Pravinrus Khumpangtip

BancFirst Corporation (NASDAQ:BANF) maintains solid and intact fundamentals amidst economic fluctuations. Although revenues and margins are a bit sluggish, growth prospects are still optimistic. Also, its strong liquidity position makes it flexible to generate higher yields in the long run. It may reap rewards once more earning assets mature this year. The thing is, it can sustain its rebound soon after the interest rate hikes. Investors may consider it ideal not only for its fundamentals but also for its consistent dividends. But they must be more careful since the stock price appears overvalued.

Company Performance

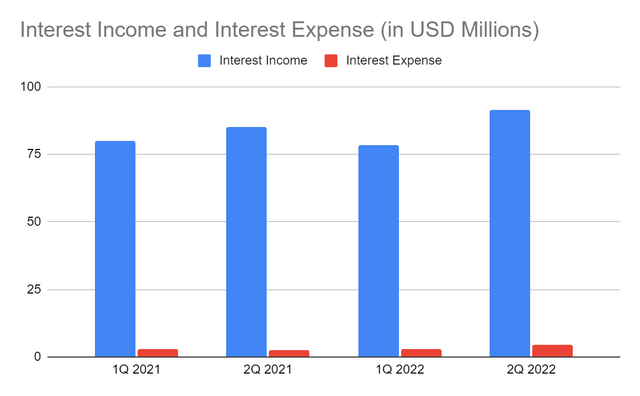

The past two years have been a challenge for the banking industry. But, the near-zero interest rates became an opportunity to capture more willing borrowers and incur lower interest expenses. The same went for BancFirst Corporation, leading to lower interest income and expense. But, its efficient and prudent portfolio management and expansion helped it remain stable.

This year, the company has a larger operating capacity. But, only a few short-term drastic changes are visible in the operations right now. Interest income amounts to $91.5 million, an 8% year-over-year increase. It is also a 17% rebound from the continued decrease from 3Q 2021 to 1Q 2022. Thanks to its acquisition of Worthington National Bank. It now has more earning assets that bear interests. Its loans and interest-bearing deposits are the primary growth drivers of interest income.

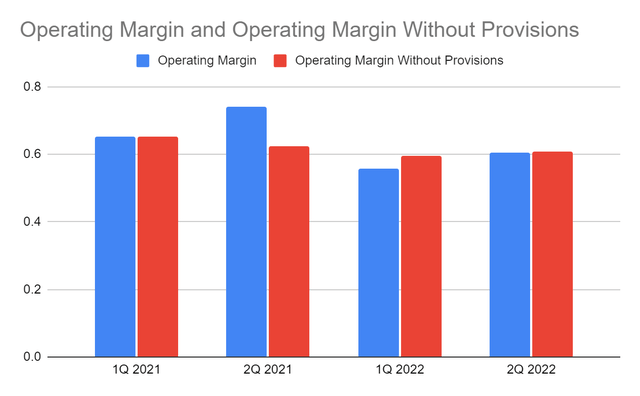

Likewise, interest expense is in an uptrend, increasing by 21% from the comparative quarter. The value is not a surprise, given the substantial increase in deposits. This quarter, deposit growth outpaced loan growth, which drove the increase. As such, net interest expense is 95% down from 97% in 2Q 2021. Even so, its efficiency helps it stabilize its non-interest segment in a larger operating capacity. The operating margin is 61%. Although it is a massive year-over-year decrease, it is a rebound from 1Q 2022. We must also watch out for provisions for credit losses. In 2021, it was more of a reversal, but this year, provision losses may be normalized, given the interest rate hikes.

Interest Income and Interest Expense (MarketWatch) Operating Margin (MarketWatch)

Honestly speaking, there is nothing special about its short-term operations even after the M&A. But, once more earning assets mature, tables may turn. These assets are more interest-sensitive, which may drive their interest income. Also, its stable and intact fundamentals in a high-inflation environment make it an enduring bank. I will discuss more of its asset-sensitive balance sheet in the succeeding parts.

Potential Risks And Opportunities

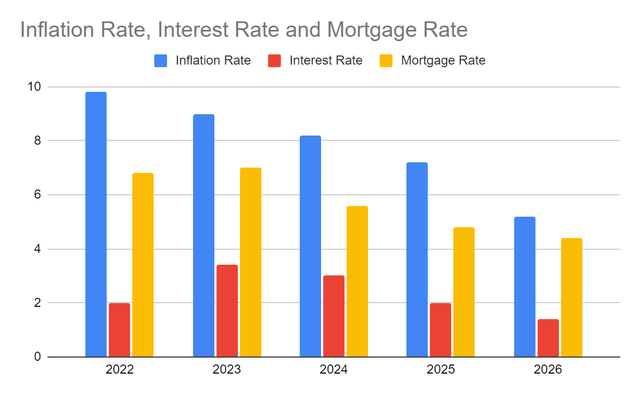

BancFirst Corporation sees a strong rebound from its sluggish performance in the last few quarters. It has a solid quarter with its solid portfolio. But, external forces may have a mixed impact on its performance as the economy reopens. Today, inflation remains high although it seems to relax at 8.5% from 9.1% in June. But, the inflation rate may increase again, given the pent-up demand and slow recovery in port congestion. The low inventory levels matched with potential shortages are raising prices. That is why I estimate inflation to reach its peak at 9.8%. In the long run, it may stabilize and go down to 5-7%.

In turn, interest and mortgage rate hikes persist to stabilize inflation. They may both increase further, given the recent Fed Funds Rate raise. Interest and mortgage rates may peak at 3-3.4% and 6.8-7%, respectively. But like inflation, they may stabilize and start to cool down in the following years.

Inflation Rate, Interest Rate, and Mortgage Rate (MarketWatch)

These pose risks to BANF. Note that in the first half, deposit growth outpaced loan growth. Organic loan growth only amounts to 7% while client deposit growth is 37%. That may be the primary reason for the relative increase in interest expenses. The continued increase in interest rates may lead to more expenses if the trend persists. Also, note that loan growth may be slower since there is no expected M&A soon. Loan provision reversals may no longer be accounted for. It may make its income lower as the interest rate continues to skyrocket.

Even so, BANF is still well-positioned in the high-inflation environment. Its capitalization on M&As may pay off despite the interest rate hikes. For instance, its interest-bearing deposits with banks are over $3 billion. They comprise 28% of the total assets from 19% in 4Q 2021, making the company more liquid. Higher interest rates may lead to more interest income in their deposits with other banks.

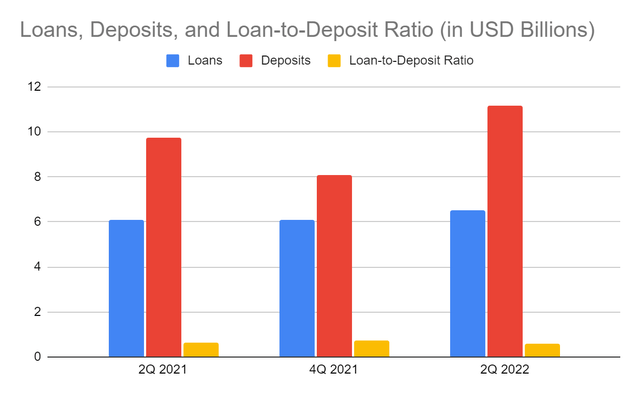

BancFirst Corporation may not be exciting, but its fundamental stability is a force to reckon with. Its liquidity position is one of its primary attributes. As mentioned, customer deposit growth outpaced loan growth in the first half. But the components of its loan and deposit mix fit the current scenario in the economy. The quality of loans may have a better impact this year. In fact, 42% of loans are expected to mature this year, leading to a potential increase in loans. More earning assets will mature this year, which gives it an advantage in the high-interest environment. Also, 47% of deposits are non-interest bearing so only 53% will add to interest expenses. The percentage is a bit higher than in the comparative quarter.

But, the loan-to-deposit ratio is low at 59%. It is way higher than the ideal 80-90%. It means that the company is not maximizing its operating capacity. It is a conservative and safe way to handle loans, given the expected maturity of loans this year. It will provide more reserves, should there be defaults. Of course, a low ratio may lead to a faster increase in interest expense than income. That is why the company is yet to optimize its growth potential.

Loans, Deposits, and Loan-to-Deposit Ratio (MarketWatch)

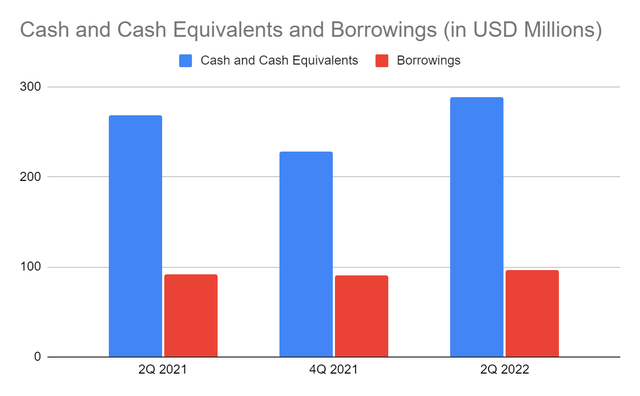

Moreover, its cash levels are stable and enough to make a single payment for borrowings. The total amount of $288 million is more than thrice as much as its borrowings of $97 million. This excess cash makes the company liquid and flexible to make adjustments to its operations. Its impact may become more visible once the interest and mortgage rates become more stable. It may either use it to expand further even without borrowing or deposit it to yield more returns.

Cash and Cash Equivalents and Borrowings (MarketWatch)

Stock Price Assessment

The stock price of BancFirst Corporation remains in an uptrend. But, there seems to be a slight downtrend in the last week. At $113.94, it is already 59% higher than the starting price and 3% lower than the recent peak. It appears attractive, but investors must watch out for the potential overvaluation. The PE Ratio of $24.09, PTBV Ratio of 3.81, and Price/Cash Flow Ratio of 21.75 adhere to it. The trend of the PTBV Ratio is upward if we compare the historical TBV to the average stock price. From 2.1-2.2x in 2021, it is now 3.81x. It is also higher than five-year historical multiples of 2.15x. Indeed, the stock price adheres with the fundamentals, but it appears higher than what it is worth.

Meanwhile, its dividend payments are consistent. But, its dividend yield of 1.26% adheres to the supposition the stock price is not cheap. The dividend yield is lower than the average of the S&P 600 of 1.41% and the NASDAQ composite of 1.51%. The fundamentals may prove that the stock is secure and ideal but not matched with the price. To assess the stock price better, we may use the Dividend Discount Model.

Stock Price $113.86

Average Dividend Growth -0.001623617905

Estimated Dividends Per Share $1.24

Cost of Capital Equity 0.01402349258

Derived Value $91.88035014 or $91.88

The derived value shows that the stock price is overvalued. There may be a 19% downside in the next 12-18 months. So, investors must watch out for its slight downtrend in the last week.

Bottom line

BancFirst Corporation is already an enduring bank in Oklahoma. Its fundamentals are still solid and intact, making it a secure investment. It is well-positioned against inflation. But, the stock price is too high for its actual value, allowing investors to get returns now. The recommendation, for now, is that BancFirst Corporation is a hold.

Be the first to comment