joshblake/E+ via Getty Images

Introduction

I was wrong. On June 27, 2021, I wrote an article titled “Ball Corp.: Underperformance Offers Opportunities”. Back then, the Ball Corporation (NYSE:BALL) was one of the worst S&P 500 performers. Unfortunately, that continued as the stock is down another 34% since then.

The good news is that the reasons that made BALL one of the worst dividend growth performers on my list now make the stock an attractive risk/reward play at current levels. While certain risks are still persistent, BALL has become an attractive dividend growth stock that offers investors the chance to bet on lower supply chain tensions, lower input inflation, and a continuation of the sustainability trend supporting aluminum packaging demand.

In this article, I’m revisiting BALL, explaining why investors may benefit from adding the BALL ticker to their portfolios. It’s still a speculative dividend bet – unlike most conservative dividend opportunities – yet, that comes with more potential upside.

With that said, let’s look at the details!

Finding Value In Beaten Down Ball Corp.

The Ball Corporation is officially classified as a consumer cyclical company due to its operations in the packaging and containers industry. Thanks to its $16.9 billion market cap, Ball is one of the largest players in that industry.

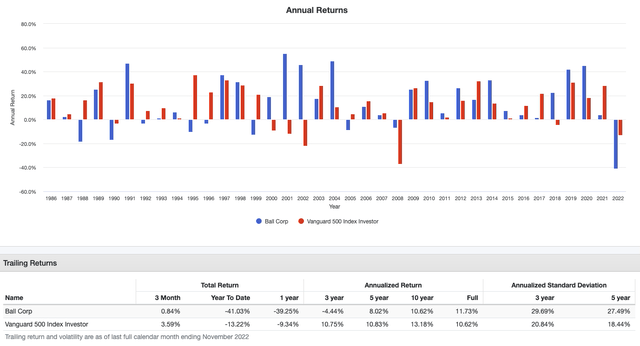

Historically speaking, BALL shares have been a tremendous source of wealth. Until 2020 (ignoring the entire recent decline), BALL shares have returned 14.0% per year since 1986. During this period, the worst year was -18%. The standard deviation was 24.8%, which is very reasonable. Also, note that the overview below shows that BALL did very well in years of significant S&P 500 weakness. The stock had a market correlation of just 35% between 1986 and 2020. It had subdued volatility and significant outperformance of 300 basis points per year. That’s something to write home about.

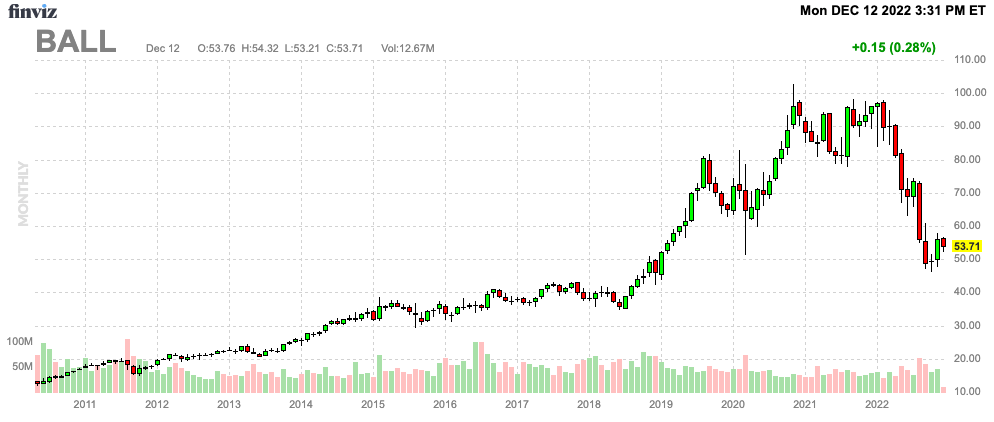

Then, things turned sour. The stock is now down 44% year-to-date and 45% below its 52-week high. Ignoring dividends, the stock has erased all gains since early 2019.

FINVIZ

The company is suffering from a number of issues. The most prominent ones are rapidly rising input inflation since the second half of 2020 when commodities like aluminum went into overdrive, significant consumer weakness in 2022, and the divestiture of Russian assets in a $530 million deal earlier this year.

In March, the sustainable metal packaging maker reduced operations at its three manufacturing facilities in Russia immediately after the country’s invasion of Ukraine and were looking to pursue a sale of its Russian business to a new owner.

The company said Arnest Group, a manufacturer of perfume, cosmetic and household products in aerosol packaging in Russia, has acquired all of Ball’s Russia-based business and the sale is not expected to impact the company’s business outside of Russia.

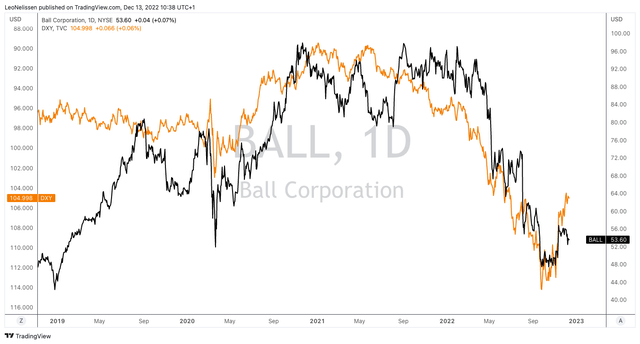

It also didn’t help that the dollar strengthened significantly this year as Ball generates roughly half of its sales outside of the United States.

What’s interesting is that the BALL stock price is highly correlated to the dollar index (inverted in the chart below). This makes sense given the company’s high foreign exposure. Yet, it’s still interesting to see how much BALL is influenced by the greenback.

TradingView (Black = BALL, Orange = Inverted DXY)

Moreover, and in light of what we’ll discuss next, the company is now increasingly tracked by investors looking for value. The other day, I read an interesting Bloomberg article on the investment choices of professionals going into 2023.

Essentially, after the pandemic, a lot of companies struggled with issues like supply chain bottlenecks, high input inflation, material shortages, and the war in Ukraine – to name a few things.

Now, these companies offer opportunities. As Jennifer Foster, co-chief investment officer at Chilton Trust puts it (part of the aforementioned Bloomberg article):

Take Ball Corp. […]. They had to sell a profitable Russian plant at a low multiple and have had supply and demand challenges. This is a high-quality company that has always had nice returns, and management is moving to control what they can control – cutting costs, pulling back on capital expenditures, and protecting the business model that’s worked well for so long. It has traded well above its average PE over the past five years because of enthusiasm over its growth, and that premium has just been taken out in this moment.

The Value Of Ball (Dividends)

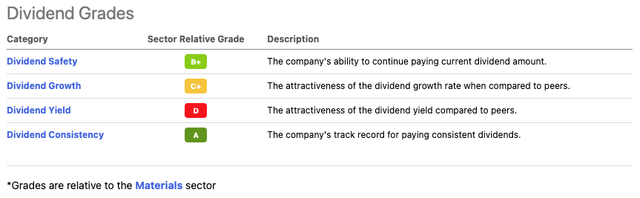

Ball Corp has a mixed Seeking Alpha dividend scorecard. The company scores high on consistency, and the safety score is good. However, the growth and yield scores are rather low.

Before we continue, it’s important to note that these scores are relative scores. Moreover, the company is being compared to the materials sector instead of the consumer cyclical sector. Some websites classify the company as a metal and glass container company, which puts it in the materials sector. General packaging would be consumer cyclical.

I believe that consumer cyclical is more appropriate. In that case, the company would score much higher on dividend yield. After all, material companies tend to have higher yields than cyclical consumer stocks. Not that it matters for BALL, but I just wanted to add a bit of context.

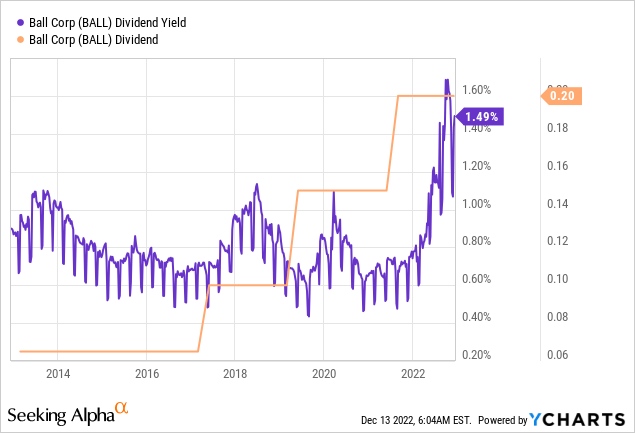

Ball currently pays $0.20 per share per quarter. That’s $0.80 per year, which translates to a yield of 1.5%.

That’s not something to write home about.

Dividend growth, however, is decent. Over the past ten years, the average annual dividend growth rate was 14.9%. The latest hikes are listed below.

- July 2021: +33.0%

- April 2019: +50.0%

- April 2017: +54.0%

These numbers really add up and make a 1.5% yield look way more attractive.

But then again, hikes in the past offer no guarantee that this will continue in the future.

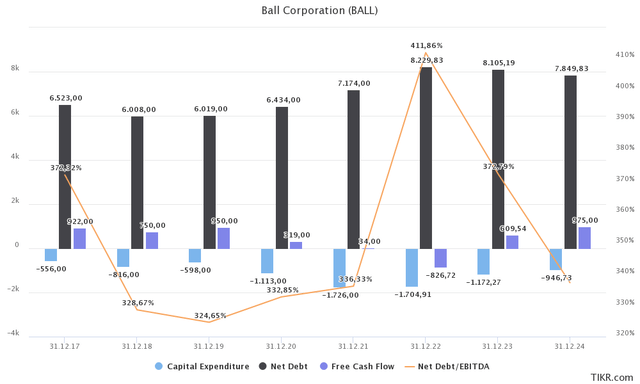

Looking at the financials below, the company suffered from falling free cash flow since 2019 when FCF peaked slightly below $1.0 billion. Higher capital expenditures made it impossible to generate positive FCF in 2022E. However, going forward, the company is expected to benefit from these investments in its business, as well as lower CapEx.

Other reasons why cash flow will be better next year include $500 million less in CapEx. The expectation of meaningfully less pension contributions needed, $90 million less in cash outflow for incentive compensation due to lower incentive comp payments from 2022 and we’ll have much less working capital pressure and also increasing our focus on selling terms.

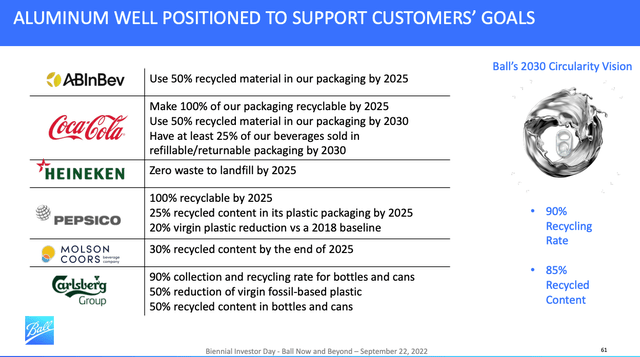

Ball Corp, which works with major drink producers like Coca-Cola (KO), PepsiCo (PEP), Heineken (OTCQX:HEINY), and consumer staples like the German Henkel Company (cans for hair spray), is benefiting from strong secular demand growth and increasing pricing power as commodities come down.

The company expects that long-term aluminum beverage can demand is likely to grow between 4% and 6% per year. These numbers are reasonable if we assume that general beverage demand is growing close to 2%. I think 2% worth of annual secular growth makes sense.

Now add pricing power, and Ball is in a very decent spot to maintain high sales growth.

So far, it looks like the company can grow sales by at least 5% per year. EBITDA might continue its longer-term growth trend of 5-8% per year.

Unfortunately, in the short term, challenges persist due to inventory destocking and consumer weakness.

In summary, our customers continue to lean on aluminum as their package of choice. We also reiterate our Investor Day global volume growth opportunity. Near-term volumes may be pressured in certain regions as everyday consumers are feeling the pinch of inflation. Our global beverage teams have positioned their businesses for slower growth in the fourth quarter, inclusive of preparing for temporary actions to achieve year-end inventory goals, keeping supply/demand tight and preparing for optimal financial improvement in 2023.

With that said, in 2023, the company is likely to do $610 million in FCF. That implies a 3.6% FCF yield. That is still rather low, yet it does support the dividend and dividend growth. In 2024, FCF is expected to be $980 million as BALL can quickly improve cash generation. In less than two years, we’re likely looking at a 5.8% FCF yield, which is an attractive number.

However, because net debt is not yet expected to come down due to currency headwinds, pressure on shipments, and the sale of the Russian business, the company will prioritize debt reduction as we head into 2023.

As a result, yearend net debt to comparable EBITDA is expected to remain at current levels, which is higher than where we would like it to be and we are have prioritized debt reduction in the near term as we move into 2023.

The company’s balance sheet is not a major risk. However, debt reduction is appropriate. The net leverage is 4.1x. This is likely to fall to the high 3x EBITDA range in 2023. The company’s debt is BB+ rated. Its credit facility is Baa3 rated by Fitch. Liquidity isn’t an issue, but the company needs to get leverage down in order to get a higher debt rating.

So, what about the valuation?

Valuation

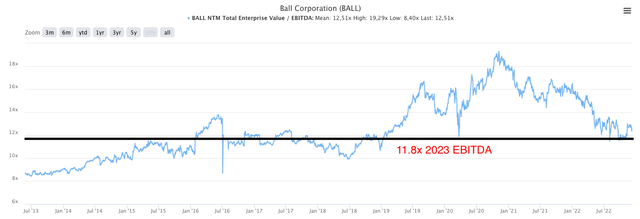

Thanks to the stock price decline, the company comes with a much better risk/reward. After all, if the company didn’t have any issues, it wouldn’t be trading almost 50% below its all-time high. With risks come opportunities.

BALL is trading at 11.8x 2023E EBITDA using its $26.0 billion enterprise value. This consist of its $16.9 billion market cap, $8.1 billion in 2023E net debt, and $1.0 billion in pension liabilities and minority interest (roughly 90% of that is pension liabilities).

That valuation is very fair. I wouldn’t call it deep value until it’s in the 10x range (or below). Yet, this valuation is not a deal-breaker. Especially not in light of ongoing macroeconomic challenges.

So, let’s answer the question stated in the title.

Is Ball Corp. A Good Dividend Stock?

Yes, the BALL ticker offers good dividend opportunities.

However, it’s not for everyone. While Ball has been a tremendous source of wealth and low volatility (safety) in the decades prior to the pandemic, it is now a bit of a speculative play.

The company has a somewhat elevated debt load, it needs to leave supply chain and commodity inflation behind, and execute to benefit from a strong secular growth trend fueled by higher aluminum can demand.

The dividend benefited from strong growth prior to 2022. While I expect that long-term dividend growth will remain a huge tailwind, I believe the company will have to prioritize debt in both 2023 and 2024.

Given the bigger picture, BALL will likely return to its old glory within the next five years. However, it comes with some risks that make BALL riskier than your “average” well-known dividend stocks.

That said, I’m applying a buy rating due to the risk/reward. However, I do not expect a quick upswing due to macroeconomic challenges. We’re likely in a longer-term bottoming process, followed by more upside in the second half of 2023.

(Dis)agree? Let me know in the comments!

Be the first to comment