JHVEPhoto/iStock Editorial via Getty Images

Thesis

Intel (NASDAQ:INTC) is struggling. On the backdrop of macroeconomic challenges, a slowing PC demand and a general downturn for semiconductors, the company shocked Wall Street with a disastrous Q2 2022: For the June quarter, revenues plunged 17% year over year, earnings per share dropped by 79% to 29 cents, and guidance significantly misses analyst expectations. Given these results, it is no surprise that Intel stock is down by more than 50% since April 2021 all-time highs. But INTC shares are still not trading cheaply. Investors should consider that Intel’s one-year forward P/E is estimated at x14 and P/E at P/B. Arguably, this is in line with the broader semi sector.

A Very Bad Q2 2022

Intel’s June quarter was very bad. From the period April to the end of June, the company generated total revenues of $15.3 billion, which was significantly below consensus of about $18 billion and reflected a topline year-over-year decline of 17%. Additionally, Intel’s gross margin decreased by almost unbelievable 870 basis points to 43.6%, versus 49.8% estimated. Non-GAAP earnings per share plunged by 79% versus the same period one year prior, down to 29 cents. Guidance further added to negativity: The company estimated Q3 revenues at $15.5 billion, which is considerably below analyst consensus expectations between $16.5 billion and $18 billion. Moreover, gross margin is expected to remain depressed at about 45.3% (versus 49.0% consensus).

Reflecting on these results, CEO Pat Gelsinger shared investors’ disappointment over the business performance:

This quarter’s results were below the standards we have set for the company and our shareholders. We must and will do better

But Intel’s CEO was also quick to blame the challenging macro-environment for the company’s bad performance in Q2:

The sudden and rapid decline in economic activity was the largest driver of the shortfall but Q2 also reflected our own execution issues in areas like product design, and the ramp of AXG [Accelerated Computing Systems and Graphics Group] offerings.

Structural Problems

Personally, I believe that investors listening to this explanation may come away with an incomplete picture of Intel’s performance. Investors should consider that the company has underperformed for years – despite a strong semiconductor cycle. From 2018 to 2021 Intel’s revenues have only grown at about nominal GDP growth, from $70.8 billion to $74.7 billion. Net income, however, shrunk from $20.6 billion to $18.8 billion. This decrease was mainly driven by a considerable depreciation of the company’s gross margin, which decreased from 61.7% in 2018 to $56.7% in 2021. Investors who would also like to include the past twelve months into their analysis will find that Intel’s business fundamentals have deteriorated further: revenues are down 4% versus the FY 2021 and net income almost halved to $11.3 billion.

Given Intel’s fundamental performance, I would expect the company to trade at a P/E of about x8 and a P/B below x1. But this is not the case. INTC shares currently trade in line with the broader semi sector – at a one-year forwards P/E of about x14 and P/B close to x1.5. Moreover, if investors look at Intel’s historical average 5-year P/E multiple vs self, they find that Intel is about standard deviation overvalued. Bloomberg’s Equity Relative Valuation anchors the average historical and ‘fair’ P/E multiple for Intel at x12 (data as of August 16).

Risks To My Thesis

Firstly, the government support for the chip industry, as ‘Chips and Science Act’, could provide a fundamental tailwind to Intel and aid sentiment towards INTC stock. However, increasing government support in the form of ‘non-economic’ subsidies could also be bearish for Intel as competition increases.

Secondly, Intel generates about 90% of revenues from the PC and servers segment. Accordingly, a major global push on PC purchases could result in a significant upward revision of Intel’s EPS estimates.

Residual Earnings Valuation

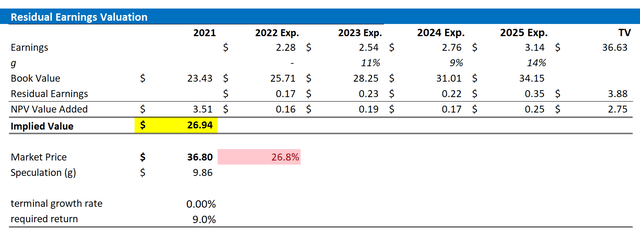

Let us now look at the valuation. What could be a fair per-share value for Intel’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on Intel’s cost of equity at 9%.

- To derive Intel’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 0%. This is more/less in line with Intel’s cyclical adjusted performance for the past 3 years.

Based on the above assumptions, my calculation returns a base-case target price for Intel of $26.94/share, implying material downside of almost 35%.

Analyst Consensus EPS; Author’s Calculation

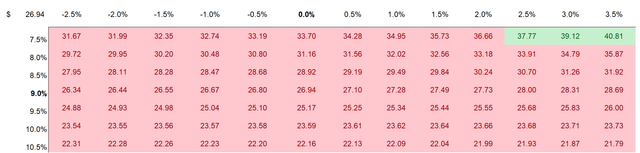

I understand that investors might have different assumptions with regards to Intel’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculation

Conclusion

Reflecting on Intel’s structural underperformance paired with stagnating revenues and depreciating margins, INTC stock looks like a value trap. Moreover, at one-year forward x14 P/E the stock is not trading cheaply and especially considering a slowing PC demand cycle and a very challenging macroeconomic backdrop in general, I see a very unfavorable risk/reward for Intel shareholders. Personally, I calculate that Intel stock is fairly valued at $26.94/share and accordingly see almost 30% downside. I anchor my thesis on a residual earnings model based on analyst consensus estimates. Simply put: Intel is a Sell.

Be the first to comment