Denis Linine/iStock Editorial via Getty Images

Analysts covering Microsoft (NASDAQ:MSFT) are claiming a bright future is ahead. The reports state Azure will disproportionately benefit from growing demand for cloud services and will continue to narrow the gap with AWS. Investors will also see increased value from large share buyback programs and an increasing dividend. Despite this growth, the stock has dropped by nearly one-quarter since the beginning of the year due to tech selloffs. This has caused many investors to want to jump into the stock. However, it still appears to be slightly overvalued and does not give an adequate margin of safety. Therefore, I would like to see the stock continue to fall before buying.

What Does Credit Suisse Think of Microsoft?

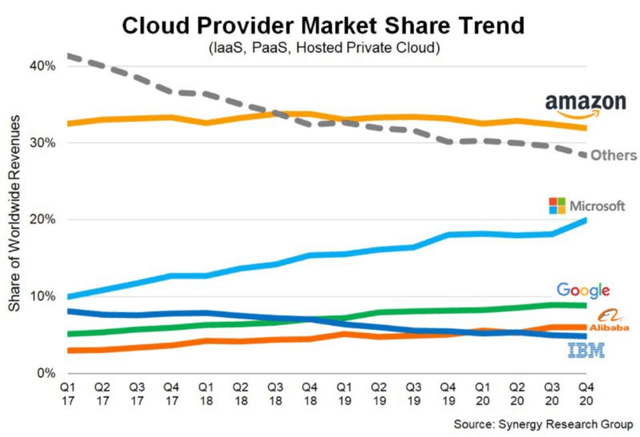

Credit Suisse (CS) recently announced it expects Microsoft Azure to disproportionately benefit from an accelerated shift to cloud services. The reasoning behind this statement is because Azure is narrowing the gap with Amazon’s (AMZN) AWS while also widening the gap with Google Cloud (GOOG)(GOOGL). Furthermore, Azure is growing meaningfully faster than AWS, Google Cloud, and Alibaba Cloud (BABA) when achieving similar revenue run-rate milestones.

Since the end of 2017, it is estimated that Azure has increased its market share by over 9 percentage points to reach 21% in the most recent quarter. During this time, AWS has continued to hover at around 33% of the market share.

Cloud Services Market Share (Synergy Research Group)

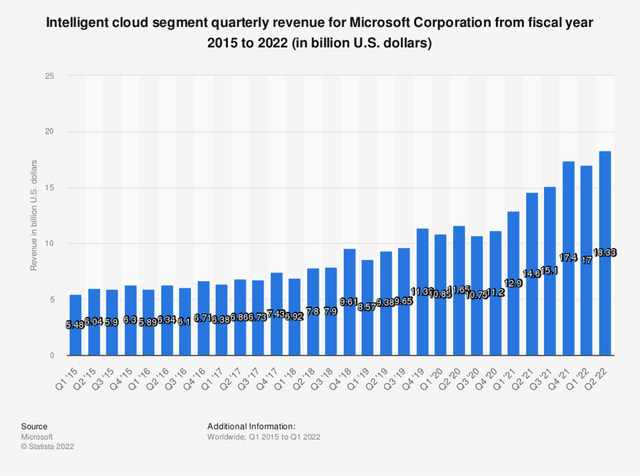

Although Azure’s fundamentals are not broken down by Microsoft, we can still see how the Intelligent Cloud segment has performed over the past few years and compare this to AWS. From 3Q15 to the company’s most recent earnings report, cloud revenues have increased from $5.9 billion to $19.05 billion. This calculates to a Y/Y CAGR of about 18.2%.

Intelligent Cloud Revenue (Statista)

AWS has also been growing rapidly during the same time period. Since 3Q15 to the most recent report, AWS had increased its revenue from $2.09 billion to $18.44 billion. This is a Y/Y CAGR of 36.5%. While this may seem like bad news for Azure, it is important to note that the growth rate stated for Microsoft includes many other products outside of Azure. Therefore, it is difficult to see Azure’s true revenue growth rate to compare to AWS.

Other Analysts Are Betting on Microsoft Too

Other analysts are betting on Azure and other products from Microsoft too. Wedbush recently stated Microsoft is a top pick in the current market due to continued cloud growth. Other analysts are stating the acquisition of Activision Blizzard (ATVI) and focus on Xbox will help Microsoft grow and diversify.

Furthermore, Microsoft Edge is expanding its user-base. Now that Internet Explorer is officially shut down, Microsoft plans to expand on Edge and continue to make it more popular among consumers. The company’s most recent effort to do this is by adding a free built-in VPN to Edge. Edge has recently become the second most used Desktop browser worldwide, only being behind Google Chrome. This new VPN is a unique offering from Microsoft to create continued growth. Other popular browsers have VPNs but they must be paid for. The only other browser that has a free VPN is Opera, which Microsoft is leagues ahead of. All in all, Microsoft is set to see higher fundamentals from both Azure rising in market share and its other products expanding their features.

Large Share Buybacks and Dividends Give Shareholders Increased Value

Last year, Microsoft announced a $60 billion share buyback program. At the time of this announcement, the buyback represented a buyback ratio of just under 3% of shares. Microsoft will likely continue to issue more share buybacks in the future due to the company having a large cash position and ability to generate a strong free cash flow. In its most recent quarter, the company had $104.69 billion in cash, as well as generating about $20 billion in free cash flow. In the same time period, Microsoft bought back about $8.35 billion worth of shares.

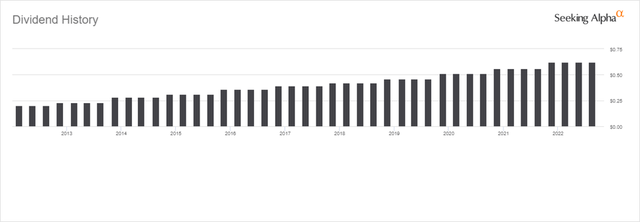

On top of the large share buybacks, Microsoft continues to raise its dividend. At the same time of announcing its share buyback, the company also announced a dividend hike of 11% to $0.62 per quarter. This follows Microsoft’s trend of consistently increasing its dividend. Over the past 10 years, the quarterly dividend has increased from $0.20 to $0.62. This calculates to an annual CAGR of 12%. Once again, this trend will likely continue to increase due to Microsoft’s large cash position.

Microsoft Dividend History (Seeking Alpha)

Why Did Microsoft Stock Drop So Much?

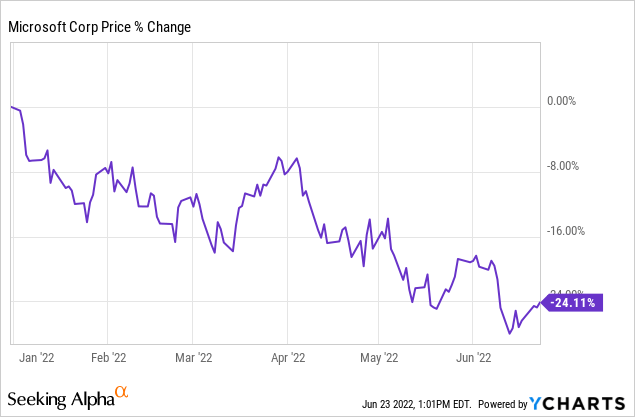

Despite Microsoft likely having a bright future, its stock is down nearly 25% since the beginning of the year. This could allow investors to see great value from an investment if they can get in at the right price.

One of the biggest reasons why Microsoft stock is down a large amount this year is because of the selloff of the tech sector. Rising interest rates and worries of a recession are causing investors to move away from tech and into consumer staples and other stable investments. Furthermore, many tech companies are lowering their headcounts in anticipation for worse futures. Meta Platforms (META) froze hiring due to lower revenue caused by changes to Apple’s (AAPL) privacy options. Robinhood (HOOD) and Coinbase (COIN) also recently laid off large percentages of their workforces. These are causing concerns for many other tech companies, including Microsoft.

Supply chain issues are also causing Microsoft to see decreased demand and production. Microsoft’s products like Xbox and Surface need chips to be manufactured. As long as the chip shortage continues, the company will not be able to manufacture enough of these products and will likely see lower revenue. The chip shortage also hurts computer manufacturers like Dell (DELL) and HP (HPQ). These manufacturers use Windows as an operating system and as long as their manufacturing is restricted, Windows will see less demand.

However, the rising demand of Azure is placing Microsoft ahead of many other tech companies. Azure allows the company to protect itself from downturns in other aspects of its business and we are already seeing this with its share price being down much less than other competitors. Companies like Netflix (NFLX) and Spotify (SPOT) are down 60%-70% YTD due to seeing inflated demand during the pandemic. Azure allows Microsoft to see continuously high demand even after the pandemic and allow the company to thrive in the upcoming future. However, getting into Microsoft at the right price is crucial.

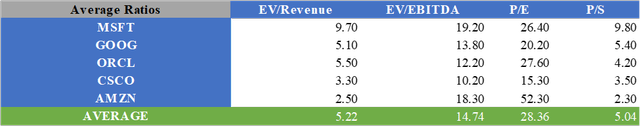

The Stock’s Multiples are Higher Than Competitors

Since Microsoft is a very sought after stock, its multiples are far above many of its competitors. The company currently has the highest EV/Revenue, EV/EBITDA, and P/S multiples of any of its major competitors. The stock currently has the second highest P/E only behind Amazon. It is important to mention that Amazon’s core retail business has much higher expenses than AWS, meaning its margins are much lower than Microsoft’s, which causes a higher P/E.

Another reason, besides its high quality business model, for many of Microsoft’s higher multiples is because of the company’s net debt. Microsoft currently has a net debt of -$26.7 billion. Since this figure is included in many valuation methods, it causes the intrinsic value to be much higher than companies with a positive net debt. Therefore, Microsoft’s higher multiples could be justified in the eyes of many investors.

Valuation

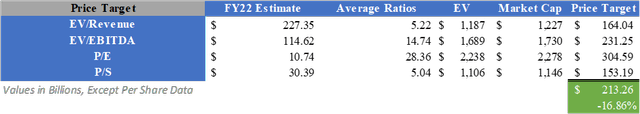

Despite if the valuation multiples are justified, I believe it is best to be as conservative as possible when valuing a stock. Therefore, I will use a relative valuation with industry-average multiples as well as a DCF. For the relative valuation, I multiplied consensus analyst estimates for FY22 by the average multiples for EV/Revenue, EV/EBITDA, P/E, and P/S of Microsoft and its competitors. After adjusting for the company’s net debt and averaging the price targets, a fair value of $213.26 can be calculated. This means the stock could have a downside of 16.86%.

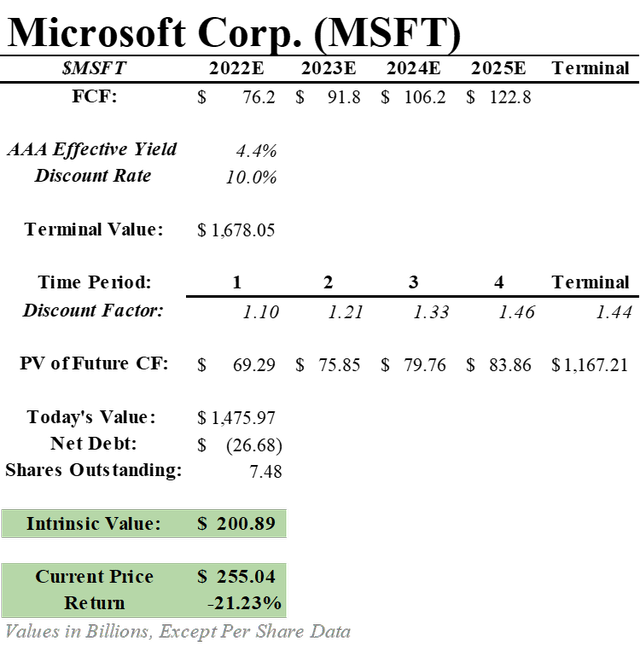

For the DCF, I used consensus analyst estimates for Microsoft’s free cash flow in the upcoming years. I then used a discount rate of 10% to give a nice premium over current AAA corporate bonds and a terminal growth rate of 2.5%. After finding the sum of the discounted cash flow projections, adjusting for net debt, and dividing by the number of shares outstanding, a fair value of $200.89 can be calculated. This gives the stock an implied downside of 21.23%.

What Does This Mean for Investors?

Microsoft likely has a very positive future ahead due to Azure closing the gap with AWS and widening the gap with smaller competitors. Azure is seeing massive growth in revenue and increasing its market share at a rapid rate. Many analysts are claiming Azure will disproportionately benefit from increased demand for cloud services and this will push the stock higher. Investors are also seeing increased value due to increased share buybacks and a great dividend. Despite these reasons for growth, the stock is down nearly 25% YTD due to a general selloff of the tech sector. While this may seem great for investors looking to buy, I would like to see it drop a bit more to provide a margin of safety. Therefore, I will apply a Hold rating to Microsoft stock.

Be the first to comment