JamesBrey

SLR Investment’s (NASDAQ:SLRC) diversified investment portfolio with high yields and robust income growth trends will likely boost its earnings in the following quarters and help bring down its payout ratio below 100%. Moreover, there is significant upside potential for SLR’s stock price in 2023, which currently appears significantly undervalued based on valuations and fundamental factors. Therefore, it’s the perfect time for new and existing investors to capitalize on the buying opportunity for hefty gains in the future.

Lofty Dividends are Completely Safe

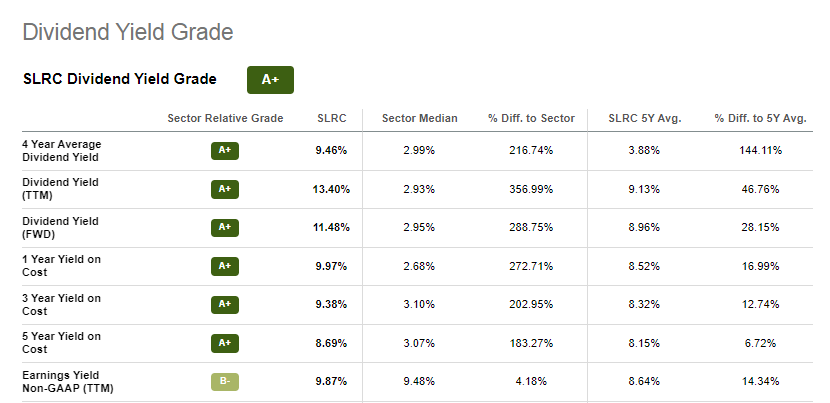

Dividend Yield Scorecard (Seeking Alpha)

It is no secret that SLR Investment has the potential to maintain a high dividend yield despite having to pay more cash in dividends than its earnings. In particular, this trend began in 2020 and continued through September 2022. Nevertheless, this trend is likely to change in the near future as the company now appears in a position to offer complete coverage to its dividend payments. The company’s robust income growth potential is likely to help its fourth-quarter earnings per share exceed the $0.40 level for the first time in two years. In an earnings call, SLR Investment’s co-CEO Bruce Spohler also hinted that the company is likely to cover its dividend well before recent expectations. For 2023, Wall Street is expecting earnings of $0.42 per share in each quarter, with high estimates hovering around $0.48 per share. With this scenario, the dividend will not only be fully covered by earnings but there is also room for further dividend increases because the payout ratio will fall below 100%.

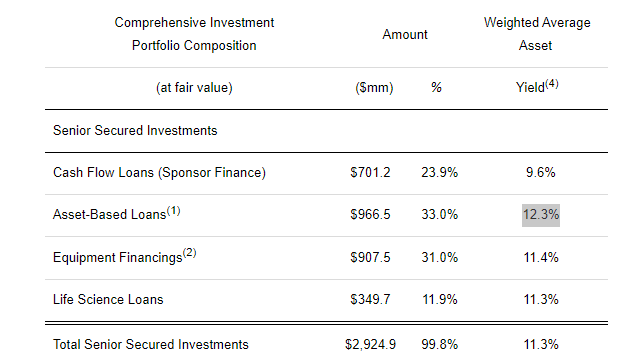

Its conservative investment strategy, diversified portfolio, and increasing portfolio investment yields make me confident that the dividend will be increased in 2023. Its $2.9 billion investment portfolio was spread across over 780 businesses in more than 100 industries at the end of September. In addition to diversification, senior secured loans comprise 99.8% of the portfolio, which lowers the risk of losing the invested amount because liens against borrower assets provide additional credit risk protection. A weighted average portfolio yield of 11.3% was achieved by the company at the end of September 2022, up from 9.6% in the second quarter.

Portfolio Composition (Q3 Earnings Release)

There is an increase in weighted average yields across all four asset classes in the company’s portfolio due to floating-rate loans. Asset-based loans had the highest yield, while equipment and life science loans also exceeded 11%. Cash flow loans, also called sponsor-financed loans, earned lower yields at the end of September than the rest of the asset classes. However, the yield on cash flow loans has also been improving over the past few quarters. The cash flow portfolio’s weighted average yield increased to 9.6% in the third quarter from just over 8% in the second quarter. In addition, EBITDA for the cash flow portfolio rose to $113 million from $82 million at the beginning of the year.

The company’s robust investment income growth also supports the bullish thesis about its portfolio strength and potential earnings growth. The company reported a massive year-over-year increase of 47% in gross investment income for the third quarter, driven by recent investments, organic growth, and LIBOR and SOFR increases. The income growth trend is expected to continue in 2023 with around $221 million in investment income for the full year, a 25% increase from last year.

Upside Ahead for SLR Investment Stock

SLRC Price Change (Seeking Alpha)

A bearish broader market environment has weighed heavily on shares of SLR Investment so far in 2022. However, after hitting a 52-week low of around $12 last month, its stock price has started to recover. Strong third-quarter financial results and an improvement in broader market trends contributed to investors’ optimism. Despite recent gains, SLR Investment’s stock is still down around 23% in 2022. Additionally, the stock looks like a bargain due to attractive valuations. Based on Seeking Alpha quant’s system, the stock earned an A-plus grade on valuations, which means it is in a buying zone. Particularly, a trailing and a forward price-to-book ratio of 0.78 compared to the industry average of 1.31 suggests the stock is significantly undervalued. Currently, its share price is down around 20% based on a net asset value of $18.37.

Aside from valuations, income and earnings per share growth are among the key drivers of stock price movements. In the case of SLR Investment, the company’s income and earnings are likely to increase at a high double-digit rate in the following quarter, which could help in boosting investor confidence. Furthermore, investor confidence may also be bolstered by the company’s ability to sustain high dividends as well as potential dividend increases in 2023.

The overall sentiment of the stock market can also impact its stock price. After one of the worst downtrends in 2022, the markets appear to be stabilizing in 2023. The S&P 500 has already gained almost 500 points from its October low amid hopes of a slowdown in rate hikes. Based on the latest Fed meeting minutes, the majority of officials were in favor of a slower rate hike policy, meaning smaller increases through 2023. As of now, interest rates range from 3.75 to 4%, but market analysts anticipate a terminal level of 5%, which means rates may rise another 100 basis points. According to the CEO of SLR investment, a 100 basis point increase in rate would boost earnings by $0.12 per share.

In Conclusion

SLR Investment is one of the best high-yielding companies to add to a dividend portfolio. The company’s dividends are completely safe, and its earnings growth power supports a dividend increase in 2023. The diversified investment portfolio, large percentage of senior secured loans, and high yields are likely to minimize downside risk and maximize earnings growth. Aside from dividends, SLR Investment looks like a perfect stock to ride the stock market recovery, as its shares are likely to surge along with the S&P 500. The company’s stock price may also benefit from low valuations, financial growth, and improving fundamentals.

Be the first to comment