Annabelle Chih

Thesis

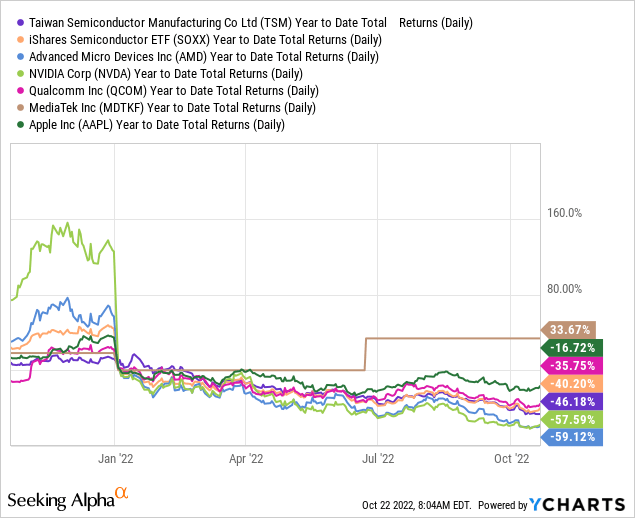

TSMC’s (NYSE:TSM) Q3 release didn’t lift buying sentiments, even though TSM had been battered in 2022. It posted a YTD total return of -46.18%, below the Semiconductor ETF’s (SOXX) -40.2% performance.

As we explained in our pre-earnings article, we expected near-term downside volatility to continue. Therefore, it seems the market remains tentative over a material re-rating on TSMC, given the inventory digestion in its end customers. Furthermore, we believe weak export data released recently by South Korea and Taiwan pointed to a worsening global economy as investors parsed the impact on TSMC’s forward performance.

Our analysis suggests that TSMC last traded at a significant discount against its historical averages and also its peers. Given its massive CapEx expansion over the past two years, we believe the de-rating is justified, as the market needs to factor in further execution risks.

Management highlighted it’s confident that it could post revenue growth in 2023, while the semi industry is expected to post negative growth. Furthermore, it stressed that the inventory digestion should reach its nadir in H1’23 before staging a second-half recovery.

Notwithstanding, TSMC’s visibility is derived from what its customers are expecting. And its customers’ track record in their forecasts for 2022 has been quite disappointing. Moreover, except for Apple (AAPL), which has executed relatively well, AMD (AMD) and NVIDIA (NVDA) have lost significant credibility with investors, given their markedly lower revisions to guidance.

Qualcomm (QCOM) and MediaTek (OTCPK:MDTKF) have also faced challenges in their smartphone segment as growth in China slows further.

Therefore, we believe the market needs to reflect the risks of TSMC’s operating deleverage given its high CapEx requirements, which could markedly impact its operating profit performance in 2023.

Nevertheless, our analysis indicates that the battering in TSMC has created attractive entry levels for investors with a long-term focus. We expect the market to continue demonstrating volatility over the next few months as it draws in bearish investors/traders while forcing more weak TSMC holders to capitulate.

Hence, investors are urged to continue using a dollar-cost averaging approach to reduce their allocation/timing risks.

Accordingly, we reiterate our Buy rating on TSM.

TSMC’s Massive Growth In 2022 Is Set To End

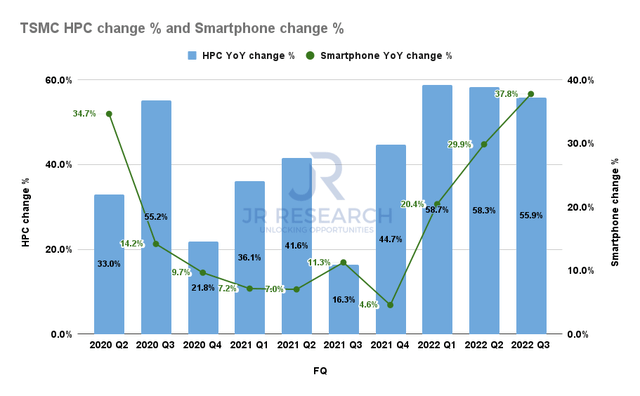

TSMC HPC revenue change % and Smartphone revenue change % (Company filings)

TSMC posted another solid quarter, as revenue increased by 47.9% YoY in Q3. The growth was broad-based, with its two critical segments, High-performance Computing (HPC) and Smartphone demonstrating robust growth.

As seen above, HPC posted revenue growth of 55.9%, while Smartphone delivered a revenue increase of 37.9%. However, investors are reminded that the market is forward-looking. Management was also reticent in issuing 2023 guidance, as it’s usually done in Q4. However, management highlighted that it expects 2023 to be a “growth year.” TSMC CEO C.C. Wei accentuated:

The ongoing inventory correction will also affect TSMC. [But,] we expect our business to be less volatile and more resilient than the overall semiconductor industry during this period. Looking ahead to 2023, with the successful ramp-up of N5, N4P, N4X, and the upcoming ramp of N3E, we’ll continue to expand our customer product portfolio and increase our addressable market. Thus, while the ongoing semiconductor inventory correction will affect our first half 2023 utilization rate, we expect our business to be supported by stronger demand for our differentiated and leading advanced and specialty technologies, and for 2023 to be a growth year for TSMC. (TSMC FQ3’22 earnings call)

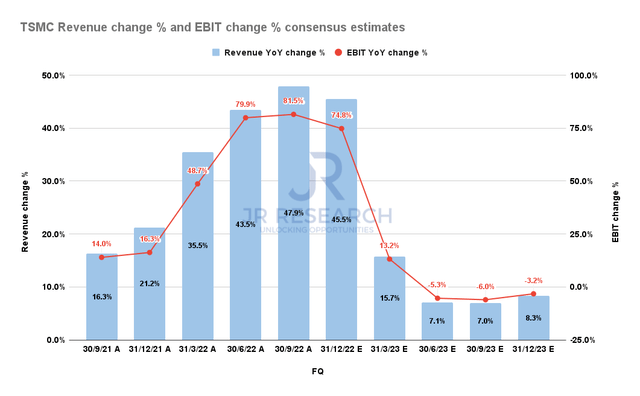

TSMC Revenue change % and EBIT change % consensus estimates (S&P Cap IQ)

So, it’s pretty clear that management expects its revenue growth to slow markedly in 2023. However, the consensus estimates (bullish) suggest TSMC is still expected to post high single-digit revenue growth through FY23.

Accordingly, TSMC is projected to deliver revenue growth of 8.1% for FY23, even though the semi industry is expected to post 0% growth (according to the revised Refinitiv data). Hence, semi industry analysts could still be overly optimistic in their forecasts, as TSMC highlighted that “in 2023, still a growth year for TSMC [but] the overall industry probably will decline.”

Therefore, we believe the market’s current positioning indicates that it thinks the Street analysts might need to revise their forward estimates downward for TSMC.

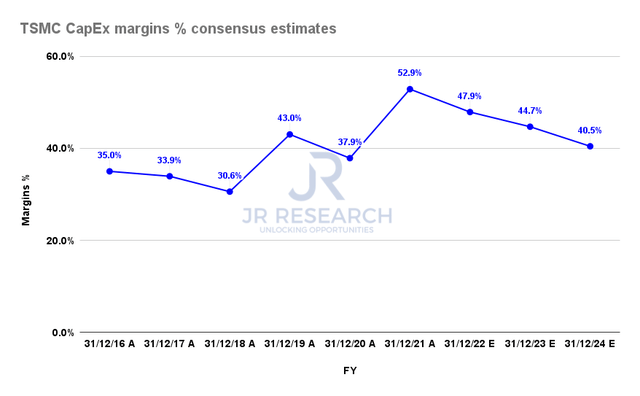

TSMC CapEx margins % consensus estimates (S&P Cap IQ)

Also, we gleaned that TSMC’s CapEx margins are still expected to be above its long-run guidance of “mid-to-high 30s.” Hence, TSMC could still undergo an extended digestion phase that the Street analysts may not have reflected accordingly.

TSMC’s Valuations Have Been Battered

With this in mind, we aren’t surprised that TSMC has underperformed most of its most important customers and the SOXX YTD in 2022. Besides the two main “culprits,” AMD and NVIDIA, which revised their guidance markedly, TSMC’s underperformance is quite stunning.

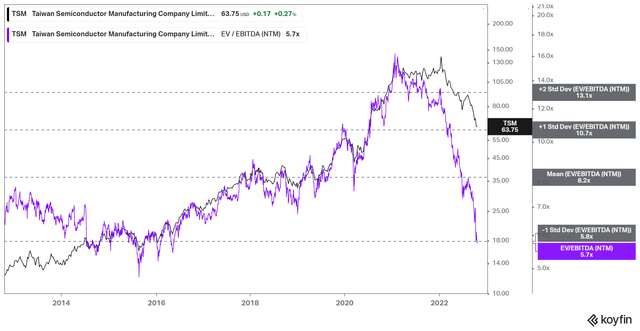

TSM NTM EBITDA multiples valuation trend (koyfin)

However, it’s hard not to get excited knowing TSM’s EBITDA multiples have collapsed to the two standard deviation zone under its 10Y mean. Hence, we postulate that the market has inflicted significant damage in its valuations, possibly expecting more downside risks to the current consensus estimates.

As such, TSM’s NTM EBITDA multiple of 5.7x is also well below its semi peers’ median multiple of 7.8x (according to S&P Cap IQ data). In addition, its NTM normalized P/E of 10.7x is markedly below the semi industry forward P/E of 14x and below its SOXX peers’ forward P/E of 12.9x.

Therefore, we view TSM’s valuation constructively at these levels and believe the reward-to-risk profile has improved tremendously.

Is TSM Stock A Buy, Sell, Or Hold?

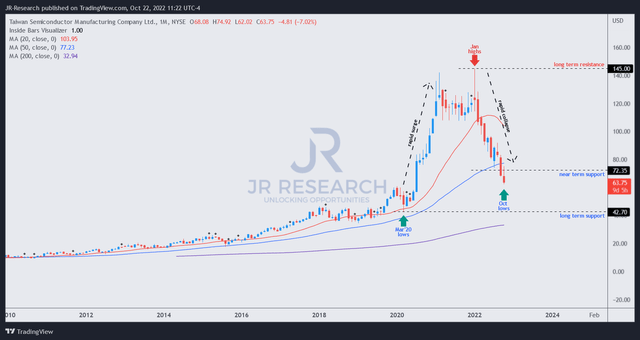

TSM price chart (weekly) (TradingView)

Despite its nearly 60% collapse from its January 2022 highs, TSM remains in a long-term uptrend.

But, the market was ruthless in the digestion of its rapid surge from its March 2020 COVID lows, as it digested its gains all the way back to levels last seen in July 2020.

Therefore, the rapid selloff from its January bull trap highs has likely impacted the conviction of weak hands who bought near those levels, throwing in the towel on the way down.

The downside break of its June lows was also critical, as buyers who applied stop losses close to its 50-month moving average have likely been taken out. However, the extent of its selldown is emblematic of a move to force weak holders to give up. Despite that, we still need a validated bullish reversal to form on its long-term chart over the next two to three months, which is critical to maintaining its long-term bullish bias.

Given its attractive valuation and highly pessimistic sentiments, we are confident of the reward-to-risk profile of its current levels. As such, we reiterate our Buy rating on TSM.

Be the first to comment