shaunl

Ardmore Shipping Corporation (NYSE:ASC) saw an upside of 160% (YoY) with the price return trending just⁓ 10% shy of reaching the 52-week high of $10.60 a share. The company’s Q2 2022 EPS of $0.82 was $0.10 better than consensus estimates of $0.72. Revenue was up 68.93% (QoQ) at $107.1 million indicating higher margins into 2023.

Thesis

Over the past year, Ardmore Shipping has been building its balance sheet, refinancing costly debt, and rebuilding relationships with financing institutions including banks. The company intends to look into strategic mergers and acquisition (M&A) activities and an energy transition including the adoption of methanol and hydrogen to lower overhead costs. Overall, it expects higher time charter equivalent (TCE) rates to persist into the third quarter despite the ongoing Russia-Ukraine conflict and volatility in global oil demand.

Company Overview and Strategy

Ardmore Shipping owns and operates approximately 25,000 to 50,000 deadweight tons of MR products and chemical tanker fleets. It sets itself apart by providing modern fuel-efficient fleets of mid-size tankers, seaborne transportation products, and chemicals globally to oil and chemical companies. While the company’s main strategy is to perpetuate the development of modern, high-quality fleets, it has revolutionized its core business into an energy-transition plan.

As the center of its long-term strategy, the energy-transition plan ensures Ardmore Shipping focuses on driving fuel efficiency improvements, especially with its new developments such as the e1 Marine joint venture. In the announcement of this joint venture back in Q1 2021, Ardmore explained that it was meant to increase the usage of hydrogen onboard for mid-sized power applications and lower carbon dioxide emissions. The usage of standard methanol was cited as more effective as opposed to gasoil to lower CO2 emissions as well as renewable methanol to attain carbon neutrality.

While its ownership was pegged at 33.3%, Ardmore (same as its partners: e1 and Maritime Partners) the e1 venture has helped Ardmore to strengthen its marine technology and lower its overall cost of fuel. As we know, ships have different levels of emissions depending on the fuel type used and companies such as Ardmore will command premium pricing.

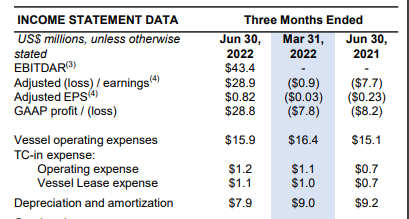

As of Q2 2022, Ardmore’s revenue hit a record $107.1 million, an increase of 68.93% (QoQ) buoyed by a 971% (QoQ) increase in operating income to $34.3 million. The company managed to decrease its operating expenses and raise its net income by more than 464% (QoQ). The company also announced the sale of three old ships in the second quarter of 2022 further supporting guidance of $14 million in its operating expenses down 11.9% (QoQ) in Q3 2022. This move is expected to lower depreciation and amortization costs into 2023.

Ardmore Shipping

What we see is that Ardmore is getting it right in cost control and efficiency even as e1 Marine begins commercialization.

Company’s focus into Q3 2023

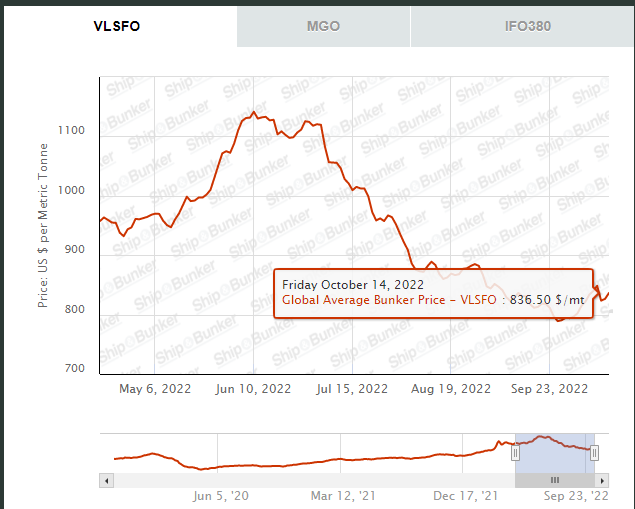

To maximize earnings and cash flow, Ardmore is focused on augmenting its freight trading performance. It also plans to optimize voyages, especially in a high bunker price environment.

Ship and Bunker

Global average bunker prices (VLSFO) hit their highest price level at $1,141.50 per metric ton on June 10, 2022. Despite the sharp decline into Q3 2022, prices have begun to increase towards the $836.50 per MT level (as of October 14, 2022). High bunker prices will necessitate an increase in voyage costs QoQ. Over the past 7.5 years, marine fuel costs have risen close to 700% with the price jump in 2022 larger than any other period in the last decade.

According to OPEC, oil demand is also expected to increase by 2.7% or 2.64 million barrels per day (BPD) in 2022 and by up to 2.34 million BPD in 2023. The company also expects a higher product tanker demand due to the ongoing refinery dislocation that will give an added layer for growth. Ardmore reported a forecast rate of 8.9 million bpd of export refinery growth capacity in the Middle East and Asia (from 2022 to 2026). This rate was almost twice the 5.9 million bpd reported in refineries located in Europe, Japan, and Australia.

For Ardmore, the increased scale will see an improvement in commercial flexibility. Further, the company’s emphasis on quality fleets which is equal to lower operating costs will lead to higher utilization rates and lead maximum value appreciation in the long run.

While only 3 old ships were reportedly sold in Q2 2022, the earnings report reveals that up 271 ships of the product tanker fleet (approximately 9%) are aging at over 20 years. About 13% or 239 ships of the chemical tanker fleet are over 20 years old. This is a cause of worry for the company considering the average life span of a ship is approximately 25 years to 30 years. The operating expenses will be too high to manage if the ships age beyond this period. The company may be forced to increase scrapping especially due to the high container demand and surging steel prices.

The company explained that the past two years have seen an elevated level of scrapping with about 29 product tankers (representing 68 ships or 2% of the fleet) scrapped since 2021. While scrapping levels are expected to be low in the near term an increase in aging ships may grow these levels in the long term.

Risks to the Downside

As we consider the aging fleet, the company is also not slowing down on its net fleet growth rate. Before year-end 2022, Ardmore expects to add 1.4% of its product tankers and 1.1% of its chemical tankers. However, this growth represents low ordering activity with a very limited berth available until 2025. Additionally, there is a lack of clarity on the propulsion technology likely to be adopted by the new fleet as we get into 2023. We can also deduce that the tanker owners have been disillusioned by the emission regulations.

A directive by the International Maritime Organization (IMO) released in Q2 2022 and expected to be enforced in 2023 requires all ships to calculate their annual carbon intensity based on the vessel’s emissions for the cargo on board. It is then expected to show that the emissions are progressively reducing. The main challenge here is that ships will be required to drop their cruising speeds by up to 10% and lower their fuel usage by almost 30% to reduce emissions. Notwithstanding older ships can still be retrofitted with devices to decrease their emissions.

In Europe, there has been an emissions trading system (ETS) that has been in place since 2005. However, this system only applied to heavily polluting industries like oil, steel, cement, glass, and commercial aviation. It is expected that this ETS will be extended to the shipping industry in 2024. The likely implications will be the lower availability of vessels (due to compliance challenges) and higher operating costs for the companies. Shipping companies will need to buy certificates equal to the number of emissions recorded at an annual rate where one certificate will be equal to 1 ton of carbon dioxide.

Ardmore will need to comply with the IMO carbon regulation guidelines to optimize its operations. Already the company is expected to increase its production of fuel-efficient fleets of MRs. Additionally, the company’s $185 million fully revolving credit facility and the $108 million senior term loan are linked to carbon emission reduction and other environmental/ social initiatives. In the long-run, further production losses could stem from Russia (due to the ongoing war) before the end of 2022 which may affect the importation of crude oil and affect maritime services.

Ardmore witnessed an 18% decline (in the six months ending on June 30, 2022) in its cash levels from $55.4 million in Q4 2021 to $45.4 million in Q2 2022. However, its asset balance increased by 1.62% (over the six months) to $733.1 million boosted by an increase in vessels held for sale.

Bottom Line

Ardmore Shipping has increased its scale by improving commercial flexibility through modern fuel-efficient fleets. The company expects lower operating costs into 2023 as well as high utilization rates meaning maximum value appreciation. ASC is projecting a favorable supply outlook against increasing demand for the product and chemical tankers. However, Ardmore is facing an increase in the aging ship population with low ordering activity expected in the near time. Still, the company expects to increase its profits into 2023 buoyed by strong market conditions, a robust reduction in leverage, and cash flow breakeven levels that may open up new capital allocation opportunities. We recommend a buy rating for this stock.

Be the first to comment