Igor-Kardasov/iStock via Getty Images

My last article on Afentra plc (OTCPK:STGAF) in early 2021 (formerly known as Sterling Energy plc) focused on the opportunity to buy into a new quality management team at essentially cash value. In October 2021, the Company announced that it was in a competitive bid process to buy assets from Angolan State Oil Company Sonagol. The assets in question were a 20% non-operated stake in oil production Block 3/05 and a 40% non-operated stake in appraisal Block 23. Although there were many other companies involved and the chances appeared to be about one in six, the London Stock Exchange AIM section suspended the share price at 14.5p (against the companies preference) due to the potential deal, IF successful, would represent a reverse takeover under AIM rules. On 28 April 2022 Afentra announced a Sale and Purchase Agreement “SPA” to purchase the Blocks from Sonagol. On 19 July 2022 Afentra announced it had acquired a further 4% interest in production Block 3/05 and a 5.33% interest in appraisal Block 3/05A from Croatian National Oil Company Industrija Nafte “INA”. The Company re-emerged from suspension when it published an AIM readmission document on 10 August 2022. The share price increased ~100% to 30p and fell back slightly to 28p at time of writing. The total firm consideration is $102.5 million and there is a further $61 million in contingent consideration, mainly linked to future Brent prices over $65 for 10 years.

Afentra Plc Company Presentation

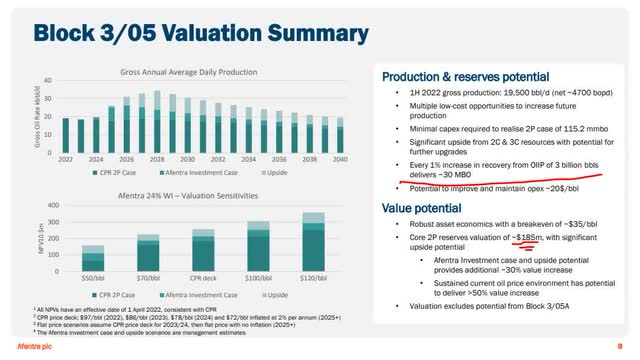

Slide 8 of the Company’s presentation on the deal shows the Competent Person Report “CPR” valuation of the 2P reserves acquired of $185 million, and the Afentra investment case is 30% higher at $241 million with a sustained higher oil price scenario valuing the acquisition 50% higher than the CPR case, a scenario that is currently playing out, at $278 million. Afentra’s market capitalisation at time of writing is $73 million! The crafty former Tullow Oil CEO Paul McDade had pulled off the first stage of a potential Company transforming deal. There remains a deal closing catalyst in early Q4 that if achieved will represent a massive transformation in the Company’s value.

Deal specifics

Afentra Plc Company Presentation

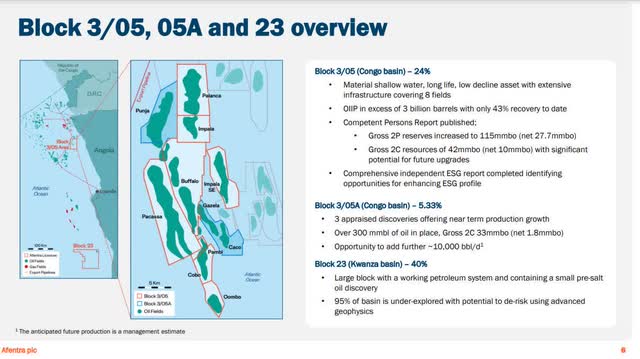

Slide 6 of the Company’s presentation dated 10 August 2022 shows a good overview of the assets acquired. The Block that attracted $99 million of the $102.5 million firm consideration, production Block 3/05, to put it mildly a monster producer with a lot more to produce! It had 3 billion barrels of oil initially in place with only 43% of that produced thus far. Gross 2P reserves stand at 115 million barrels and on closing, Afentra’s 24% share of those reserves will be 27.7 million barrels. It produced 19,500 barrels per day in H1 2022 (net 24% share of that production would be 4,700 barrels per day to Afentra. The effective date for the Sonagol 20% of Afentra’s 24% share in this Block is 20 April 2022 and the effective date for the other 4% acquired from INA is 30 September 2021! So Afentra is ‘on the hook’ for these barrels from as far back as September 2021 and will get credit for them on closing.

Afentra Plc Company Presentation

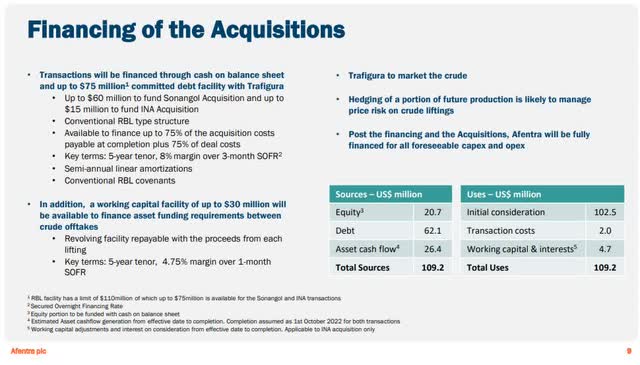

Slide 9 on financing shows that by the time the deal closes they can use $26.4 million of post effective date cash from their interest to set against the firm consideration of $103 million. There is massive upside in the “long-life field”. Slide 8 (above) shows that every 1% improvement in recovery from Oil initially in place of 3 billion barrels results in 30 million barrels gross of reserves.

The Opportunity provided by the Catalyst

Afentra’s market capitalisation at time of writing is £62 million ($73 million). Slide 8 shows the CPR value of the assets acquired (using Brent price deck $97 2022, $86 2023, $78 2024 AND $72 2025 inflated 2% per annum thereafter) is $185 million. Slide 9 shows that Afentra will not issue a single extra share to finance the acquisitions! Trafigura are providing $62 million in debt to finance the acquisition. Afentra will only need to use $21 million of its own cash to purchase the assets as $26 million will come from the asset post effective date cash flow itself! When you subtract the debt used to acquire the assets from the 2P reserve valuation of $185 million, the net of debt value is $123 million which is 48P per share in terms of Afentra share price. (220 million shares in issue and a single extra share required to finance the deal). 48P doesn’t value the cash they didn’t use to acquire the assets (about $15 million) or the management team or the carried Somaliland exploration asset (free cost-carried through to an exploration well by GENEL) or indeed the spare $48 million of debt capacity they secured with Trafigura ($110 million facility agreed in total) and on the 10 August webcast Paul McDade confirmed they were free to use this facility on other acquisitions.

Management are buying!

Afentra’s management have been buying shares since the re-admission to the London Stock Exchange on 10 August 2022.

On 10 August, CEO Paul McDade purchased 821,192 shares at a price of 24.30 pence per share (£200,000). It brought his holding to 3,088,192. (1.4% of the Company’s issued shares).

On 11 August non-executive chairman Gavin Wilson purchased 300,000 shares at a price of 24.50 pence per share (£73,500). It brought his holding to 2,981,666. (1.35% of the Company’s issued shares).

On 18 August COO Ian Cloke together with persons connected closely with him, purchased 143,277 shares at a prices of 26.2 and 26.9 (£25,932). It brought his (and persons closely associated with him) holding to 2,063,832. (0.94% of the Company’s issued shares).

Again, on 19 August COO Ian Cloke purchased 64,177 shares at a price of 30.91 pence (£19,837). It brought his (and persons closely associated with him) holding to 2,128,009. (0.97% of the Company’s issued shares).

Conclusion

The catalyst of deal closing in early quarter 4 offers acquisition upside of close to a doubling in the share price from today’s current price of 28p, in a CPR Brent price deck scenario (mentioned above) and 50% higher than that again in a continued scenario of higher oil prices. This all excludes a valuation of the management team itself. The closing of the gap between the current share price and a share price that would begin to closely price in the new acquisitions could begin to slowly happen now and accelerate as we get closer to closing. There is an upcoming election in Angola which some would argue adds some risk into the closing possibility but, if anything, the opposition is also aligned with the need to attract foreign investment in their oil fields. With the very strong US Dollar, American investors in Afentra plc benefit from current USD strength to get a very cheap entry at ~28p to London Listed oil Company with ultimately USD Brent based revenues. The liquidity offered by the London market is far greater than the STGAF ticker, so it’s better to invest in London ticker AET.L (#AET for twitter discussions and update and @AfentraPLC for the Company’s twitter feed).

Be the first to comment