ipopba/iStock via Getty Images

“Talent is often suffocated by the desire to be deemed talented.“― Mokokoma Mokhonoana

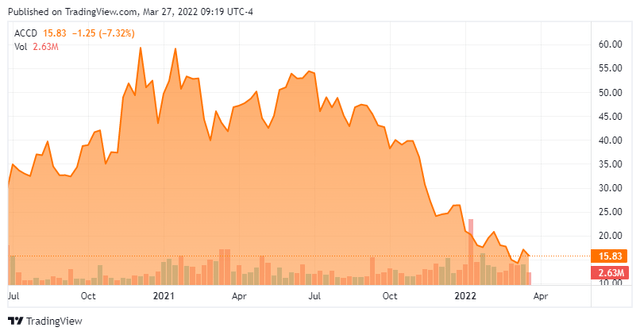

In today’s article we take our first in-depth look at Accolade Inc. (NASDAQ:ACCD). Like so many small cap cloud and SaaS concerns, shareholders have had little to cheer about in recent months as most of the market has gone into ‘risk off’ mode and high beta sectors of equities have gotten pummeled. Is the sell-off in this name overdone? We attempt to answer that question via the analysis below.

ACCD – Stock Chart (Seeking Alpha)

Company Overview:

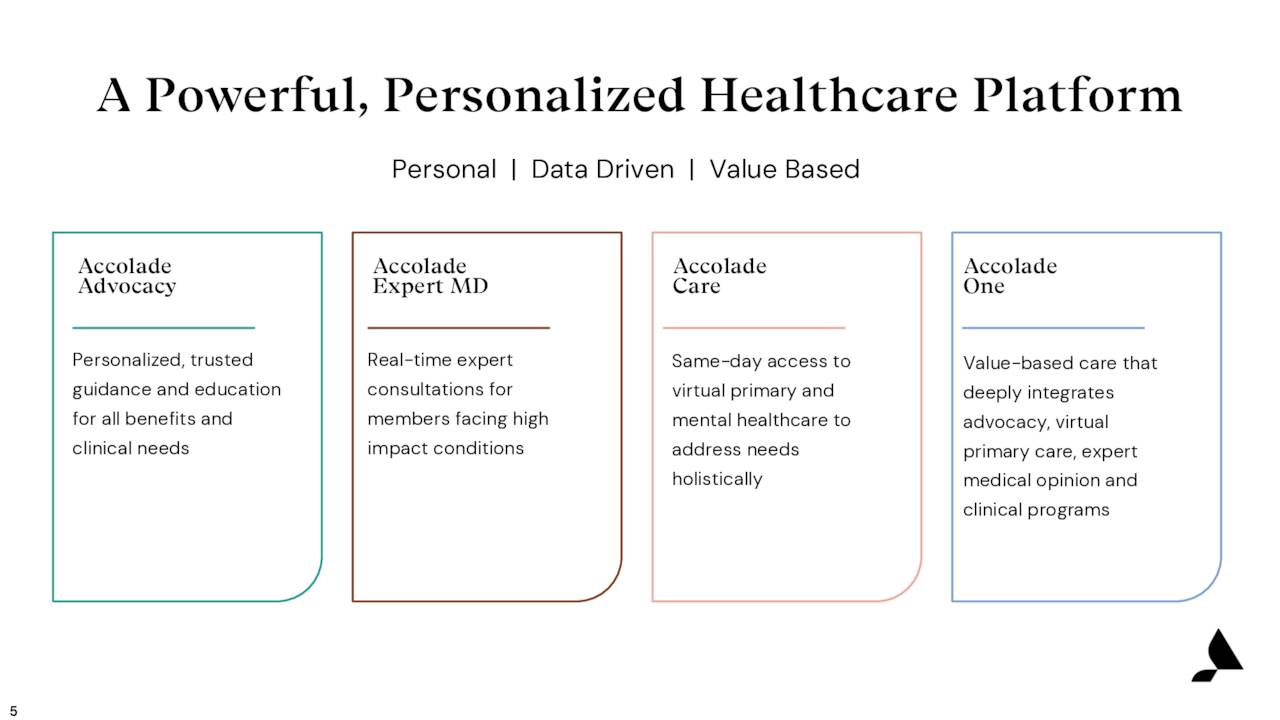

Accolade is based just outside of Philadelphia. The company develops, maintains and enhances technology-enabled solutions that help people to understand, navigate, and utilize the healthcare system and their workplace benefits. Accolade’s platform consists of cloud-based technology and multimodal support from a team of health assistants and clinicians.

ACCD – Core Capabilities (January Company Presentation)

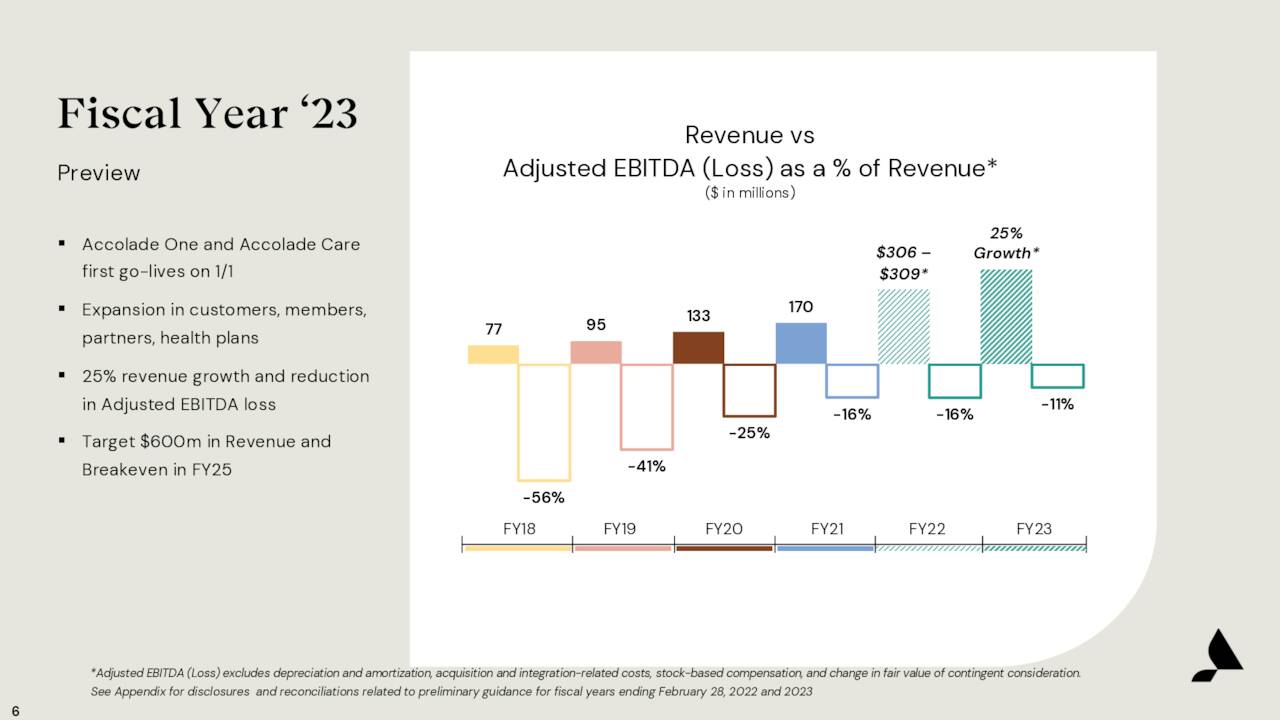

The company operates a healthcare information platform for enterprises and end users. This comprehensive platform can provide all employee’s healthcare information in one integrated system Accolade came public in July of 2020 and quickly rallied to $60 a share soon after its IPO, valuing the company company at over $3 billion for a time. This was more than a rich valuation given the company had sales of just $133 million in FY2019. Sanity quickly returned in the market, however. Currently the shares trade for just under $16.00 a piece, equating to an approximate market cap of $1.05 billion.

Third Quarter Results:

On January 10th, the company reported third quarter results. The company posted earnings of 31 cents a share even as adjusted EBITDA was a negative $11.9 million for the quarter. Revenues rose over 115% to nearly $83.5 million, which was significantly above the consensus. However, the ‘beat’ was largely due to recognizing $7 million in revenue in the third quarter, Accolade was originally planning to recognize in Q4.

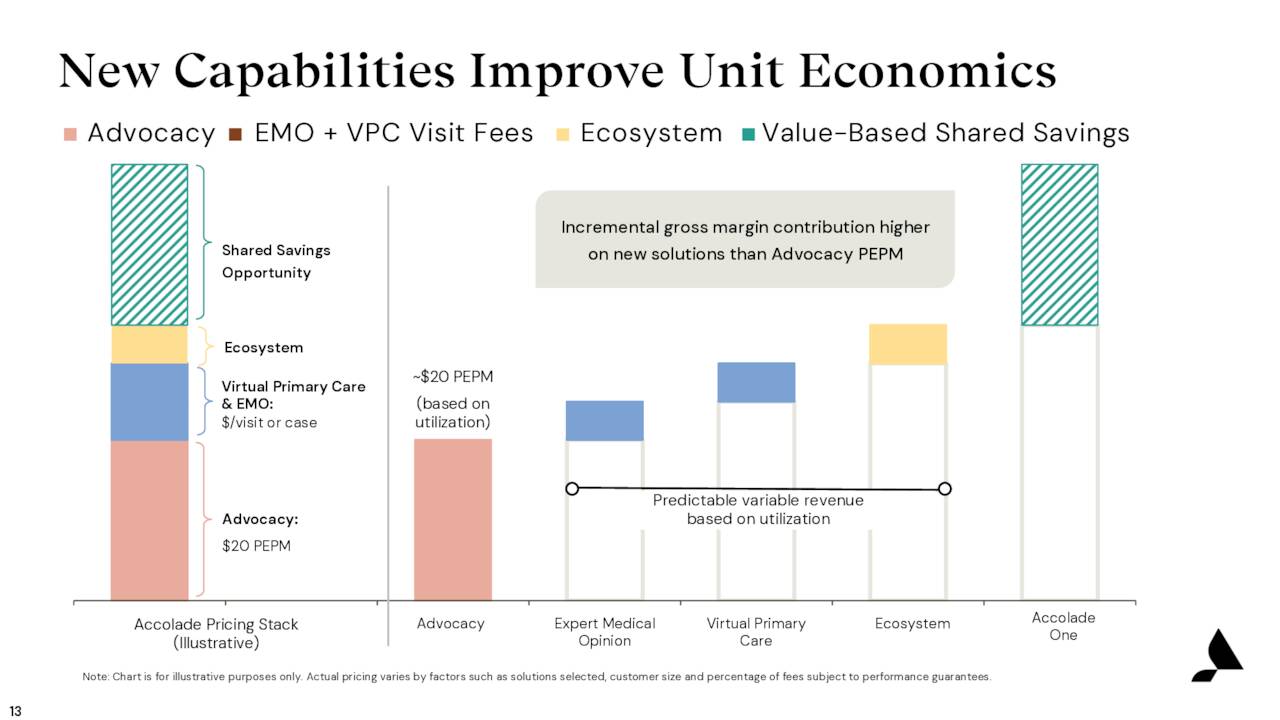

ACCD – Growing Capabilities (January Company Presentation)

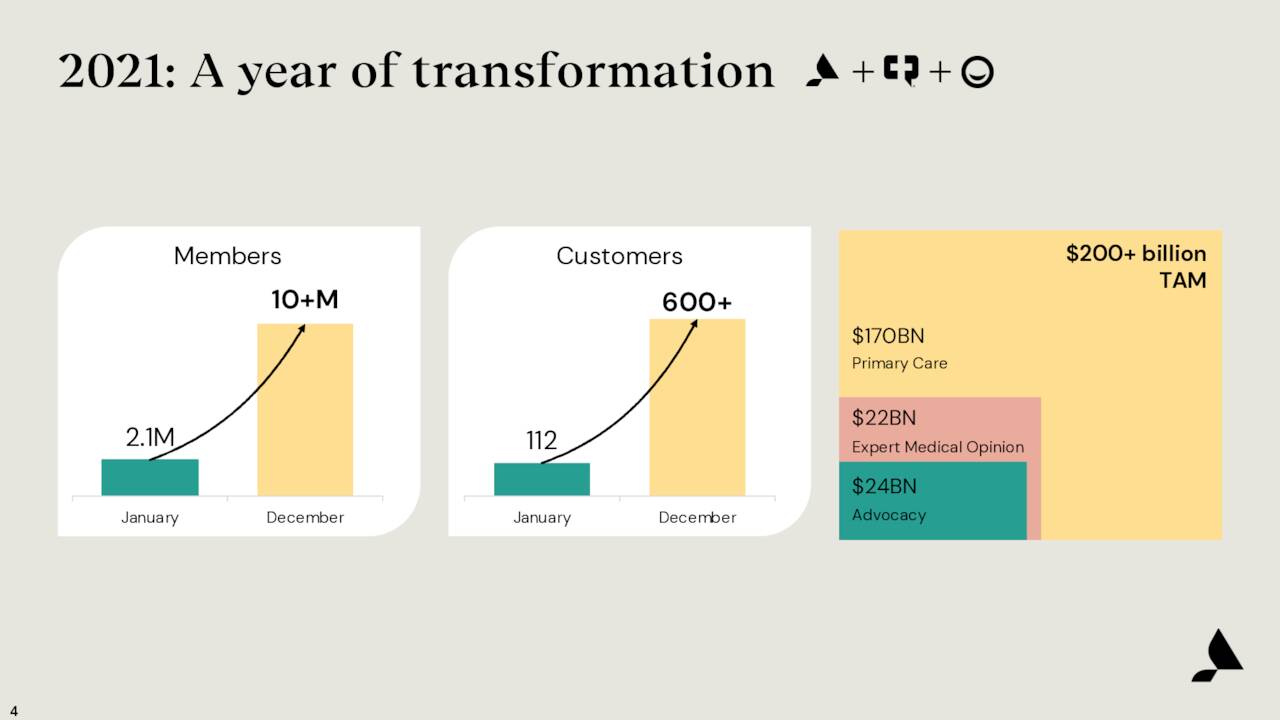

The company has done a solid job expanding its customer base and total addressable market in 2021 as it has added new capabilities to its platform.

ACCD – 2021 Accomplishments (January Company Presentation)

The company also provided guidance for between $90 million and $93 million worth sales for Q4 and $306 million to $309 million in FY2022, which was up slightly from previous full year guidance.

Financial Highlights for Fiscal Third Quarter ended November 30, 2021

| Three Months Ended November 30, | % | ||||||||||

| 2021 | 2020 | Change(2) | |||||||||

| (in millions, except percentages) | |||||||||||

| GAAP Financial Data: | |||||||||||

| Revenue | $ | 83.5 | $ | 38.4 | 117 | % | |||||

| Net Income (loss) | $ | 22.5 | $ | (16.6 | ) | 236 | % | ||||

| Non-GAAP Financial Data(1): | |||||||||||

| Adjusted EBITDA | $ | (11.9 | ) | $ | (11.4 | ) | (5 | )% | |||

| Adjusted Gross Profit | $ | 39.2 | $ | 16.1 | 144 | % | |||||

| Adjusted Gross Margin | 47.0 | % | 41.8 | % | |||||||

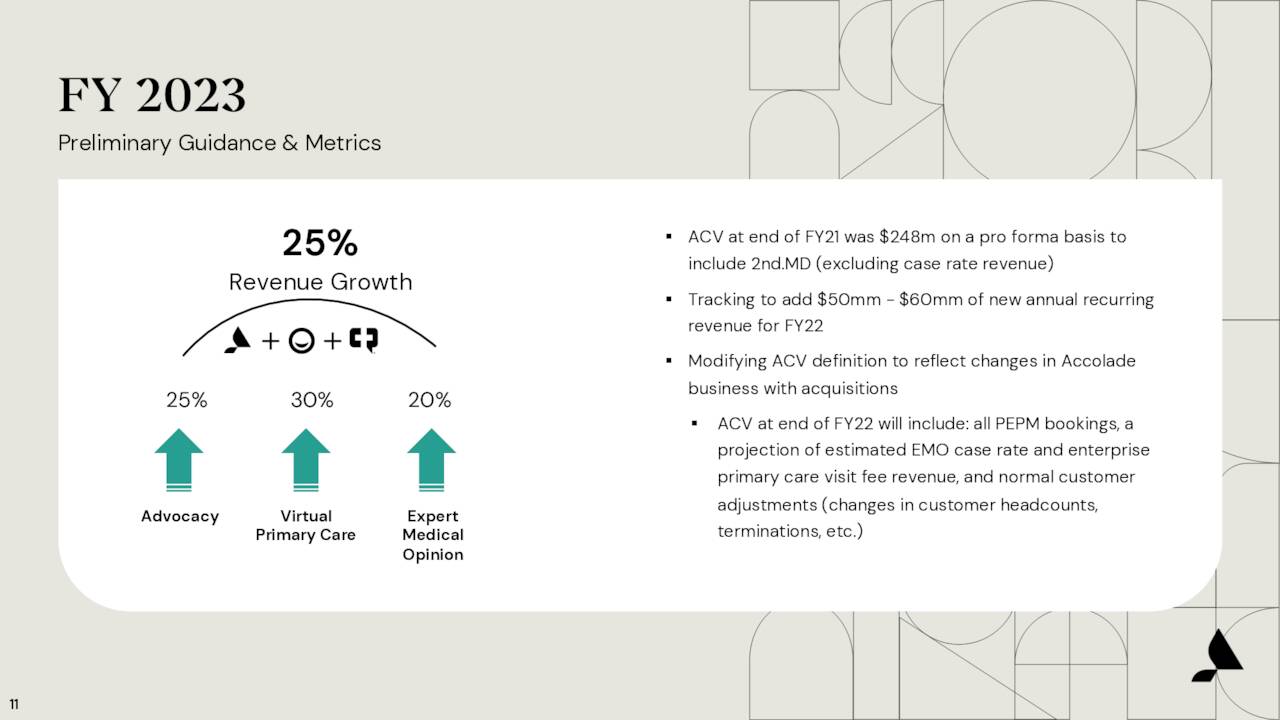

For FY2023, leadership is expecting 25% growth in revenues and a reduction in Adjusted EBITDA loss.

ACCD – FY2023 Guidance (January Company Presentation)

Analyst Commentary & Balance Sheet:

A dozen analyst firms have chimed in around Accolade so far in 2022, including Goldman Sachs and Needham. All have reiterated Buy ratings, albeit most with downwardly revised price targets. Current price targets range from $30 to $52 a share.

There has been no insider activity (buying or selling) in the shares since January of 2021. The company ended the third quarter with just over $365 million in cash and cash equivalents on its balance sheet against approximately $280 million of long-term debt.

Verdict:

ACCD – FY2023 (January Company Presentation)

During the third quarter earnings conference call, the company’s CEO projected the company will breakeven on an EBITDA basis in FY2025 when Accolade delivers $600 million in annual revenue.

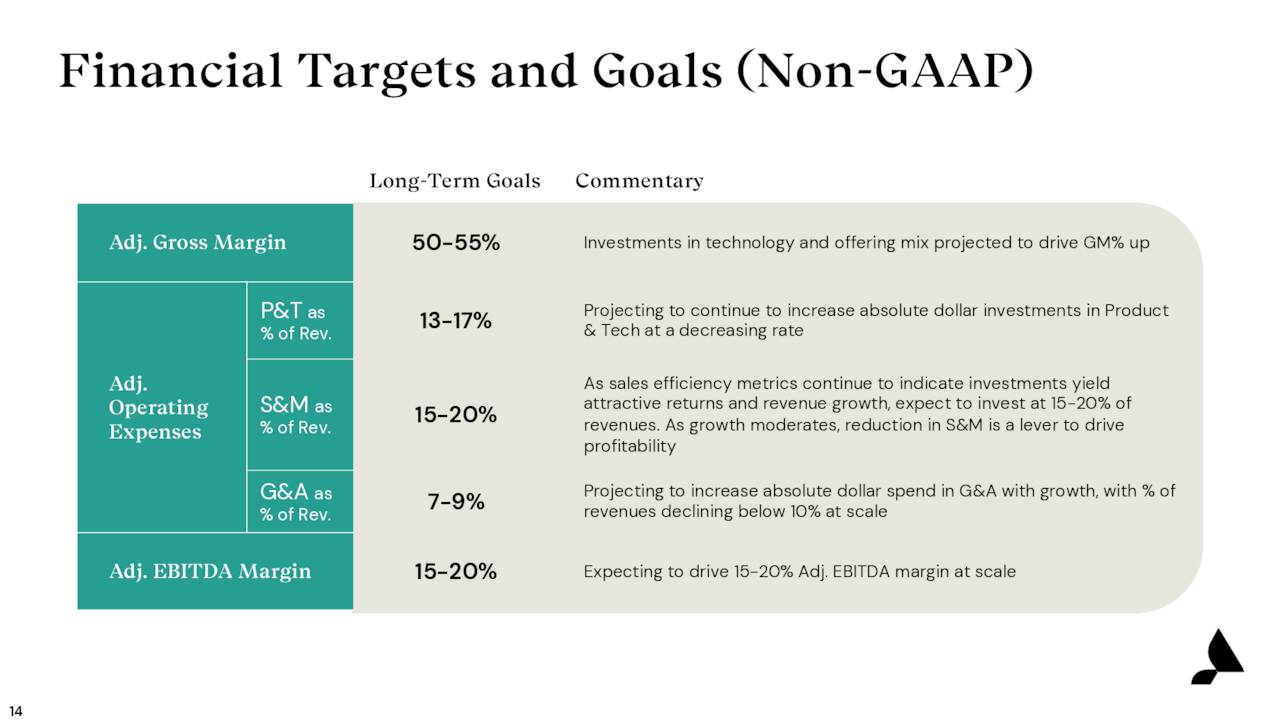

ACCD – Financial Targets/Goals (January Company Presentation)

For FY2023, the analyst consensus has the company losing nearly $2.00 a share (on a wide range of estimates) on revenue growth just north of 25% to just under $390 million. This means the company’s valuation is just a bit under three times forward sales. Not terribly expensive given growth prospects. Accolade has done a good job diversifying its customer base since it came public. At the time of their debut on the public markets seven quarters ago, their single largest customer represented 25% of total revenues and Accolade’s top four customers made up 60% of overall revenues. Today no single customer represents more than 10% of sales.

For investors comfortable investing in a growth name where profitability is several years off, Accolade seems to merit a small ‘watch item‘ position after the recent steep decline in the shares.

“I would hope not to be like the artist who has to depend on the naivety of his audience for applause.“― Criss Jami

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment