Artyom_Anikeev/iStock Editorial via Getty Images

Why do I believe Rolls-Royce (OTCPK:RYCEF) stock just hit rock bottom?

Let’s have a look at the idiosyncratic factors leading this aerospace manufacturer’s recent rally. And what recent price action looks like from a technical point of view. You may not have heard of Rolls-Royce other than a luxury car manufacturer.

Which it is, and great cars indeed, but it’s also a major player in the aerospace, energy, and defence industries. In fact, the company has recently made three major announcements that could lead to more sales and higher revenues. We’ll look at them in more detail separately.

Electric Luxury Vehicles

Probably, Rolls-Royce’s most famous product is its luxury cars. And they also happen to be some extremely beautiful machines. Traditionally these vehicles carried large V8s, which would not have been of any concern until a few years ago.

I’m not sure how conscientious people are about gasoline cars but governments around the world are. Various countries are to prohibit the sale of cars that do not comply with zero emissions by 2035 or 2040.

Rolls-Royce has been getting itself ready, and in October 2022, announced that it had already secured 300 pre-orders for its new $413,000 Spectre all-electric model. That fact on its own is meaningful, but I believe we should also look at how much of a margin there is for Electric Vehicle growth.

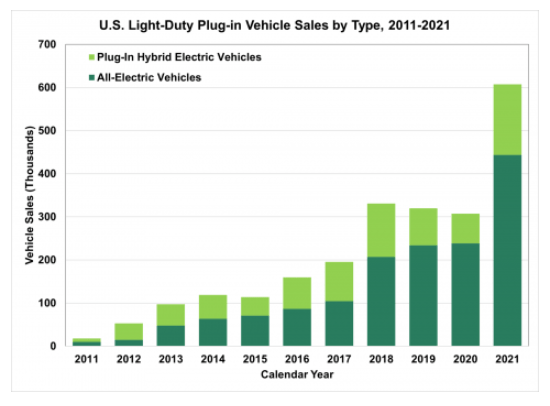

The chart below shows the growth of alternative fuel and hybrid electric vehicles from 2011 to 2021. As we can see growth has been consistent and is steadily gaining speed. I see no reason to believe that the electric vehicle market has topped out yet or anywhere close.

EV and HEV Vehicle Sales (energy.gov)

Of course, Rolls-Royce cars are not mainstream, but they should still take a similar portion of EV sales as they now take in gasoline car sales. In 2021, Rolls-Royce sold nearly 5,600 cars worldwide. So, I believe they have a lot of room for growth here.

Plus, according to data by Experian, EV sales grew by 60% in the US for the first quarter of 2022. And currently, EVs only account for 4.6% of new registrations.

Nuclear Energy Program

Rolls-Royce is developing a Small Nuclear Reactor (SMR) program, designed to be more cost-effective than traditional plants. These plants produce around one-seventh of a typical nuclear power plant but at one-twelfth the cost.

The company is making use of its technology and know-how of nuclear energy from the manufacture of nuclear submarines. RLLCF has secured GBP500 million, GBP210 million coming from the UK government.

The project design of SMRs would allow the company to produce power plants to local country specifications. Which would mean these plants could be exported across the globe. As an example of demand, the United Arab Emirates began constructing a Korean-designed nuclear power plant in 2012, and in 2020 the first electric power was delivered to the grid.

Hydrogen Fuelled Airplane Engine

In November 2022, Roll Royce announced it had successfully tested a new hydrogen jet engine. The news is important for an industry accused of causing a large share of Co2 emissions. The statement from the company said this was an “exciting milestone” in their quest for zero-emissions flight.

The test was conducted with EasyJet, a company that together with Rolls-Royce has committed to net zero carbon emissions by 2050. The testing is in the early stages and other companies such as Airbus are also exploring hydrogen-fuelled airplane engines.

However, Rolls-Royce is first past the post in completing a successful test run. It’s still early to determine how this market will develop and where the company can position itself. However, they have a small starter advantage and are giants in conventional airplane engines. This leads me to think they would be leaders in this segment also.

Rolls-Royce Technical Viewpoint

This is where we would want to see the technical picture aligned with the fundamental view of Rolls-Royce stock price. And indeed, in my opinion, the technical indicators I follow lead to a bullish trend for this manufacturer.

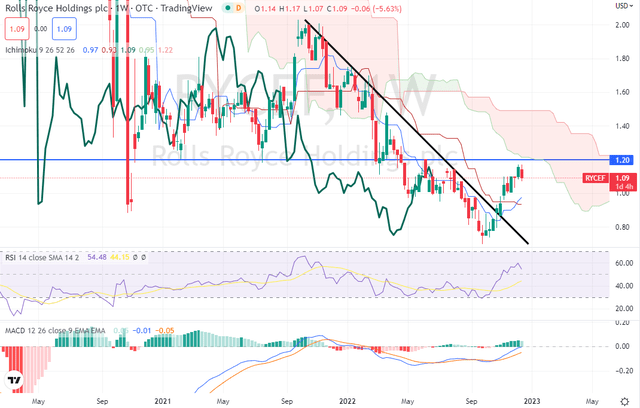

Let’s see what I found. I use the Ichimoku Kinko Hyo, the RSI, and the MACD together with support and resistance levels to determine my technical view. From the weekly chart below, we can see that RCCLF stock price is still below the Ichimoku cloud indicating the market is still in a long-term bear trend.

However, the other indicators are both showing signs of bullish momentum. The MACD shows the fast line above the slow line and gaining faster. They haven’t crossed the zero line yet for full confirmation of bullish momentum.

While the RSI, although more of an overbought or oversold indicator, is above 50 which indicates bullish momentum also. And lastly, price action broke through a major resistance line (black line) 7 weeks ago. Which also indicates there could be more bullish action.

RLLCF weekly Chart (TradingView)

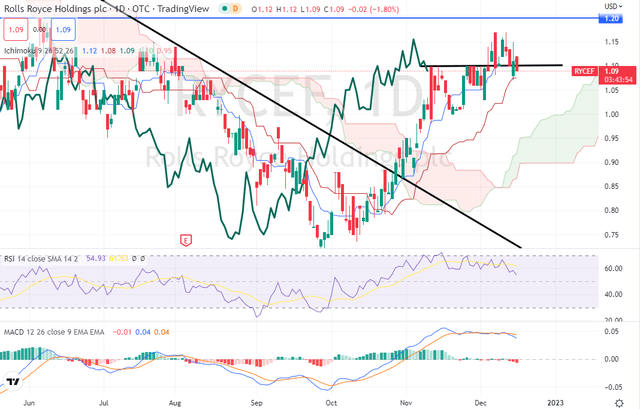

Looking at the day chart we see a clear bullish environment. The indicators although tipping south are still in bullish territory. While price action is above the Ichimoku cloud, confirmation from the lagging line (green line) also present, and both the fast moving average (blue line) is above the slow moving average (crimson line).

RLLCF stock price recently broke a resistance line at $1.10 but it remains to be seen if it can hold it. The next test comes at $1.20 which is a resistance line from the weekly chart. Overall, my technical view is bullish short-term with price action needing to cross above the weekly Ichimoku cloud for long-term confirmation.

Conclusion

In a time of global economic uncertainty, it makes a lot of sense to think carefully about which stocks have the longest runway and the best chances of producing revenue streams. RLLCF stock looks like it has both of those in my opinion.

The company is involved in business lines that are not about to go away any time soon. People need energy and transportation, which will continue to be in demand, even better when using clean energy. And the demand for luxury products is expected to continue growing as the world gets richer.

I see these factors converging to create considerable increases for Roll Royce revenues and a bullish environment for RLLCF stock price. Of course, there is always the risk of overestimation and bad corporate governance. But then, with no risk, there would be no reward.

Be the first to comment