Denis Doyle/Getty Images News

Overview

The Invesco Aerospace & Defense ETF (NYSEARCA:PPA) (“the fund”) provides exposure to a broad range of established companies involved in the development and manufacturing of US defense and aerospace operations.

The fund is invested in 56 stocks with at least 90% of its total assets in common stocks that comprise the SPADE™ Defense Index.

The fund has a total expense ratio of 0.58% per annum (4th cheapest among similar ETFs). SPDR and iShares provide similar ETFs in the Aerospace and Defense sector with lower expense ratios.

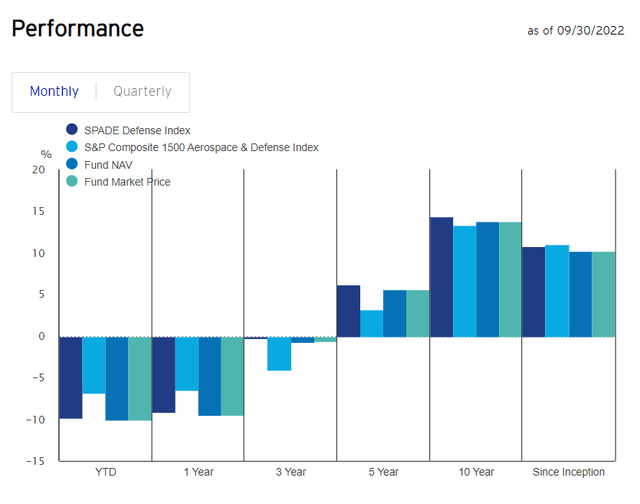

Performance

The fund has been able to track its index relatively closely, however it has not been able to outperform the SPADE Defense Index.

The fund’s NAV has grown approximately 10.17% per annum since its inception compared with the Index at 10.84% per annum.

Invesco

Portfolio

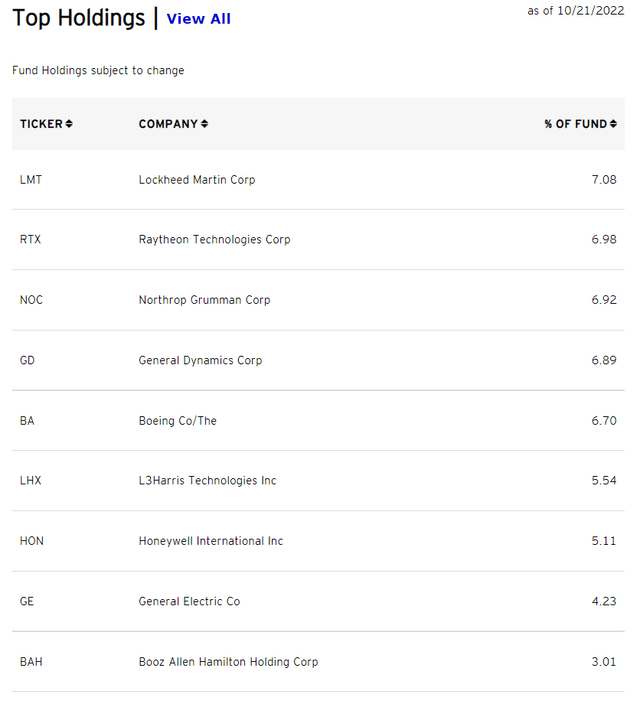

The fund provides exposure to an interesting segment of the industrial industry, the aerospace and defense sector.

Companies in this sector tend to be rather large, slow growing, but remarkably stable due to the widespread use of long-term government contracts for most of their services.

The fund’s largest holding is Lockheed Martin Corp. (LMT) which is the world’s largest defense contractor by revenue. It consistently tops the list of top 100 contractors of the U.S. federal government.

The U.S. Department of Defense had a 12.4% share of the U.S. federal budget in 2021, equivalent to $1.51 trillion (about $4,600 per person in the US) in available funding.

Lockheed Martin Corp. was a prime contractor for the U.S. government and received 10.3% of the total funding available.

Defense & Security Monitor

Boeing Co. (BA) and Raytheon Technologies (RTX) have also been beneficiaries of government spending, each earning 5%+ of the available funding.

All three companies are part of the top 5 holdings for the fund which can be seen below.

Invesco

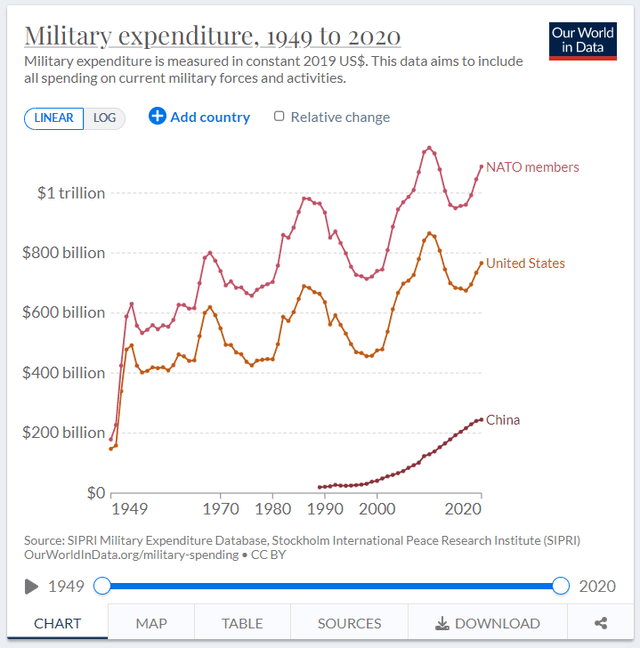

Government Military Expenditure between 1949 and 2020

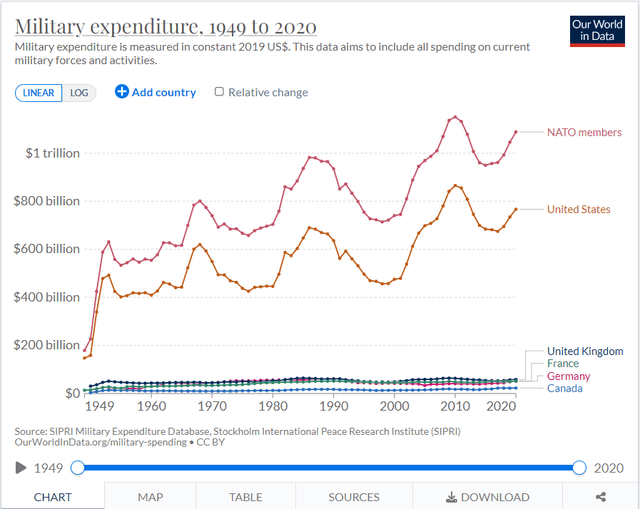

NATO members are the key clientele for the PPA fund holdings. The United States has the highest military expenditure among NATO members alongside Europe and Canada.

In 2021, US defense expenditure was estimated to be around $726 billion with Europe and Canada spending around $323 billion combined.

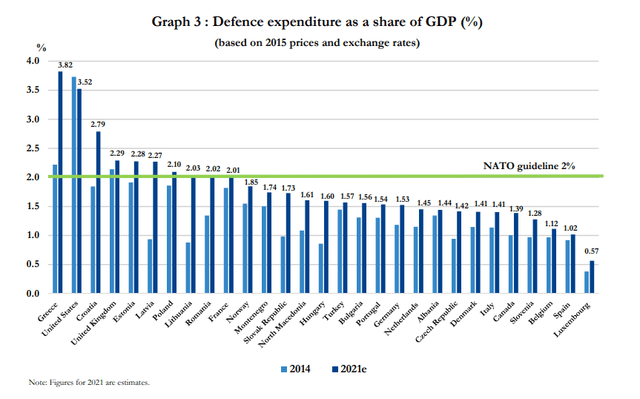

Defense expenditure by NATO members has been gradually increasing since 2017 however many NATO members are still spending less than the 2% NATO guideline on defense expenditure.

NATO guides towards a 2% defense expenditure as a share of GDP but many large economies such as Germany and Canada do not meet the 2% guideline – see below:

NATO

There is a lot of room for additional defense expenditure by NATO members which can be beneficial for the fund.

Military expenditure by NATO members has increased in a cyclical manner from 1949 to 2020 largely driven by the United States – see chart below.

Our World in Data

Multiple catalysts

There are multiple catalysts which will support increased military expenditure by NATO members. The first catalyst is the Russia-Ukraine war.

I believe that the risk of war was forgotten and neglected by many European governments. Now that Putin has brought war back to Europe, there is more political goodwill to increase military expenditure in NATO countries.

The second catalyst is China. The United States has enjoyed its status as the world’s sole superpower since the end of the Cold War.

Now there is a changing world order where China is trying to exert more influence on the global stage and become a superpower itself.

NATO members will have to continue outspend China on military expenditure to contain its influence and diplomatic power.

Our World in Data

The last catalyst I want to talk about is climate change. Climate change has caused countries in the Middle East and Africa to suffer from extreme drought.

Agricultural land is turning to desert and heat waves are killing crops and grazing animals. The lack of economic stability has made the region prone for conflict which is leading to the displacement of millions of people fleeing to Europe.

A high level of uncontrollable migration is a serious risk for Europe as it can destabilize the region politically and economically.

European governments will have to increase military expenditure to control immigration and police their borders.

Conclusion

The fund invests in large, slow growing, but remarkably stable companies due to the widespread use of long-term government contracts for military expenditure.

There are multiple long-term catalysts supporting an increase in military expenditure by NATO countries which suggests there is further upside in the Invesco Aerospace & Defense ETF.

If you enjoyed the article, please like it and subscribe to receive more articles!

Be the first to comment