Editor’s note: Seeking Alpha is proud to welcome Stephen Frampton as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Sitthiphong

The time is right to begin building a position in Nuvei (NASDAQ:NVEI), a quality, growing, and reasonably priced stock. In the short term, the price could fluctuate dramatically on sentiment, but in the long term, the company’s returns could be significant.

Nuvei is a payment service provider (PSP) that competes with the likes of Stripe (STRIP), Worldpay, Adyen (OTCPK:ADYEY), and Fiserv (FISV). They make money from the merchants who use their platform by way of a fee on volume of sales and subscriptions for services provided. Nuvei reaps most of its profits from online payments (e-commerce), with a special concentration of revenue (25%) coming from regulated online gaming.

The payments industry is a lucrative one, but also an economically sensitive one. As a result, the current bearish mood in the markets has crushed the valuation of these stocks.

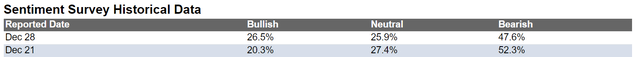

There are twice as many bears as bulls! (AAII Sentiment Survey)

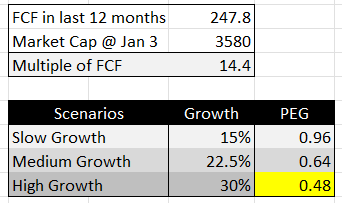

Nuvei’s business has shown few signs of slowing, however, with continued growth despite headwinds. The price could go lower in the short term, but at its current valuation of 14x-15x free cash flow and a medium-term growth rate in the range of 20%-30% (for a PEG well below 1), Nuvei is looking like a great risk-adjusted pick. Though that assumes we have the patience to hold on despite volatility.

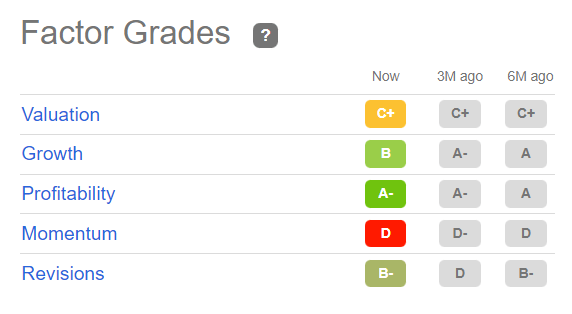

Seeking Alpha’s quant rating for Nuvei is currently a hold, based on the following factors:

Momentum extremely poor (Seeking Alpha Quant Factors)

In this article, I’m going to run Nuvei through my own critical factors so you get an idea why I differ from SA and rate the stock a buy.

Management: Competent Owner-Operators

Companies where the founder is both the operator and a significant owner are positive for shareholders because one can have extra confidence in the integrity and ability of management. When a CEO has skin in the game, they tend to make better decisions. Founder and CEO of Nuvei, Philip Fayer, founded the predecessor to Nuvei in 2003 and grew it to where it is today. He owns 20% of the shares and 33% of the voting rights. We can be confident that management’s interests are aligned with the long-term interests of shareholders.

High Returns on Capital Employed

According to Warren Buffett, “The primary test of managerial economic performance is the achievement of a high earnings rate on equity capital employed (without undue leverage, accounting gimmickry, etc.).” Using a house as an example, if you were to buy a home for $100,000 cash, it rose in value 10% that year, and you rented out the basement for $10,000, you “made” $20,000. Divide the earnings ($20,000) by the equity capital employed ($100,000) and the house has a return on capital of 20%. You, the “manager,” made an excellent investment, almost as good as Berkshire Hathaway (BRK.A).

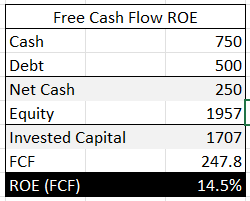

How is Nuvei’s management doing? We’re going to use free cash flow to find out instead of earnings because earnings can be manipulated. For example, Amazon (AMZN), to avoid taxes, purposely keeps earnings low by expensing investments as R&D and using depreciation to hide profitability. Nuvei is much like Amazon in this respect: lower earnings, but big free cash flow. As such, it seems appropriate to value it using the metric the business is optimized for. Below is the calculation:

Nuvei generates a fair amount of cash in relation to its equity (Numbers from TIKR Terminal)

14.5% is a good return on capital, especially in an environment where long-term bonds are returning 3%-5%. Furthermore, management expects FCF margins to increase as the business matures, as per Nuvei’s Q3 earnings report. This makes sense because Nuvei doesn’t need to invest much more capital once the technology is developed; they just have to maintain it, update it, add to the infrastructure when needed, and win customers. Like Alphabet (GOOG) or Microsoft (MSFT), it’s the type of business model that is capital-light and scalable. Even higher returns on capital are possible in the future.

Sizable Growth Runway

According to the Q3 earnings report, 87% of Nuvei’s revenue comes from payments made for goods and services on the internet – i.e., e-commerce. E-commerce is a secular trend that is not slowing down. E-commerce retail sales are expected to rise by around 10% annually over the next five years and take up a greater portion of total retail sales. It’s a trend that’s growing much faster than the economy at large.

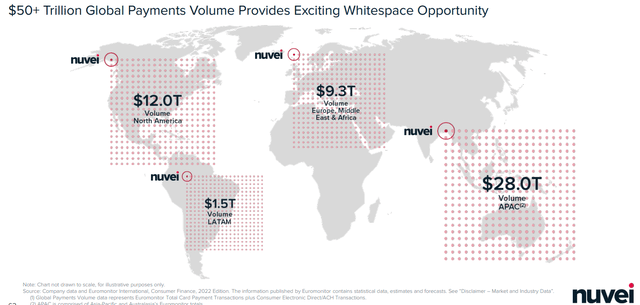

In addition to being tapped into this secular growth trend, the existing market for payments is massive. Nuvei estimates the total addressable market globally is $50T. Currently, Nuvei processes only $95B of it. That means Nuvei processes less than 0.01% of global payments – lots of market share left to take.

Nuvei’s estimate of global payment market, by geography (Nuvei Capital Markets Presentation 2022)

Nuvei also makes acquisitions from time to time to expand product offerings and grow its customer base. Importantly, CEO Fayer noted during the most recent earnings call that they refrained from acquiring any businesses in 2021 because valuations were too rich. This shows maturity on the part of management, which I find encouraging. Acquisitions are a small but important part of Nuvei’s growth story.

These three factors – secular growth of e-commerce, acquisitions, and a massive payments market to grow into – have driven gross payment volume growth at a 30% annual rate. Management suggests this could continue into the foreseeable future.

Management is guiding high (Nuvei Q3 Earnings Report)

Moat – Durable Competitive Advantage

An economic “moat” is required to maintain high returns on capital employed. A moat prevents competitors from crossing into your business castle and lowering your returns to the industry average.

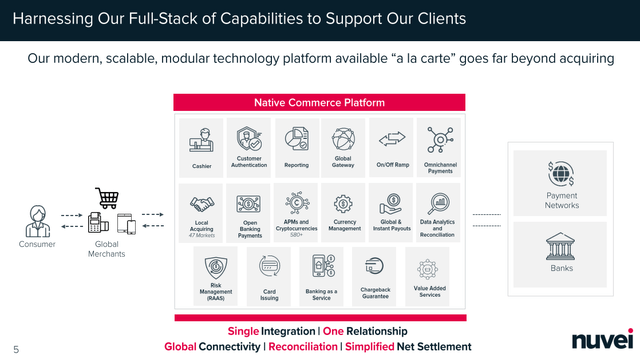

The payments industry is incredibly competitive. Except for the payment networks – Visa (V) and Mastercard (MA) – everyone else is fighting for each inch of competitive advantage. That said, Nuvei’s platform has managed to differentiate itself from lower quality competitors. Nuvei has vertically integrated across the whole range (full stack) of payment services. Except for owning the network or the bank, Nuvei does the rest: processing, acquiring, refunding, merchant reporting, authenticating, derisking, currency managing, and more (even accepting WeChat pay and cryptos). It’s a one-stop shop for merchants. Only a handful of PSPs have this full range of functionality.

Nuvei’s services (Nuvei Capital Markets Presentation 2022)

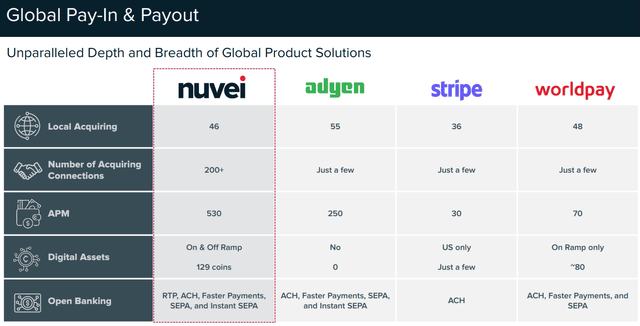

In addition, Nuvei is the world leader in the number of payment methods accepted, at 530, and competes with the best in terms of number of local payment acquirers and connections.

Nuvei compares well with top competitors (Nuvei Capital Markets Presentation 2022)

Lastly, Nuvei has carved out a niche in regulated online gaming (betting and gambling). According to comments made in 2022’s capital markets presentation, many of the major online gaming websites and apps in North America have chosen Nuvei. It’s not a glamorous honor, but in the payments industry any distinction counts.

Nuvei has done as good a job as a payments company can do in terms of creating a durable competitive advantage. They have world-class technology, top-tier connections and even a niche they dominate (however small and ignoble). That said, Nuvei cannot be said to have moat in the same sense as the railroads or Google search. Nuvei’s lack of moat is a disadvantage that must be made up elsewhere for this to be a solid investment.

Profitability/Free Cash Flow

A business must be profitable and/or cash flowing in order for me to invest in it. A company that generates free cash flow often does not need to issue shares or debt to finance its growth. Most of today’s biggest companies were profitable from the start.

In the last 12 months, Nuvei earned revenue of $834.86M and free cash flow of $247M, resulting in an excellent FCF margin of 31%. Gross margins have been consistently around a whopping 80% (numbers from TIKR Terminal). A high gross margin is a great sign of pricing power; Nuvei’s vertical integration is clearly demonstrating cost savings.

Nuvei not only generates free cash, but it also generates a lot of it, meaning investors don’t have to worry about excessive dilution or debt. It also is enormously profitable, which is indicative of excellent pricing power and competitive position. Nuvei is extremely attractive on this metric.

Strong Balance Sheet

The balance sheet tracks the assets, liabilities, and equity of a company. Any issues with liabilities would show up here; Nuvei has no such issues. With $250M more cash than long-term debt, their debt could be extinguished at any time. Nuvei has nearly twice current assets to current liabilities (current ratio of 1.88), meaning that short-term liabilities are taken care of, in addition to long-term debt. Nuvei has a pristine balance sheet over which investors can salivate.

Smaller Company

In his book “One Up on Wall Street,” legendary investor Peter Lynch said he preferred companies that were smaller because it increases the ability of them to double in price, double again, and double again. Put concretely, it’s going to take a lot for $2T Apple to double (it might need another planet), while a $10M company might just need one new customer to double. The chances of catching a multibagger are much higher in quality small and medium caps than are in large caps or mega caps. The probabilities favor the smaller companies, so I prefer to look there.

Nuvei is not a small company, but with a market cap of “only” $3.5B, a little growth into the huge payment market goes a long way, especially compared to other PSPs like Fiserv ($64B) or Adyen ($43B). We can count Nuvei as a potential multibagger.

Share Count Under Control

Dilution can be a major drain on returns. If a company grows its earnings by 20% but in order to do so issued 20% more shares, then shareholders received no net gains whatsoever. However, if a company grows earnings by 20% and uses those earnings to buy back 20% of its shares then it returned around 40%. Shareholders clearly prefer the latter to the former.

Nuvei issues shares as compensation for employees, but did begin buying back shares as the price fell substantially. Nuvei is neither a massive diluter nor doing massive buybacks, so overall it’s neutral for this criterion. That said, because insiders own a lot of this stock, FCF is so high, the balance sheet so pristine, and the growth so spectacular, it would not surprise me if Nuvei buys back a significant percentage of the company as long as the share price remains depressed. Nuvei investing in Nuvei would be intelligent and positive.

Industry Sentiment and Outlook

As a longer-term investor, I prefer investments that have a positive future outlook but negative current sentiment. That’s because this means the businesses have a higher chance of being around in the future while being marked down in the present. Nuvei falls into this category. As an economically sensitive technology company, rising rates and a potential recession are hitting Nuvei hard right now. However, Nuvei operates in payments, a service the world can’t function without. Temporary forces are driving the price down of an essential service. From a long-term perspective, this is an optimal setup for maximizing returns.

In the short term, the negative sentiment could take the price anywhere, even further down, in which case I would just buy more. Let’s explore the price now.

Reasonable Valuation

The PEG ratio, popularized by Lynch, is a simple and effective way to calculate price relative to growth. The weakness of the common P/E ratio is that it doesn’t account for growth. A stock might look cheap based on a low P/E multiple, but if the underlying business has ceased to grow then such a low valuation is justified. Inversely, some higher P/E multiple stocks with strong, growing underlying businesses can be better value than low P/E multiple stocks because they are compounding capital, not simply preserving (or destroying) capital.

The PEG ratio is an improvement on the P/E multiple because it can put these two businesses in the same terms; it can compare apples to oranges. You simply take the multiple or earnings or FCF and divide by the growth rate of earnings or FCF. A company growing earnings at 20% with a 20 P/E multiple would have a PEG of 1 (20/20). As investors, we’re looking for PEGs below one. Lynch suggested PEGs of 0.5 are the treasure we seek.

Nuvei might be that treasure. Management has guided 30% revenue growth until 2027 and 50% FCF margins by 2027 (from the 30% today), which seems aggressive, but not impossible given the size of the market and Nuvei’s operating leverage (the extent to which new revenue is not accompanied by new costs). Significant growth in revenue and incremental growth in margins is very possible. I take this into account in the PEG calculation below:

PEG Ratio Calculation (Author’s Calculation)

As we can see, even in a low-growth scenario, Nuvei’s PEG ratio is 1. This suggests that on the pessimistic end of possible outcomes, Nuvei is fairly valued. In a best-case scenario (high growth) the PEG ratio hits Lynch’s treasure mark, below 0.5, suggesting the stock might be undervalued significantly and become a multibagger.

The PEG ratio is an excellent valuation estimator, but not much of a valuation tester. If we want to know what expectations are built into a price, the discounted cash flow model is the gold standard.

The DCF Model of valuation extrapolates future free cash flows according to a set of assumptions, discounts (reverse compounds) the cash flows back to the present and adds them together to determine the net present value of the business. Benjamin Graham derided this kind of valuation as “dividing estimates by guesses and setting the result to 3 decimal places.” It’s true that this type of analysis can give a false sense of accuracy and precision, so we shouldn’t just believe the value we come up with, but it does allow us to effectively test assumptions, which is quite valuable. Valuation is always a bit of a guessing game, but it’s nice to know what the guesses are.

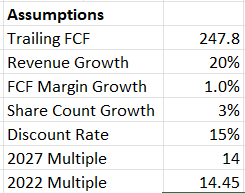

The assumptions I’ve built in for Nuvei are below: relatively safe revenue growth assumption (considering its history and guidance), half the margin expansion management guided, a relatively high amount of share growth, a fairly aggressive discount rate (considering its balance sheet), and the exit multiple being the same as the present multiple, despite extreme bearishness in the market toward stocks like this one.

Fairly conservative assumptions overall (Author’s DCF Analysis)

The results are as follows:

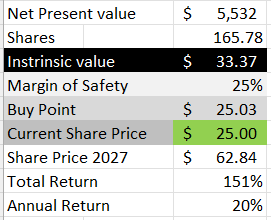

Nuvei’s price is well below intrinsic value (Author’s DCF Analysis)

The intrinsic value (the sum of the discounted future cash flows) is $33.37/share. If we apply a 25% margin of safety (to account for mishaps in our assumptions) a safe buying price for Nuvei is around $25/share, or right around where the price is today. If we were to sell in 2027, we could expect a total gain of 151%, or $1 becoming $2.5, for an annual return of 20%. That sounds pretty good to me.

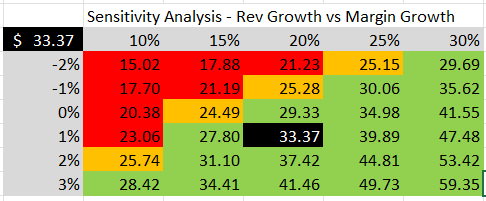

We can fiddle with the assumptions to see what happens to the intrinsic value if, say, revenue and margin growth differ materially from our assumptions. The results are below:

The x-axis tracks revenue growth and the y-axis tracks Margin Growth. The cell where they meet is the intrinsic value under those assumptions (Author’s DCF Analysis – Sensitivity Analysis)

The black square is our base-case scenario, corresponding to our assumptions above (20% revenue growth and 1% margin growth). The orange squares are the scenarios built into our margin of safety. The red square are those scenarios not priced in. As we can see, a fair amount of missed expectations is built into the current price (~$25/share).

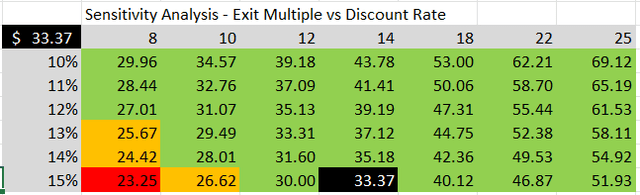

Another important set of assumptions are related to valuation. If the market decides to pay up for Nuvei stock, then we can expect our return to increase. Likewise, if the market decides it doesn’t like Nuvei, then our multiple could compress, weighing on returns. Moreover, the discount rate we use to reverse compound future cash flows has a huge impact. Typically, the discount rate is chosen in relation to the company’s weighted average cost of capital (the cost of money to the company), which is significantly affected by interest rates and market risk. Were interest rates were to go lower and perceived risks were to lessen, Nuvei would be valued using a lower discount rate, causing the present value of future cash flows to increase, increasing total return and vice versa. The results are below:

The x-axis tracks the exit multiple of FCF and the y-axis tracks the discount rate. The cell where they intersect is the intrinsic value of the stock under those assumptions. (Author’s DCF Analysis – Sensitivity Analysis 2)

Like the previous sensitivity analysis, the black square is our base-case scenario corresponding to the assumptions we used in the original DCF (14 multiple on FCF and 15% discount rate). The orange squares correspond to the scenarios built into our margin of safety. The green squares are what our current price is pricing in. Any decrease in the discount rate would see Nuvei go much higher, but that would require central banks to lower interest rates and perceived risk to decrease, which seems unlikely as of now. Moreover, for the multiple to go lower than 10 seems unlikely given the growth and margin profile of this business. As such, I am happy with the assumptions built into the margin of safety because they seem on the unlikely side of events.

Overall, the valuation appears reasonable, even valuable, based on our PEG ratio and DCF calculation of intrinsic value. In addition, the current price is pricing in significant negative surprises (i.e., bad news) in terms of valuation and growth factors. Nuvei looks to be at a price point that we could begin a position.

Scoring Nuvei

If I were to score Nuvei on the criteria outlined and discussed above, it would look like this:

- Competent Owner-Operators: 5/5

- High Returns on Capital: 4/5

- Moat – Durable Competitive Advantage: 2/5

- Long Growth Runway: 4/5

- Profitability/Cash Flow: 5/5

- Strong Balance Sheet: 5/5

- Smaller Market Cap: 3/5

- Share Count Under Control or Being Reduced: 4/5

- Market Sentiment and Outlook: 4/5

- Reasonable Valuation: 4/5

Total: 40/50 = 80%

Risks and Drawbacks to Nuvei

Volatility is not risk, but it can feel like it, and Nuvei will have its fair share. It makes its money from fees on volume of sales processed. If that volume were to go down (in a recession, for example), profits would fall accordingly. Likewise, when the economy is booming, volume of sales could increase dramatically, causing profits to skyrocket. Over the long term, I believe the average growth will be significant, but it won’t be for the weak-stomached.

This issue is potentially compounded by the fact that 25% of revenue is concentrated in regulated online gaming, which is highly cyclical. When people have less money, they gamble less and vice versa. Nuvei’s profits could swing significantly with this dynamic.

Gaming exposure also makes Nuvei feels like a “sin stock,” a stock that makes money unethically, immorally, or at the expense of someone else (like cigarette companies, for example). Companies that don’t add value but exploit weaknesses are also perhaps destined for obsolescence and troubles, as attitudes toward their business get increasingly negative. That said, activities like smoking, drinking, eating junk food, and gambling seem to be part of human nature and have existed for millennia, but that doesn’t mean we need to invest in it. For those who do invest, they are exposed to added social risk and increased volatility as a result.

Speaking of volatility, Nuvei also processes crypto payments – or, to use the sanitized term, “digital asset sales.” Until the crypto crash, Nuvei received 10% of revenue from crypto transactions. Exposure to this sector has been drastically reduced, but is present. The CEO expressed during a recent earnings call that they would not be aggressively pursuing this line of business in the future, but it is nonetheless present.

Perhaps most significantly, competition is formidable. Nuvei is currently doing very well from a technological standpoint, but that can change quickly. It is a smaller player in a field of giants, which is why the opportunity is so great, but also why it is fraught with risk. That said, with gross margins at 80%, Nuvei is clearly putting the pressure on others, not vice versa, for the time being. This could change, in which case I would withdraw my investment, but at present Nuvei’s competitive position is strong.

Another risk is the valuation: It is good, but not great. In the long term, if the thesis plays out, we’re splitting hairs here because the stock will be up significantly anyway. But in the short term, not quite all the downside is priced in. There is room for a serious recession or collapse in sentiment to drag the price lower.

Conclusion

The time is right to begin building a position in Nuvei. However, as Seeking Alpha’s quant rating suggests, momentum is not on the stock’s side. But this could be seen as an advantage for the long-term investor, as it means the price could remain depressed, giving us time to build a position before momentum swings back positive. If that’s the case, I’ll be happy to grab more.

Be the first to comment