ipopba

“Humility is nothing but artfully disguised arrogance.” Gourav Mohanty

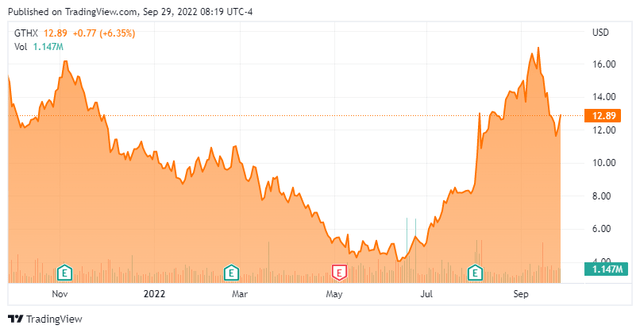

Today, we take a look at a small developmental concern that has seen a nice rise in its stock over the past couple of months despite a dismal market backdrop. Can the rally in the shares continue? An analysis follows below.

Company Overview:

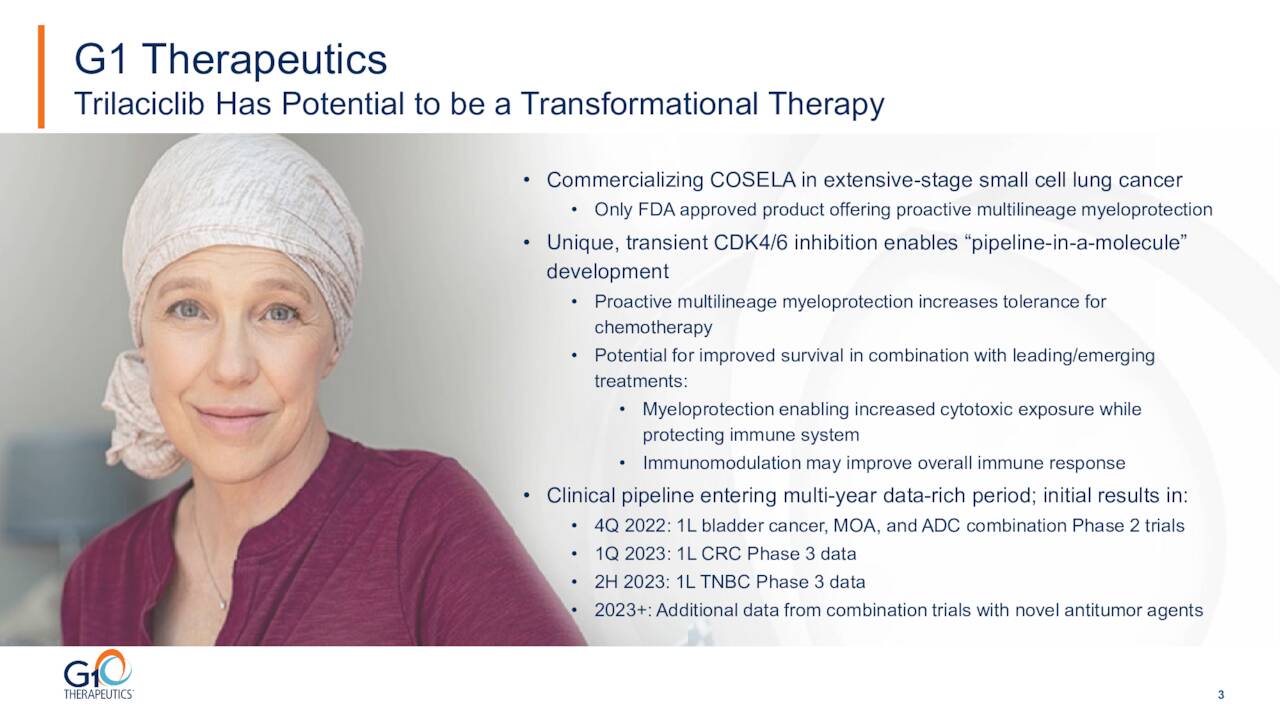

G1 Therapeutics, Inc. (NASDAQ:GTHX) is based in North Carolina. This clinical-stage biopharmaceutical company is focused on the development and commercialization of small molecule therapeutics for the treatment of patients with cancer. Currently, the stock trades just below $13.00 a share and sports an approximate market capitalization of $520 million.

September Company Presentation

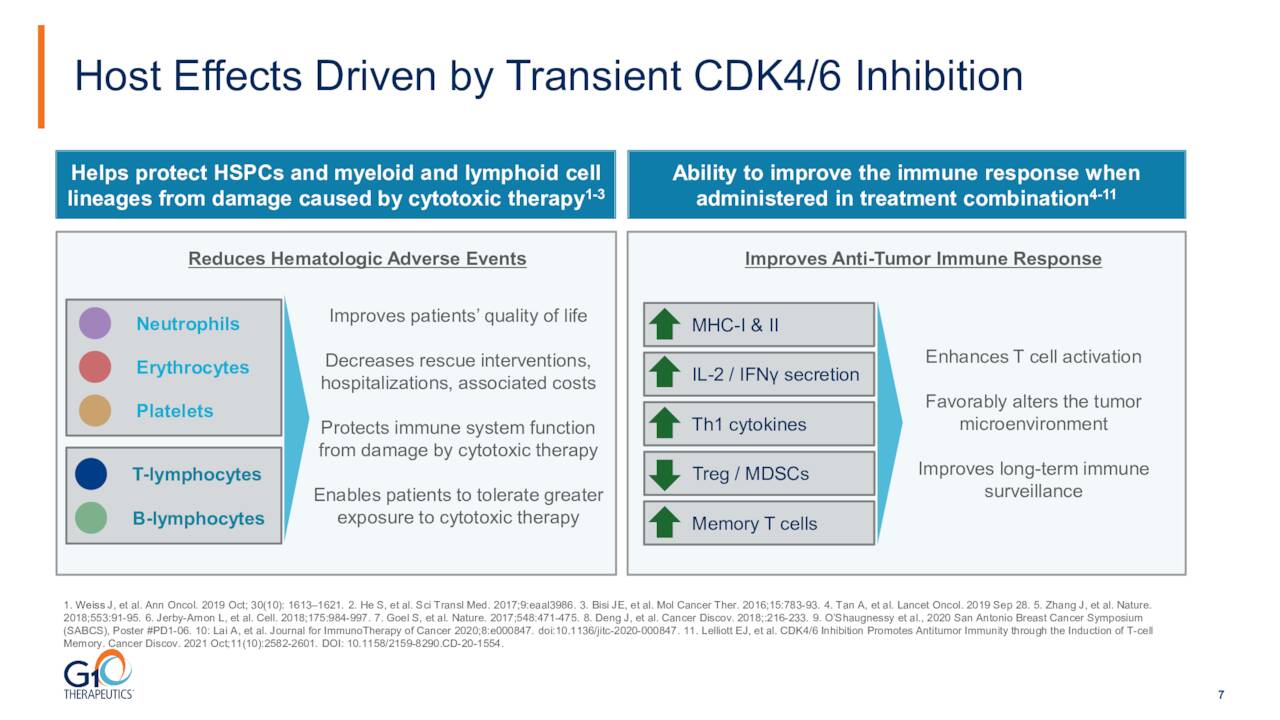

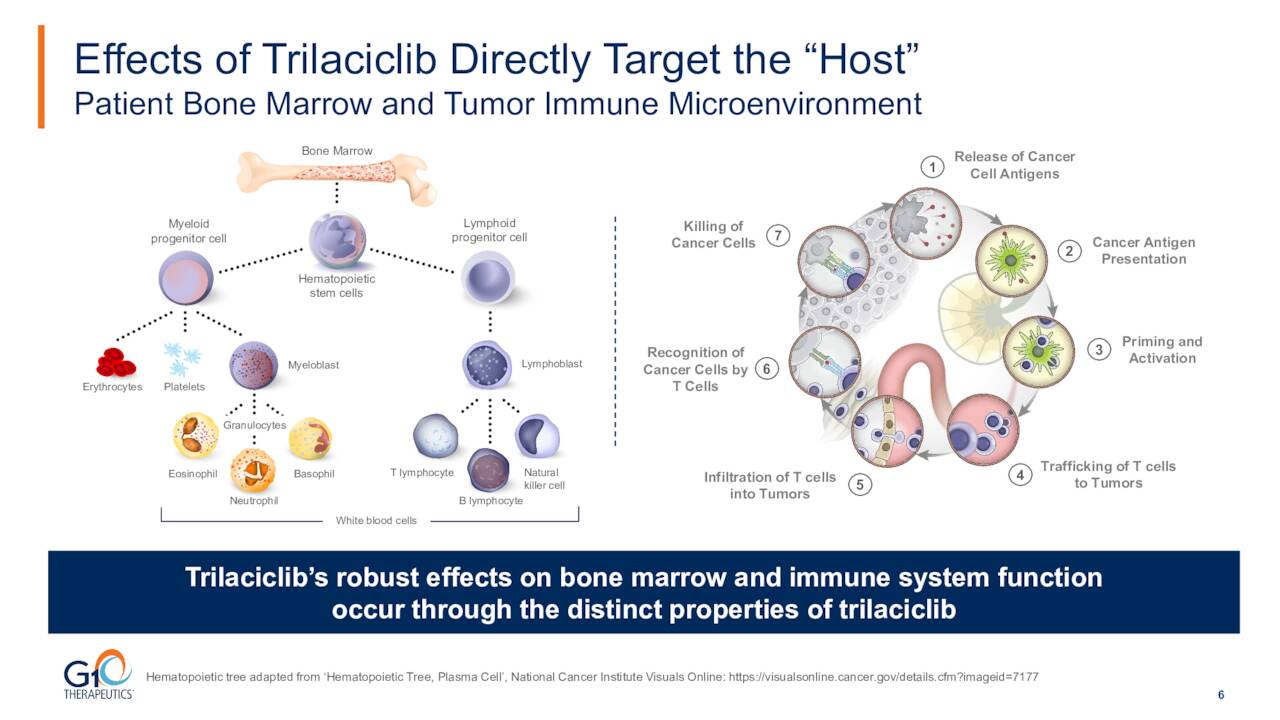

The company’s main asset is a drug named trilaciclib which goes by the brand name COSELA. The product is a small-molecule, short-acting, inhibitor of cyclin-dependent kinases 4 and 6. COSELA is used to reduce the risk of blood/bone marrow problems (such as low red/white blood cells and platelets) caused by chemotherapy. It is also tumor-agnostic.

September Company Presentation

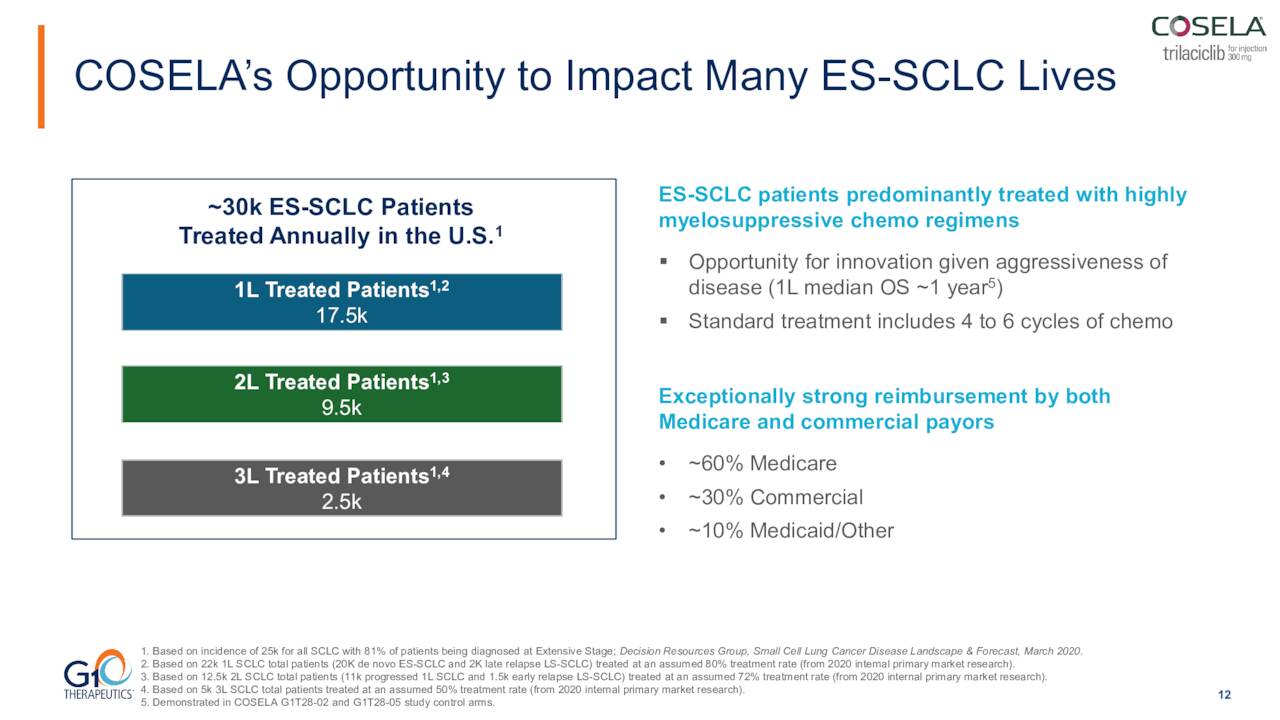

This compound is already FDA approved to decrease the incidence of chemotherapy-induced myelosuppression in adult patients when administered prior to a platinum etoposide continue regimen or a topotecan containing regimen for extensive stage small cell lung cancer or ES-SCL in the first quarter of 2021. This is a relatively small indication, and COSELA only did $8.7 million of net product revenue in the second quarter of this year. Vials sold did increase 60% on a year-over-year basis, it should be noted. COSELA was recently approved in China. This entitled G1 Therapeutics to $13 million in the form of a milestone payment and potentially $156 million in additional milestone payouts from its marketing partner Simcere in China as well as double-digit royalties on net product revenues.

September Company Presentation

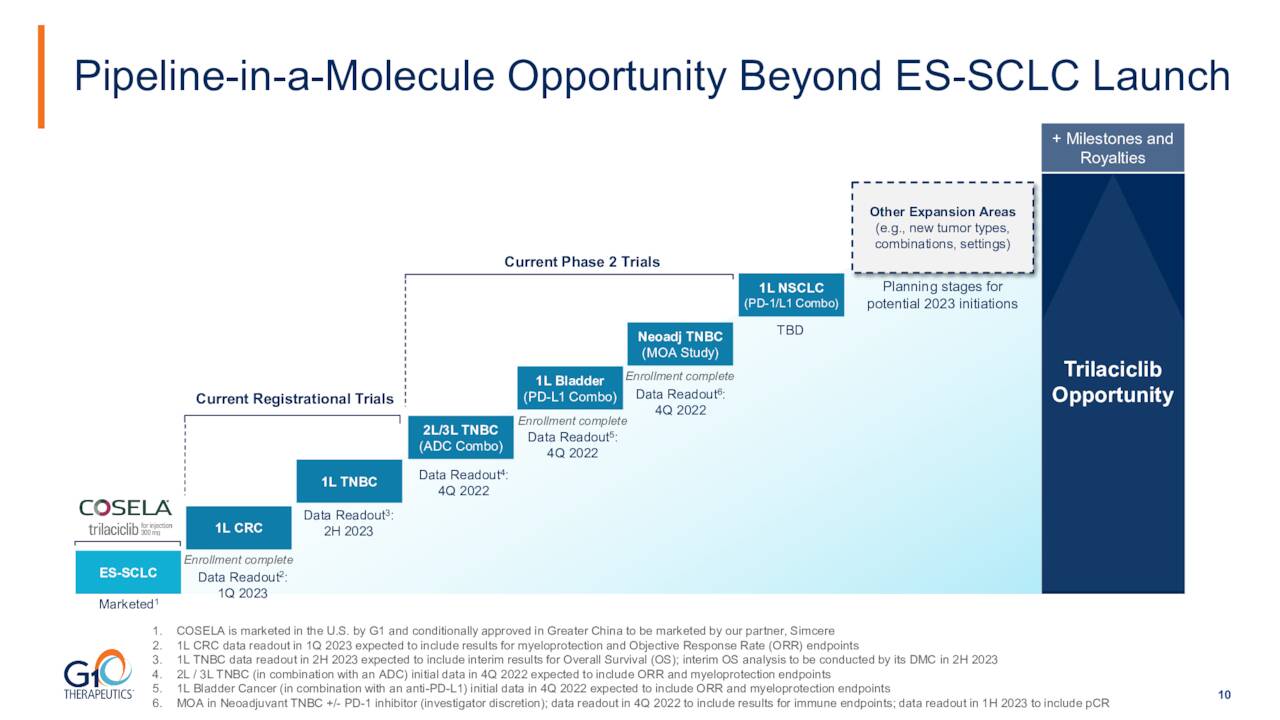

However, leadership envisions an entire pipeline based on this asset. Trilaciclib is being evaluated across a range of tumor types and chemotherapy regimens to assess its potential myeloprotection, antitumor efficacy and safety in combination with chemotherapy and other agents.

September Company Presentation

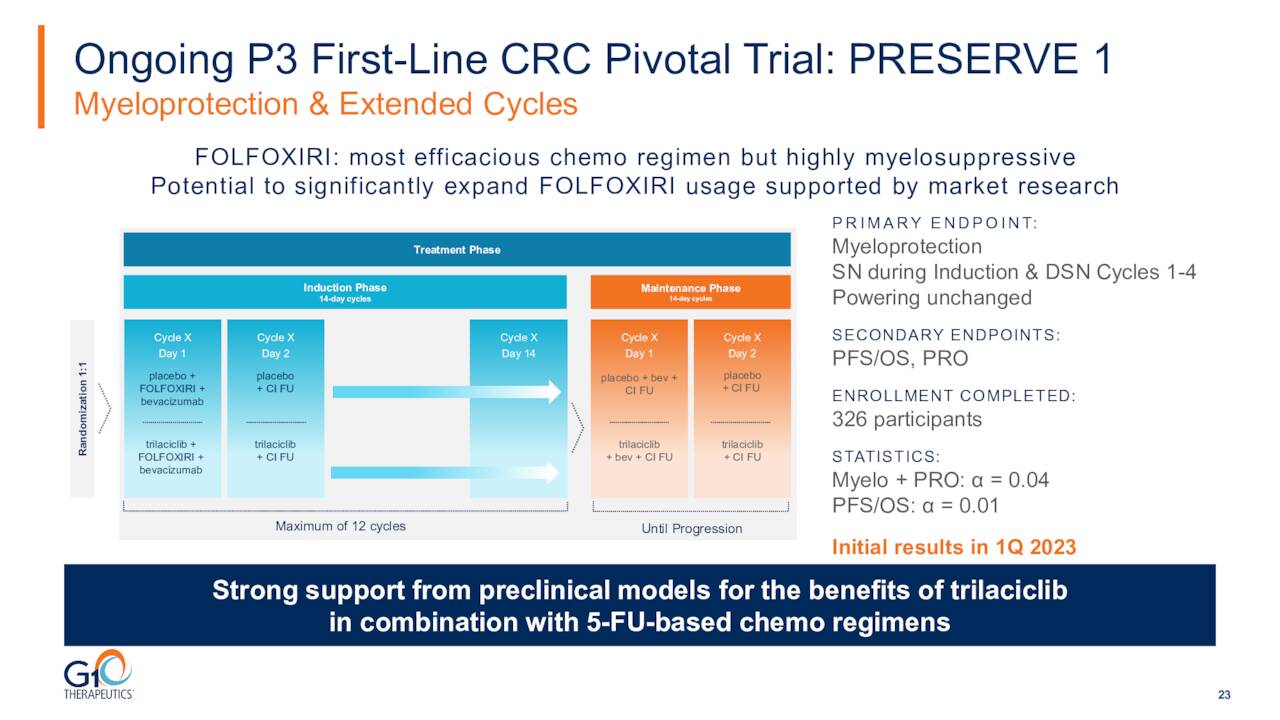

As you can see above, the company has a couple of registrational studies in progress as well as several Phase 2 trials for various new indications for COSELA. The first registrational trial is targeting metastatic colorectal cancer or mCRC and called PRESERVE 1. This is a global multi-center, randomized placebo-controlled, line extension pivotal 326-person Phase 3 trial of trilaciclib metastatic CRC receiving first-line trilaciclib or placebo administered prior to FOLFOXIRI (a combination of fluorouracil (5-FU), folinic acid, oxaliplatin and irinotecan) and bevacizumab.

September Company Presentation

The population impacted by mCRC is potentially three times bigger than that SCLC for COSELA. Colorectal cancer is the second-largest cause of cancer death in the United States, with some 150,000 Americans diagnosed with this disease. Most currently receive 5-FU based chemotherapy regimens.

September Company Presentation

Enrollment for PRESERVE-1 was completed in the second quarter. Initial results from this study, which include those from the primary endpoint in the first quarter of 2023. This trial was pushed back by the invasion of Ukraine. This study was overenrolled to compensate for loss of patient data in Ukraine due to the ongoing conflict.

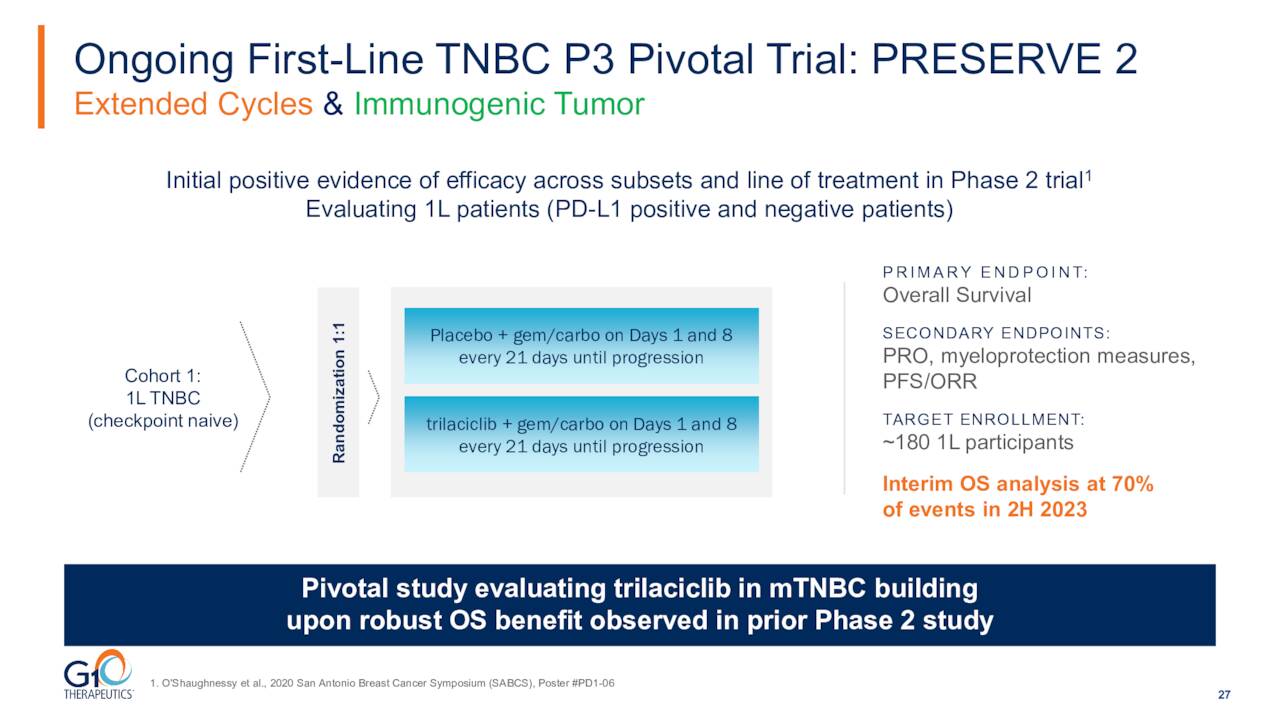

Initial Data from a Pivotal Phase 3 Trial of Trilaciclib in Triple Negative Breast Cancer or mTNBC is due out in the second half of 2023. This 170-person study ‘PRESERVE 2’ target patients with PD-L1 positive and negative metastatic TNBC receiving first-line gemcitabine and carboplatin. An interim overall survival analysis should be conducted by a data monitoring committee in the second half of 2023. If that data meets the criteria, the trial will stop. If not, it will go onto final analysis.

September Company Presentation

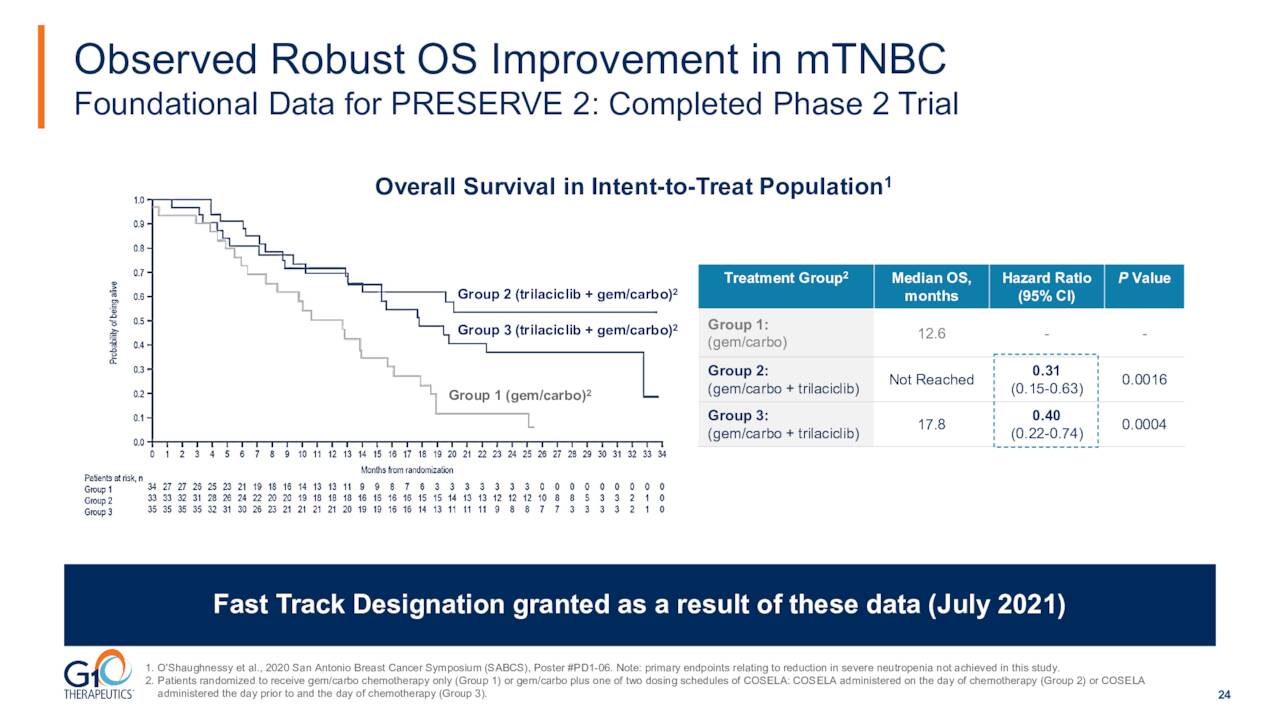

A Phase II trial for this indication saw robust statistically significant improvements in the most clinically meaningful endpoint of overall survival in patients receiving trilaciclib compared to patients in the control group, with hazard ratios of 0.31 and 0.4 in the two trilaciclib groups.

September Company Presentation

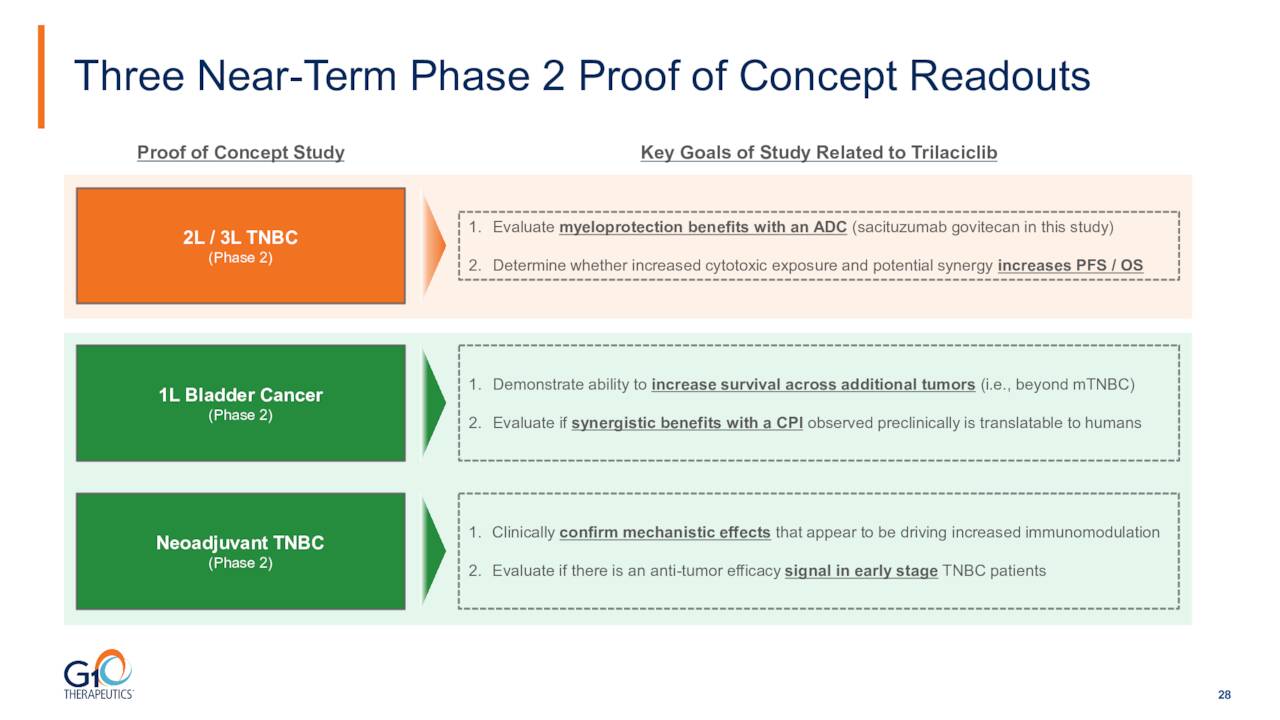

Initial readouts from three Phase 2 trials for additional indications should be out by the end of this year.

September Company Presentation

Analyst Commentary & Balance Sheet:

Two weeks ago, Wedbush ($25 price target, up from $20 previously), Needham ($32 price target) and H.C. Wainwright ($67 price target) all reissued Buy ratings on the stock. On August 3rd, JPMorgan Chase maintained its Sell rating on the stock with a $14 price target.

Insiders were small sellers in the stock through the first half of the year. However, two insiders have taken advantage of the recent pop in the stock to dispose of nearly $1.6 million worth of shares in aggregate over the past six weeks. Just over 10% of the overall float in the shares is currently held short. The company ended the second quarter of this year with just under $145 million in cash and marketable securities on its balance sheet against just north of $75 million in long-term debt. This does not include the $13 million milestone payment from Simcere. The company posted a loss of $39.4 million in the second quarter. Management has guided it believes funding in place is sufficient to fund activities planned into 2024.

Verdict:

G1 Therapeutics’ future looks promising as COSELA or trilaciclib is already approved for one indication with the potential for approval for several larger indications in the years ahead. Readouts from five different trials (Two registrational and three Phase II) should also be out over the next year or so.

That said, the stock has tripled off its June lows. In addition, insider selling has picked up a bit in August and September. Finally, outside a new marketing partnership, the company is going to have to do a significant capital raise given its quarterly burn rate. My guess is that happens after some upcoming trial readouts, which hopefully will be positive.

Therefore, GTHX merits a small “watch item” position for now. After further trial results and the company addresses its medium-term capital needs, a larger position may be warranted.

Note: Options are available against this equity, and they have decent liquidity, so a covered call strategy is viable.

“Accepting errors is one of the hallmarks of true humility; while pride shifts blame to somebody or something else.” – Dr. Lucas D. Shallua

Be the first to comment