Bilanol/iStock via Getty Images

The FTX saga has so many potential impacts on markets and investing writ large. Consider that the environmental, social, and corporate governance (ESG) movement was primarily based on seeking investments in firms that did not harm the environment. Then came an energy crisis in Europe, underscoring the importance and even need for energy independence. Russia’s invasion of Ukraine strained so many developed nations across the Euro Area, primarily Germany.

The good news is that a mild winter appears to be verifying across the pond, helping to ease the financial burden and potential human catastrophe that was once feared. Lower oil prices also help. I assert that demand and investor interest in going green at all costs could be a relic of the past.

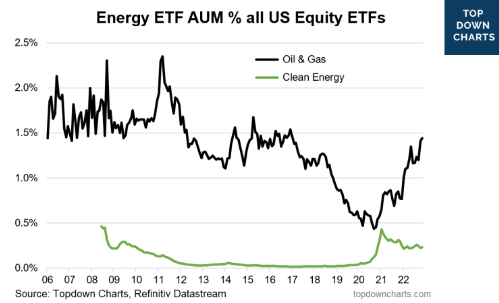

One fund that was very popular over the last few years as clean energy took off versus oil & gas is KRBN. Recently, though, oil and gas assets under management have regained the upper hand on clean energy, according to Top Down Charts.

Oil & Gas AUM Up, Clean Energy AUM Down

Top Down Charts

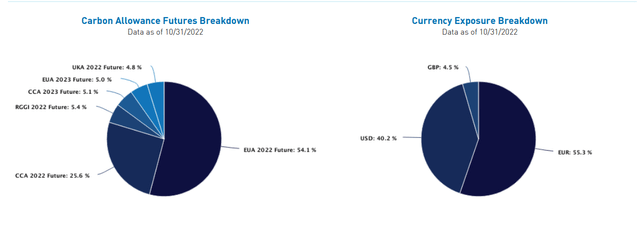

According to KraneShares, The Global Carbon Strategy ETF (NYSEARCA:KRBN) is benchmarked to IHS Markit’s Global Carbon Index, which offers broad coverage of cap-and-trade carbon allowances by tracking the most traded carbon credit futures contracts.

Currently, the index covers the major European and North American cap-and-trade programs: European Union Allowances (EUA), California Carbon Allowances (CCA), the Regional Greenhouse Gas Initiative (RGGI), and United Kingdom Allowances (UKA).

KRBN Portfolio Composition

KRBN features a total annual fund operating expense ratio of 0.78% and has $766 million in net assets as of October 31, 2022. At a high level, buying carbon allowances effectively makes it more expensive for companies to emit dangerous carbon into the atmosphere. Buying KRBN is also thought to result in incentivizing pollution reduction efforts around the world.

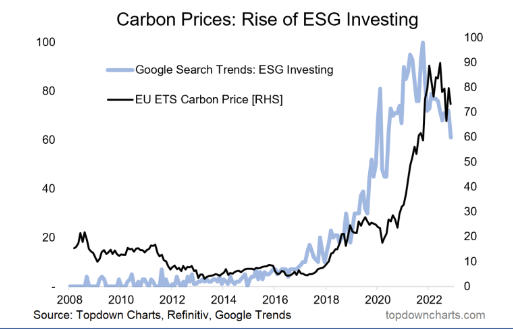

I assert, though, that less interest today in the “E” of the ESG trend, first driven by major risks seen in Europe and then exacerbated by the lack of corporate governance at FTX, might cool interest in a product like KRBN. I could be off base on that take – maybe the current wane in KRBN interest and de-emphasis of renewable energy is more of a byproduct of temporarily higher interest rates and a brief rebound in “old” oil and gas energy. According to Top Down Charts, ESG search trends are well off the highs.

ESG Investing Google Search Trends Down Big

Top Down Charts

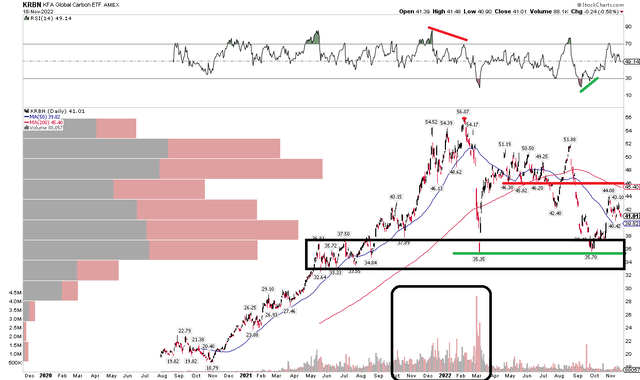

The Technical Take

But let’s get down to business and objectively assess price action in KRBN to get clues on where the ETF might go from here.

For starters, notice how volume has really dried up in the fund versus what was exhibited in the price run-up a year ago. A capitulation-like event then took place in early 2022 when European natural gas prices spiked above 200 euros/MWhr. Interests shifted from green (KRBN) to black (oil and gas). Shares then rebounded from a congestion zone in the mid-$30s to above $50 by late Q2 2022.

As fears of a difficult winter gripped energy traders, carbon allowances were cast aside in August and September – KRBN fell to support near $35 once again. I now see resistance around $46, which is also where the 50-day moving average comes into play. A drop below $35 would spell doom for KRBN holders, so it’s fine to hold it now, but even fundamental and environmental investors must respect price action.

KRBN: No Man’s Land Right Now. Watch $46 and $35. Volume Way Down YoY.

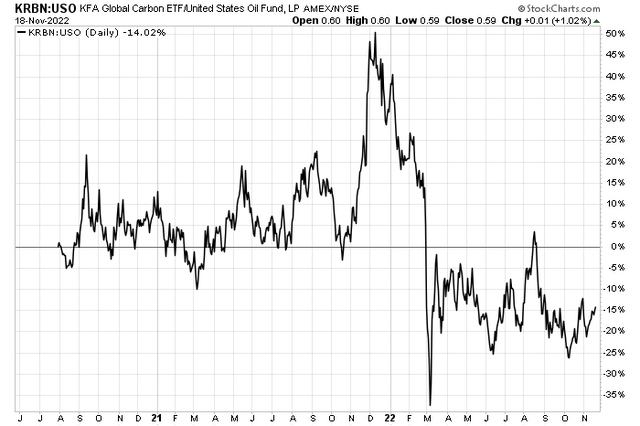

Relative to performance on the United States Oil Fund (USO), KRBN also finds itself mired in the lower end of its historical relative valuation. The chart below does not support a buy recommendation in KRBN, but the ETF is not in a protracted downtrend either.

KRBN vs USO: Lower End of the Historical Relative Relationship

The Bottom Line

Investor interest is waning in the carbon offset market. Volume is down, Google searches are lower, and corporate governance – the “G” – might be a bigger piece of ESG going forward. I think KRBN is still a hold here, but it is a sell under $35.

Be the first to comment