miniseries

The best housing plays? Am I kidding? With these headlines coming at us fast and furious?

“Home sales declined for the ninth straight month in October.” (CNBC, November 18, 2022)

“’This will be the first year since 2011 to post a calendar year decline for single-family [housing] starts,’ said National Association of Home Builders Chief Economist Robert Dietz. ‘We are forecasting additional declines in 2023.’” (Press release, November 17, 2022)

“Mortgage volumes at Wells Fargo slowed further in recent weeks…Its retail origination pipeline is down as much as 90% from a year earlier.” (CNBC, November 2, 2022

But…

As with almost any investment opportunity, there is more than one angle to the housing story. These positive angles are also true:

- The average housing stock is down 58% from its past 2-year peak, as I’ll show in detail below. A lot of bad news has been priced in.

- Housing remains in serious shortage in our great country. At its last reading, the single-family home vacancy rate was 0.9%, the lowest since 1965 except for the prior two months, and below the 1.6% average.

- Hard to believe, but the Fed will not raise interest rates forever. Already some major product categories have seen price declines, like rents, gasoline, semiconductors, used cars and ocean shipping. I will go out on a limb and predict that the Fed will say it is done raising interest rates within two months.

- Yes, a recession is likely during 2023. But I will also predict that the recession will be relatively mild, and far easier than the ‘08/’09 Great Recession. The major reason is the banking system is in very strong shape, a far cry from ’08.

So, while I won’t claim that the timing of this note represents the bottom in housing stock prices – I admit I’m a crummy trader – I do believe some housing stocks, but not all, are excellent values at present.

The housing stock universe.

Housing has a number of sub-industries. The core ones are:

- Existing home sellers, or realtors

- New home builders

- Home mortgage originators

- Managers of home mortgage credit risk

- Managers of home mortgage interest rate risk

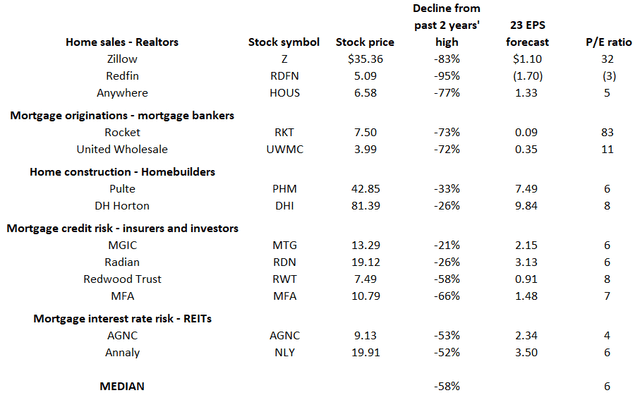

Here is a simple valuation table for major stocks in these five sub-industries:

The list is in the reverse order of my investment preference. Let’s get the bad news out of the way first.

Avoid the realtors

Sure Gordon, kick them when they are down – way down, by an average of 85% from their recent peaks. But the realtors have numerous problems.

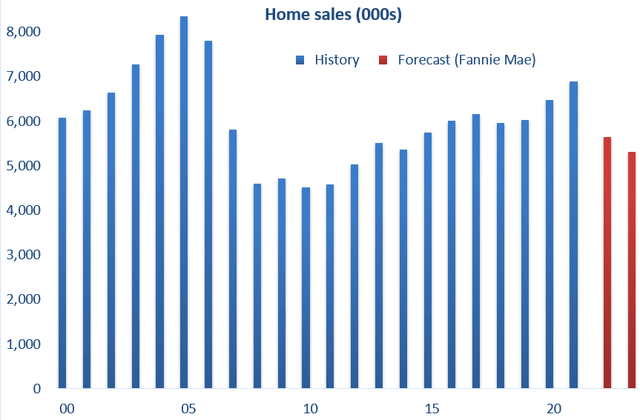

Demand, or home sales, will be weak for many years. Home sales obviously have been declining, and haven’t hit bottom yet, as this chart suggests:

National Association of Realtors, Census Bureau and Fannie Mae

Sources: History – National Association of Realtors, Census Bureau

Forecast – Fannie Mae.

A clear drag on home sales for the foreseeable future is the up to 80% (see below) of American homeowners with low-interest mortgages. Buying new homes, which requires taking on higher mortgage rates, will be an expensive proposition for them.

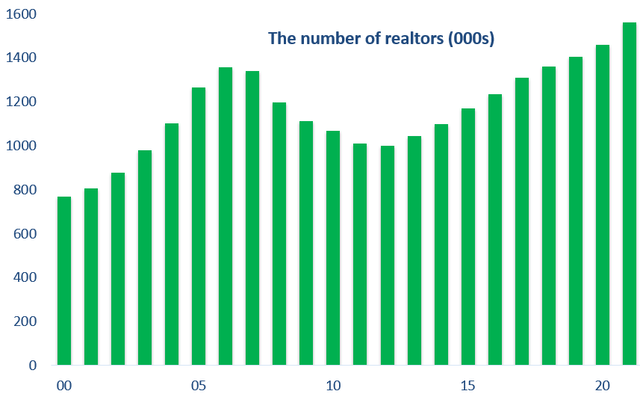

Old school supply, or the number of realtors. Lots of realtors have to be fired to reduce capacity enough to meet the reduced supply, as this chart shows:

National Association of Realtors

Source: National Association of Realtors

From the ’08 experience, this process will take several years to complete.

New school supply, or online realtor models. Those human realtors increasingly have to compete with online home sale solutions like selling one’s home to an online bidder like Opendoor. And other fintechs have business models that are trying to horn into some of the realtors’ commissions, like Zillow and Rocket.

Bottom line – don’t buy realtors. The realtor business will for many years ahead struggle with weak demand and excess supply. Zillow and Redfin are very expensive considering that view, even after their dazzling price declines. Even Anywhere (the former Realogy) is exposed to more earnings disappointments for a while.

The mortgage bankers are iffy

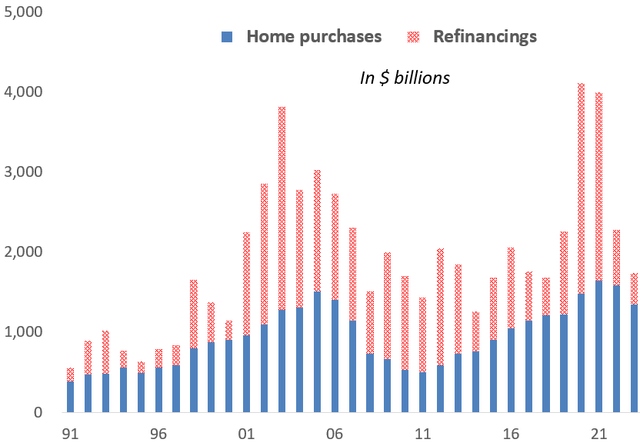

Like the realtors, the mortgage bankers are facing an extended demand/supply problem. Here is a demand (mortgage originations) history and Fannie Mae’s forecast:

Source: Fannie Mae

Demand – the usual post-refi plunge may be worse this time. As has happened before, the end of a refinancing boom has already cut mortgage originations roughly in half. But mortgage rates were below 4%, and a while below 3%, from early 2019 into early 2022. During that period, $10 trillion of mortgage loan were originated, meaning that upwards of 80% of homeowners have below-4% mortgages. When will they refinance again? Not for many years, if ever.

Supply – Way too much, as this quote argues:

” The number of production employees per firm is down 7% from the previous quarter and 19% from one year ago. However, overall volume has dropped so swiftly that some companies are having difficulties adjusting staffing and other costs to match market conditions…” (HousingWire, November 21, 2022)

Bottom line for mortgage bankers – No rush to buy. I put out a weak buy call on Rocket a few weeks ago (Rocket Companies…A Cautious Buy), but that was at a lower price.

Home builders. Great long-term buys, but no rush

Yes, new home sales are down by a third from their 2020 peak. And serious affordability issues will more than likely push new home sales lower next year. But these long-term positives are also true:

- That large housing shortage I highlighted above.

- Interest rates will not rise forever.

- 2023 earnings should still be good because builders currently have large backlogs of sold homes to complete.

- Balance sheets are generally solid, with low debt levels and high proportions of their land inventory held as options, not purchases.

- Industry competition is relatively modest. Venture capitalists haven’t figured out a way to pitch money-losing digital homebuilding ideas to investors.

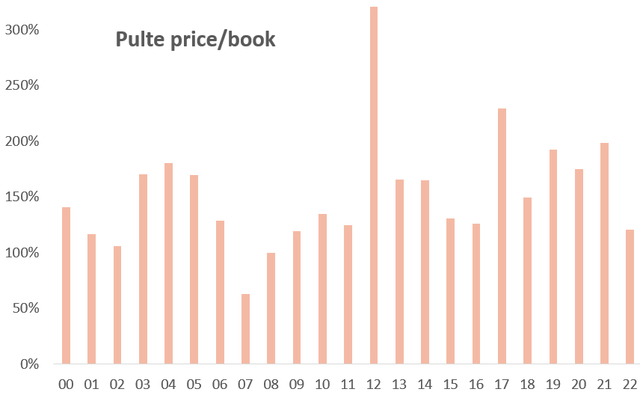

- Valuations are historically low. For example, this chart shows that Pulte’s price-to-book ratio is near the bottom of its range:

Pulte financial reports, Yahoo Finance

Sources: Pulte financial reports, Yahoo Finance

I can’t promise that the homebuilder stocks will be higher a year from now. But long-term, these stocks are quite cheap.

Mortgage credit risk managers – “This ain’t ‘08” plays, Buy them

Two types of public companies specialize in managing home mortgage credit risk. One is private mortgage insurance companies like MGIC and Radian. They insure Fannie Mae and Freddie Mac against defaults on mortgages with less than 20% downpayments. The other are REITs Redwood and MFA, who insure loans that don’t meet Fannie Mae or Freddie Mac’s underwriting standards.

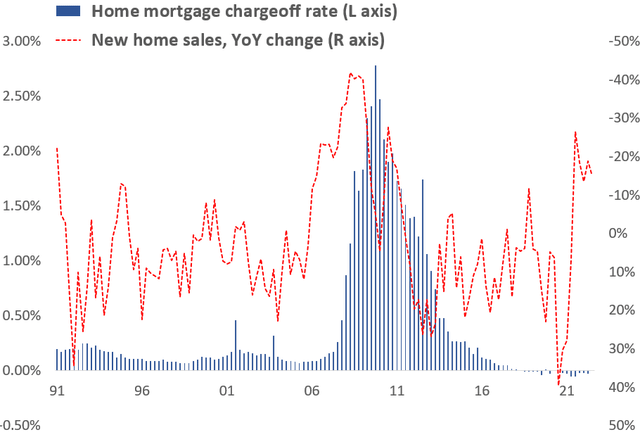

Mortgage credit is a different housing animal, part 1. Credit risk managers aren’t directly impacted by existing home sales. Or new construction activity. Or mortgage originations. Their primary issue is home foreclosures. Are foreclosure rates automatically linked to, say new home sales? Take a look:

Federal Reserve, Census Bureau

Sources: Federal Reserve, Census Bureau

This chart makes several key points:

The primary reference point for a housing downturn in the media and for many investors is the Financial Crisis. But this chart shows how unique that period was for housing. I have written about this fact many times (most recently in Buy MGIC: Capital-Light Strategy Meets A Housing-Light USA). The two unique factors were a large housing excess and dazzlingly bad lending standards.

Declines in new home sales don’t consistently cause surges in home foreclosures. Check out the recessions of ’91 and ’01.

Foreclosure rates over the past five years are far lower than prior to the Financial Crisis. That is because underwriting standards have never been better in modern history.

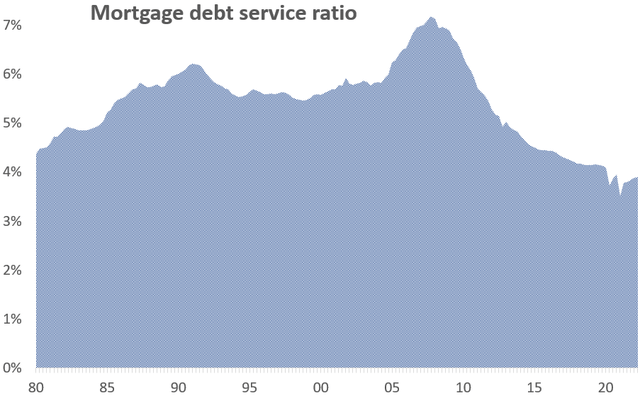

Different animal part 2. Now consider this chart, which shows the percent of household income going to mortgage payments:

Source: Federal Reserve

A record low at present! Compared to a record high in ’07. While that 80% of homeowners with 4% or lower mortgage rates stinks for realtors and mortgage bankers, it is awesome for mortgage credit managers.

Bottom line. Unless we are headed to a massive recession, the 7 P/Es these companies are selling at are quite cheap. And you get paid to wait. MGIC and Radian are buying back their stock like crazy and Redwood and MFA have dividend yields of 12% and 16% respectively.

Mortgage interest rate risk managers. Now is the time to buy

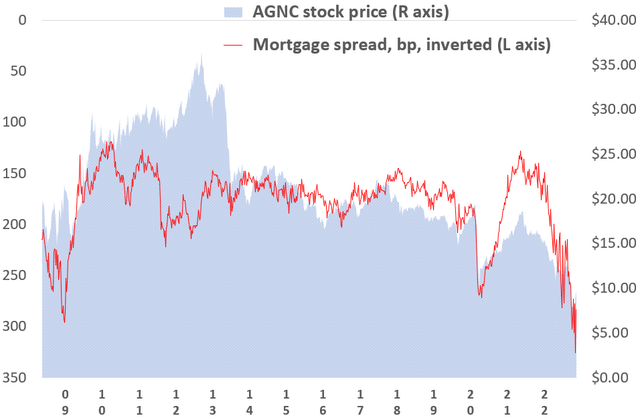

AGNC and Annaly are two REITs that invest in mortgage-backed securities (MBS). The MBS are insured by Fannie Mae and Freddie Mac, so AGNC and Annaly don’t have credit risk. But they do have to manage a lot of interest rate risk. I give my best explanation of their risk management in “AGNC Investment: An 11% Dividend Yield Looking A Lot Safer”. But I’ve discovered a simple and logical analysis. AGNC’s stock price is largely driven by “mortgage-to-Treasury spread”, or the yield on a fixed rate mortgage less the 10-year Treasury bond yield. Take a look:

Yahoo Finance, Freddie Mac, Federal Reserve

Sources: Yahoo Finance, Freddie Mac, Federal Reserve

You can see that the mortgage spread widened dramatically this year, surpassing the Financial Crisis spread. The main reason for this year’s widening is a decline in investor demand. For one, the Federal Reserve stopped buying MBS. Second, bond funds have experienced liquidations, causing some funds to sell their liquid MBS.

But when – and remember that is when and not if – the Fed stops raising interest rates, investors should flock back to bond funds. That will especially be true if a recession emerges. And that will narrow the mortgage-to-Treasury spread. Which in turn will give a boost to AGNC’s stock price. For example, a return to a 200 bp spread should take AGNC to $16, and a return to a 150 bp spread would take it to $20. In the interim, AGNC is paying a 15% dividend, and Annaly a 17% dividend. Yes, you read those right.

As I said above, I believe the Fed will announce an end to its rate increases within a few months, so this recommendation has some urgency.

Be the first to comment