Maks_Lab/iStock via Getty Images

Clarus Corporation (NASDAQ:CLAR) doubled its net revenue from 2016 to 2021 thanks to acquisitions. Management recently delivered a beneficial 2022 outlook and clearly noted that it continues to look for new acquisitions in the international markets. In my view, if supply chain disruptions don’t ruin CLAR’s plans, we will likely see a significant increase in the company’s valuation. I believe that Clarus Corporation looks like a buy.

Clarus Corporation: M&A Integration And Significant Sales Growth

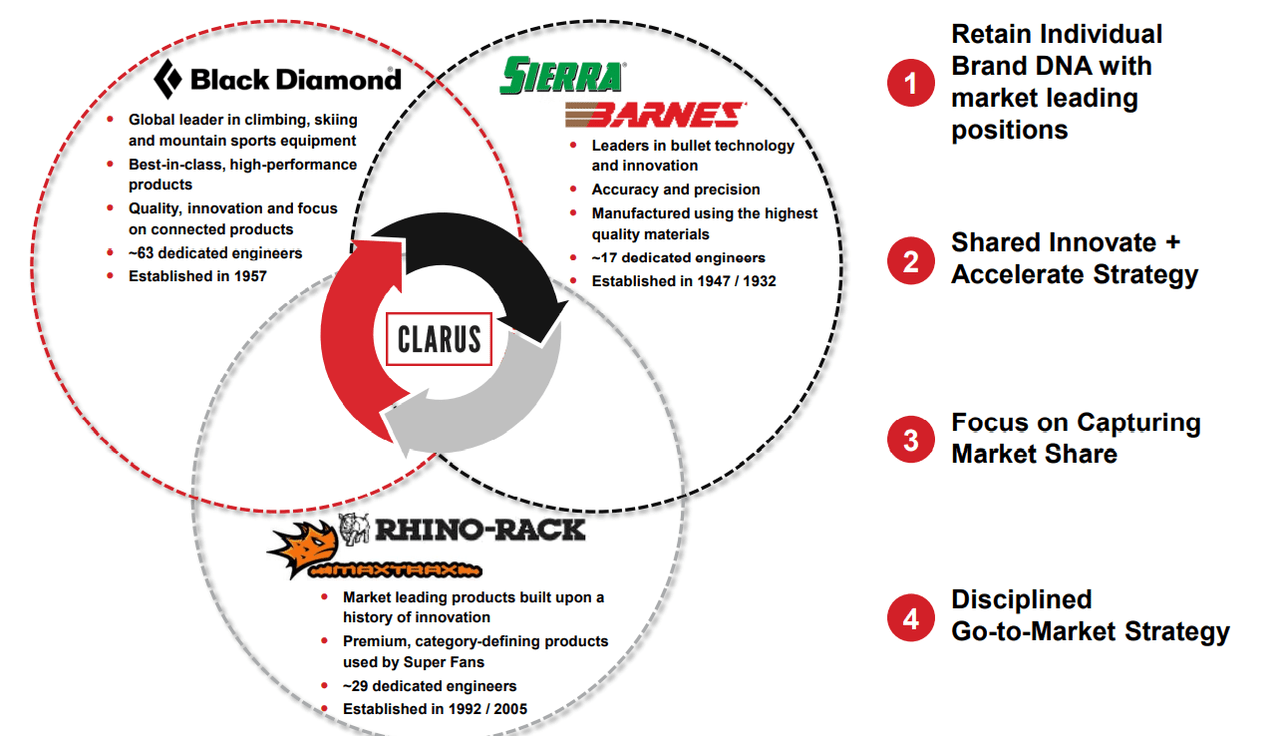

Clarus Corporation designs, manufactures, and distributes outdoor equipment and lifestyle products. The company is the owner of several brands established in 1947, 1957, and 1992. In my view, individuals inside the organization really know how to design brands and gain market share in target markets:

Investor Presentation March 2022

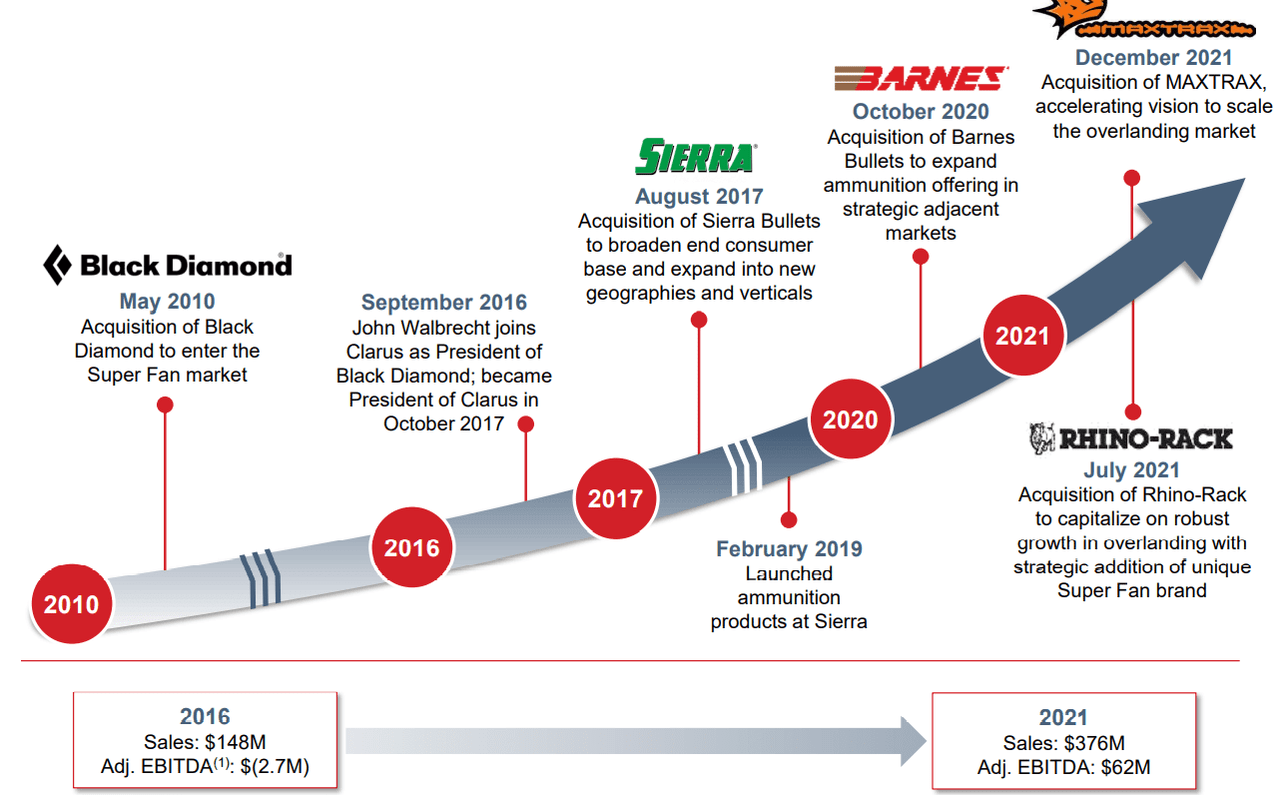

It is quite relevant noting that Clarus has a lot of expertise in the M&A markets, which will likely help the company grow substantially in the next decade. In the last five years, total sales almost doubled thanks to the acquisition of new brands.

Investor Presentation March 2022

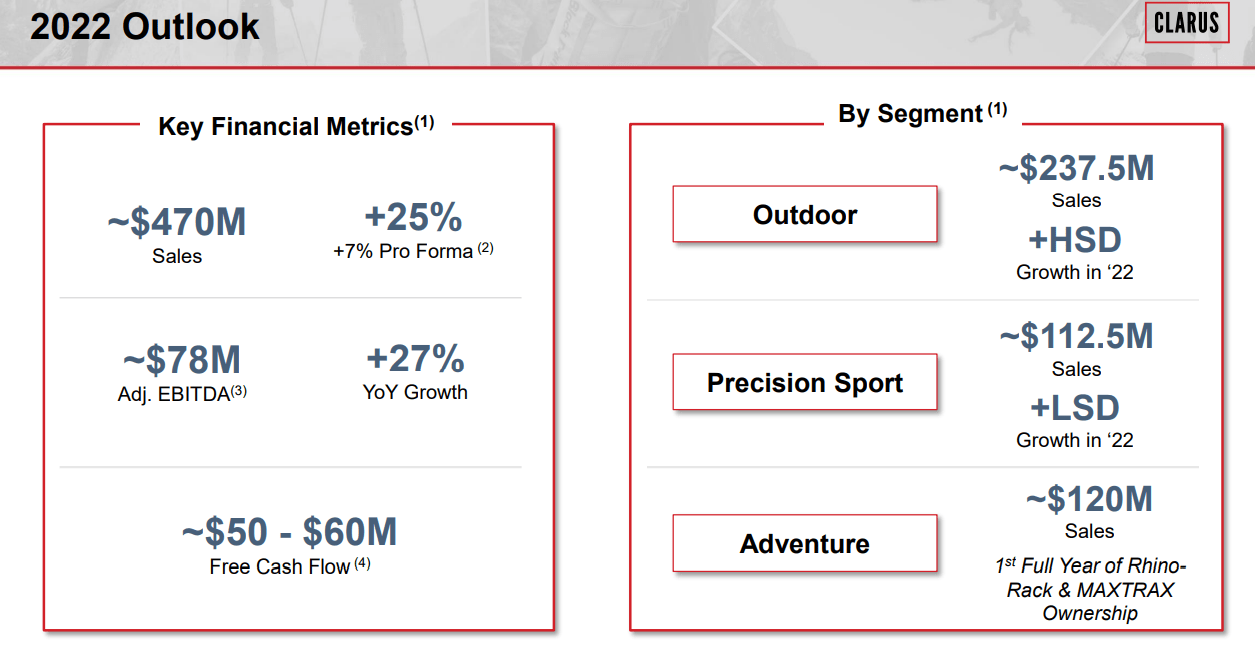

I also believe that the outlook couldn’t be better. Clarus expects 25% sales growth, 2022 FCF $50 million to $60 million, and EBITDA growth of close to 27%. I decided to run DCF models right after I saw the figures prepared by management.

Investor Presentation March 2022

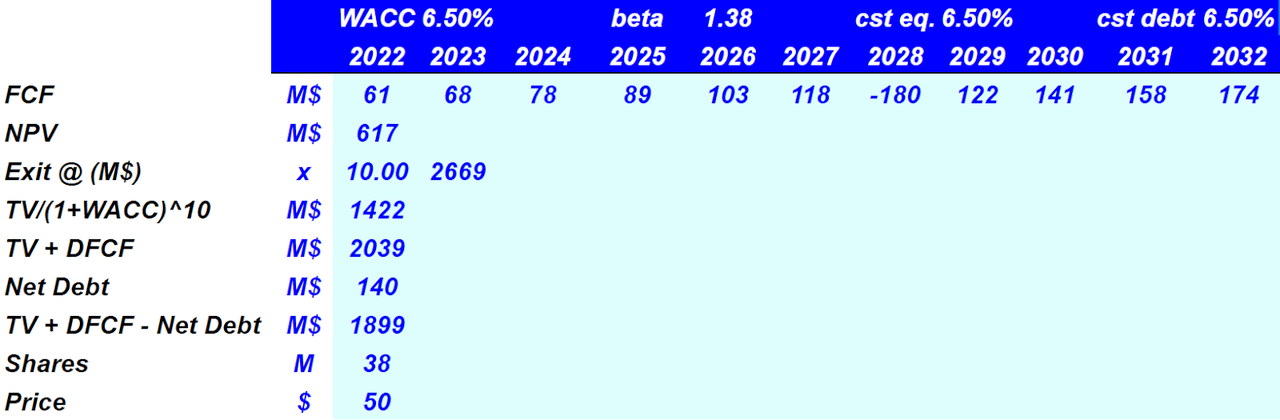

In my view, if sales growth grows as expected, capital expenditures stay close to $9 million, and the EBITDA margin is really at 16.5% as promised, Clarus’ valuation will likely increase:

Clarus anticipates fiscal year 2022 sales to grow approximately 25% to $470.0 million compared to 2021. Source: Clarus Reports Record Fourth Quarter and Full Year 2021 Results

The Company expects adjusted EBITDA in 2022 to be approximately $78.0 million, or an adjusted EBITDA margin of 16.5%. In addition, capital expenditures are expected to be approximately $9.0 million and free cash flow is expected to range between $50.0 to $60.0 million.

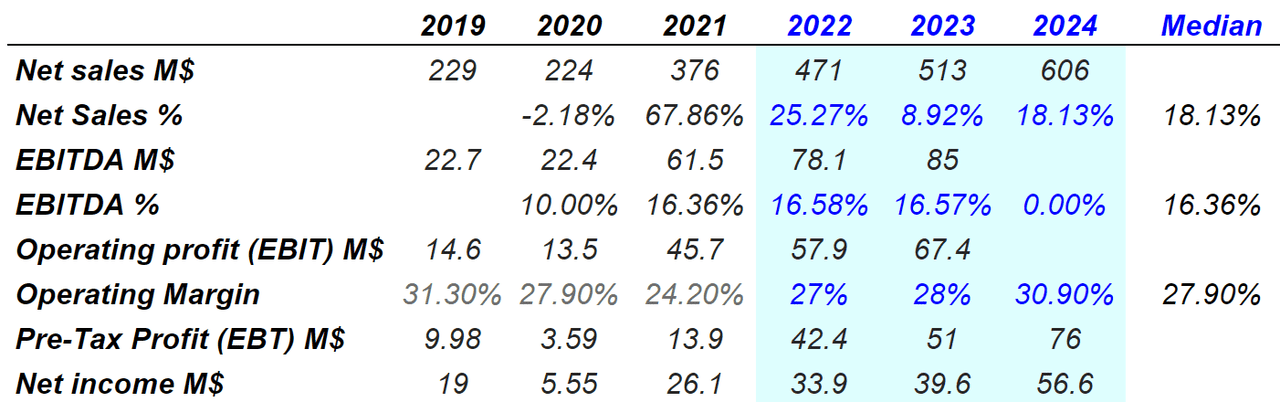

Estimates Couldn’t Be Better For Clarus

Clarus’ directors are not the only individuals offering beneficial estimates. Investment analysts are also giving beneficial net sales projections. Market estimates include 25% sales growth in 2022, and 18% sales growth in 2024. Also, including sales growth since 2019, the median sales growth would be 18%. Finally, with a median operating margin of 27%, the net income should stay close to $33-$57 million from 2022 to 2024:

Marketscreener.com

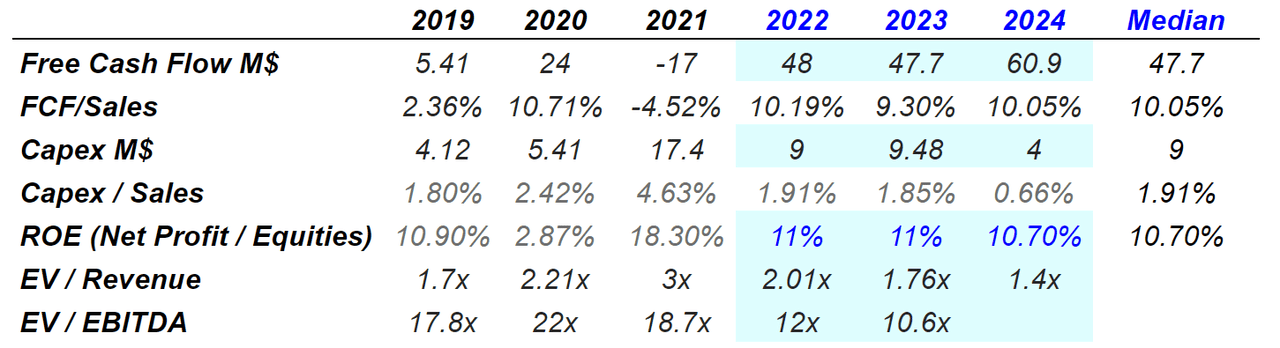

Most investment advisors are also expecting a significant increase in free cash flow and a median FCF/Sales around 10%. With these figures and an ROE of 10%, I believe that the company’s EV/Forward 2022 EBITDA should be larger than 12x. I believe that the company is somewhat cheap.

Marketscreener.com

Base Case Scenario: Internationalization And New Technologies

Clarus was founded in 1991, so management counts with a lot of know-how. In my view, the company really knows how to design new brands, create relationships, and expand the number of product categories. Under this case scenario, I believe that the company will likely be able to innovate, so that revenue growth trends north:

Within our Outdoor segment, we intend to utilize our “innovate and accelerate” strategy to leverage our strong brand name, customer relationships, proven capacity to develop new innovative products and product extensions in each of our existing product categories, and to expand into new product categories. Source: 10-K

It is also quite relevant that management continues to develop new technologies for outdoor sports. The company is famous for its climbing hard goods and trekking poles. Under this case scenario, Clarus will continue to offer higher standards of safety through innovative technologies:

We intend to focus on the expansion of our apparel and footwear categories, driving further innovation in lights, trekking poles, snow safety, and climbing hard goods, while broadening our appeal in gloves and packs. Source: 10-K

I also expect significant sales growth due to the internationalization efforts promised by management. The company noted that the Sierra and Barnes brands could be very successful in Europe and outside the United States. More internationalization will likely bring more revenue growth and economies of scale. As a result, the company’s fair valuation will likely grow:

We believe there is a significant opportunity to expand the presence and penetration of each of our brands globally. The European alpine market is currently significantly larger than the U.S. market and is highly fragmented by country, with no clear leader across Europe. We believe there is also a significant opportunity to expand our Sierra and Barnes brands more extensively outside the U.S. market through additional sales and marketing investments. Source: 10-K

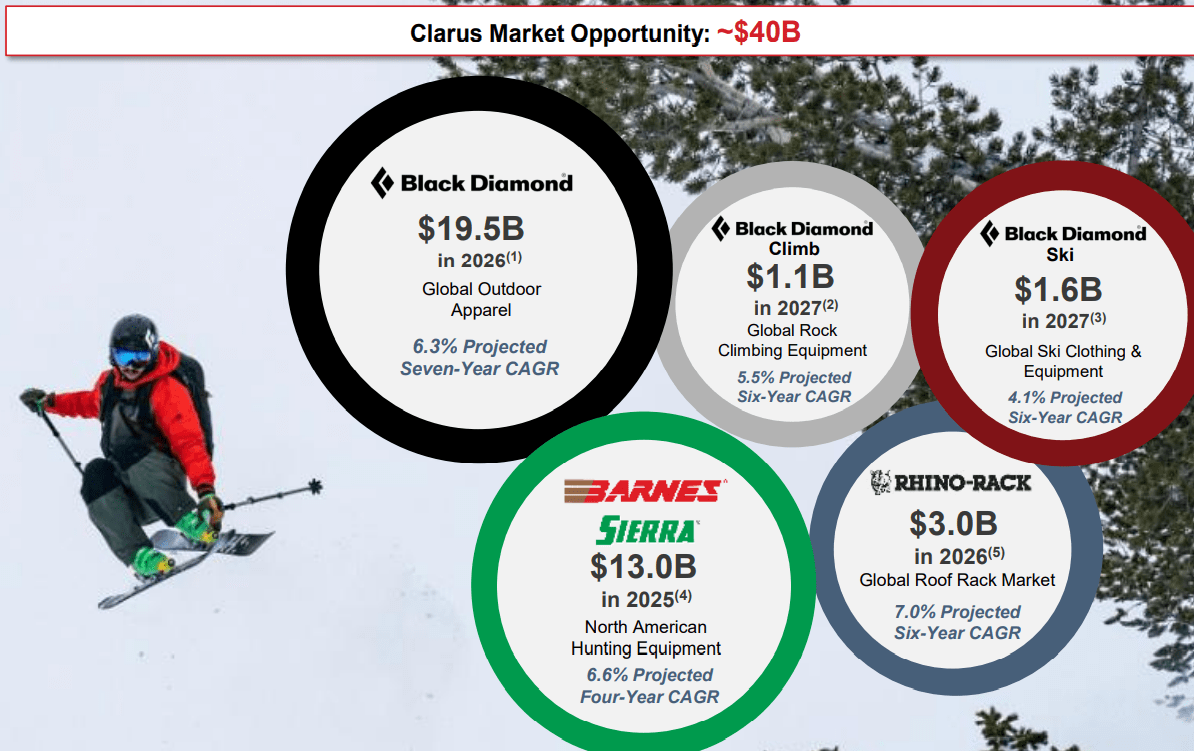

I used sales growth of 7%, which is close to the market growth of Clarus’ target market. In the last presentation given to investors, Clarus Corp. noted that global outdoor apparel, global rock climbing equipment, and other target markets are expected to grow at a CAGR between 4.1% and 7%:

Investor Presentation March 2022

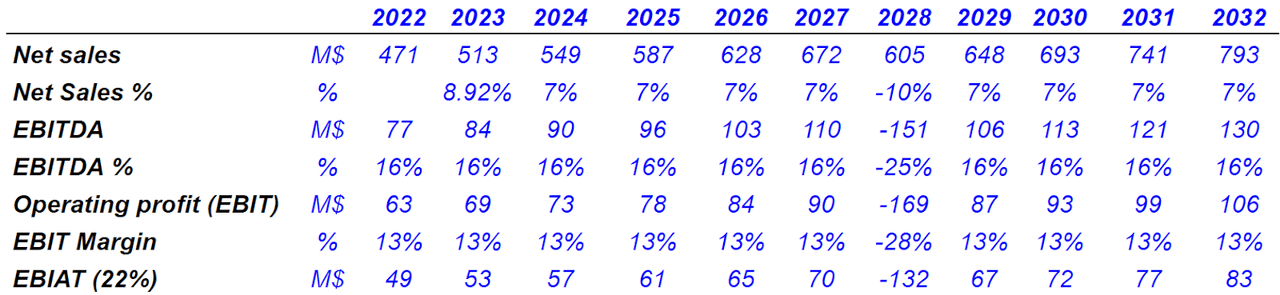

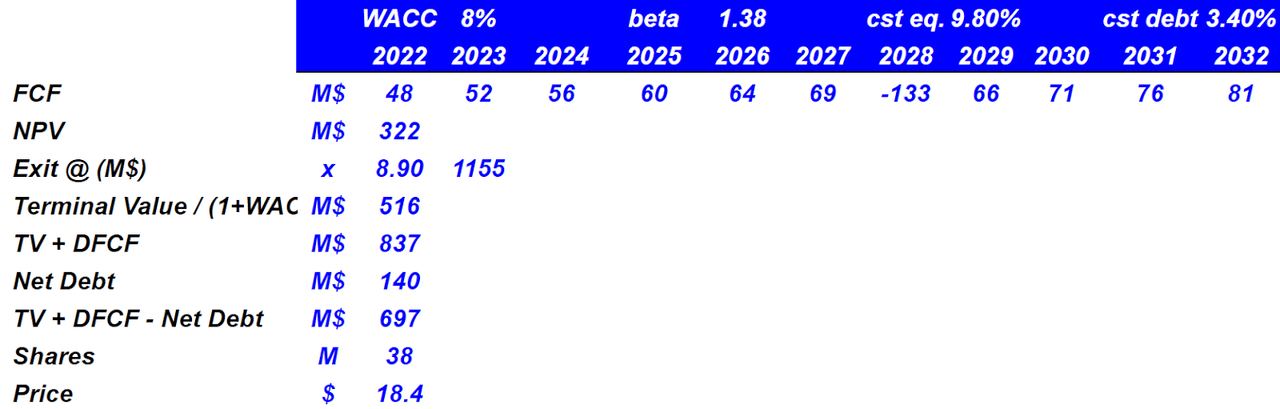

With sales growth of 7% from 2024 to 2032, I obtained 2032 sales of $793 million. If we also assume an EBITDA margin of approximately 16% and operating margin of 13%, 2032 EBIAT should be $83 million.

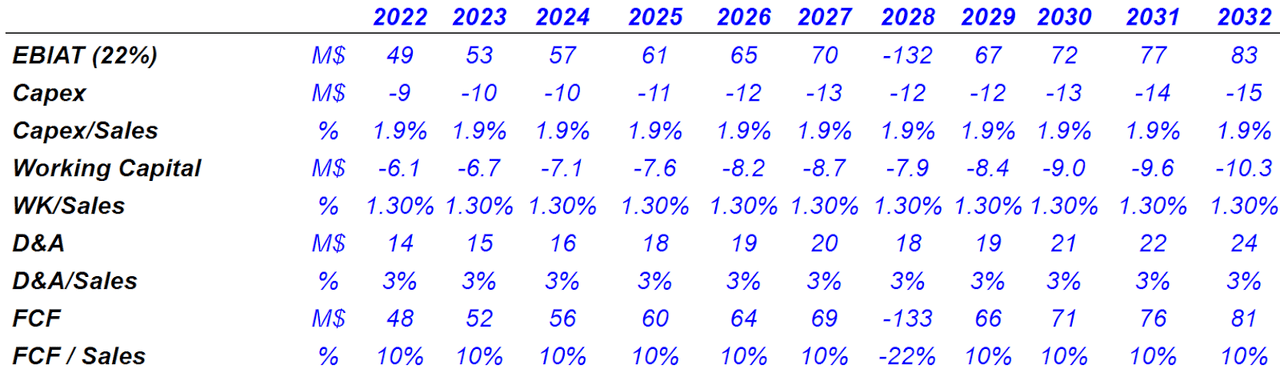

YC

Also, with conservative and growing capex of $9 million to $15 million, working capital/sales of 1.3%, and D&A/sales of 3%, 2032 FCF should be $81 million. Note that my FCF/Sales ratio would stand at 10%, which is close to the figure reported in the past.

YC

Under this case scenario, I used a CAPM model, which is close to that of other advisors. The cost of equity stands at 9.8%, the cost of debt would be 3.4%, and the WACC stands at 8%. The net present value of future free cash flow is $322 million, and with an exit multiple of 8.9x, the terminal value is equal to $516 million. Finally, the implied share price would be $18.4.

YC

Risks Could Arise From Damage, Bodily Injury, Or Defects In Manufacturing

If Clarus does not invest sufficiently in monitoring the manufacturing processes, defects could be especially damaging for the business model. Once the media learns about accidents caused by Clarus’ products, the destruction of the brand could be significant. As a result, revenue expectations could decline significantly:

We remain exposed to product liability claims by the nature of the products we produce. Exposure occurs if one of our products is alleged to have resulted in property damage, bodily injury or other adverse effects. Any such product liability claims may include allegations of defects in manufacturing, defects in design, a failure to warn of dangers inherent in the product or activities associated with the product, negligence, strict liability, and a breach of warranties. As a result, product recalls or product liability claims could have a material adverse effect on our business, results of operations and financial condition. Source: 10-K

Another clear risk comes from failure of demand prediction, excess inventory levels, or shortage. If management cannot predict new orders from customers, revenue may decline, or may grow less than expected. In the worst-case scenario, the free cash flow should decline, which would diminish the company’s fair valuation:

We often schedule internal production and place orders for products with independent manufacturers before our customers’ orders are firm. Therefore, if we fail to accurately forecast customer demand, we may experience excess inventory levels or a shortage of product to deliver to our customers. Source: 10-K

Given the current supply chain disruptions, lack of raw materials may affect Clarus’ production levels. If the level of inventory increases, or management has to increase prices, revenue may also decline:

Pricing and availability of raw materials for use in our businesses can be volatile due to numerous factors beyond our control, including general, domestic, and international economic conditions, labor costs, production levels, competition, consumer demand, import duties, and tariffs and currency exchange rates. Source: 10-K

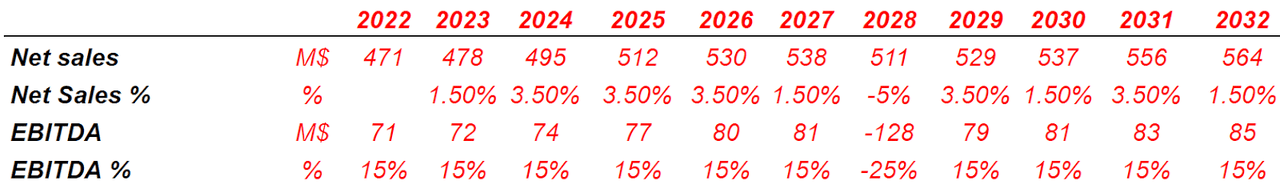

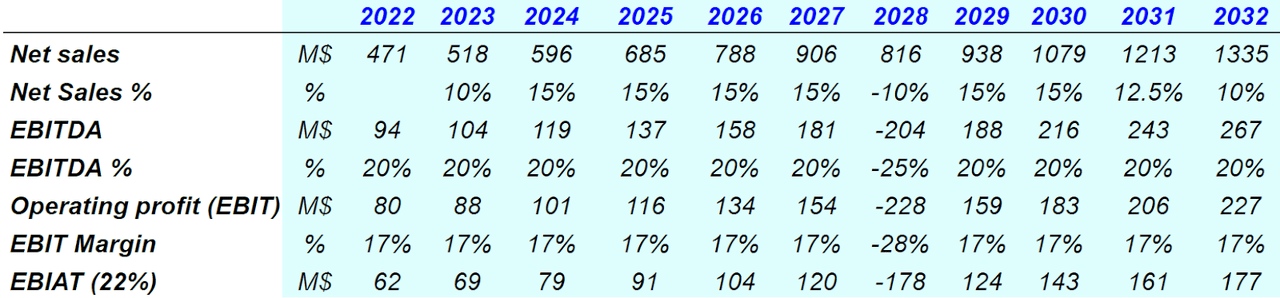

Under this case, I used pessimistic sales growth of 3.5%, and an EBITDA margin of 15%, which implied 2032 EBITDA of $85 million.

YC

I assumed the working capital/sales, D&A/sales, and capital expenditures almost similar to that depicted in the proviso case scenario. The result includes 2032 FCF close to $50 million and 9% FCF/Sales.

YC

If we also assume a WACC of 10% and an exit multiple of 8.9x, the terminal value stands at $290 million, and the implied equity value should be around $375 million. Finally, the fair price should be close to $10.

YC

If The Company Acquires Competitors In The International Markets, The Fair Price Could Be Close To $50

I received with optimism the acquisition of Rhino-Rack in Australia and New Zealand. In my view, if management continues to acquire other targets in Europe, Asia, or Latin America, revenue growth will likely improve:

The acquisition of Rhino-Rack adds a leading market position in Australia and New Zealand, with significant whitespace to grow our presence in U.S. Source: 10-K

Clarus Corp. did note that it intends to make meaningful acquisitions in the future, so this case scenario is quite likely. Management is looking for businesses with recurring revenue and strong cash flow generation. If the market likes the new acquisition and the new figures, in my view, FCF growth would likely justify larger valuations:

We expect to target acquisitions as a viable opportunity to gain access to new product groups, customer channels, and increase penetration of existing markets. We may also pursue acquisitions that diversify the Company within the outdoor and consumer enthusiast markets. To the extent we pursue future acquisitions, we intend to focus on super-fan brands with recurring revenue, sustainable margins and strong cash flow generation. We anticipate financing future acquisitions prudently through a combination of cash on hand, operating cash flow, bank financings, private placements and new capital markets offerings. Source: 10-K

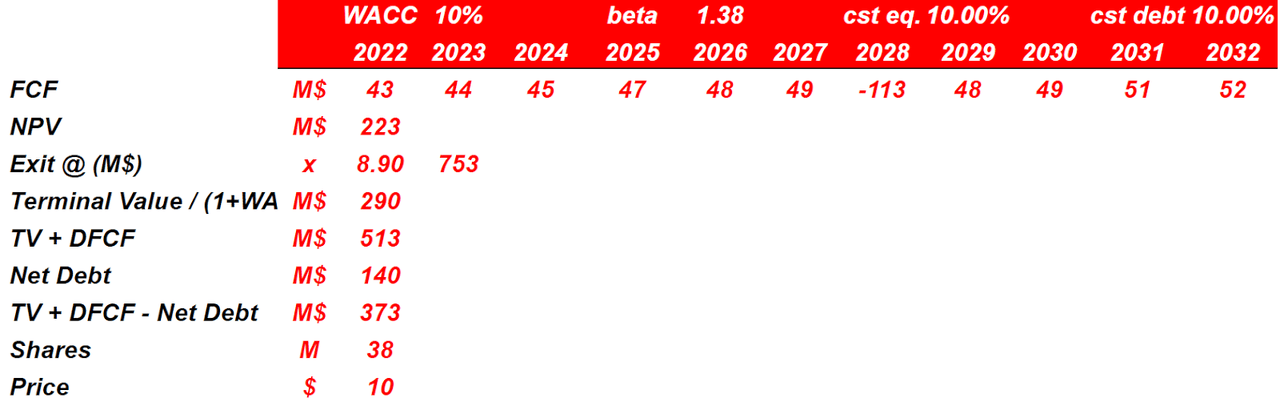

Under the best-case scenario, I included 15% sales growth, an EBITDA margin of 20%, and operating margin of 17%. The implied EBIAT with these figures should be close to $175 million:

YC

If we also use a WACC of 6.5%, the NPV terminal value should be around $615 million, the implied equity valuation could be 1.9 billion, and the implied fair price would be $50 per share.

YC

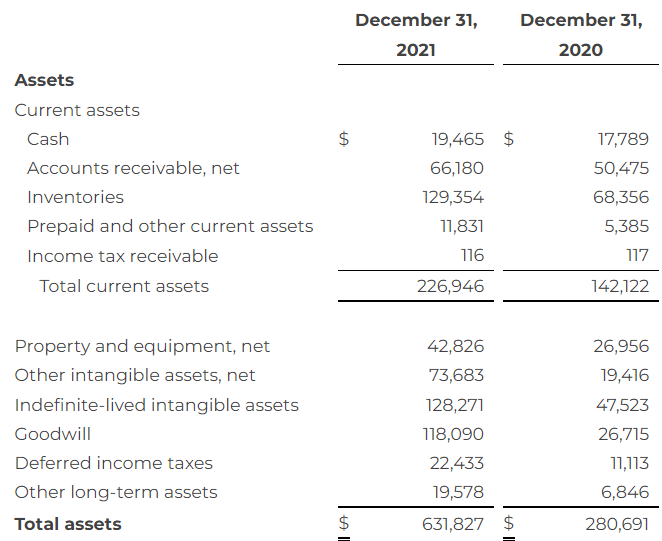

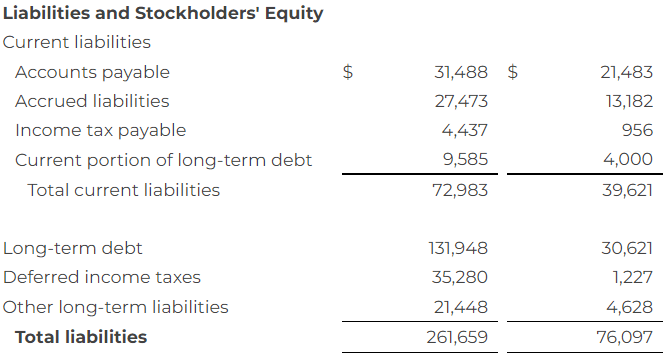

Balance Sheet

With an asset/liability ratio over 2x, $19 million in cash, and goodwill accumulated, Clarus does report a healthy balance sheet. The company may be expecting cost synergies from recent acquisitions, which could bring increases in the EBITDA margin.

10-K

With long-term debt worth $131 million and short-term portion of long-term debt of $9 million, I believe that management could ask for more debt if needed. In my view, if the company proposes beneficial acquisitions to investment bankers, Clarus will likely receive financing. Take into account that I am expecting 2022 EBITDA close to $94 million.

10-K

Conclusion

With sales doubling in the last five years thanks to acquisitions, Clarus really knows how to integrate new targets. It is quite likely that management will try to acquire new brands to sustain future FCF growth. If the company is also successful in expansion efforts in Australia, Europe, and Asia, the fair valuation will likely increase significantly. Yes, I see some risks coming from supply chain disruptions and lack of raw materials. With that, I believe that there is more upside potential in Clarus’ stock price than downside risk.

Be the first to comment