M. Suhail

The investing environment has changed dramatically in the last year and a half. At the beginning of 2021 rates were low, inflation wasn’t a big concern, and the fundamentals of the US economy remained strong. Median income, unemployment data, and consumer spending were all at impressive levels just 2 years ago.

Today the economic situation is very different. The housing market is showing signs of slowing, inflation continues to weigh on businesses and consumers alike, and the Fed has made clear that rates will likely continue to rise for some time.

Home Depot (NYSE:HD) is in the center of a slowing housing market, and rising rates are likely to continue to significantly slow this industry as well as new construction demand over at least the next year. Inflation continues to weigh on Home Depot’s earnings and margins as well.

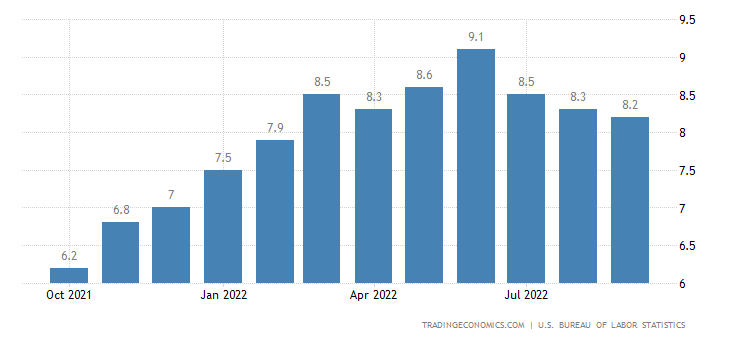

Inflation Data (US Bureau of Labor Statistics)

Even though the overall rate of inflation has slowed since the middle of this year, prices continue to rise at a very high rate. Costs have been going up consistently since March 2021, and inflation remains the most significant challenge that the US economy faces right now.

Home Depot’s recent earnings were decent, but there were some warning signs as well. The company reported a net profit of $5.2 billion and $5.05 in earnings per share. Revenue rose 6.5% from last year and nationwide sales rose 5.8% year-over-year. The average sales ticket was up 9% or a little over $90. Management reiterated full-year guidance.

Despite reporting some strong numbers, Home Depot’s report contained several significant concerns. First, the number of transactions dropped noticeably on a year-to-year basis. The overall number of sales fell by 3% on a year-to-year basis. Rising ticket prices offset falling sales, but pricing power only goes so far long-term, and Home Depot obviously likely isn’t going to be able to continue to increase prices at the same rate the company recently has. Home Depot’s net margins have held up very well even during this inflationary period, and the company recently reported net margins of 10.88%, which is a 10-year high for the company.

Home Depot has benefited from three main trends over the last several years. A strong housing market, impressive demand for do-it-yourself construction projects as more people buy homes as well as work from home, and low rates. With the overall economy showing significant signs of slowing now, people beginning to return to work in higher numbers, and rates continuing to rise, this company faces a number of significant headwinds. Home Depot also benefitted significantly from pent-up demand, as many people waited until after the pandemic to purchase and remodel homes, and the company’s falling overall transactions show that trend is slowing as well.

Still, there are also clear signs that the overall economy and the housing market are slowing. First, housing listings are now rising for the first time since 2019, and Realtor.com saw a 13% increase in new homes being listed in just in May. Demand for refinancing with rates up was also down 70% year-over-year, price cuts have been seen in over 10% of homes listed over the summer, and mortgage applications were down 16% year-over-year as well. A recent Fannie Mae survey also showed 79% of people think now is not a good time to buy a new house. There are also other signs of a broader slowdown in the US economy. New home construction starts were down 9.6% over the summer, and homebuilder confidence turned negative in August. The personal savings rate is also now at just 3.5%, down significantly from the 9.5% pre-covid rate in 2019. Jobless claims have risen to 8-month highs, and the number of small businesses defaulting on leases has reached alarming levels, with nearly 35% of small businesses having issues paying their rent.

Home Depot’s stock is also still not cheap using a number of metrics. The company trades at 16.83x forward earnings, 2x forward sales, and 14.42x forward cash low. This is a significant premium to the sector average for the residential construction industry, which is 12.82x forward earnings, 1.05x forward sales, and 9.75x forward cash flow. Home Depot has obviously outperformed peers such as Lowe’s (LOW), but the company’s stock is not cheap. Management recently reported a mid-single-digit growth rate of 6.5%, and if a slowing economy and continued inflation cause the company’s profits to slow, the stock is likely to trade at 13-14x forward earnings.

Home Depot benefitted from a number of economic and financial trends over the last several years, as well as more people working longer hours from home. Today the company is operating in a very different and more challenging environment. Rates are rising, people are increasingly returning to work, and the overall economy as well as the housing market continues to slow. Home Depot faces significantly more headwinds than tailwinds today.

Be the first to comment