nespix/iStock via Getty Images

Note: This article was, in a different form, released on Cash Flow Kingdom in the past. It was produced with Darren McCammon.

Investment Opportunity: Sprott

Sprott (NYSE:SII) is an investment fund manager that specializes in precious metals (Gold, Silver, Platinum, and Palladium). More recently, the company has also moved into uranium. Last year, they purchased and renamed a uranium ETF, the Sprott Uranium Trust ‘SPUT’, which has enjoyed remarkable growth since. SII’s trusts tend to increase in size, SII benefits when the underlying hard asset (gold, silver, uranium, etc.) experiences increased interest and/or higher prices.

Thus, SII is effectively an alternative way to invest in these commodities — one that benefits not just from an increasing price but also potentially from a combination of price gains plus a general increase in sector interest. Gold, silver, uranium, and many other commodities have risen in price in recent weeks and months. As a result, SII’s assets under management, or AuM, have been growing, and its shares have risen sharply and have been hitting new highs in recent days. We think that the company’s stock might have further to go.

In order to understand SII’s overall strategy, we have to look at how trusts work, and how the approval in August of 2021 of SPUT’s at-the-money program has helped to drive the company’s assets under management.

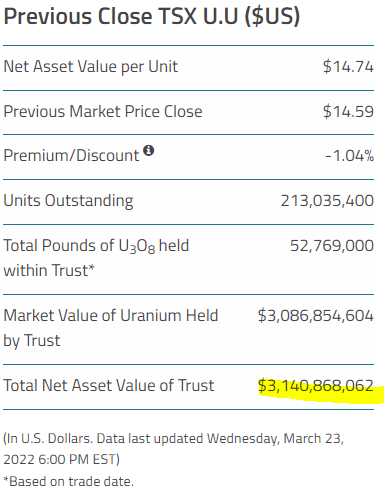

SPUT’s uranium ATM program issues shares via the Canadian ticker, U-UN.TO, and uses the proceeds to buy physical uranium for the trust. In order to do this, the price of the trust must be at least 1% above the underlying price of uranium assets held in the trust in order to cover fees. By utilizing this ATM whenever possible, SPUT thus soaks up uranium and has been able to sequester over $3 billion dollars worth of physical uranium.

SPUT website

Sequestering uranium reduces the available supply and in doing so also tends to lead to higher uranium prices. In short, SPUT has the potential to “corner” the uranium market.

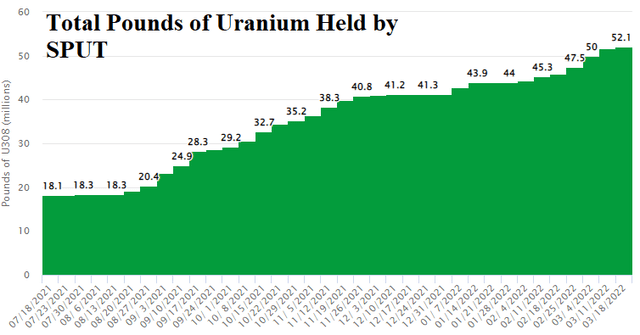

SPUT’s policy currently states its purpose is to buy uranium, but never to sell it. In theory, SPUT could still loan out some uranium for (short) periods of time to ensure an efficient market, but SPUT is, we believe, unlikely to ever release permanently any of the trust’s physical uranium. While this policy could be changed at some future date, there is little incentive for SII to do so. In addition to the 1% commission Sprott collects on every pound of uranium sequestered, it also gets to collect 35 basis points annually for managing the trust. So, if SII were to ever sell the physical uranium in SPUT, they would be directly reducing their fund’s assets under management and thus their own income. In other words, the price of uranium may fluctuate up and down, but the physical pounds of uranium SPUT will most likely only continue to rise:

Over the last 6 months, SPUT has been using their ATM extensively and has been sequestering more and more uranium, as we can clearly see in the chart above. As a result of this, and also due to the impact of the increasing price of uranium, SPUT’s AUM has been increasing at a strong rate of around $300 million a month. SII’s monthly 35 basis point collection on SPUT has also been growing meaningfully over that time frame.

Sprott Earnings

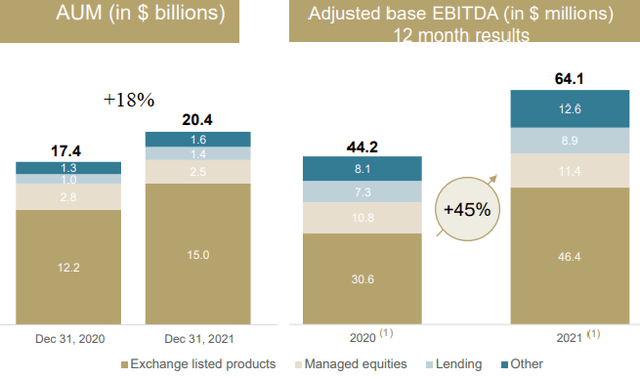

As a result of the success with SPUT and other initiatives, Sprott grew its AUM by 18% in 2021, to more than $20 billion, as we can see in the following presentation slide:

This, in turn, led to an excellent EBITDA growth rate of 45% compared to the previous year. In other words, while increased AUM does result in more costs (mostly tied to bonuses), there are also significant economies of scale involved. Last year, an 18% increase in AUM resulted in a 45% increase in EBITDA. It seems reasonable to assume that EBITDA growth in the coming quarters and years will continue to outpace AUM growth due to tailwinds from operating leverage.

Adjusted EBITDA for Q4 was 71¢ per share, or a $2.84 run rate ($71 million run rate). This covered the 2% dividend easily, at a 2.8x rate. Based on these results, Sprott is currently trading at a pricy high-teens EV/run-rate EBITDA ratio, but that is still meaningfully less than their 5-year average EV/EBITDA of 21x. On top of that, the valuation should not be looked at in insolation. Instead, we should keep in mind that Sprott’s most recent EBITDA growth rate of 45% warrants somewhat of a premium valuation. The EBITDA equivalent of the PEG ratio is a rather attractive ~0.4, which indicates that Sprott is not too expensive relative to the growth the company generates. Likewise, SII’s forward PE ratio of 25 isn’t low, yet meaningfully lower than this firm’s longer-term average PE ratio of more than 30. This stock isn’t cheap, because Mr. Market likes growing asset managers, especially when they are also inflation plays. There are good reasons to agree with the market, we believe, as inflation hedges with growth momentum seem like a good choice in the current environment.

If one were to assume SII continued to grow in 2022 at roughly the same rate it grew during the second half of 2021, the company would finish out the year with over $24 billion of AUM. Given Sprott’s continued high use of the Sprott Uranium Trust at-the-money program to purchase physical uranium and other tailwinds such as the recent purchase of the Uranium Mining ETF (URNM), we think it is possible that the company achieves this growth just from growth in their uranium assets. However, Sprott is not just a uranium play, thanks to their exposure to gold, silver, etc. In fact, Sprott is so well known in the sector they are frequently asked to advise other asset managers. Case in point, recently $8 billion in AUM Ninepoint sub-contracted them to help manage their uranium, gold, silver, and other precious metal assets. Mr. Market’s recently increasing interest in SII’s own gold and silver funds, thanks to tailwinds for precious metals stemming from inflationary pressures, should also be a tailwind for Sprott in 2022.

Takeaway

We consider Sprott a solid uranium and precious metal investment and also a good inflation hedge for a portfolio. Not only have they successfully fostered remarkable growth in SPUT in a very short period, but they are doubling down by buying the Global Uranium Mining ETF.

With the western world now signaling investments in nuclear energy are “ESG friendly“, we suspect Sprott’s vehicles SPUT and URNM might attract the attention of some large funds looking for exposure to this theme. Sprott’s assets seem like one of the most reasonable and readily available choices for major investors to find uranium/nuclear power exposure.

Sprott isn’t especially cheap, but it generates strong growth and seems like an obvious inflation hedge. To us, it looks like an investment-worthy choice, although buying it when prices were lower (we originally published this article on February 14, with SII slightly below $40) provided for a better risk-reward ratio.

Be the first to comment