onurdongel/E+ via Getty Images

Investment Thesis: G-III Apparel Group seems undervalued at the current price, and could see a significant rebound assuming continued sales growth.

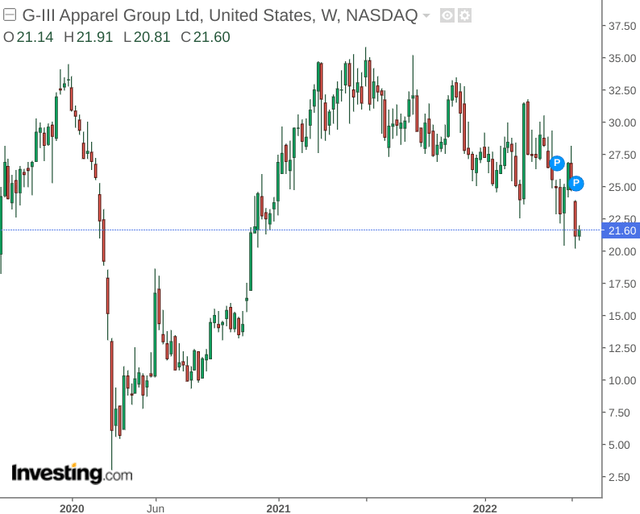

G-III Apparel Group, Ltd. (NASDAQ:GIII) saw a strong recovery in its stock price post-COVID, before seeing a gradual decline into 2022 as inflationary and supply chain concerns have started to weigh on the broader economy.

As a leading American clothing company, G-III Apparel Group manufacturers and markets men’s and women’s apparel through owned brands such as Donna Karan and DKNY, as well as through licenses with large brands such as Calvin Klein and Tommy Hilfiger.

The purpose of this article is to determine whether G-III Apparel Group has the potential to see renewed upside from here.

Inventory Ratio Analysis

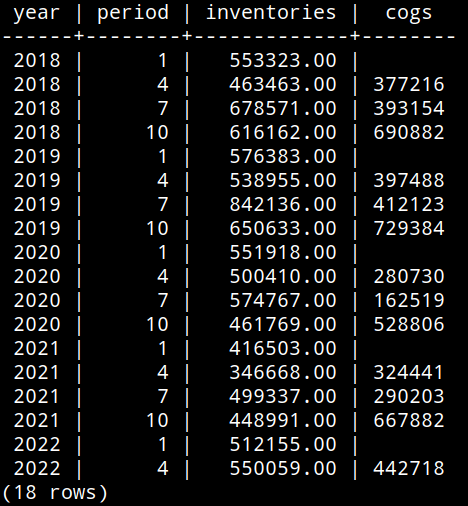

To determine the overall trajectory of inventory turnover on a yearly basis, I calculated the ratio by summing up the cost of goods sold across each quarter in a particular year, and then divide this by the average inventory across each quarter for the year. The calculations were performed using SQL – with the relevant figures sourced from historical quarterly reports for G-III Apparel Group. Note that the inventory levels recorded at the end of January were included in the financial statements ending for April of each year and have been included (cost of goods sold figures were only included for the months ending April, July, and October). Here is the original collated data:

Figures sourced from historical quarterly financial reports for G-III Apparel Group. SQL Table created by author.

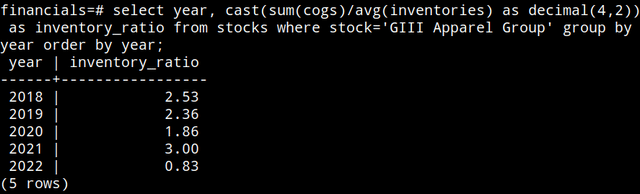

When calculating the inventory ratio on a yearly basis, the results are as follows:

Calculations made by author using SQL.

When taking into account that the inventory ratio for 2022 only includes performance up to April, we can see that the ratio in 2021 was at its highest level in four years.

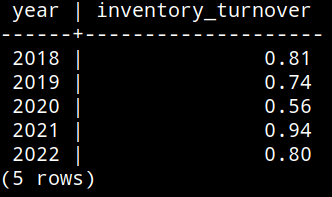

Additionally, when comparing the inventory ratio recorded for the month of April (i.e., cost of goods sold for April in any particular year divided by the recorded inventory for April) – we can see that turnover is less than that recorded in 2021 but still higher than that recorded in 2019 and 2020.

Calculations made by author using SQL.

It should be noted that since the inventory for the month of April only is being used – this may not account for seasonal fluctuations as was done when averaging for the whole year. However, a preliminary analysis would suggest that while inventory turnover has the potential to remain at the higher end of the historical range seen in the last five years – we could see a drop in turnover from that of last year.

Looking Forward

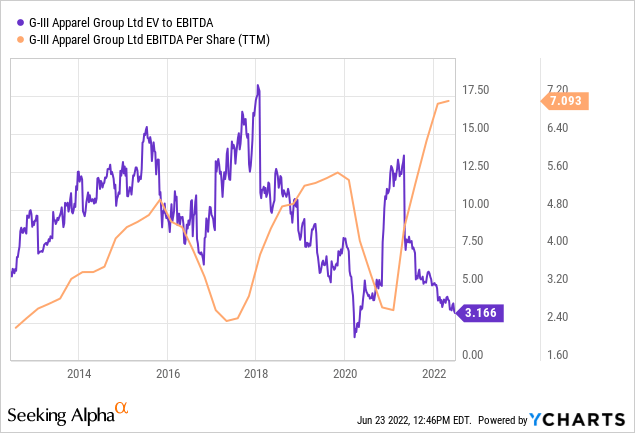

When looking at the EV/EBITDA ratio for G-III Apparel Group, we can see that the EV/EBITDA ratio is trailing near a 10-year low while EBITDA per share is at a 10-year high.

YCharts.com

This would suggest that the stock is undervalued and investors are possibly being too avoidant of the stock given current macroeconomic and supply chain concerns.

While we have yet to see how sales performance will ultimately pan out this year, I take the view that if we see the inventory ratio achieve similar levels as that of last year, the stock could see significant upside. That would serve as a signal that sales growth still remains strong despite macroeconomic pressures.

In terms of potential risks aside from inflationary pressures – the effects of recent COVID lockdowns in China have yet to be fully realized. With the company’s owned brands such as Donna Karan and DKNY having a sizable manufacturing presence in China, the disruption to the company’s supply chain could mean that even if demand remains vibrant in spite of inflation – the company may not be able to fulfill demand due to shortages.

On the other hand, the upcoming quarters could also reflect a potential sales boost coming from the completed acquisition of the Karl Lagerfeld brand, which itself saw growth of 40% in sales in 2021 as compared to 2020.

Conclusion

To conclude, in spite of the macroeconomic risks, I see G-III Apparel Group as a potential buy at the current price. The company has continued to see growth in earnings and inventory turnover, and should we see a continuation of this trend – then I take the view that the market could potentially reward the company’s resilience in terms of being able to bolster sales despite supply chain constraints.

Be the first to comment