It’s been a long time since certificates of deposit offered attractive rates but the current environment has turned the narrative of the last few years on its head. designer491

Never Too Smart For A Lesson In Humility

The comments section on my articles can be hit or miss because sometimes there is more feedback that I can keep up with and other times I receive a few kind comments and likes. In my previous article, The Retiree’s Dividend Portfolio – Jane’s August Update: Dividend Income Set To Double After 5 Years, I received quite a few comments but the one that struck me the most was the following question (paraphrased):

“At what point would you consider selling shares in exchange for fixed income instruments like Brokered CDs and Treasuries?”

Here was my exact response:

I think the carnage is just getting started after the last few weeks.

To your point, I think if we get short-term CD rates moving into the 3% range then it would be hard to not focus on shifting funds. John and Jane do have a considerable amount held in these categories already but I think everyone here can admit there comes a point where rates are so appealing that it would be hard to argue against it.

My issue currently is that most of these yields in the 3% range are for long-term certificates (five years or more) and I am hesitant to go with anything that long. A few years ago Charles Schwab would offer short-term brokered certificates around 2-2.5% for one-month or 3-month terms that I really loved using for excess cash.

Looking back at my response, it’s no wonder that the commenter asked if I was living under a rock or just had really bad investment options because he said every criterion I provided is already available through Brokered CDs or Treasuries.

If I am being honest, I feel pretty embarrassed about the whole situation because I consider it to be my job to keep up with changing trends in the world of finance. Not only do I consider it to be my job, but it is literally my job at work to be aware of changing trends when it comes to financing in the mortgage and automotive markets. Rather than dwell on the fact that I missed the memo, I decided it would be better to take action by writing an article that looks at my retirees’ portfolio Traditional and Roth IRAs to determine if there are any positions (entire or portions) that would be good candidates for selling and converting those funds into short-term Brokered CDs.

Selling Low Yield Stock With Minimal Upside

The goal of using brokered CD’s is to keep the income stream coming while eliminating the market volatility. Remember, the beauty of dividend investing is that it doesn’t matter if the market goes up and down as long as you are invested in the right companies who have made their dividend payments a priority regardless of the economic situation.

Prior to the current environment of rate increases, Certificates of Deposit have been offered at abysmal yields, largely because financial institutions were flush with deposits where they didn’t need to pay much more of 50-100 basis points. Because of the low CD yields, financial institutions were able to secure an ultra low source of financing that allowed them to achieve an above-average net interest margin spread even though interest were also at a record low.

Prior to COVID we were beginning to see the rise of deposit rates alongside a few rate increases by the Federal Reserve. Within the first month of COVID business closures and panic with the added “government” action infused financial institutions with a new round of deposits which then send deposit rates crashing again as many institutions didn’t need money to lend out so they dropped rates to discourage more deposits from coming in.

All of this is to say that retired investors have had to search for alternatives to CDs because they need a stable and meaningful yield that can help supplement their income during retirement. Until recently, dividend-paying stocks were the alternative they needed that would allow them to generate the income that they were looking for.

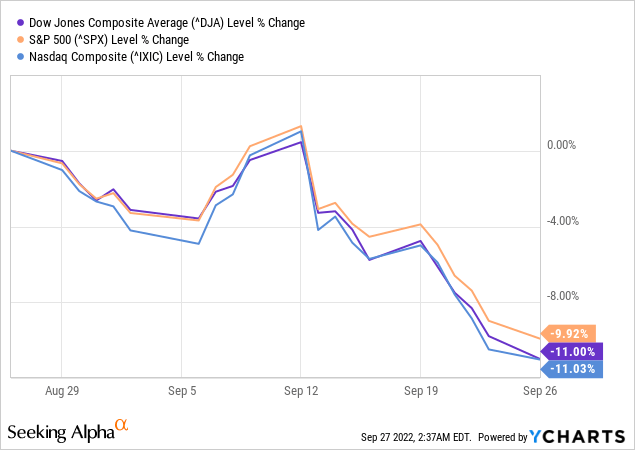

Consider the following image and think about the damage done to portfolios over the last week. The reality is that it didn’t matter if your portfolio is focused on dividend investing or growth – no one who was invested in the stock market was safe from the carnage of the last month.

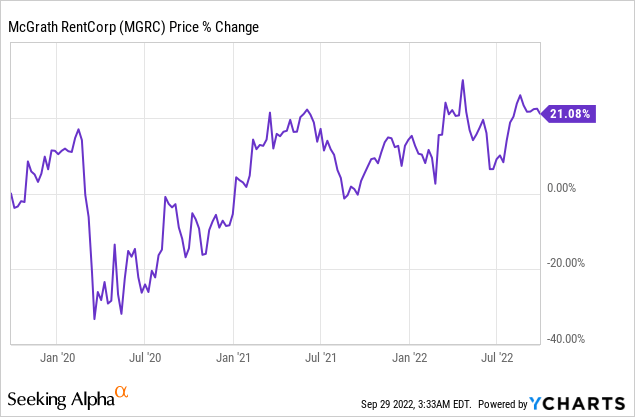

Now imagine if you were to take some of your stocks offering 2% yields and minimal upside and sell those to reinvest the funds into a certificate that can’t lose value, is FDIC insured, and provides a monthly income stream in the form of interest income. Let’s consider one company we recently sold in Jane’s Retirement Portfolio – McGrath RentCorp (MGRC).

I want to start by emphasizing that MGRC is a great company with a stable business model and my analysis/thoughts are not to suggest negative outlook/events on the horizon that would cause the price to go down.

Looking at the image above we can observe that MGRC is trading at its highest price point over the last decade and even though the company has grown its dividend every year for the last 29 years straight, it is trading at a current yield of 2.11% which is also near its lowest yield over the last decade (this is despite its average five-year growth rate of 11.5%). Given this information, I see a stock that has more to lose than it does to gain and with the dividend well-below my safe CD yield it would be counter-productive to continue holding shares. For this reason it makes perfect sense to liquidate the position and wait until the share price has fallen to where it is both attractive from a potential upside and dividend yield standpoint because then we can say we are holding the stock for the attractive dividend yield and the potential for upside appreciation.

Over the last few days we have sold a handful of stocks that have more to lose than to gain and will reinvest those proceeds into short-term CD’s with terms less than six months.

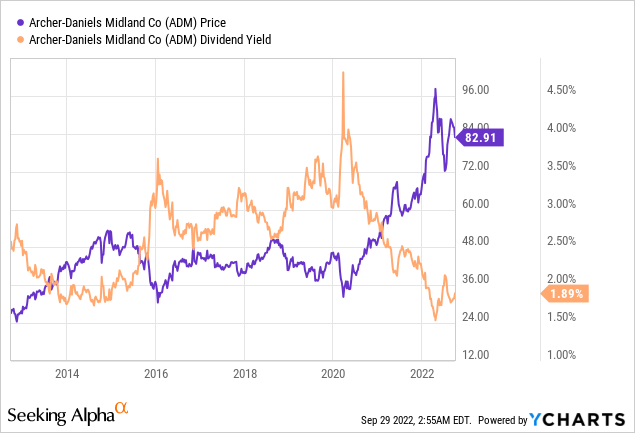

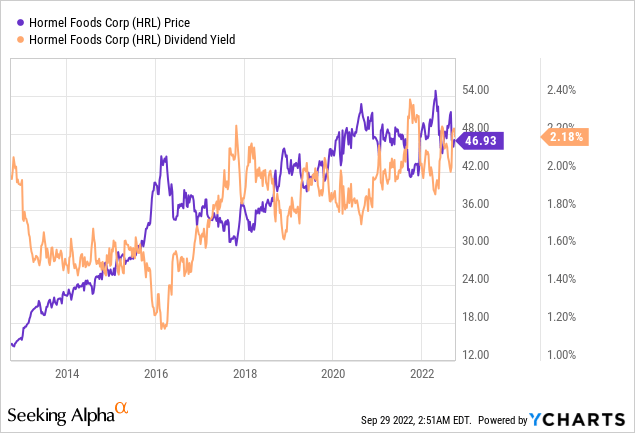

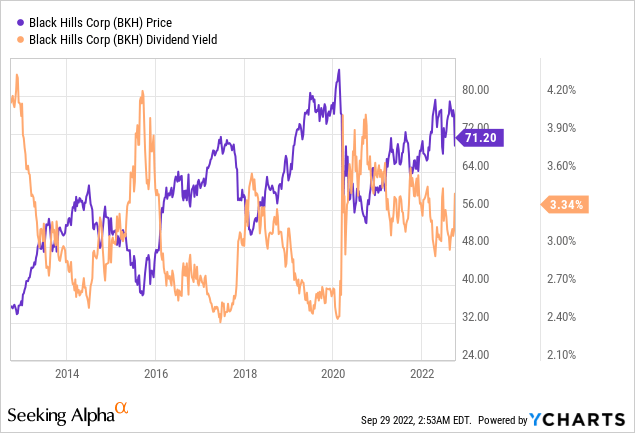

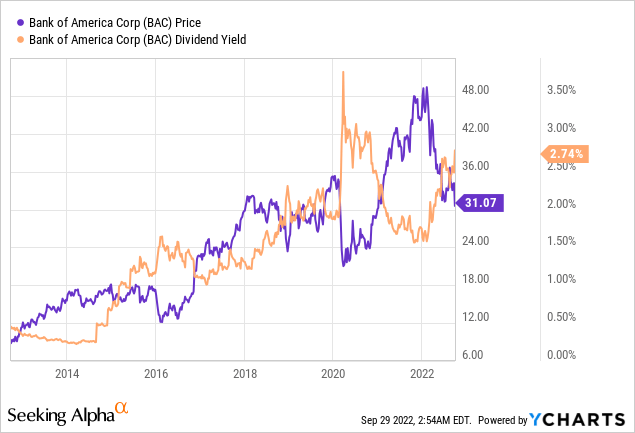

The YCharts images below exhibit some or all of the following characteristics that led us to sell part of or all of a position.

- The dividend yield is at the low end compared to its historical yield over the last 10 years.

- The stock price is at the high end compared to its historical price over the last 10 years.

- The dividend yield is near or below the three month Brokered CD rate of 3.35%

One way to think about the bullet points is that the more of these that are true (sometimes it could be only 1/3 or 2/3 are true) then the more likely it is that a larger number of shares were sold.

Archer-Daniels-Midland (ADM)

Hormel Foods (HRL)

Black Hills (BKH)

Bank of America (BAC)

This strategy is meant to cover all of the stocks that are low-hanging fruit, in the sense that it’s a no-brainer to sell shares and then reinvest funds into CDs.

We will also be looking at selling additional stocks that don’t necessarily fit the paradigm of the bullet points above. I plan to expand on these more in a later article.

MGRC Vs Certificate of Deposit – Comparison

Now that we’ve established the criteria for how we chose to liquidate stocks, let’s look at a practical example of what an investment with MGRC would look like compared to a CD. To do this we are going to look at how a $20,000 investment in MGRC would compare to a $20,000 investment into a three-month CD at 3.35% APY.

At the current stock price of $84.37, we would be able to purchase 237 shares of MGRC. The current quarterly dividend payout is $.455/share which would amount to $107.84 per quarter or $431.34/annually.

The same investment in a certificate of deposit paying a 3.35% APY would be $165.44 per quarter or if we continue to purchase new three-month certificates (assuming the rate remains the same going forward) it would result in $661.76/annually.

Not only will John and Jane make substantially higher interest from a CD but in these examples we didn’t even consider what the negative consequences would be if the stock price decreased and the shares needed to be sold. Even when we consider a more stable entity like MGRC (consistent cash-flows and relevant business model during good and bad times) it can experience major price fluctuations over the course of several months/years as evidenced by the image below.

Even though the chart may look attractive from a growth perspective, it has seen a 15% price swing over the last three months. Given the current price of $84.37, this would mean that if the stock price fell by 15% and the investor had to sell shares (a good example of this would be due to an RMD withdrawal from a Traditional IRA) this would result in a devastating loss of $3,000 in principal if we go back to our example of a $20,000 investment into MGRC.

This means that our $431.34/annually would be offset by the loss of $3,000 resulting in a total benefit of -$2,568.66 for the year while the benefit for the CD would still be the same at $661.67/annually. The last benefit to consider that the CD may have is that at the end of one year you also have the return of $20k of principal that could be used to purchase shares of MGRC at a discount so that a year later you could potentially sell shares at a 15% gain.

Conclusion

Feedback like the comment I received was a wake-up call for me and I appreciate that I don’t live in a bubble where it would be possible to ignore this kind of information. Growing up my dad always had the following motto – “Making mistakes doesn’t make you an idiot but continuing to make the same mistakes over-and-over again does.”

So, to the commenter who accurately called me out on this I really do appreciate the feedback and I hope this article reiterates how much consideration I give to constructive feedback. I always found it interesting and challenging growing up in a generation that isn’t known for taking ownership of mistakes. I am thankful that I had influences throughout my life that made it clear that the best way to improve is by owning the mistake and making a commitment to fix the problem (in this case, I am thankful that I was able to implement the fix sooner than later which minimized the negative consequences).

For those looking for a call to action let me reiterate the three bullet points that summarize the kind of stocks you should consider selling in favor of CDs and Treasuries. As a general rule, the more bullet points that are true the more of a position you should consider selling.

- The dividend yield is at the low end compared to its historical yield over the last 10 years.

- The stock price is at the high end compared to its historical price over the last 10 years.

- The dividend yield is near or below the three month Brokered CD rate of 3.35%

John and Jane are long ADM, BAC, HRL.

Be the first to comment