undefined

Harmonic Inc. (NASDAQ:HLIT) is a broadband and video software business. The two business segments are known as appliance and integration(broadband) first, and the second being SAAS and service(video). The first segment is around 73% of revenue with the rest going to video.

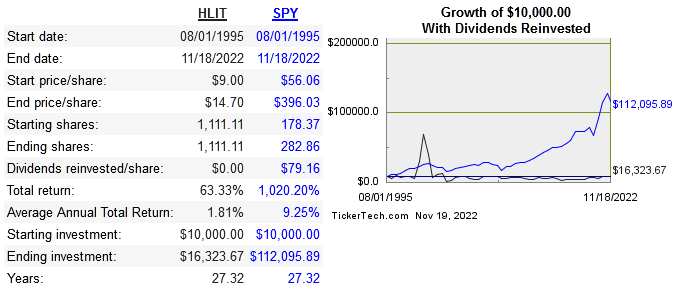

They were founded in 1988 followed by an IPO in 1995 with shares performing very poorly over the long run. Below is the share price performance:

dividend channel

Below are the return on capital metrics:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

HLIT |

0.3% |

-6.9% |

-4.9% |

4.1% |

n/a |

|

-2.4% |

4.3% |

4% |

n/a |

n/a |

|

|

8.3* |

59.3% |

13.7% |

n/a |

-57.7% |

|

|

10.4% |

1.1% |

0.3% |

n/a |

n/a |

*8 year

Capital Allocation

Long term debt is at reasonable levels. It currently sits at $138 million with $105.2 million in cash. Share count peaked in 2012 and was reduced every year until 2017. Since then shares have been diluted every year. They’ve never paid a dividend and have made less than 10 acquisitions so far. I wouldn’t expect many more acquisitions or to share count to be meaningfully reduced.

Risk

Gross margins have averaged about 50% over the long run, but operating and net margins have been very inconsistent. It’s hard to know what the mean operating margins should even be because there have been so many years where it was negative.

There is growth potential in both segments and the SAAS side is expected to grow faster. Free cash flow has been positive for the past five years(ttm free cash is negative however). The issue is whether recent growth can continue and continue profitably. The next issue is whether today’s price is too high for that growth.

Valuation

Share prices are up over 2x since the covid lows in 2020, and they have been consistently beating estimates. Unlike many other tech stocks, HLIT is hitting new highs this year instead of crashing from last year’s peak.

Below is a comp of the price multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

HLIT |

2.5 |

26.7 |

-96.2 |

5.2 |

n/a |

|

ADTN |

1.9 |

181.3 |

-18.8 |

1.4 |

1.7% |

|

CASA |

1.1 |

-7.1 |

12.9 |

6.2 |

n/a |

|

COMM |

1.2 |

10.7 |

-36.3 |

3.5 |

n/a |

The sales and book value multiples are too high for the expected growth in the future. These multiples are much higher than the business deserves.

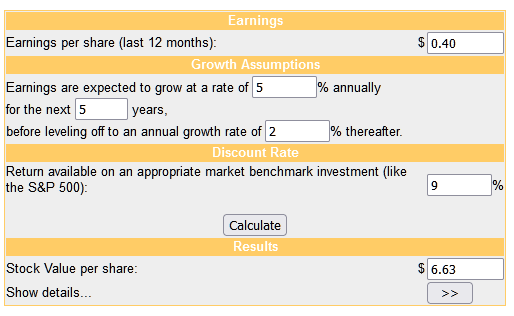

Below is the DCF model using 2021 EPS and what I feel is a generous EPS estimate:

money chimp

Overall I think the growth story is interesting, but I’m not ready to participate at this price. It will be worth observing and waiting for a multiple contraction.

Conclusion

The stock has been a terrible investment in the very long run, but the recent growth story is a positive right now. Many stocks are still down far below the 2021 market peak, but HLIT has done the opposite and it is hitting new highs. In spite of this, the company is too overvalued for the potential growth. I do think it’s worth keeping on a watch list to see if margins stabilize and growth continues profitably.

Be the first to comment