Sezeryadigar

In an economic storm, finding reliable shelter makes a huge difference to one’s portfolio values. AGNC, the largest Agency mREIT, has 5 different fixed-to-floating preferred stocks to keep us dry – which are best?

The preferreds range from those resetting to 90-day LIBOR plus a credit spread (four issues) to one resetting to the 5-year Treasury Bond plus a credit spread. One of these currently floats (AGNCN); three convert (NASDAQ:AGNCM, NASDAQ:AGNCO and NASDAQ:AGNCP) in early 2024 through early 2025 (all 90-day LIBOR resets); and the last, NASDAQ:AGNCL (5-yr. Treasury Bond reset), converts in 2027.

We look at each in greater detail, but first let’s examine their overall safety since they all rank equally (pari passu) if trouble hits.

AGNC Safety Analysis

Asset Portfolio

AGNC Investment (AGNC) invests in and primarily holds mortgage securities issued by U.S. Government sponsored enterprises like Freddie Mac and Fannie Mae. There are other smaller positions, including hedges. The key takeaway is that all the mortgages are essentially guaranteed by the U.S. government with zero uncured defaults – ever.

Because the bulk of the securities are older (seasoned), they are both fixed rate and far below current mortgage rates. As interest rates rise, these securities fall in value faster than many other fixed rate instruments (low interest payments plus long maturities equals very high duration), pressuring AGNC’s leverage ratio as equity is dissolved by falling mortgage values (AGNC, like other Agency mREITs, marks their portfolio to market for valuation purposes).

AGNC obviously sees rates moving and hedges through a variety of vehicles that all produce income when rates rise and mortgage values fall (capital losses). While the income doesn’t perfectly offset falling values, it provides cash flow to give the mREIT greater flexibility to weather adverse interest rate movements.

Preferred Valuation Metrics

Traditionally, one looks to how much equity sits beneath the preferred, which in this case looks to be about 3.3 times coverage – a fine ratio. We take it further to look at dividend cash flow coverage, which we estimate to be almost 13 times all preferred dividends – excellent coverage that even a curmudgeonly Mr. Burns could love (the Simpsons).

Why do we examine cash flow? mREITs are tax passthrough entities whose pretax and after tax income are identical. Financing rates in the sub debt and preferred stock markets are not identical – preferreds are typically lower because those dividends are paid from after tax income (theoretically much lower than pretax income). Since mREITs use preferreds more like debt than equity, we should also look at them that way; and they do trade partly as a credit spread to their reference interest rates and partly as safety margins to the underlying common equity.

Macroeconomic Environment

First, the Fed has slowed the rate at which it is raising rates, indicating we are nearing the top of the interest rate cycle. That should slow economic losses at Agency mREITs as hedging costs decline.

Second, tight housing supply and much higher mortgage rates make paying one’s mortgage the best bargain in town. No one wants to move until the costs make more sense for any family. As sticky inflation keeps rates relatively higher, AGNC should experience asset value stability with rising income somewhere near the end of 2023 if the Fed’s current forecast is close to true.

Third, relatively healthy employment rates means households can afford their mortgages. The government guarantees are unlikely to enter into any of this.

Safety Conclusions

These are really quite safe. Although mREITs carry high leverage that managers must keep in line, the assets are the highest quality one can find. Barring a Black Swan, the AGNC preferred stocks are well covered and should trade at the better end of the high yield market (there is a lot of senior financing above the preferred that comprises the bulk of AGNC’s leverage).

We can confirm this relationship by looking at the currently floating AGNCN preferred at 90-day LIBOR plus 5.111%. It trades very close to par ($25) in a chaotic market with high yield credits spreads around 5%.

Note: credit spreads can move significantly when economic events dictate change. In a recession, we could see high yield credit spreads move beyond 10 percentage points, which would significantly lower any preferred trading price no matter how frequently it is reset. A changing credit spread will have as much effect on a preferred stock price as any interest rate change. We further note the sharpest spread increases last the shortest amounts of time, too. In other words, Black Swans are resolved and we move on.

Welcome to the Tether Ball

If a preferred stock trades on the combination of current interest rates, credit spreads and equity safety, then there exist conditions under which a preferred stock will tend to trade close to its par value even if there is little chance it will be called by the issuer – a phenomenon called tethering.

How can we predict when and where these phenomena will appear? We do not have crystal balls, but we have good indications of the directions in which we are likely heading. Between the Treasury yield curves, Fed pronouncements and published economic data we can see most people expect a shallow recession next year followed by weak recovery.

In that environment, we see stabilizing interest rates offsetting declining consumer credit to keep credit spreads a little wide – about where they are today.

Looking forward is important because four of these preferreds are going to convert from 2024 to 2027. Here are the details:

| Ticker | Current Dividend | Convert Date | Index | Credit Spread | 12/14/22 Price | Yield to Convert | Adjusted YTC |

| AGNCL | $1.9375 | 10/15/27 | 5-yr. Treasury | 4.39% | $22.14 | 10.81% | 10.81% |

| AGNCM | 1.71875 | 4/15/24 | LIBOR* | 4.332 | 20.58 | 22.55 | 20.00 |

| AGNCN | 2.2972** | 10/15/22 | LIBOR | 5.111 | 24.92 | N/A | N/A |

| AGNCO | 1.625 | 10/15/24 | LIBOR | 4.993 | 20.76 | 17.47 | 17.47 |

| AGNCP | 1.531251 | 4/15/25 | LIBOR | 4.697 | 19.85 | 16.97 | 16.97 |

Source: SA, Quantum Online and my calculations

*LIBOR will cease to be published in June 2023 to be replaced by 90-day Term SOFR as administered by the CME. In general, 90-day LIBOR will be replaced by 90-day Term SOFR plus 26.2 basis point. Currently, LIBOR is trading just inside that spread.

**Implied annual rate based on latest LIBOR reset.

Who Is Invited?

For any floating rate security to tether near its par price, it must reset frequently enough to keep duration very short – typically 90 days or sooner. Four AGNC issues should tether depending on the required credit spread over the interest rate index.

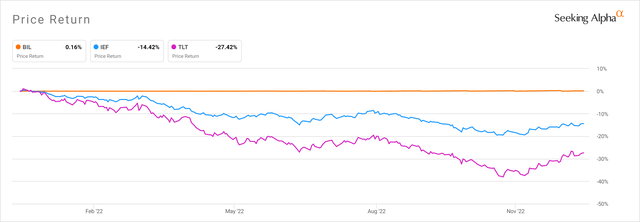

If you want to see proof, simply look at how much a 90-day T-bill ETF moves in price versus longer dated Treasury ETFs. The reset date, or maturity date, being so soon keeps the price from falling as much longer dated treasury instruments.

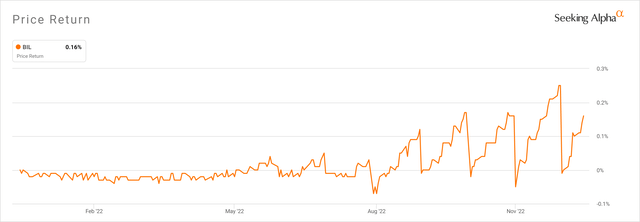

The short term T-Bill ETF clearly holds its value as it moves between resets:

As rates moved higher, the accrued interest increased between resets while holding its capital value very near par.

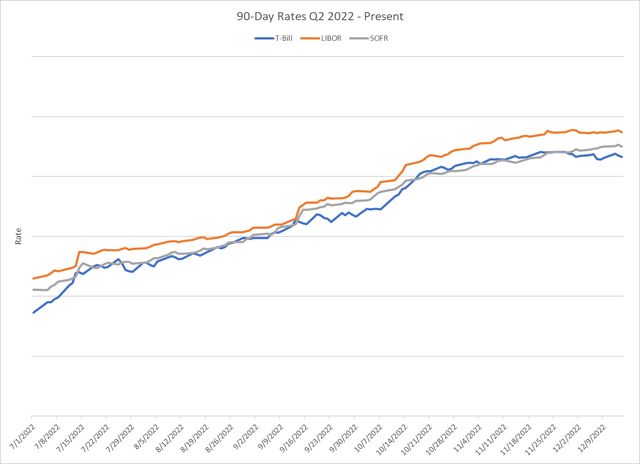

Our preferreds are priced against indices other than Treasuries, so let’s see how the 90-day T-bill, LIBOR and Term SOFR rates have moved since July 1, 2022:

90 Day Rates in 2022 (CME, Global Rates. com, US Treasury)

We see these move as expected with T-Bills typically offering the lowest rates. Now that we see how a 90-day reset security should trade with respect to rate resets, what credit spread is required to keep any issue near par?

Credit Spreads Determine Winners

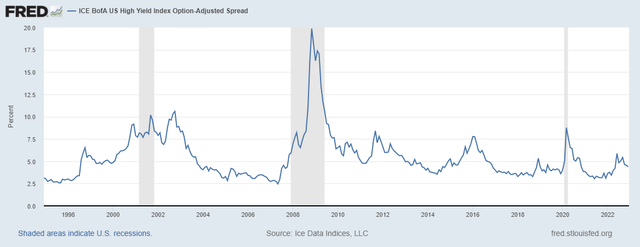

Preferred stocks with too low a credit spread will not make it back to par on their own. How those credit spreads are assessed is not a clear science. There is no published list of where mREIT Agency FtF preferreds should trade relative to T-bills or any index rate. We have to look at existing data to see how spreads have tended to move. The following graph details high yield (less than investment grade) spreads from 1997 to today:

St. Louis Fed High Yield Spreads (FRED Economic Data)

After we filter out black swans like 9/11 in 2001, the GCF in 2008, COVID in 2020, we see high yield credit spreads cluster around 4-4.5% and are currently around 5% today, or slightly elevated and predicting a slight recession in high yield debt.

We expect 2024 through 2027 to be choppy with a recession that could be worse with some late recovery to growth by 2026. Absent a Black Swan between now and then, we see any of the Agency FtF preferred with less than a 4.5% spread as too little to make it back to par.

We further see most Agency mREIT issues priced their margins over the floating rate index around 5% – that makes good sense. It makes further sense that we see higher margins in the non-Agency mREIT sectors, too.

With a 4.332% margin over LIBOR, AGNCM is a weak tether candidate that will need a little push to get to par. If 22.55% YTC is too high, where should it settle?

AGNCM’s margin is 16.8 basis points below 4.5%, which is worth $0.042 a year of as an annuity value. Assuming a 5% discount rate, that $0.042 a year is worth an $0.84 discount from par, or an implied price upon conversion of $24.16 assuming historic credit spreads hold. That takes our yield to convert down from 22.55% to an Adjusted YTC of 20%, still materially above its stablemates.

Not bad and as rates come down, all preferreds tend to trade higher, giving the AGNCM a better than even shot of getting to par in 2025 if the Fed’s prediction of inflation falling to 3.1% by the end of 2025 is anywhere close to correct.

The other three LIBOR based FtF issues have floating margins much closer to 5% with the AGNCP having just enough margin to make it tether in our forecasts.

We have 3 issues we expect to tether, one of which already trades in the high 24’s (AGNCN). Which one an investor might prefer depends on style and one’s goals.

Above Par?

Before we move on, a quick note on premia to par: we do not expect much movement above par unless it’s clear the issuer cannot call the issue.

Staying materially above par for a long time is unlikely because rates falling enough for the preferreds to trade that high in price implies an issuer can sell a cheaper preferred into the market. Then the issuer can redeem the more expensive issue at par instead of its above par price. That happens a lot in mREIT preferreds because they are used more like unsecured debt than permanent capital.

Matching Issues to Investing Styles

We typically see three different approaches on SA: Traders, Buy and Hold/Yield Based Investors, and Technical/Cyclical Investors.

Traders are typically short-term in nature (Colorado Wealth Fund publishes analyses we believe are great for that approach). Buy and Hold folks are typically passive yield/income investors more concerned with income than capital values. Then there are technical/cyclical investors who look at total return over parts of the economic cycle or during a technical cycle.

We fall into the cyclical investors universe where the economic/interest rate cycle dictates how we rotate sectors – a medium term horizon.

For traders, we see lots of inefficient pricing due to low trading volumes and a lack of analyst coverage. Any of these securities can provide volatility and profitable trades.

For income focused investors, we like the AGNCN until rates peak and then lock yield longer. The AGNCL provides both the longest protection today and five years after each reset. It also will not tether under most conditions due to the longer reset periods, either.

For cyclical investors, we like the AGNCN for holding cash and the AGNCM for the superior YTC and the upside opportunity if rates fall faster than the Fed predicts (the Treasury yield curve is predicting this).

Conclusions

- Preferred stocks trade on a combination of yield over a credit spread and margin of safety above the common stock. If interest rates or credit spreads rise, the preferred price falls. As threats to the common stock mount, the preferred price falls;

- Preferreds that reset their dividend rates every 90 days or sooner tend to be very price stable after conversion (assuming no further credit spread adjustments);

- The credit spread over an interest rate index determines whether a floating preferred can tether to par organically;

- Using a yield to conversion (YTC) calculation for FtF preferreds with appropriate credits spreads gives useful total return expectations that we recommend using to value residential Agency mREIT FtF preferreds.

- We use our AGNCN as a high powered “savings account” and are buying AGNCM for its adjusted YTC of 20%.

Be the first to comment