Tommaso Boddi

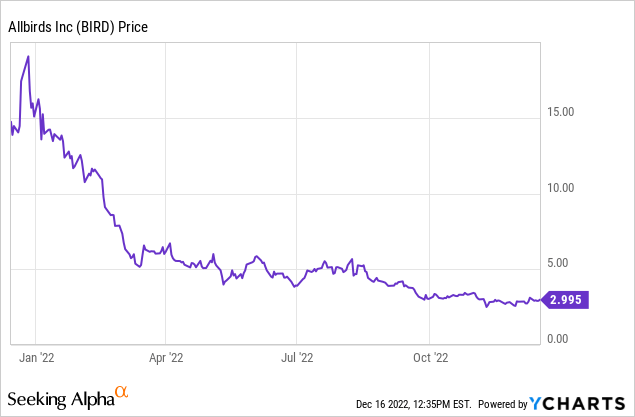

While so-called “disruptive commerce” stocks were all the rage during the pandemic, these companies have struggled through 2022 as both investors retreated from growth appetite and consumers pulled back on discretionary spending amid a looming recession. One of the hardest-hit names this year is Allbirds (NASDAQ:BIRD), the sustainable footwear company that is known for producing high-comfort shoes made of wool.

Year to date, shares of Allbirds have declined a whopping 80%. Though Allbirds has retained double-digit growth rates and remains a market-share gainer in footwear, the company has struggled to hold onto its profitability and may need to rely on more discounting to keep up its growth.

I remain neutral on Allbirds and don’t consider the stock a must-buy rebound play. Though the continued slide in the stock has made it more attractive as a potential quick-flip rebound, I think there are too many fundamental clouds on the company’s horizon that will make a near-term rally difficult.

In particular, Allbirds is heading into the critical holiday period (with affordable shoes in the ~$100 price range, Allbirds products are highly giftable) amid a tough macroeconomic backdrop. The company has noted that it is entering Q4 with higher promotional activity than in prior years, which will have an impact on gross margins. At the same time, the company’s adjusted EBITDA is slipping: and though Allbirds did restructure its headcount, the fact that it laid off “only” 3% of its staff in November (versus double-digit percentage headcount reductions for many companies in Silicon Valley) doesn’t give us much confidence in Allbirds’ ability to swing to a profit anytime soon, especially if gross margins continue to head south.

At the same time, we should acknowledge that Allbirds’ continued stock price deterioration has positioned it favorably from a valuation perspective. At current share prices hovering around $3, Allbirds’ market cap sits at just $445.8 million. After we net off the $180.7 million of cash (against no debt) on Allbirds’ latest balance sheet, the company’s resulting enterprise value is $265.1 million.

Next year, Wall Street analysts (per Yahoo Finance) peg Allbirds’ consensus revenue at $362.3 million, representing 17% y/y growth (potentially aggressive; as this represents acceleration over Allbirds’ FY22 guidance range of 10-14% y/y growth). This puts Allbirds’ valuation at just 0.7x EV/FY23 revenue. While we lament the fact that Allbirds’ gross margin is slipping, we do still think that a consumer-products company with margins in the high 40s/mid-50s, at scale, can eventually grow to become quite profitable as long as Allbirds can navigate through the current harsh environment.

All in all, I’d adopt a watch-and-wait stance with Allbirds. Holiday results will give us direction on whether Allbirds can keep up its growth rates (without dipping too much into promotions and sacrificing margin) and directionally point us to how long Allbirds can last on its existing liquidity without tapping into additional capital in a challenging market.

Q3 recap

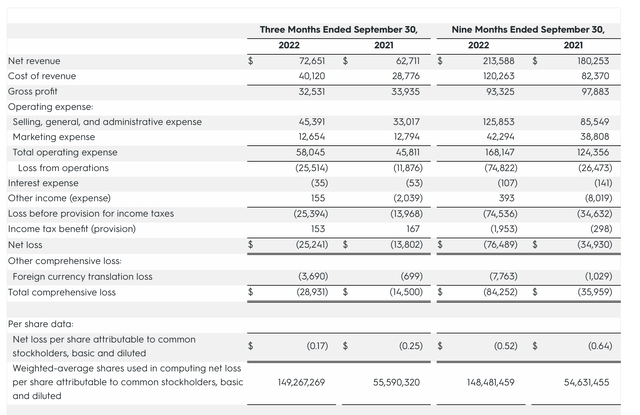

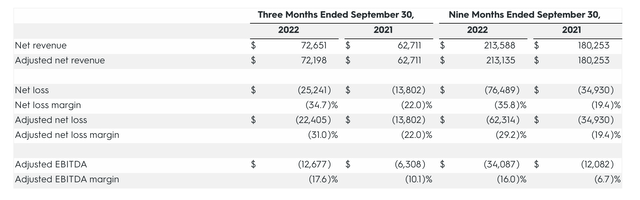

Let’s now go through Allbirds’ latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Allbirds Q3 results (Allbirds Q3 earnings release)

Allbirds’ revenue in Q3 grew at a 16% y/y pace to $72.7 million, beating Wall Street’s expectations of $67.8 million (+8% y/y) by a huge eight-point margin. Also of note is the fact that revenue growth accelerated slightly over 15% y/y growth in Q2.

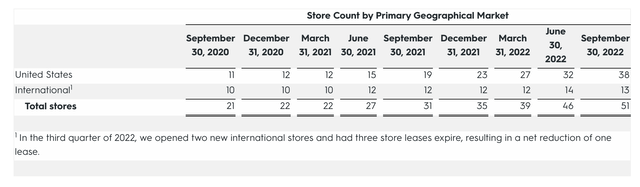

Several drivers are behind the revenue beat. The first is that Allbirds opened five net-new stores in September: six in the U.S., and closing one store overseas. The total store count of 51 is 65% larger than last year.

Allbirds store count (Allbirds Q3 earnings release)

The company also noted that reseller partner sales are picking up, and that in particular sell-through at REI stores is gaining traction.

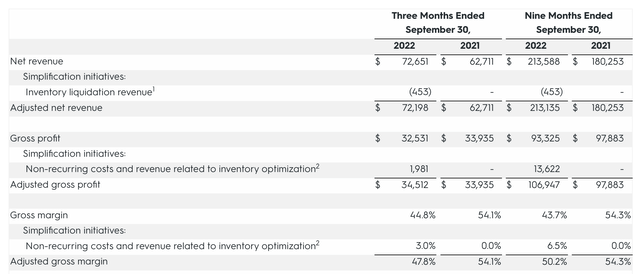

However, part of the lift in sales is also due to a step-up in promotional activity, which the company expects to ramp further in Q4. The resulting impact here, however, is that adjusted gross margins took a hit – down 630bps to 47.8% in the quarter after eliminating three points of one-time drag from inventory optimization.

Allbirds gross margins (Allbirds Q3 earnings release)

Outside of higher promotional activity, other factors that dragged on gross margins included a revenue mix shift away from international (which has higher margins than in the U.S.), as well as a revenue mix shift toward channel partners like REI with lower net effective prices.

Here is management’s commentary, delivered on the Q3 earnings call, on the plan to step up promotions in Q4 – which is driven in part by competitors’ actions as well (key points highlighted):

Since we last spoke, we are seeing increased choppiness in the external environment, in addition to worsening FX headwinds and extended COVID lockdown in certain areas of China. We expect Q4 to be negatively impacted by persistent inflation and high levels of promotional activity, which will impact our U.S. business, along with a weaker consumer backdrop in Europe and worsening FX headwinds. In fact, we are preparing for a scenario in which consumer headwinds worsened in the coming months, and as the full impact of these myriad market dynamics are fully digested by consumers […]

Looking ahead to holiday season, we expect the external environment to be the most promotional we’ve experienced since launching the company in 2016. Despite that, we have prepared a great product road map alongside the right mix of inventory, and we’ve coupled that with a strong holiday marketing campaign. Taken together, I feel confident as we head into this all-important season despite the noisy external environment.”

Driven primarily by its gross margin decay, Allbirds’ adjusted EBITDA loss doubled y/y to $12.7 million, representing a -17.6% adjusted EBITDA margin – a 750bps deterioration from -10.1% in the year-ago Q3.

Allbirds adjusted EBITDA margins (Allbirds Q3 earnings release)

Meanwhile, year to date, the company has burned through $82.2 million in operating cash flow (-$107.2 million in free cash flow, after accounting for $25 million of capex primarily associated with new store openings). The company’s $180 million of balance sheet cash is supported by an unused $40 million credit line. At its current run-rate, the company should be able to last through 2023 without raising additional capital, as long as losses don’t continue to accelerate from here – however, as cash dwindles, Allbirds’ strategy to rely on opening new storefronts to drive growth may become more pinched.

Key takeaways

It’s difficult to feel confident on Allbirds as we head into the holiday season. Allbirds’ steep gross margin decay is further complicated by the fact that Q4 is expected to be even more promotional than Q3 (driven by competitive behavior). Watch and wait here until we see more evidence that the company is on solid ground.

Be the first to comment