Portra

Sometimes, it’s not enough to just buy a stock that is trading on the cheap. You also have to pay attention to the quality of the company, its likely growth and cash flow generation potential moving forward, and a variety of other factors. It’s also imperative to keep in mind that the picture can change over time based on the actions that management takes and how the market receives the value proposition of the firm in question. One company that I have been on the fence about recently that is trading on the cheap is US Foods Holding Corp (NYSE:NYSE:USFD). Although shares of the company have been quite cheap recently, especially on a forward basis, the company’s operating history has been a bit rocky from a profitability perspective. Having said that, management is now showing some really good signs of improvement for the enterprise. Assuming this trend can continue, the picture for shareholders might be quite nice. I wouldn’t go so far as to change my rating from a ‘hold’ to a ‘buy’ just yet. But if management can continue to demonstrate some consistency in profits and cash flows, such an upgrade would not necessarily be out of the question at some point in the future.

Getting tastier

Back in June of this year, I wrote an article talking about the mixed financial performance of food distributor US Foods. This enterprise, which operates a distribution network servicing around 250,000 customers across the US, delivering to them fresh, frozen, and dry foods, as well as certain nonfood items, has been trading at rather cheap levels lately. However, I did not appreciate the historical bottom line issues the company had demonstrated, including prior to the pandemic years. In addition to this, while shares of the company were looking cheap, they did not look all that special relative to similar players. At the end of the day, this mixed picture caused me to rate the business a ‘hold’, reflecting my belief then that it would likely generate performance that would more or less match the market’s performance for the foreseeable future. So far, this call has proven to be slightly more pessimistic than what reality had in store. You see, while the S&P 500 has generated a return of 7.7% since the publication of that article, shares of US Foods have generated a return for investors of 10.1%.

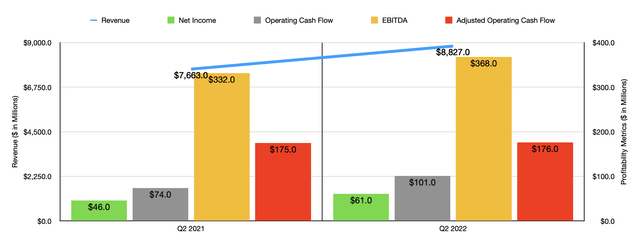

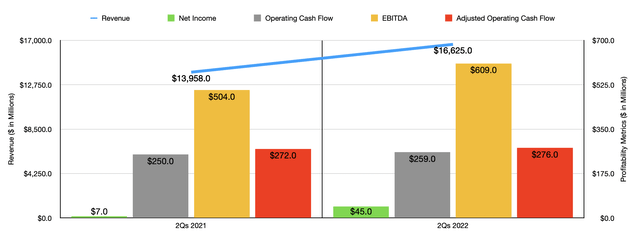

In my last article, we only had data covering through the first quarter of the company’s 2022 fiscal year. Fast forward to today, and we now have data covering the second quarter as well. During that quarter, the company posted some results that left a positive impression on me. Revenue, for starters, came in strong, totaling $8.83 billion in all. This represents a 15.2% increase over the $7.66 billion the company generated the same time one year earlier. Thanks to this strong growth, results for the first half of the year as a whole came in at $16.63 billion. That’s a whopping 19.1% above what the company achieved the same time one year ago. For the second quarter on its own, the rise in revenue was driven largely by a 15% increase in food cost inflation that the company passed on to its customers. Total case volume, meanwhile, dropped by 0.4%, while independent restaurant case volume grew 0.3%.

Although the rise in revenue was nice, the fact that it came from the company’s ability to push higher costs onto its customers suggests that this increase may not all be permanent. What was more impressive, however, is the fact that profitability was quite robust. For the second quarter of the year, net income came in at $61 million. That’s 32.6% above the $46 million the company generated the same time one year earlier. the big driver behind this improvement seems to have been a rise in the company’s gross profit margin from 15.3% to 15.7% that management attributed to optimized pricing, increased freight income from improved inbound logistics, optimization associated with the cost of goods sold, and other related factors. Operating cash flow was also robust, rising from $74 million in the second quarter of 2021 to $101 million at the same time this year. However, it’s also true that if you adjust for changes in working capital, it would have risen more modestly from $175 million to $176 million. Meanwhile, EBITDA reported by the company also increased nicely, rising from $332 million to $368 million. That translates to a year-over-year increase of 10.8%.

For the 2022 fiscal year, management has offered some guidance for investors to rely on. Currently, the expectation is for EBITDA to total between $1.2 billion and $1.3 billion. In fact, the company is currently thinking that the official results that come in will be near the high end of that range. The company also thinks that earnings per share, on an adjusted basis, should come in at between $1.95 and $2.25. That would translate to net income, at the midpoint, of roughly $474.6 million. No guidance was given for operating cash flow. But if we assume that it would increase at the same rate that EBITDA it’s forecasted to, we should anticipate a reading, at the midpoint, of $767.5 million.

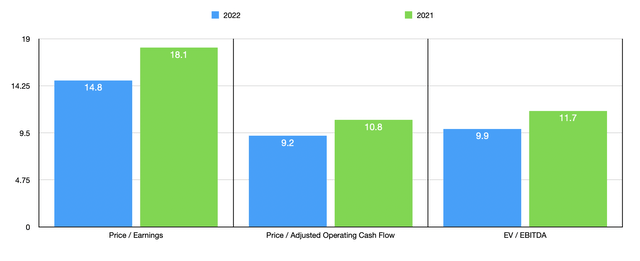

Based on these findings, the company seems to be trading at a forward price-to-earnings multiple of 14.8. That compares to the 18.1 reading that we get using data from last year. The price to adjusted operating cash flow multiple should decline from 10.8 using results from last year to 9.2 using estimates for this year. A similar trend can be seen when looking at the EV to EBITDA multiple, with that figure dropping from 11.7 to 9.9. My analysis of the company also involved comparing it to five similar businesses. On a price-to-earnings basis, these companies range from a low of 9.4 to a high of 72.1. In this case, two of the five companies were cheaper than our target. Using the price to operating cash flow approach, the range for the four companies with a positive multiple was between 9.7 and 56. In this case, US Foods was the cheapest of the group. Meanwhile, when it comes to the EV to EBITDA approach, the range was between 6.6 and 17.4. Three of the five companies in this scenario were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| US Foods Holding Corp | 14.8 | 9.2 | 9.9 |

| Performance Food Group Company (PFGC) | 72.1 | 28.4 | 14.7 |

| United Natural Foods (UNFI) | 10.8 | 11.0 | 6.6 |

| The Chefs’ Warehouse (CHEF) | 45.2 | 56.0 | 17.4 |

| The Andersons (ANDE) | 9.4 | N/A | 7.5 |

| SpartanNash Company (SPTN) | 18.5 | 9.7 | 8.4 |

Takeaway

Purely from a pricing perspective, shares of US Foods look to be pretty appetizing. This is true even though the company is probably closer to being fairly valued compared to similar firms. the company is also demonstrating for shareholders that it’s able to increase its bottom line at a nice clip. And management’s forecasts should result in shares being cheaper than the company would be if it were stuck at levels of profitability that matched the 2021 fiscal year. In the event that the company can continue to demonstrate this bottom line performance consistently, I do think that I could eventually come around to upgrading it. But until more of that consistency is baked in, I have decided to keep the company as a ‘hold’ for now.

Be the first to comment