Kirk Fisher/iStock Editorial via Getty Images

Agree Realty (NYSE:ADC) remains one of the highest quality REITs I have ever come across. The fact that it is a net lease REIT already helps in that regard, but management deserves most of the credit as it has both intentionally focused on investment grade tenants as well as kept leverage well-below peers. ADC has sustained a material premium to peers, but that premium is much-deserved as ADC offers lower risk and may even be able to sustain rapid growth on account of the lower cost of capital. While ADC is unlikely to deliver huge returns from here, it remains buyable for those looking for a flight-to-safety pick that offers some yield.

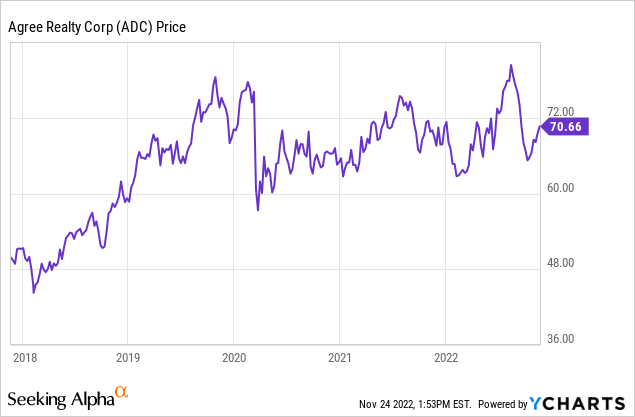

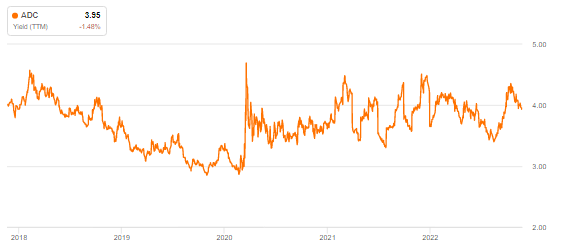

ADC Stock Price

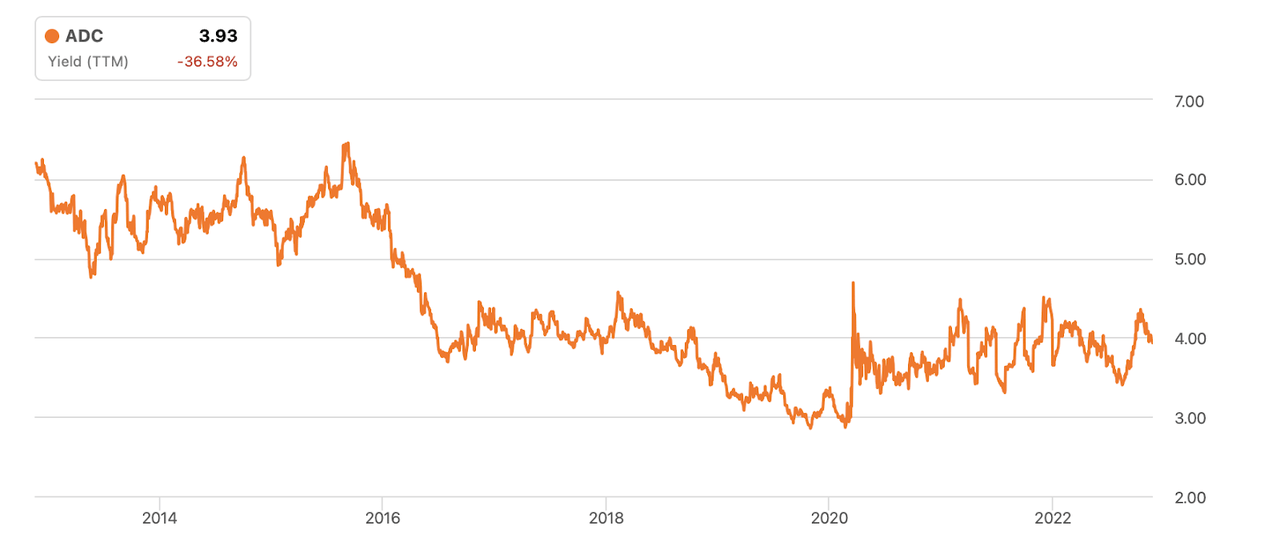

ADC is not trading far from 52-week highs, but valuations have compressed over the past few years.

I last covered the stock in April where I rated it one of the few buyable opportunities in the REIT sector. Since then, ADC has delivered 3% positive returns as compared to the 8% decline in the S&P 500 and I note that Realty Income (O) has declined 12% over that same time frame. Even after that outperformance, ADC is still quite interesting here due to its unique lower risk characteristics.

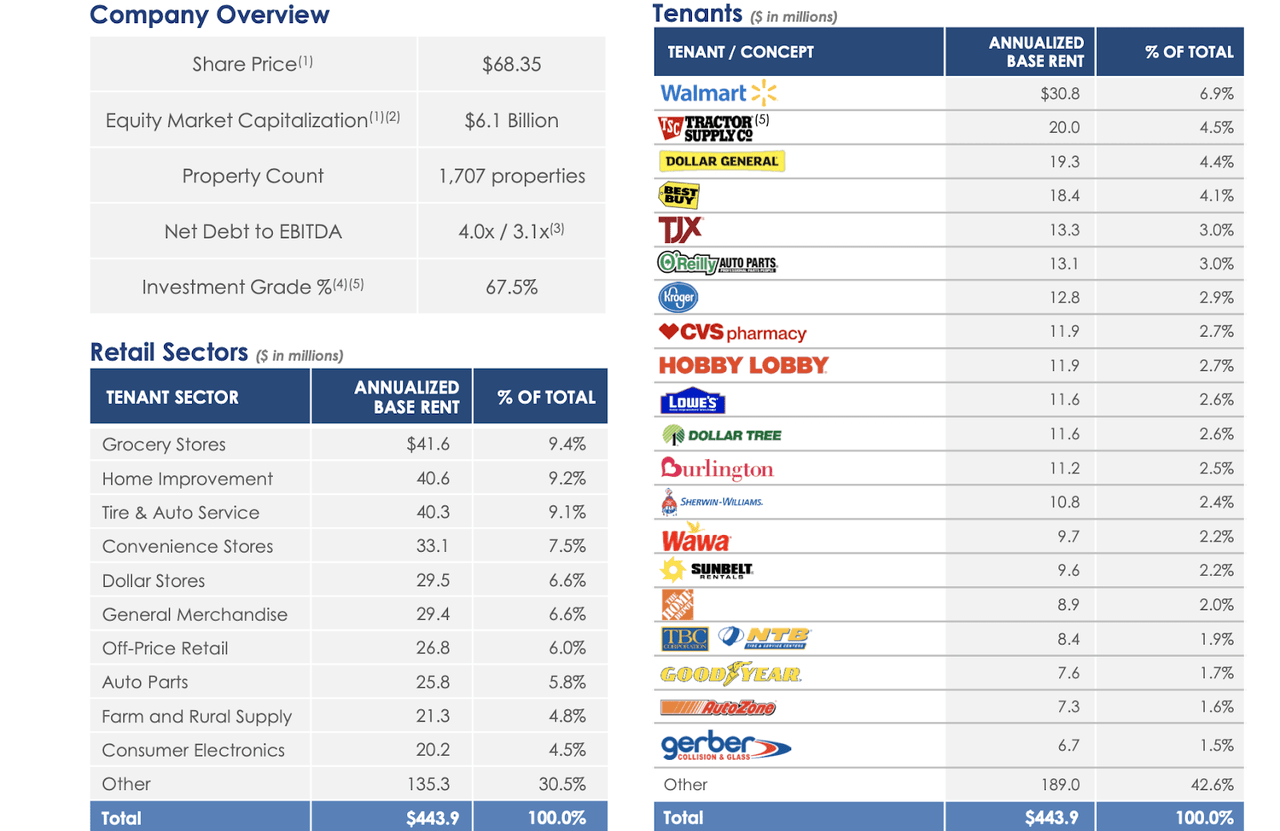

ADC Stock Key Metrics

ADC is a net lease REIT which may have less of a fan following than O. That is a shame, but it is understandable considering that ADC perennially trades at a lower dividend yield.

November Presentation

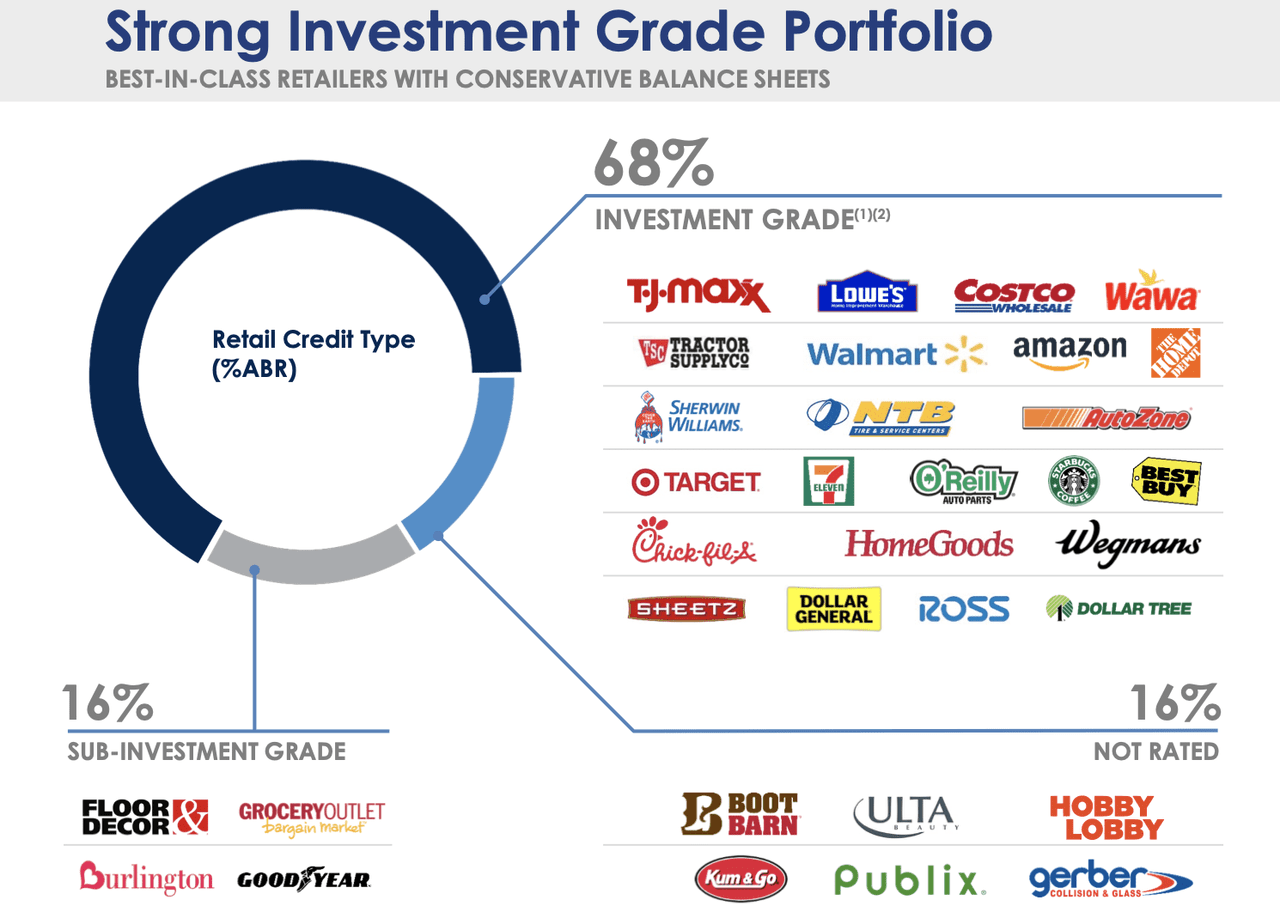

ADC has shown an increased focus on investment grade tenants, with 68% of its tenant roster having an investment-grade rating.

November Presentation

One could make an argument that investment-grade tenants may be overrated considering that the vast majority of NNN REITs performed very strongly amidst the pandemic, but a high investment-grade tenant roster will undoubtedly always lend itself to lower perceived risk.

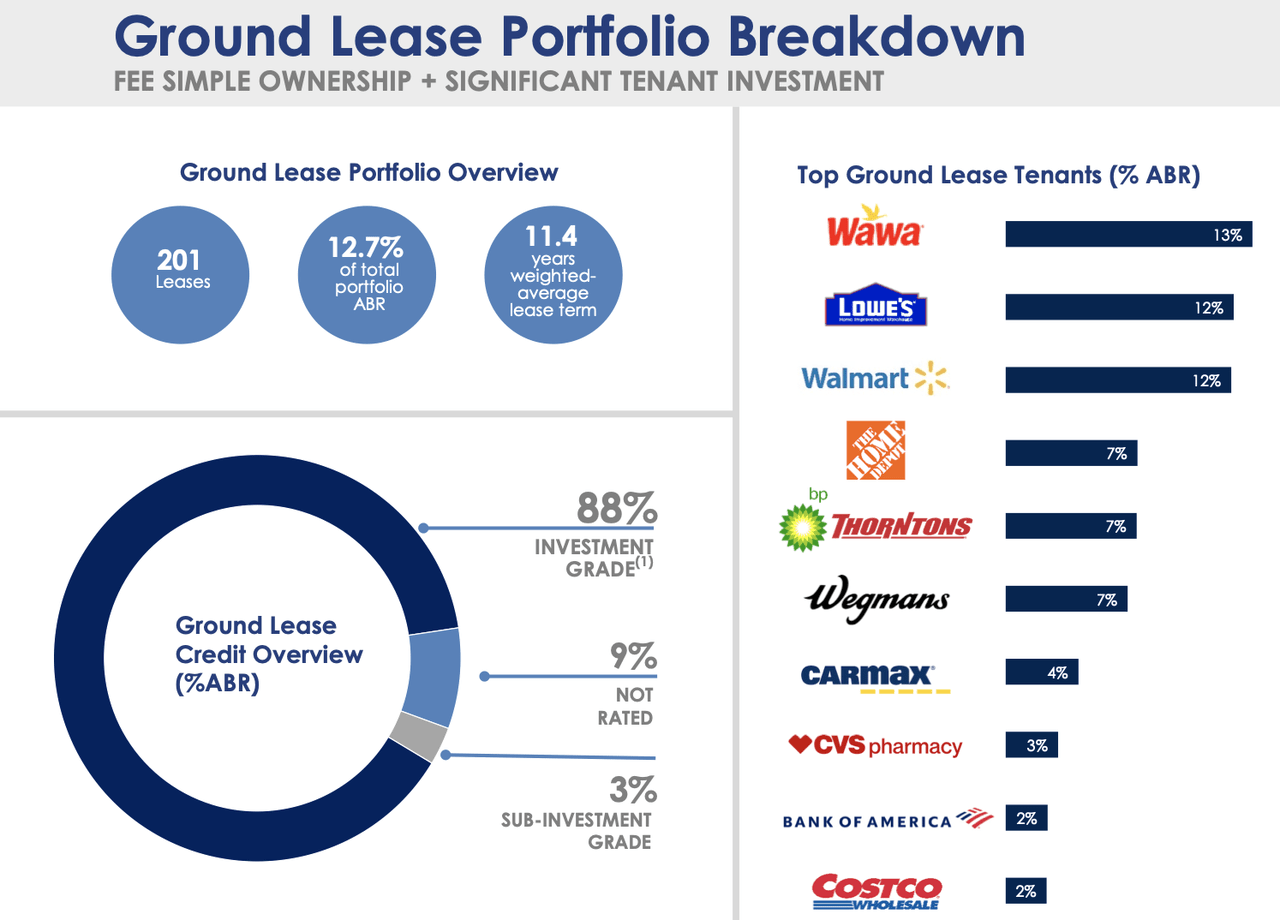

ADC has also been growing its ground lease business with 12.7% of its portfolio coming from that segment. Ground leases offer a potentially lower risk alternative to traditional net leases, though as discussed above net leases are arguably already low risk to begin with.

November Presentation

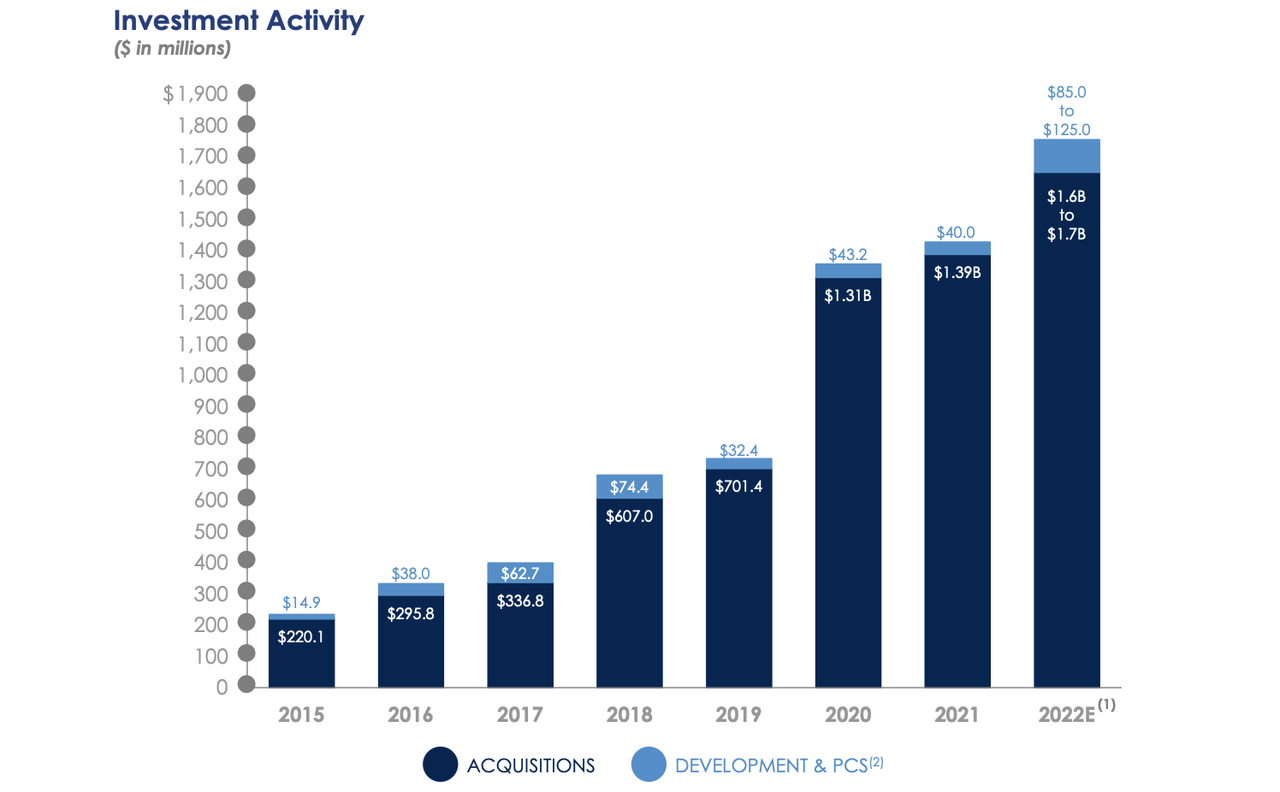

ADC has accelerated its investment pipeline over the past several years and is projecting up to $1.73 billion in acquisitions this year (for reference, the market cap recently stood at $6.2 billion).

November Presentation

It is no coincidence that ADC has seen its dividend yield dip considerably since 2015 – management has taken full advantage of the lower cost of capital to accelerate growth ambitions.

Seeking Alpha

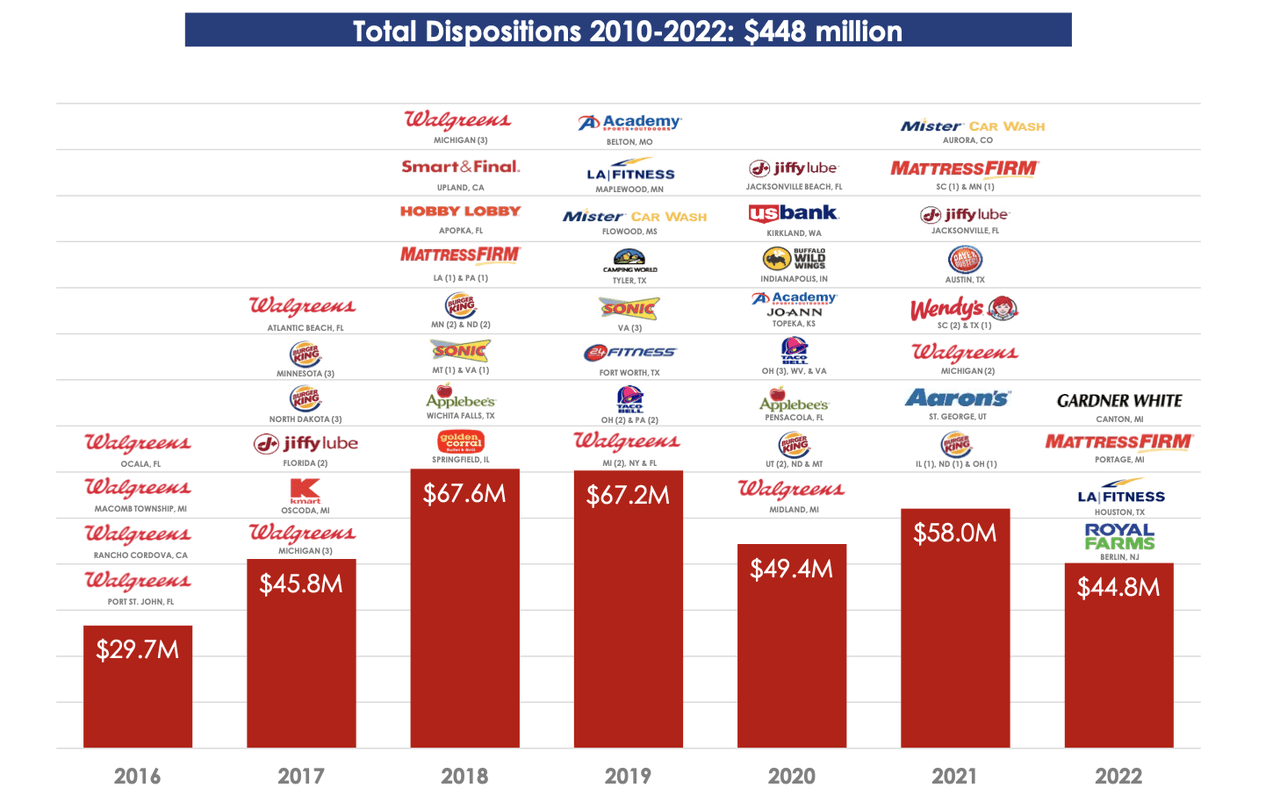

The high investment grade tenant exposure is the easiest way to determine credit quality. But an underrated metric in my view is that of dispositions. ADC has historically seen disposition activity represent a low single-digit percentage of investment activity. Mid-tier NNN REITs may see dispositions total 10% to 20% of investment activity annually – the low amount of dispositions at ADC are proof of the strong credit underwriting.

November Presentation

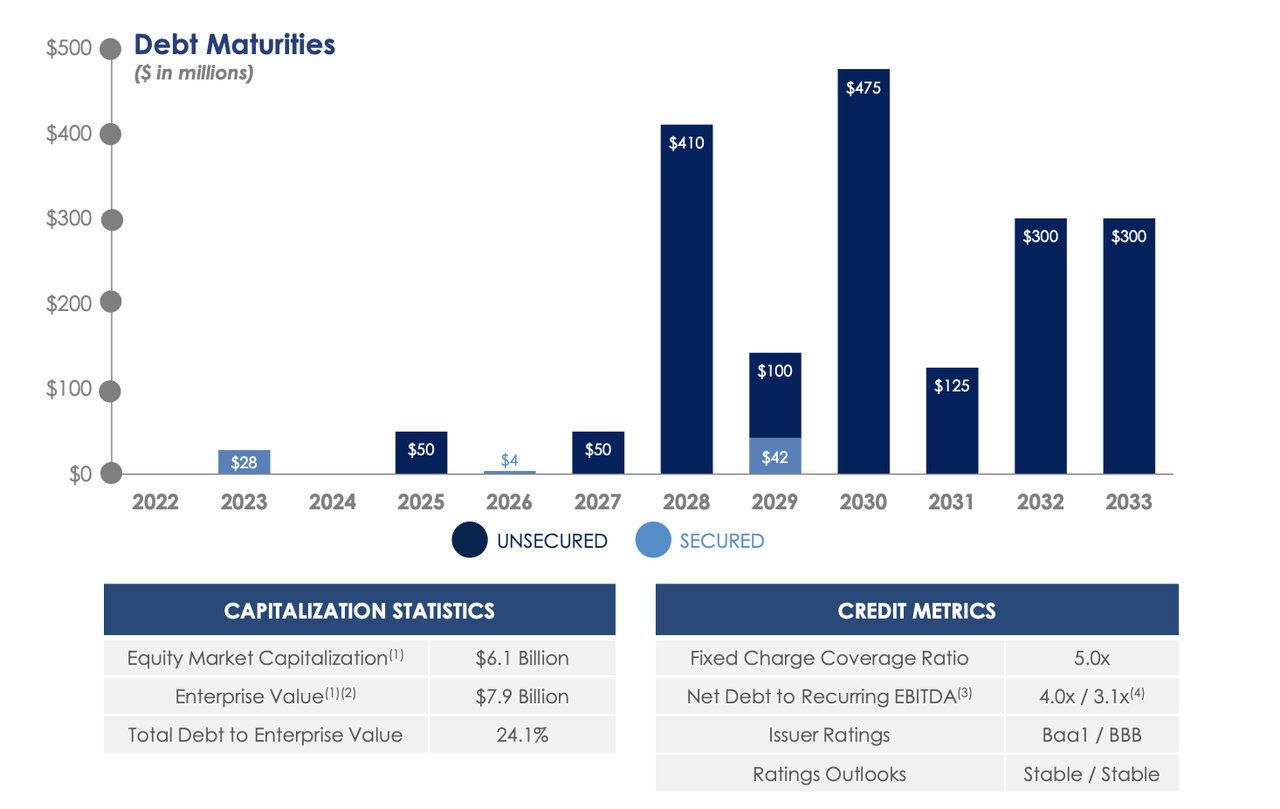

ADC maintains a low leverage ratio of 4x debt to EBITDA and has minimal debt maturities over the coming years. This means that the rising interest rate environment may impact ADC less than peers needing to refinance debt at higher rates.

November Presentation

On the conference call, management acknowledged that they have often been criticized for maintaining a lower leverage ratio. In fairness, one could argue that NNN REITs can support a higher leverage ratio and thus ADC may be leaving money on the table. But on the flipside, the lower leverage ratio appears to have helped ADC command some valuation premium, reducing its cost of capital and potentially enabling it to sustain faster growth rates than peers. Management has even forced itself to maintain lower leverage ratios by consistently entering forward equity transactions to ensure that they are always bringing in equity capital.

That commitment to conservatism has paid off, as ADC continues to grow rapidly. Adjusted funds from operations (‘AFFO’) grew 7.8% to $0.96 per share in the latest quarter.

Amidst the rising interest rate environment, cap rates have not expanded materially and management has shown an unwillingness to reach for yield. That is good long term for shareholders, but management acknowledges that investors probably should not be expecting NNN REITs to grow in the upper single digits or double digits over the next year.

Is ADC Stock A Buy, Sell, or Hold?

At recent prices, ADC traded hands at 18x FFO and a 4.1% dividend yield. That yield is at the high end of where the stock has traded over the past 5 years.

Seeking Alpha

It is worth noting that even amidst the pandemic crash when many other NNN REITs saw their dividend yield soar into the double-digits, ADC still traded below a 5% dividend yield. It is clear that the stock has great institutional support – the company has succeeded in earning the trust of investors. I expect most peers to see growth decelerate meaningfully because of rising cost of capital. Management hasn’t showed a willingness to drive up leverage, but with its stock still trading at a notable premium to peers, I expect the company to continue growing AFFO at a 4% to 5% clip moving forward. For a very low risk 4.1% yield, that kind of growth rate is nothing short of stellar. I expect ADC to re-rate to a 3.5% yield or lower over time, representing 17% potential upside from multiple expansion alone.

What are the key risks here? Because ADC trades at a premium to peers, the main risk that investors must consider is that of deteriorating sentiment. If ADC suddenly encounters troubled tenants, then I wouldn’t be surprised if the stock sold off rapidly as it would imply a breaking in the thesis. Realty Income trades at around 16x AFFO, implying that ADC could fall double-digits just to trade in-line with O. I find such an event to be quite unlikely due to the strong track record, high investment grade exposure, and low leverage profile, but stranger things have happened. Another risk is that sentiment can change rapidly. Just because ADC has sustained a premium thus far, does not mean that it will continue moving forward. Simple math suggests that no matter how high quality ADC is, the stock is still offering just around double-digit forward returns from here. It is possible that investors sell off the stock to pursue alternatives with greater return potential. That said, I still find this unlikely as ADC has proven itself to be one of the lowest risk REITs, one truly deserving to be considered a bond-replacement substitute. Who might like ADC? In spite of the premium, I expect ADC to keep up with more discounted peers due to the elevated growth rate. Moreover, I expect the stock to continue offering lower volatility amidst choppy markets. Those seeking a combination of safety and yield may find ADC highly attractive here – I reiterate my buy rating.

Be the first to comment