Sean Gallup/Getty Images News

YouTube, the video service of tech giant Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL), seems to be making a lot of progress lately, launching new features and taking market share from competitors like Snapchat (SNAP), Meta Platforms (META), Apple (AAPL), Amazon (AMZN), Roku (ROKU), and others. As YouTube continues to grow, its role and importance within Alphabet should only increase.

Therefore, in this article, we will do a deep-dive into Alphabet’s YouTube component, and show some detailed key insights on why it is poised to push Alphabet’s share price higher.

YouTube’s Channel Store

One of the most recent changes in Alphabet’s new strategy when it comes to YouTube, is the new “Channel Store.” A few days ago, YouTube announced that it wanted to launch a channel store to compete with other streaming services such as Apple TV+, Amazon Channels, Roku, and other major streaming platforms.

The concept is to have a store, where users can buy subscriptions to services like Netflix (NFLX), HBO (WBD), Disney (DIS)/Hulu (CMCSA) and others through the YouTube platform itself. That would mean it could be a serious threat to other companies with very similar business models, such as Roku.

Although YouTube has apparently been working on this concept for at least 18 months and is now discussing how a revenue-sharing arrangement would work with its streaming partners. The Channel Store is rumored to be available as early as this fall.

In contrast, Roku generated US$3.76BN in revenue last year. Apple’s TV+ is estimated to have roughly between 20 and 40 million subscribers, generating between US$1BN and US$2BN per year for the Apple Services revenue segment. Amazon’s revenue from its TV business is also not fully available, but its subscription revenue was US$31.8BN in 2021, while it spent US$13BN on video and music costs.

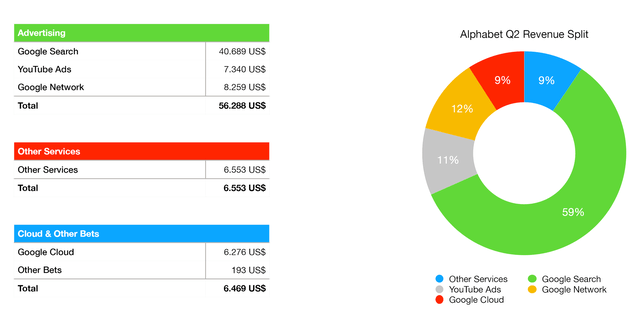

The Cyclicality of YouTube & Google

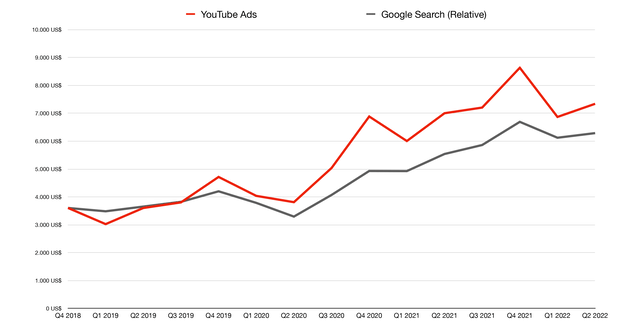

Recently, Alphabet has been providing us with more clarity on what their specific sources of revenue are, including providing separate figures on YouTube going back to the fourth quarter of 2018. We mapped these figures against Google’s largest revenue stream, namely Google Search, and had some interesting findings.

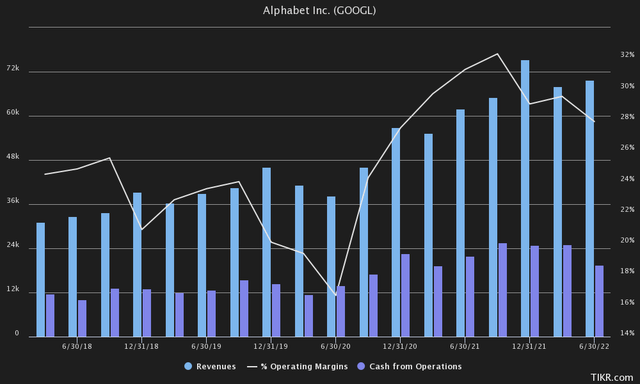

Since the fourth quarter of 2018, YouTube’s ad revenue has increased 103.61% through the second quarter of 2022. This, while Google Search, has increased 74.48%. While that may already be a noticeable difference, we expect this difference to be vastly greater towards the back half of the year. As you can see from the chart below, YouTube’s ad revenue has seen a huge spike in the second half of the year for 3 years in a row, mainly in Q4.

If we look at YouTube Ads on an annual basis in Q4, they have returned an average of 34.07% over the past 3 years. If this trend continues, YouTube ad revenue is expected to reach $11.57 billion, a big difference from the $7.34 billion we saw in the most recent Q2 figures.

YouTube Ads v. Google Search Relative (In Millions of $USD) (Author’s Calculations/ SEC)

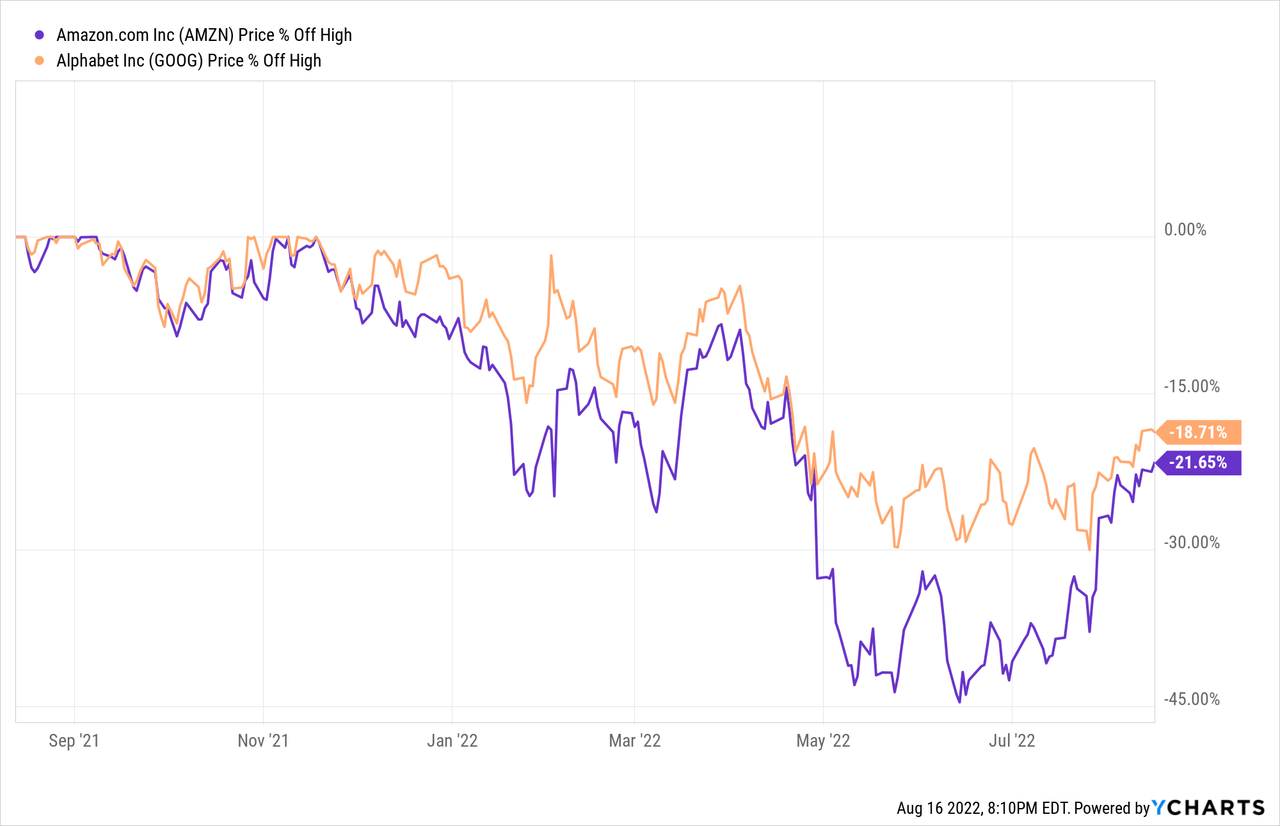

Alphabet’s revenues in general are usually expected to come in lighter in the first half of the year, as most holidays like Thanksgiving, Christmas, Black Friday, New Year, etc. are weighted towards the second half of the year. This is usually when advertisers are at peak spending, as shown in the chart above. Perhaps this is the best time to buy, as the stock is still down almost 19%, and earnings are likely to rise in the second half of the year.

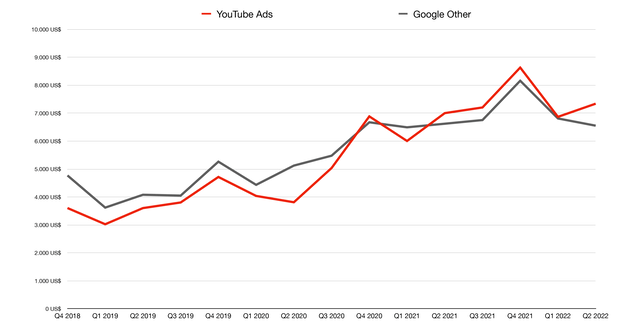

Please note that revenue from YouTube Premium and YouTube TV subscriptions are not included in the YouTube Ads section, as they are “not advertising.” Other services that are also bundled in this “Google Other” section include: Google Play, Fitbit, Google Nest, Pixel phones, and other products/services.

While Alphabet does not provide specific numbers on each individual category, they did disclose that the decline in this “Google Other” category was driven by a drop in Google Play revenue, but was fortunately “partially offset by growth in YouTube non-advertising,” and that “growth in YouTube non-advertising was largely due to an increase in paid subscribers.”

YouTube Ads v. Google Other (In Millions of $USD) (Author’s Calculations/ SEC)

In its SEC filing for the second quarter, Alphabet mentioned that YouTube’s increase in ad revenue was mainly due to its brand, higher spending and improvements in its ad formats and delivery. We’ll look at the latter now.

YouTube Shorts & TV

A fairly new addition to the YouTube suite, came last year with YouTube shorts. It is Google’s attempt to compete with its new emerging media rival, ByteDance, which is still privately owned. YouTube shorts was launched globally in July 2021, but has already taken off.

TikTok’s valuation seemed to have exceeded $460BN earlier last year, based on Tiger Global’s purchase of shares at that time. Although this year the valuation has apparently fallen below US$300BN. Alphabet may well be the best at transitioning to the new format, as other competitors such as Instagram had to roll back their “full-screen feed,” which basically mimicked TikTok, late last month after receiving massive backlash from their users.

However, after just 1 year, YouTube shorts are viewed by 1.5 billion registered users each month with as many as 30 billion daily views based on the latest earnings call. This compares to the estimated 1 billion monthly active users of TikTok and the estimated 1 billion videos watched daily. As for YouTube TV, the service crossed the 5 million subscriber mark in the second quarter. YouTube also announced a partnership with Shopify (SHOP), giving creators an edge by allowing them to link their stores directly on their channels.

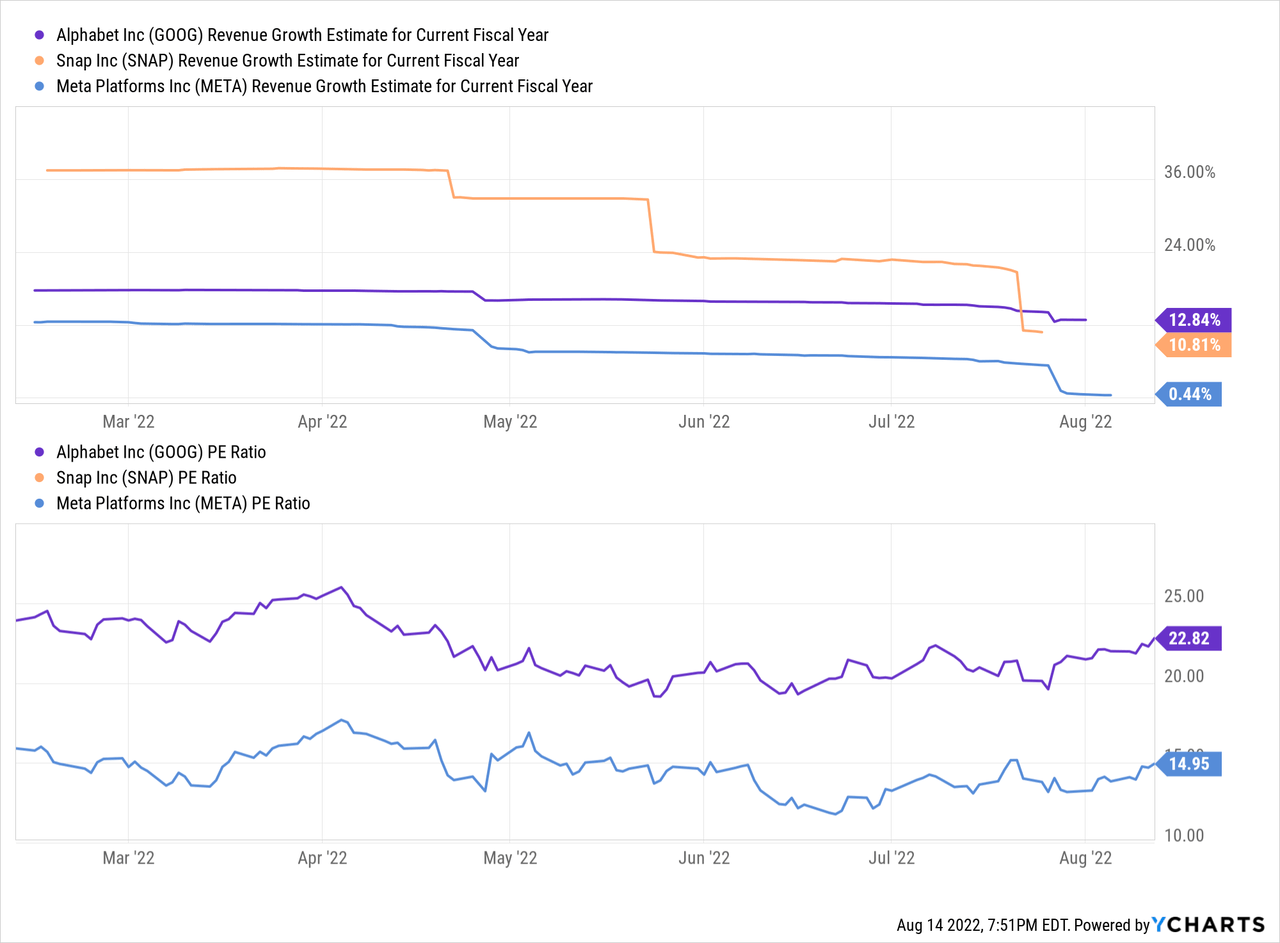

As you can see in the chart above, this is also reflected in the valuation of these companies. Only Meta has better fundamentals in terms of its P/E ratio, although this is likely due to its very weak growth of late, and poor outlook, which has caused investors to rate the company at a terminal growth rate, resulting in a P/E ratio of less than 15.

Snapchat, on the other hand, has a negative price-to-earnings ratio and is not even expected to outpace Alphabet’s revenue growth this year. YouTube shorts themselves are only in the early stages of being tested for monetization with ads, and could add a ton of value to Alphabet, looking at the valuations of TikTok, Meta and Snapchat.

YouTube Premium & YouTube Kids

As mentioned earlier, YouTube Premium and YouTube TV were the reason for Alphabet’s out performance in the “Google Other” service revenue sector.

If it weren’t for Google Play, which was lagging in terms of revenue, the “Google Other” section could have increased significantly more thanks to YouTube Premium and YouTube TV. This came after Google Play had to lower its commissions to 15% last year. Previously, developers usually had to pay a 30% fee for the first year. Currently, about 99% of developers qualify for a 15% fee, which could depress the category’s results for the rest of the year.

YouTube Premium is a service that allows users to watch ad-free videos and music for a monthly or annual subscription fee. The service used to be called “YouTube Red,” but was relaunched as Premium when it had fewer than 10 million subscribers. The service also works on the YouTube kids app, which we believe is another key reason for YouTube’s future success.

YouTube Premium has been successfully relaunched, as by 2020 it had reached 30 million subscribers, more than three times as many as a few years ago, when it was still called YouTube Red. This spectacular growth is currently continuing: Google reports that by September of last year it had reached 50 million Premium and Music subscribers. One of the biggest advantages of such a subscription model could be the ability to raise subscription prices if necessary.

Alphabet only raised prices at its 2018 relaunch, when it changed from $9.99 to $11.99 per month for its new subscribers. This could be done just like Amazon, which earlier this year raised its prices for Amazon Prime up to 43% in certain European countries. This could certainly be a good revenue engine in a recession, when advertising spending is down. We believe YouTube is also excellent at playing the long-term game, capturing long-term market share with its unique YouTube Kids platform.

The platform is focused on providing content primarily to children under the age of 13. We believe it is the only platform that includes the youngest audience, and introduces them to the free-to-use service from a young age, compared to services like Netflix, Apple TV+, and other streaming services that are either paid or do not offer a children’s service.

Recessions & Risks

In our view, there are two risks that could cause the stock to fall temporarily. The first risk is a decline in advertising spending during a recession, and lower growth as a result. The second risk is the threat of regulation, such as fines, lawsuits and class action lawsuits due to Alphabet’s business model.

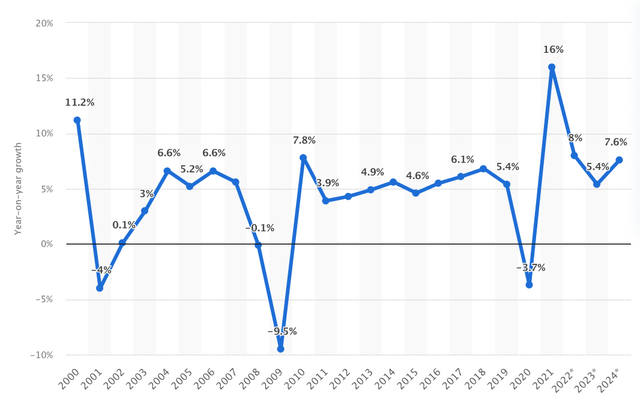

The chart below shows the growth in advertising spending since 2000, with estimates through 2024. We believe that the estimates are still relatively on the high side, as advertising spending turned negative during previous recessions. On the positive side, however, advertising spending usually remained negative for only 1 year, and then rebounded strongly.

Growth of advertising spending worldwide (Statista)

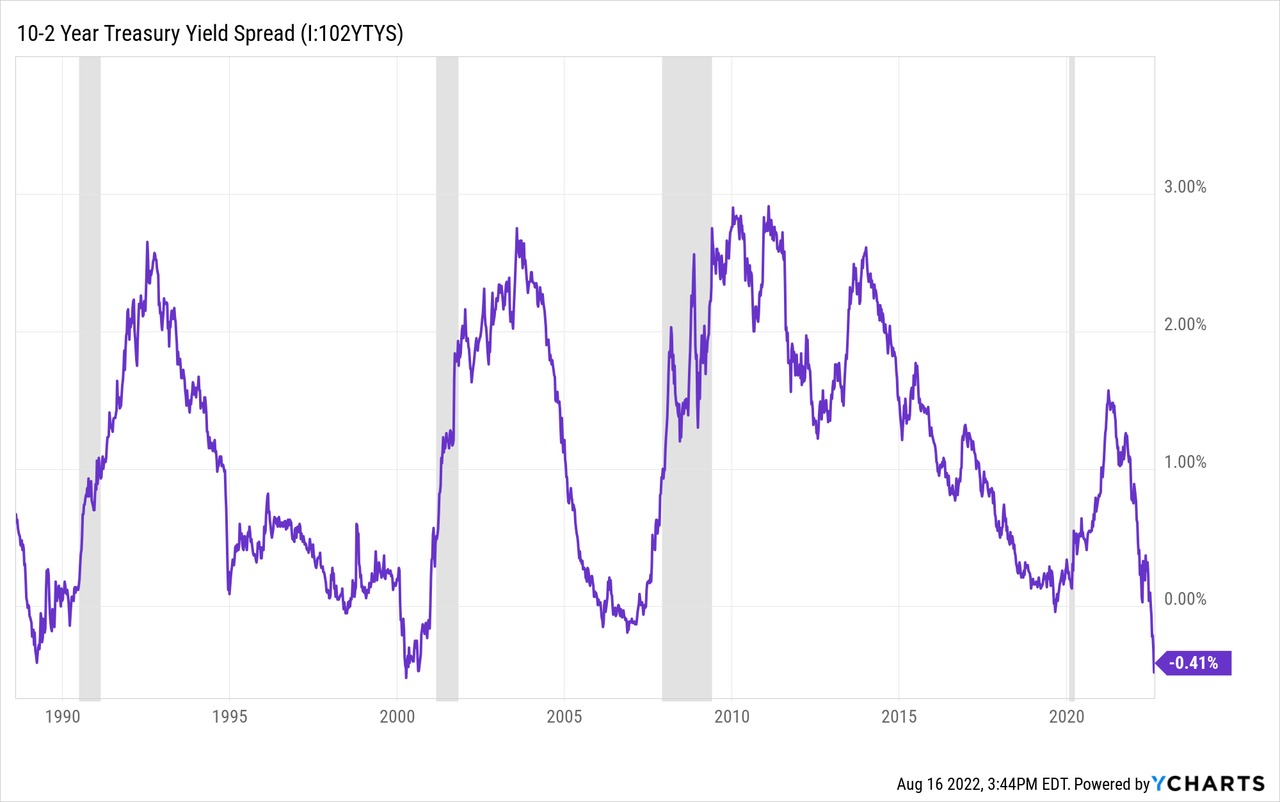

And looking at macroeconomic conditions, it is becoming increasingly likely that we are either in a recession or will be in one sometime between now and next year. For example, the 10-2 Treasury yield curve went below negative 50 bp for the first time in decades a few weeks ago.

It is currently still deeply inverted at -41bp. On the growth front, we have also witnessed two consecutive quarters of negative GDP growth, further increasing the likelihood of a recession. If the labor market were not so strong, we could have been in a recession by now. Although the labor market tends to be a lagging indicator.

Yet despite macroeconomic headwinds, YouTube and Google still managed to perform strongly. YouTube’s ad spending remained strong, as noted earlier, despite workers going back to the office and the economy picking up.

In terms of class action lawsuits, Google got one from Australian Google Play users, over their fee system that would make prices higher for consumers. As we reported, Alphabet already went from 30% to 15% and YouTube’s growth could make up for Play Store losses.

The biggest risk still remains that Europe or the United States will break up Google, as regulators begin to worry about Alphabet’s sheer market dominance. According to Bloomberg, we should also watch carefully for an antitrust case against Google by the DOJ as early as next month.

The Financial Picture

We believe Alphabet is still highly undervalued given its track record of strong growth of 20% CAGR, while maintaining strong margins and being well prepared for a recession with a strengthened balance sheet worth nearly US$125BN in short-term liquidity alone.

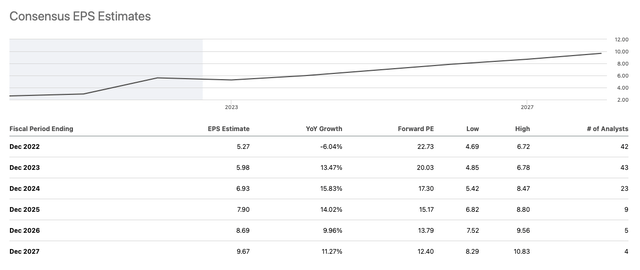

Alphabet is currently trading at a Forward P/E of 13.79 in 2026, despite the fact that it has shown more than 20% CAGR in terms of revenue and net profit. Analysts seem to be quite gloomy for 2022, estimating a significant contraction in the second half of the year and already counting on negative growth for 2022 on an annual basis.

As also pointed out earlier, a contraction in earnings due to a recession, followed by a contraction in advertising spending like in 2000 or 2008, would be a golden opportunity for investors when a sales surge comes. We believe that advertising spending would return very quickly, as it did in 2000 and 2008 or 2020, and investors would be surprised at how quickly advertising spending picks up again when coming out of a recession.

The Bottom Line

YouTube plays an important role when it comes to Alphabet’s competition with other big tech social media companies like Meta, Snapchat, Instagram, ByteDance etc. It seems to be doing this successfully and gaining long-term market share, which should be considered a valuable asset for Alphabet and its share price.

We believe Alphabet itself is also fundamentally undervalued, given its past performance and expected future performance. The stock is currently trading at 13.79x the 2026 price-to-earnings ratio, while it has historically traded at an average of about 27 times earnings. Seeking Alpha’s Quant currently has Alphabet as a “hold.”

Be the first to comment