returns more with equal volatility, or a stock with less volatility and a higher yield.

3M has a better performance history. Yet, the stock has struggled for roughly four years. Litigations and a soft business environment have caused peers to outperform the company. Volatility has increased. The same goes for its yield. However, in that case, I would prefer low-volatility alternatives with an equal or higher yield.

With all of that said, I will present some alternatives in the weeks and months ahead.

Moreover, this is not a call to get people to sell MMM or FDX. I know for a fact that some readers own these stocks with very high yields on their cost basis.

Do whatever works for you in light of your unique situation. Just bear in mind that when it comes to putting fresh money to work, I think there are better alternatives out there.

Also, please let me know in the comment section if you want more stocks to avoid.

(Dis)agree? Let me know in the comments!

Be the first to comment