MrLonelyWalker/iStock via Getty Images

The Federal Reserve may be trying to tighten up on the economy because of the high rates of inflation that are being experienced, but there appears to be little support for this from the fiscal side of the government.

“The monthly federal deficit was a record-setting $249 billion in November, $57 billion wider than the same month last year….”

This from Andrew Duehren in The Wall Street Journal.

“The federal government spent $501 billion last month, a $28 billion increase to a record high, while tax revenue dropped by $29 billion compared with last November, with the government collecting $252 billion.”

The future?

Spending to increase.

Tax collections to fall during a 2023 recession.

And, higher borrowing costs for the government.

Mr. Duehren:

“The Treasury spent 53 percent more on borrowing costs this November than it did last November. “

The future does not look any better.

And, the political situation worsens as the Republicans take over the U.S. House of Representatives.

Going back to the Obama administration, the Republicans constantly battled with the president over the budget deficit and the growth of Federal spending.

One can expect more of the same going into 2023.

Government Spending And The Pandemic

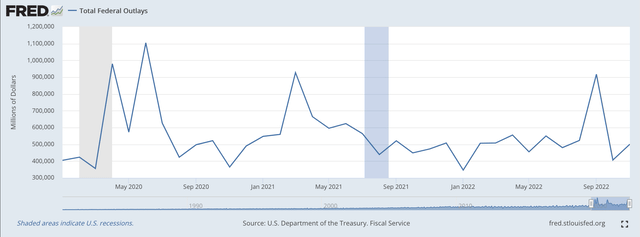

Here is the picture for the past three years.

Total Federal Outlays (Federal Reserve)

Government spending has not really receded under the Biden Administration.

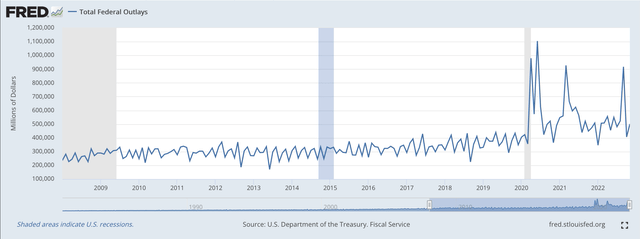

To see this, we need to go back before 2020.

Here, take a look!

Total Federal Outlays (Federal Reserve)

And, this tells us a lot about the current situation.

There is no question that the Covid-19 pandemic and subsequent events have totally disrupted the U.S. (and the world) economy.

Disequilibrium reigns.

Tie this in with what the Federal Reserve did during the same 2020 to present time period and you can see how much debt and how much liquidity has been pumped into the U.S. economy.

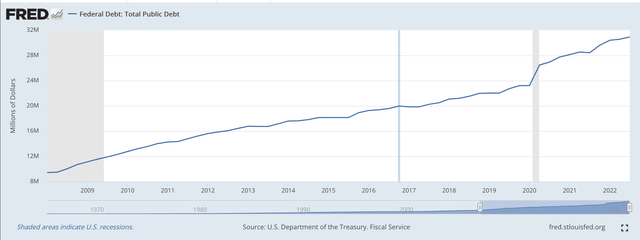

And, here is the graph showing the picture of the growing Federal debt.

Federal Debt (Federal Reserve)

Again, the takeoff in debt outstanding beginning in 2020 is remarkable.

But, things don’t seem to be getting any better.

Regardless of what the Federal Reserve may be trying to do, more and more government spending takes place and more and more Federal government debt is created.

And, this is what the Federal Reserve is fighting.

The Federal Reserve is trying to reduce the amount of government securities it carries on its balance sheet.

Quite often, I have written about the job the Fed would have to do just to reduce the amount of U.S. Treasury securities its holds on its balance sheet to one-half of what it has added to that balance sheet since the start of 2020.

Given the current plans, it will not even come close to that.

So, we have the Fed putting out Treasury securities to the open market, and we have the U.S. Treasury department putting out new securities to the open market.

This only makes the Fed’s job of fighting inflation even more difficult.

The Future

The future is not pretty.

The Fed is facing a doubting community of investors in the bond markets as participants seem to believe that the Fed is going to pivot soon from its current policy stance.

Investors just continue to believe that the Federal Reserve will not stick around too much longer with the “tight money.”

One reason for this is that the U.S. economy is in a deep state of disequilibrium.

All over the economy, individuals, firms, sectors, communities, and so on, are going to be fighting back to find some form of continuity and stability.

The debt markets are overloaded as investors took advantage of almost every possible opportunity to find something new and profitable. The range of outlets run from cryptocurrencies to “blank check companies” to opportunity funds.

And, technology continues to change at a tremendous pace.

The economy has remained relatively strong, but layoffs are now starting to be announced and the numbers are not small ones.

The bottom line is that the government cannot just keep on putting more and more money in people’s hands while at the same time raising interest rates and contracting the money stock.

The battles have just begun. Politically, the next two years may even be more contentious than the past two years. And, this will not be a pretty time for the economy.

Be the first to comment