BIPS/Hulton Archive via Getty Images

With AGNC (NASDAQ:AGNC) minting money, as predicted, we lift our view from a cautious ownership to a guarded buy. Management’s proven understanding of its business model appeared within this last quarter. So we knock on the door, wait on the butler and enter for a better view.

The Quarter

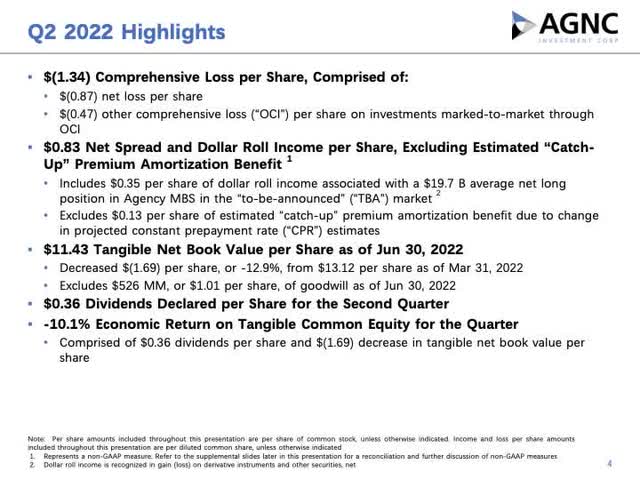

The following slide summarizes the key markers for the June quarter performance.

Management offered several comments on the health of the business at the end of the quarter. “I will also discuss the improvement in our earnings and why we believe AGNC is entering a favorable environment that will be conducive to generating strong risk-adjusted returns for our shareholders,” stated Peter Federico, AGNC CEO.

Bernie Bell, AGNC CFO, added this, “Our net interest spread for the second quarter increased over 50 basis points to 270 basis points, our highest level in well over a decade. Thus, despite our smaller asset base, our net spread and dollar roll income, excluding catch-up, increased $0.11 to $0.83 per share for the quarter.”

The spread between the current coupon MBS and the 10-year treasury note widened to extreme values, resulting in continued tangible common equity weakness. Management views this positively, offering rare advantageous purchasing possibilities.

The company noted a very clever move with its stock. It sold $50 million of common equity at $12.19 buying it back later at a price of $10.78 netting just under $1.50 per share in profit.

The company slightly lowered its leverage by one point from 7.5 to 7.4 and significantly lifted its hedge ratio stating (slide 10), “Our hedge portfolio totaled $72.5 B and covered 126% of our funding liabilities (Agency Repo, other debt and net TBA position) as of Jun 30, 2022, compared to 121% as of Mar 31, 2022.”

Past Predictions

In our Seeking Alpha article, AGNC Investment’s Achilles Heel, we discussed two important issues facing investors. Management clearly stated that tangible common equity isn’t hedged and would float negatively during interest rate hikes. They also added that income-generating spreads would widen adding cash. At this last conference, management stated, “we have discussed, wider spreads ultimately lead to enhanced earnings on our existing portfolio. The second quarter provides a great example of this dynamic as our net spread and dollar roll income increased nearly 15% to $0.83 per common share. Our net interest margin also improved materially.” The net asset value decreased predictably.

State of the Business

The call offered the investor several important windows into the business.

- Current valuation levels for Agency MBS are attractive of which history indicates are at excellent buying points.

- Asset sale risks by the Fed are extremely low. (The Fed plans to adjust rates not balance sheet reduction).

- The “supply outlook for Agency MBS has improved materially being expected at a much lower value $400 billion versus $700 billion.” (This is positive for the agency MBS markets).

- Management believes that the signs of weakness are nearing an end.

- AGNC is now looking for opportunities to begin increasing leverage.

- Management also noted, “Our expectation is that the persistent housing shortage will continue to support housing prices.”

- Aaron Pas, Senior Vice President, Non-Agency Portfolio Management, added in the last comment of the prepared remarks, “As recession concerns will likely lead to continued spread volatility and potential – potentially better entry points.”

A Lively Chat

Sometimes the best information exchange transpires during the Q&A. We believe that that was the case during the last call.

Kevin Barker, of Piper Sandler, asked, “…It seems like you are fairly bullish on the investment outlook. Why not push a little harder here on leverage in order to take advantage of that given these are some of the best investment returns… seen for quite some time?

Federico answered, “given all of the uncertainty in the market has been to err on the side of being more conservative given the challenges that the market faced… We are still seeing extreme interest rate volatility, which, as Chris said, is a headwind to Agency MBS performance.” and what we described today, is significant improvement in some of the key indicators for the Agency MBS market, whether it be supply or the credit outlook or the stability of the Fed or the stock effect of the Fed or, as you point out, absolute returns… So I think we have another month or 2 or 3 to get through this period.”

Doug Harter of Credit Suisse asked, “And how you think that should trend versus the dividend level versus kind of the earnings levels and just what – how do you think about that?”

The CEO answered the question in two manners neither one made sense to us. “Said another way, …say, 15% times the book value… at $11.43 would say that the economic earnings on our portfolio should be something in the neighborhood of around $1.75 a share, $0.28 or $0.30 above our current dividend level.” With the Net Spread and Dollar Roll earnings at $0.83 per share, we question why AGNC believes its dividend is $0.30 below fair value? Shouldn’t it be far more below?

Trevor Cranston, of JMP Securities asked, “it sounds like you guys are staying a little bit cautious near-term because of the high levels of rate volatility, …And so I am wondering if – as you see sort of some normalization of volatility over the next couple of months…”

Federico answered. ” There is clearly reasons why spreads could widen further as the Fed finally adjust to the maximum runoff, which the first full month will be October volatility is still really high.” And, “The market is highly dependent on every inflation report.”

Eric Hagen, of BTIG, asked about leverage and the high liquidity.

Federico added an interesting answer, “we are operating with lower leverage as you pointed out, but also a much more defensive portfolio position, which actually has the effect of using… more liquidity, in particular, our hedge ratio being so high at close to 125% has given us tremendous protection against short-term rate increases…”

That Wretched Interest Rate Curve

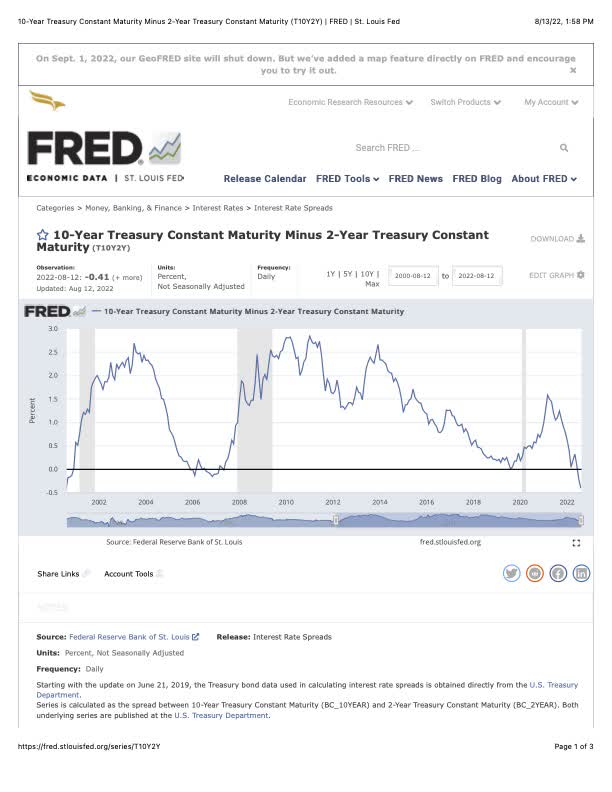

One risk not discussed during the call is a prolonged inverted curve. The indicator most commonly viewed with interest, most notably three-month bills, and two-year and 10-year Treasury notes. The slide next shows an inversion occurred in the latter part of last week.

St. Louis Fed

This, in our view, is the highest risk for AGNC. A prolonged, few years long inversion such as in 2008, represents a major obstacle. We aren’t predicting one, but remain watchful.

Chart

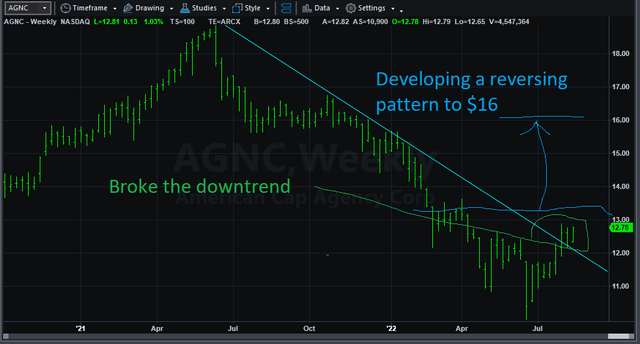

We included a weekly chart of AGNC generated from TradeStation Securities.

This week chart illustrates for investors a change in sentiment from a downward trend to a sideways trend. It shows a beginning of a reversing pattern with $16 in sight. We are removing our short call position for this reason.

Risks

The major risk is prolonged or a deep recession, accompanied with it a disastrous housing market (raising interest rates). The recession probability drives and will continue to do so, volatility. But, management added that housing shortages support by employment transfers and others offer a level of positive support. Plus, the heavy hedged posturing adds protection from the volatility. The lively chat brought out several thoughts about management thinking and views, including expected more extremes in spreads for 2-3 months, strong dividend coverage and the importance of extremely high hedging. We are guarded in our own posturing, but believe that continued purchasing of stock seems opportunistic. With the butler letting us inside for a view, we plan to continue our approach without short call option hedging.

Be the first to comment