blackdovfx

The iShares U.S. Technology ETF (NYSEARCA:IYW) is a pretty big portfolio, but being only tech-focused, it skews intensely towards a small handful of stocks. We think that some of the larger dominos have yet to experience the full headwinds of our current economic environment in our financials, which could rattle the IYW further despite already substantial YTD declines. As such, we don’t see it as particularly compelling.

Comes Down to Apple

A lot of it comes down to Apple (AAPL), which is 20% of the IYW. Apple’s YTD declines are 17% but it is a bit exaggerated because a lot of its pop happened last year after September 2021. So declines had come off an anyway short-lived, perhaps seasonal peak. The reality is that Apple has been a good store of value over the last 12 months.

The problem is that reality may be broken soon. Reports say that while by no means a failure, revision of production plans with the absence of demand surge and other indicators have shown that there may be weakness in some of the most stalwart elements of the consumer basket. Scalping furor has fallen for the iPhone 14, and apparently, Apple believes that its previous production plans were optimistic in China. This is partly coming from problems in China where iPhone sales have generally lagged, but it matters both because China is almost 20% of Apple’s sales and what it says about the iPhone’s resilience in the face of a recession.

People have already been generally less excited about new handhelds, like the foldable ones, and while a 11% decline in YoY iPhone sales in China may not seem like a lot, it could be enough to leg sweep a 24x PE multiple carrying a $2.41 trillion market cap, especially if the recession is protracted on a mixture of geopolitical issues, COVID-19 response measures in China which are political bound, and tougher financing conditions.

Rest of Tech Still to be Hit

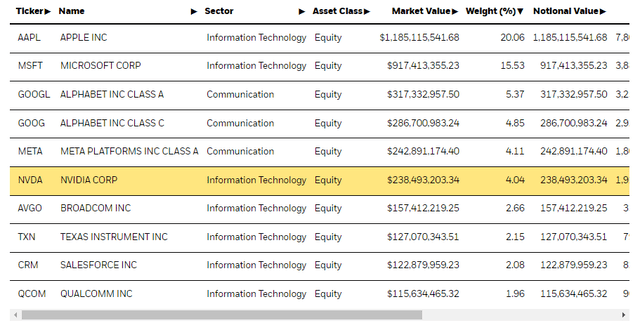

There are two other concerns we have with the rest of tech that gives us pause. The first is that a lot of the equipment and hardware companies in the ETF, Nvidia (NVDA) included, are about to go through a real glut in hardware because the semi shortages have reversed fully with all these old fabs online as well. The crypto wipeout especially risks a glut for NVDA products, and we saw the growing crypto risks years ago despite the large flows of copium on tap. Semi exposures go way beyond just NVDA and account for about 21% of the whole IYW allocation.

The other issue is more simple which is just that enterprise tech, which dominates the mix of other major portfolio elements like Microsoft (MSFT). While the secular support for cloud still is present, we worry that the consumer declines are eventually going to pass through to corporate budgets, and then the latent hit not seen yet from pass-through of even the current consumer confidence declines could be substantial.

While the 33% YTD declines reflects some of the markets understanding of declines in earnings that could come, valuations are still very high, and the declines have been exaggerated by tech peaks in the winter. There’s a way for this to fall, or at the very least, volatility will make it uncomfortable.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment