Aranga87/iStock via Getty Images

“At the rate we are currently adding carbon dioxide to our atmosphere, within in the next few decades the heat balance of that atmosphere could be altered enough to produce marked changes in the climate”.

Glenn T Seaborg – Nobel Prize winning chemist and chair of the US Atomic Energy Commission – wrote in 1966!

Since then there have been 27 UN climate change conferences around the world and they have achieved nothing except help add to the estimated 700 gigatonnes of CO2 we have thrown up into the atmosphere. That is close to the amount emitted since the start of the Industrial Revolution in 1760.

At the latest one of those UN gatherings of world leaders and “experts” in Egypt no one knows how many delegates were there but the number was estimated to be 45,000! Plus media reporters etc.

All arrived from around the globe on fossil fueled polluting planes, going to conferences in vast halls and staying in air-conditioned hotels all using electricity generated by fossil fuels. And – like most before – the only agreement reached was when and where the next such gathering should be held!

The term ESG came from the United Nations Environment Programme Initiative in 2005. It has become just another useless expression that turned into greenwashing by many companies. The E for Environment and S for Societal are anyway inextricably linked to the G for Governance – good governance that is.

I am concerned about the environment and endeavour to invest accordingly. Cleaning it up and making money doing so is a good motivator! For me that means searching for companies that are doing likewise; practical things in place of PR buzzwords and that means good governance

Air Products (NYSE:APD) is one of my choices as it is a leader in both LNG – a cleanish transition fuel – and the ultimate clean fuel that hydrogen will be.

My confidence in a strong 2023 and beyond for APD is founded on the vast – and mostly untrumpeted about – sums of money being invested hydrogen worldwide.

I will expand on those later but first will say more about…

Air Products and Chemicals

Air Products and Chemicals, Inc. (APD) is an industrial gases company. The chemical part of the name has been dropped for normal communication purposes by the company because it no longer makes chemicals; it supplies gases to those that do. APD provides essential industrial gases, related equipment and applications to customers in various industries, including refining, chemical, metals, electronics, manufacturing, and food and beverage. The Company’s segments include Americas, Asia, Europe, and Middle East and India. The Company is also a supplier of liquefied natural gas process technology and equipment. The Company develops, engineers, builds, owns and operates industrial gas projects, including gasification projects, carbon capture projects,, and carbon-free hydrogen projects supporting global transportation and energy transition. It supplies various gases, such as argon, carbon dioxide, food gases, helium, hydrogen, oxygen, and nitrogen. Its applications include aeration, cooling, cryogenic freezing, filling, fire suppression, heat treating, hydrogen fuelling, hydro processing, melting, inserting/blanketing, oxygen enrichment, and welding.

Some APD bullet points:

- Operating in over 50 countries

- 21,000+ employees worldwide

- Supplying over 30 different industries

- More than 750 facilities serving over 170,000 customers

- Eight decades in the business

- Developed in-depth knowledge of the industrial gas processes and the best-in-class project execution and operating expertise

- The most profitable industrial gas company in the world

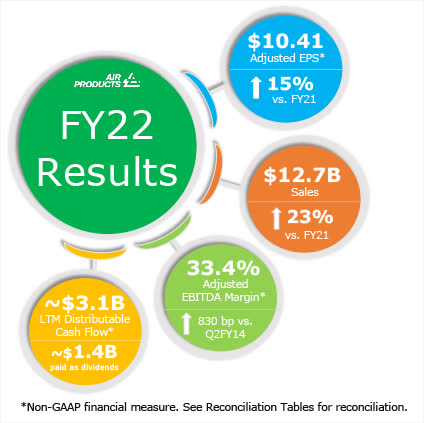

- $12.7 billion in sales

- $55 billion market cap.

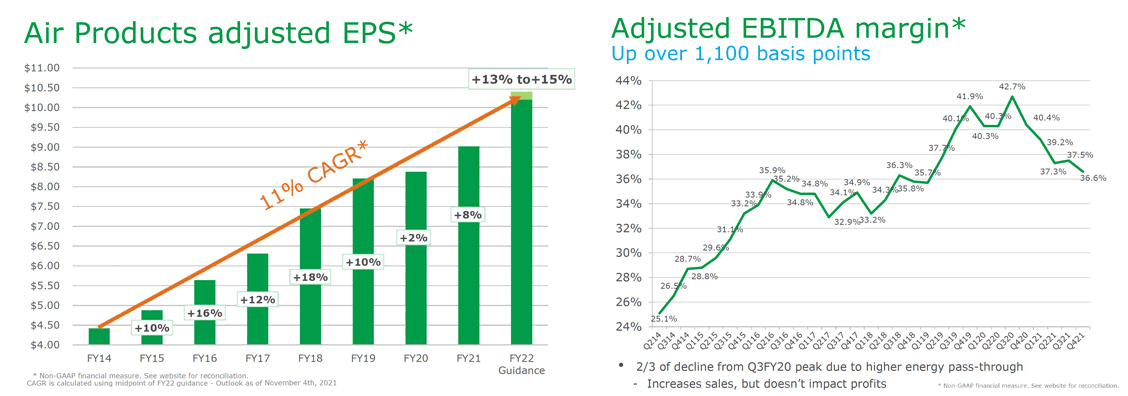

- EPS CAGR of 11% from 2014 to 2021.

- Commitment to growing EPS more than 10% over the long term

- Strong cash flow due to high margin plus low maintenance capex

- Increased annual dividend for 39 straight years

- Maintaining debt balance to maintain targeted A/A2 rating

APD website

F2022 Q3 earnings show ongoing growth:

APD

Those needing more financial information and other company information can find it on the company website.

APD also pays a safe dividend. The safest dividend is the one that is growing and APD does that year after year!

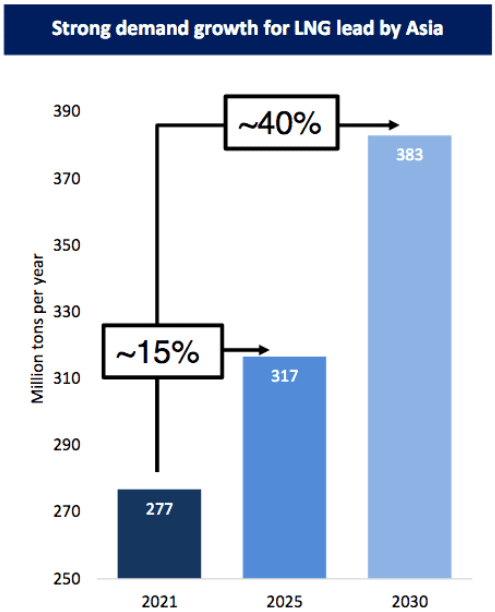

For many years APD has been the world leader in LNG technology and demand for LNG is growing hugely. Europe could still face a 30bn cubic-metre shortfall during next summer’s key storage refilling period if Russia halts all pipeline deliveries and Chinese demand for liquefied natural gas increases as it lifts more coronavirus restrictions, according to the International Energy Agency.

Asia’s needs are massive too led by China and Japan with India’s needs growing fast too. According to the IMF India is now the 5th largest economy in the world. Indian authorities plan to announce a $2.5B proposal by fiscal year-end to set up FSRUs at all major ports.

The following chart summarises Asian demand forecasts better than I can do with words…

Golar LNG

Thus natural gas – especially in LNG – form will remain the key transition fuel guaranteeing APD ongoing growth and profits until hydrogen replaces it in many applications by 2030.

Today…

APD is Accelerating that Energy Transition

By investing billions of dollars in low-carbon hydrogen projects, Air Products aims to drive decarbonisation of heavy transportation and industrial sectors that are hard to electrify. Zero-emission hydrogen fuel cell vehicles can decarbonise heavy modes of transport, like buses, trucks, ships and more, while hydrogen can also provide lower-carbon-intensity power to heavy industrial sectors, like steelmaking and chemicals processing.

To face its environmental challenges, the planet needs innovation and real investment. As the world’s largest hydrogen producer, APD is taking major steps to accelerate the energy transition.

Latest actions – reported on APD’s website – include increased sustainability commitment to $15 billion for capital investments in first-mover zero- and low-carbon hydrogen projects through 2027. A long-term supply agreement for Imperial Oil’s proposed Strathcona renewable diesel complex, with APD supplying about half the low-carbon hydrogen output from its net-zero hydrogen energy complex in Edmonton, Alberta, Canada. They also announced plans to invest approximately $500 million to build, own and operate a 35 metric ton per day facility to produce green liquid hydrogen at a greenfield site in Massena, New York, as well as liquid hydrogen distribution and dispensing operations.

Current projects that are now well advanced include this massive project in Saudi Arabia, also mentioned on the company website…

World’s Largest Carbon-free Hydrogen Project

Air Products, together with ACWA Power and NEOM, has signed an agreement for a $5 billion world-scale carbon-free hydrogen-based ammonia production facility powered by renewable energy. Sited in NEOM – pictured below – a new model for sustainable living located in the Kingdom of Saudi Arabia, the project will supply 650 tons per day of carbon-free hydrogen for transportation globally and save the world three million tons per year of CO₂.

Financial Times

The Saudi’s plan is to become the world’s largest exporter of hydrogen to replace its position as the largest exporter of oil and diversify away from what will be a declining source of income.

In Texas APD and AES Corp. (AES) unveiled plans recently to spend ~$4B to build, own and operate a green hydrogen production facility in Wilbarger County, Texas. The companies said the “mega-scale” project includes 1.4 GW of wind and solar power generation, along with electrolyser capacity capable of producing more than 200M metric tons/day of green hydrogen, making it the largest green hydrogen plant in the U.S. They will jointly and equally own the renewable energy and electrolyser assets, with Air Products serving as the exclusive off-taker and marketer of the green hydrogen under a 30-year contract.

Also in the US APD is building the world’s longest hydrogen pipeline, announced thus; Air Products says it was awarded $500M in combined new contracts – its largest-ever investment in a U.S. project – to supply the proposed $1B Gulf Coast Ammonia project in Texas. The contracts include construction of a 700-mile hydrogen pipeline from Texas City to Baytown, connecting to the world’s largest hydrogen pipeline system, running from the Houston Ship Channel to New Orleans. APD says it also will build and operate its largest-ever steam methane reformer to produce hydrogen, an air separation unit to supply nitrogen, and a steam turbine generator for the power and utilities.

There will be plenty of buyers waiting to use that hydrogen to power many things.

I shall add more opportunities later but first a bit more about

Hydrogen

Hydrogen’s history goes back 13.7 billion years. Born in the stars, hydrogen is one of the major components of our planet. The advantage of this abundant, colourless, odourless and non-corrosive element is that it contains three times more energy per kilogram than petrol. Because its atoms are so simple – made up of just one proton and one electron – it is the lightest chemical element. Hydrogen does not occur naturally on its own except in some rare instances. It is always bonded with other molecules, most commonly to form water, and water covers 70% of the Earth’s surface.

It is the main ingredient of stars including 90% of the sun that keeps us warm 92 million miles away.

Here on earth there are several techniques to produce hydrogen, but not all of them are clean.

BLACK HYDROGEN is produced using coal or lignite through a process called gasification. This method creates the most pollution, but fortunately it is no longer very common. The hydrogen produced costs between $1 and $2 per kilo.

GREY HYDROGEN is produced from natural gas via a chemical reaction called steam methane reformation. This method is the most widely used today because it is inexpensive ($1 to $3 per kilo), but it produces a lot of CO2.

BLUE HYDROGEN is produced via natural gas reformation in a similar way to grey hydrogen, but the CO2 produced is captured by filters, and then either reused or stored and not released back into the atmosphere. Blue hydrogen costs between $1.50 and $3 per kilo.

GREEN HYDROGEN – the cleanest – is produced by water electrolysis, i.e. splitting water molecules (H2O) into hydrogen gas (H2) and oxygen (O) using an electric current supplied by renewable energy (solar, wind, hydroelectric dam). This method has the advantage of not releasing any greenhouse gases, but it is expensive ($3 to $7.50 per kilo).

There are colours in between – for example, pink for hydrogen made using nuclear power – but the above serve as main examples. The price for green hydrogen is coming down fast as volumes produced go up at a time when natural gas prices are going up in order to meet growing world demand.

Prices

Prices are one big reason that hydrogen sceptics abound.

The first fuel cell appeared 182 years ago but the difficulty and costs of producing hydrogen have been prohibitive. That is changing fast. The continued rapid investment in green hydrogen and electrolysers over the next few years could mean the production cost falls under $2/kg by 2030, from an average $3.80-$5.80/kg earlier this year.

Even now, at $5/kg the price is competitive for running trains. It needs to be around $3/kg for trucking companies due to the need for many more filling stations. Once it hits that price the needs of Europe, the US and China alone would total 4,000 TWh or 100 million tonnes. Reaching that will take time and a lot of additional infrastructure. APD will supply some of that before those trucks hit the road.

Some are already on the road…

Hyundai in Switzerland has the first of 1,600 hydrogen trucks planned to be on the road by 2025, replacing dirty diesel.

Hyundai

One thing worth noting – but blindly ignored by policy makers and sceptics – is the full cost of filthy fuel such as coal and diesel. That full cost would include the cost of healthcare, time out of work and consequent costs to the economy caused by breathing in the air they pollute! Diesel causes 38,000 deaths per year and that is expected to rise to 184,000 by 2040 so there is global pressure to get that changed…

Global hydrogen happenings

Political push is among those.

In the US Senators Chris Coons (Democrat, Delaware) and John Cornyn (Republican, Texas) joined forces on the bipartisan Hydrogen Infrastructure Initiative, also known as the Hydrogen for Industry Act, which is a package of three bills and is also known as S. 3112.

In addition to that the strangely named Inflation Reduction Act, IRA, has hydrogen as one priority.

Governors from New York, New Jersey, Connecticut and Massachusetts recently unveiled plans to partner with ~40 clean power companies, utilities and universities to create plans for a regional hydrogen hub.

California has long been a leader in the US in building hydrogen car and bus refuelling stations. It plans to have 200 of those by 2025.

In the EU two back to back crises – Corona and Putin’s invasion of Ukraine – have pushed Europe to bet increasing amounts of cash on a hydrogen revolution to meet industrial ambitions and reduce carbon emissions.

For the hydrogen industry, it’s a subsidy boom. European Commission President Ursula von der Leyen is promising a €3 billion investment vehicle, dubbed a hydrogen bank, to “help guarantee the purchase of hydrogen” by spurring demand using cash from the EU Innovation Fund.

That comes on top of more than €13 billion in state aid approvals for national and cross-border projects so far: €5.4 billion for Hy2Tech, a cross-border initiative to perfect the technology; €5.2 billion for Hy2Use, aimed at applications in hard-to-decarbonise sectors such as steel, cement and glass; more than €2 billion for German projects in steel, chemicals and production abroad; €220 million for a Spanish plant, and €149 million for a Romanian plant.

In the UK the city of Bradford plans to become a hydrogen hub.

In Aberdeen – Scotland’s oil capital – they have hydrogen fuelled buses like this one…

Linde

And one of the most exciting developments I have yet seen to help save our environment is this small-scale development in Northwest England to convert un-recyclable plastics into hydrogen for use as electrical energy.

Japan will turn to hydrogen for its main electrical power supply. It plans to become the world’s first hydrogen based society. Japan also plans to install 10,000 hydrogen refuelling stations in 30 countries around the world by 2030. Toyota is building a new “smart city” for 2,000 residents near Mount Fuji that will be powered by hydrogen fuel cells. There seems to be a disconnect between that and carmaking, but since Toyota (TM) is the largest carmaker in the world and that sector is a saturated one, maybe it plans to diversify and become a leader in the worldwide growth of smart cities with hydrogen being a crucial part of that. Japanese government policy is backing that, as this detailed report shows. Japan has a population of nearly 130 million so the demand there alone will be enormous.

India is now the world’s 5th largest economy and heading to the number 3 spot fast. Its air is rottenly polluted in all major cities. In addition to its growing investment in FSRU LNG import terminals that I mentioned above the government aims to manufacture five million tonnes of green hydrogen by 2030. It has taken various measures to achieve this target: National Hydrogen Mission: The mission was launched to help India achieve its climate targets and transform it into a green hydrogen hub.

Application specifics are too numerous to detail. They include cars, buses, trucks and trains…

PETER ENDIG/DPA/AFP via Getty Images)

Airbus is building a hydrogen powered plane and Reuters reported that Rolls Royce recently successfully tested a jet engine for those.

Other applications included household heating, steel making and almost anything that currently requires fossil fuels.

Transportation of hydrogen will be crucially important. The photo at the beginning of this article shows a liquefied hydrogen carrying ship. It is more easily transported at sea in ammonia form. On land many existing natural gas pipelines can carrying it. Older ones are made of a steel that hydrogen makes brittle but many can handle hydrogen alone or mixed with natural gas. Polyethylene is now the most used material and has been for a long time to carry LNG. Those pipes can carry hydrogen too and the US and Europe are criss crossed with pipelines.

Given the opportunities there must be…

Risks facing APD

Competition is probably the main one and that comes mainly from the two other big boys in gases. Air Liquide may not be a well known name in the US – I do not think it has a US listing – but it has 20,000 employees there. Like APD it also operates worldwide. In China it is building this huge hydrogen plant …

Air Liquide/Scipig

The other big one is Linde (LIN). Linde bought Praxair in the US in 2018 and that name is probably better known there.

Both are leaders into the energy transition to hydrogen but neither has APD’s strength and presence in the still rapidly growing LNG sector. I wrote about the enormous demand growth for LNG in this recent article on Antero Resources.

I have all three in my portfolio. There are numerous small companies trying to get onto the hydrogen train but trying to pick winners from those is like trying to win the lottery. If readers know good ones please let us know in the comments.

Chart Industries (GTLS) is also active in both LNG and hydrogen but seems incapable of organic growth and reliant on acquisitions. The announcement of the latest one drove Chart’s stock price down 50%! Part of the announcement by Chart lauding the acquisition policy said; “Both companies have a history of inorganic investment integration. In the past three years, Howden completed seven highly-synergistic bolt-on acquisitions, and in that same time period, Chart completed 10 strategic bolt-on acquisitions and divested two non-core businesses. Both teams have experience in and dedicated resources for successful integration planning and execution.” Pity they don’t have any experience in product selling but that reduces the threat to APD’s market share from Chart.

While competition from the big names will remain a risk each of those is carving out a big portion of its own in this growing sector and that will be the case for several years to come thus minimising the competition risk to near zero in the short to medium term.

The vast sums of both public and private money being invested in hydrogen activities are also likely to overcome any serious threat to APD’s growth in the medium term.

The other main risk I see is APD’s high trailing PE of 32. I prefer such PEs to be 20 or under. The forward one is 28 and I think that should be attainable as results from APD’s enormous investments start to show and energy transition gains pace.

All those points should…

Take Air Products Investors To A 2023 High

In so doing investors can also sleep at night knowing they are also investing in a cleaner environment for the future. Helping that is other integral parts of APD’s leadership offerings: carbon capture and storage technology and methane separation.

The dividend has been increased every year for nearly 40 years and that adds a safe 2% to any share price growth.

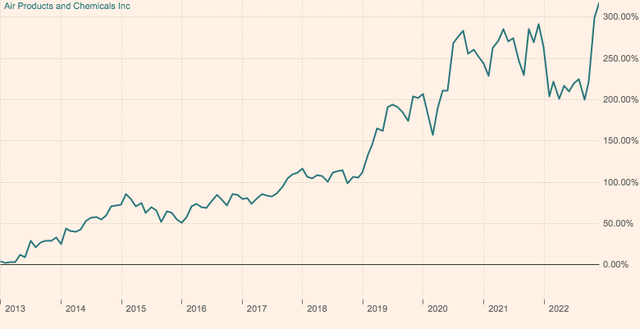

Safety also shows in this year’s share price performance: YTD APD is up 9% compared to the S&P500 that is down around 15%!

Ratings show the following:

APD Ratings

I do not follow Quants. They are mere computer “thoughts” and I prefer brain thoughts that also look to the longer term.

This chart shows the price history…

That suggests a high has been reached for now but I believe we shall see at least a 12% gain in 2023. World demand for LNG alone is set to soar in 2023 ensuring sales and earnings growth.

That plus the 2% dividend means APD will do better than many in the very uncertain times ahead. One could say that…

Staid and steady APD is a disrupter! Back in the 1970s Steve Jobs was a high speed disrupter of main frame computer makers with his desk top Apple. With hydrogen APD will be a slow speed disrupter of the major oil producers and could bring investors that above past gain over the coming 10 years too.

Editor’s Note: This article was submitted as part of Seeking Alpha’s 2023 Market Prediction contest. Do you have a conviction view for the S&P 500 next year? If so, click here to find out more and submit your article today!

Be the first to comment